Executive Comment

Insights on the market from the Vacancysoft CEO, James Chaplin

Check the latest posts

Could the proposed changes to the minimum wage increase unemployment?

With the Labour Party now in-situ, changes are being proposed to employment law which have the potential to be transformative to the UK, where the minimum wage is a key area being scrutinised. The proposal to scrap the tiered structure of the minimum wage, which means that there will be no difference in treatment, between those aged 16 year olds or those over 21 has the potential to cause a significant impact in the job market in terms of entry level roles. The question is, what are the likely second order consequences?

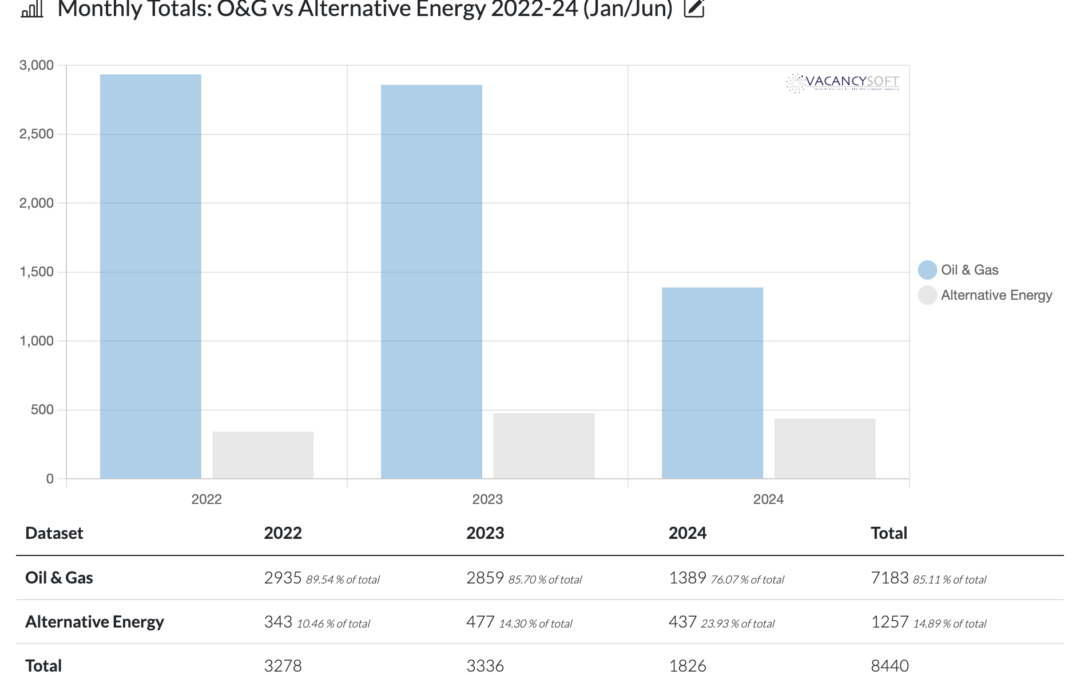

Miliband cancels new drilling licenses in the North Sea. What now?

In one stroke of a ministerial pen, the drilling licenses which Sunak had committed to, were cancelled. Miliband for a long time has been an advocate of clean energy and has committed to decarbonizing the national grid, in full, by 2030. At the same time, in a sign this Government are prepared to tackle the NIMBYs head on, previous restrictions regarding on shore wind farms are to be removed and investment into solar power infrastructure is to be trebled.

