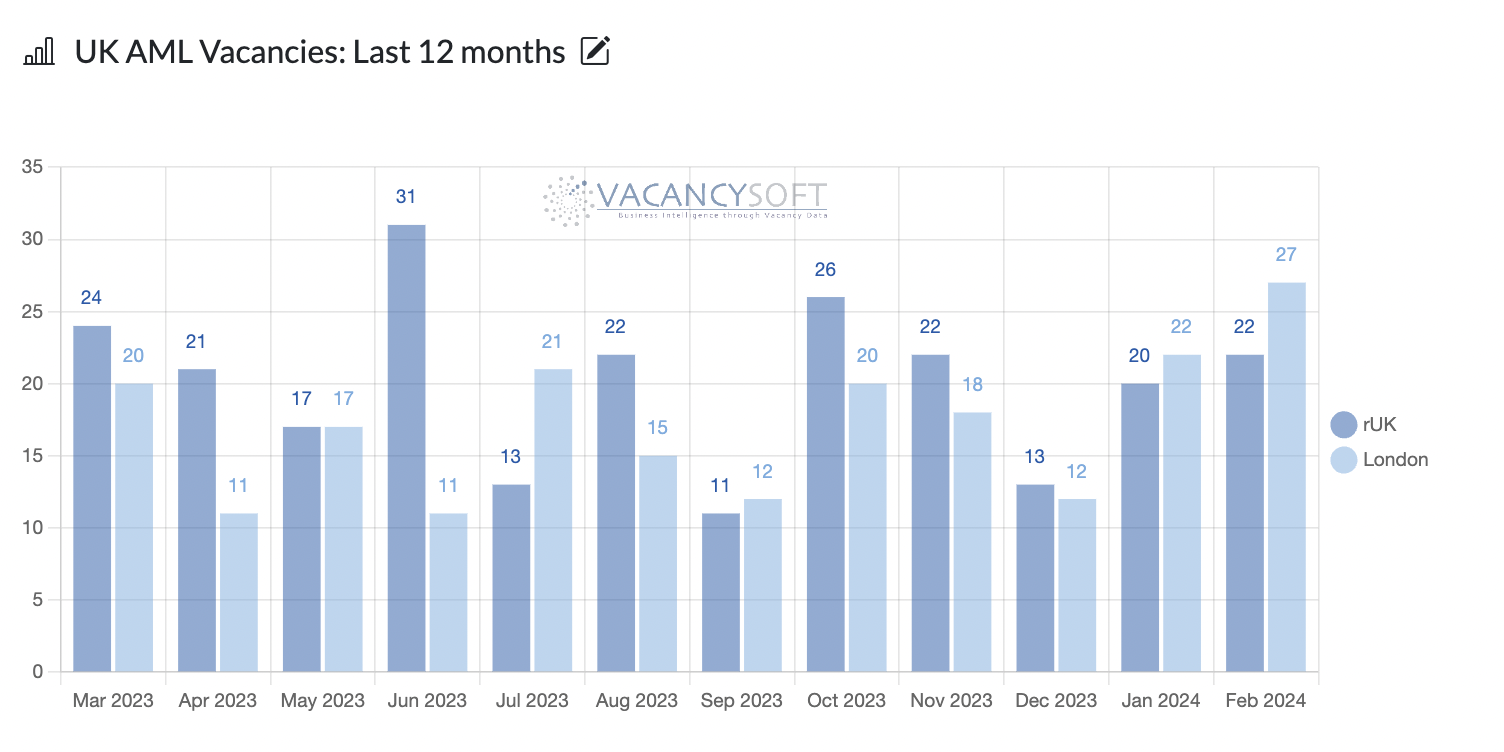

Anti-Money Laundering Vacancies hit 12 month high

Vacancies for AML hit record levels

As Russia re-elected Putin this weekend, the impact on the UK is being seen in more ways than one. Already, Grant Schapps is talking about the need for further defence spending as we move from a post-war to a pre-war world. Meanwhile, the avenues for money to be funnelled into London are slowly closing, and the determination to minimize access is clear. The decision to double the economic crime levy for very large companies from April, to £500,000 per institution is a reflection of that.

As Russia re-elected Putin this weekend, the impact on the UK is being seen in more ways than one. Already, Grant Schapps is talking about the need for further defence spending as we move from a post-war to a pre-war world. Meanwhile, the avenues for money to be funnelled into London are slowly closing, and the determination to minimize access is clear. The decision to double the economic crime levy for very large companies from April, to £500,000 per institution is a reflection of that.

With the extra funding the Government will have more resources to ensure AML compliance, for credit institutions, financial service organisations, accountancy & law firms, estate agents & brokers, along with any other market segments likely to have exposure to those wanting to bring into the country illicit funds.

Could this be what has led to a record number of AML vacancies posted in the last month? An announcement like this from the budget was almost definitely briefed in, i.e. the institutions were told in advance what was happening, hence, is the increase in recruitment a reflection of them scaling up their departments to be ready for the regime?

Interestingly, it is the SRA who have been the leading recruiters for AML positions in the last 12 months in London, which is a sign that the regulators are scaling up, so they can ensure firms are observing the regulations as required.

Just as significant is that, while over the 12 month period, 55% of the AML vacancies have been outside the capital, this year to date, the dial has shifted and the majority of the positions have been in London so far this year, with February 2024 being the peak month, in terms of share.

What does this all mean? Well, for starters the days of Londongrad are over. The U.K. is already estimated to have frozen about £25 billion worth of Russian assets, and as of February 23, 1702 individuals and 298 entities are subject to UK sanctions and the Government has targeted 129 Oligarchs, with a combined net worth of £145 Billion.

As a next step, the Government is planning to organize loans using the frozen funds as collateral, which would mean up to £30 billion would be able to be loaned to the Ukrainian Government. Meanwhile, the Russian Government only has enough funds on account to maintain their current budget losses for one more year and already rumours are emerging that very soon, taxes will increase across Russia, to pay for Putin’s war. What does this all mean?

Consider there are murmurs in Congress that a deal for Ukrainian funding that could pass, is for funds to be sent, as war-loans, akin to the aid the US gave the British in the aftermath of WW II. For the Ukrainian nation, the policies being proposed by the British could easily be replicated across the Western world. So, loaning Ukraine funds, securitized against Russian assets, means that they could quickly get access to $300 BN USD potentially, from the UK, USA and EU. More than enough to pay for everything Ukraine needs. And in the meantime, maximum pressure on the Russians financially, with as part of that, AML being strengthened at every step.

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute workshop with us and discover the power of data in shaping the future of your market!

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!