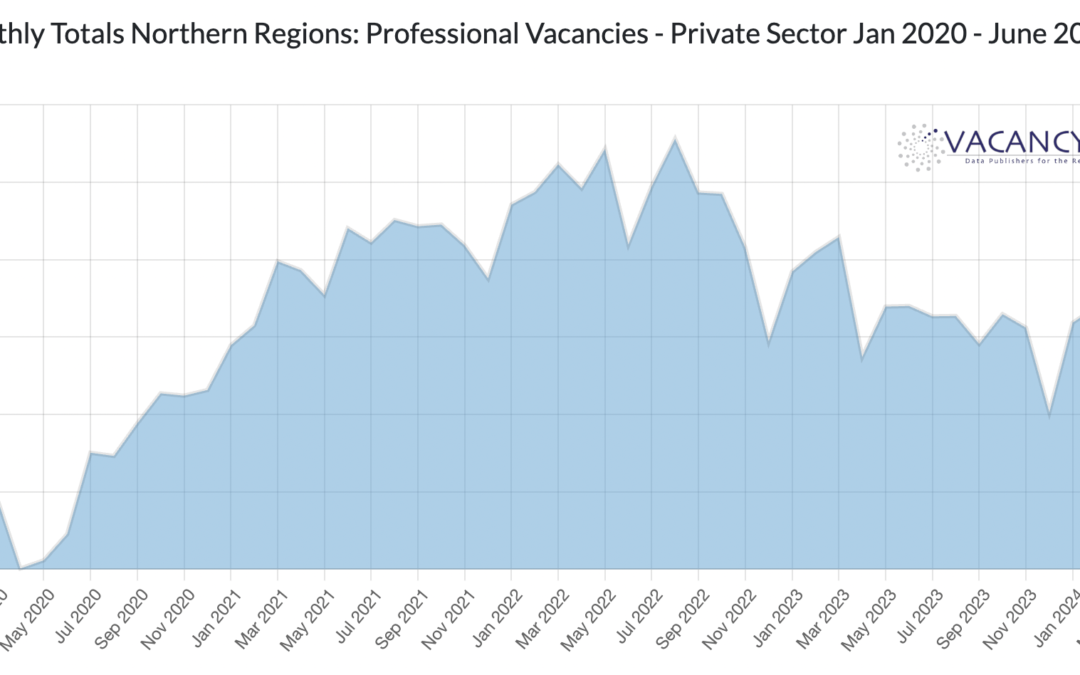

Can Labour Kickstart the Northern Powerhouse?

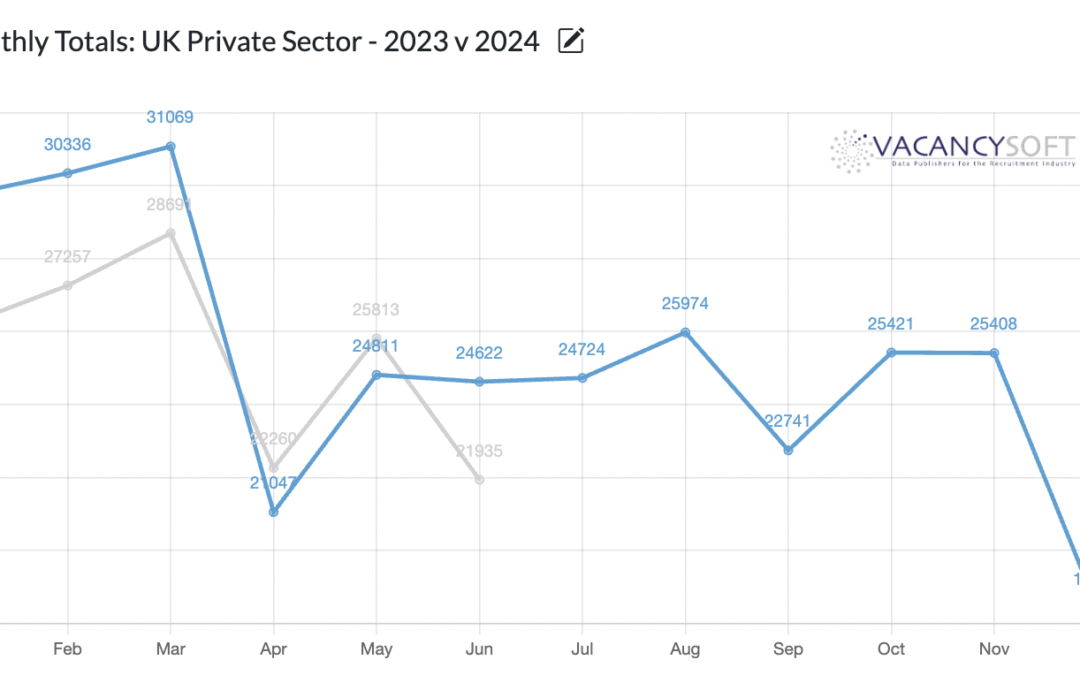

Given the recent general election, it is no surprise that vacancies dropped in June. With Businesses waiting on the outcome of the election, whilst Labour winning was a given, the coming weeks will now see a blitz of policy announcements, which will give greater clarity when it comes to investment.

Final Countdown to Election day, but what about after?

Is it the responsibility of Government to directly stimulate economic growth, or is it for them to create the environment where businesses invest themselves? Statism, or interventionist supply side policies are coming to the fore once more, and for the incoming Labour Government, there are a myriad of policy proposals designed to achieve growth.

Technology, Automation and the future of Banking

For the UK, Financial Services has a critical part to play, in terms of GDP, our balance of payments and employment. Within the Financial Services industry though, increasingly Fintech is starting to come to the fore. New challengers such as Starling, Monzo, Revolut and Wise have disrupted the incumbents and as a result, the industry has permanently changed.

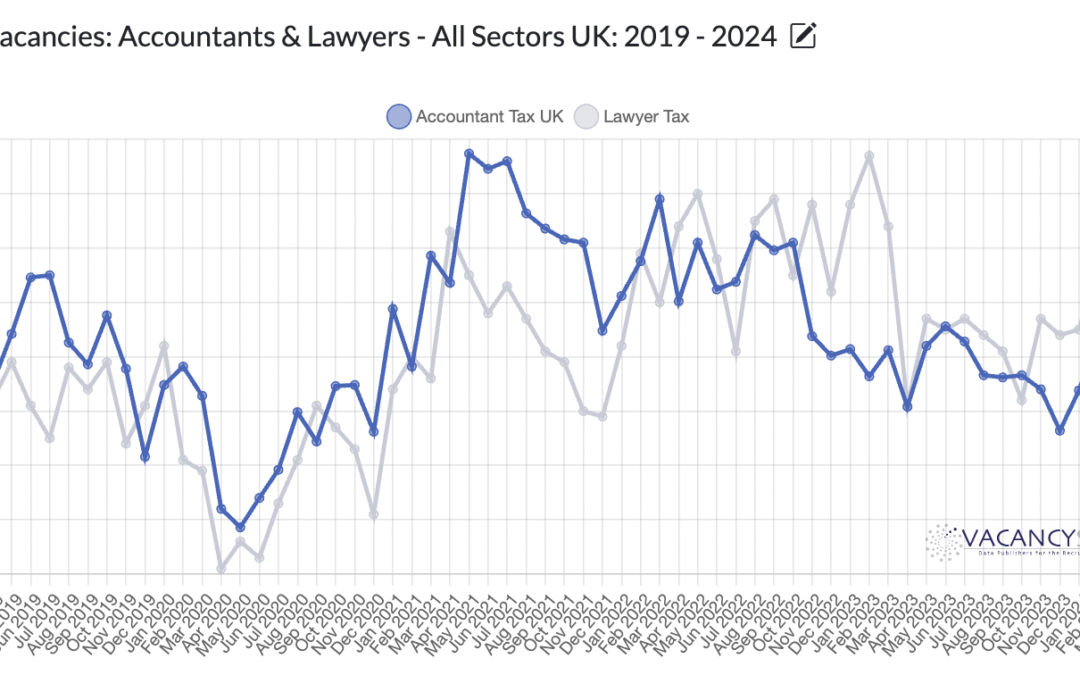

Labour’s tax dilemma

The impact of the budget on tax recruitment is apparent. March 2024 was the record month for tax vacancies going back to January 2019, beating even the peak post pandemic months in 2021. At the same time, in a recent report featured in Bloomberg, the UK is set to see 9,500 millionaires repatriate away, which is more than any other country globally, with the exception of China.

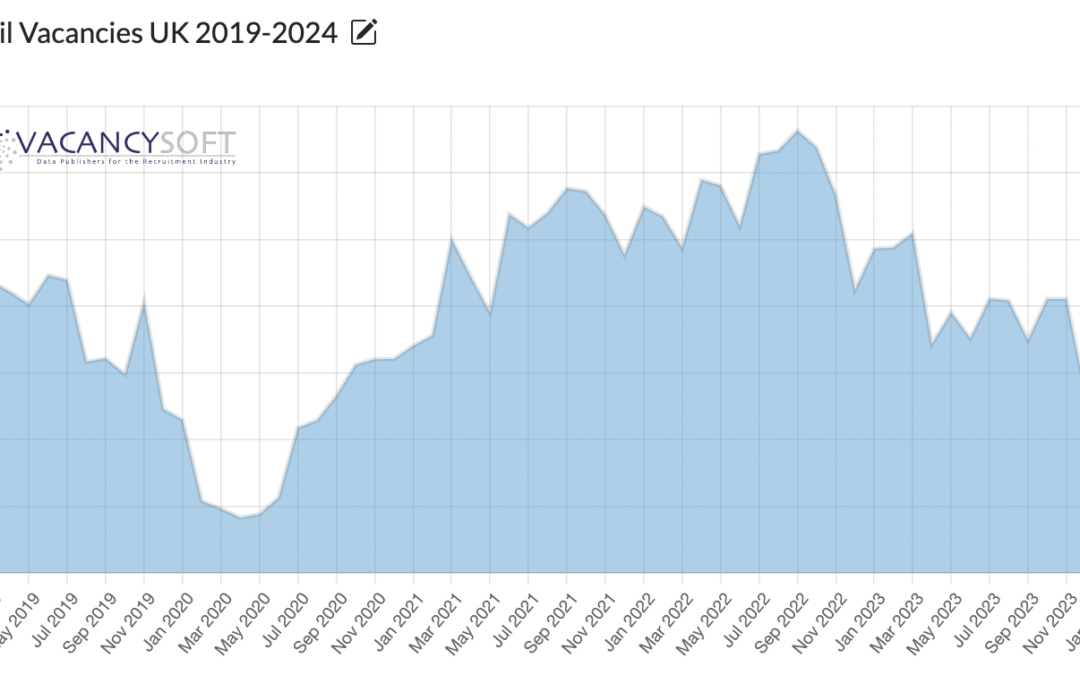

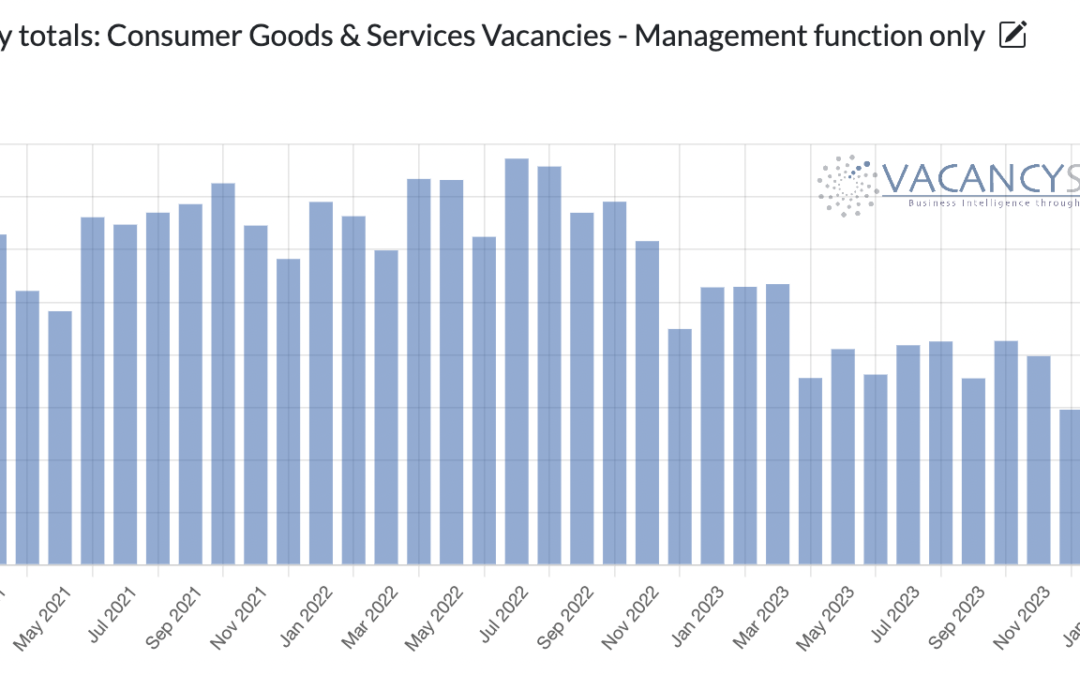

Retail slumps to four year low

With the general election looming, increasingly the question is becoming one of judgement. Who do we trust to represent the country and with that, the economy? The UK economy is consumption led, meaning that what happens in retail and consumer goods and services, is significant, when looking at economic activity. With that, in what is turning out to be a spectacular own goal, the Government’s ill fated ‘tourist tax’ on retail (not allowing VAT rebates on shopping) is starting to be felt amongst retailers.

Sunak’s bitter poison pill

For the UK Pharmaceuticals industry, the headwinds are real. The post pandemic hangover, at first caused by clinical trials being delayed on approval, so that COVID-19 related drugs could be prioritised meant that as the pandemic subsided, the pipeline of other drugs going to clinical trials had slowed to a trickle. The MHRA was supposedly tasked with creating a fast track regime to overcome this, equally even now, the EMA is approving drugs faster. Hence for pharmaceuticals companies looking at where they should organise trials, the UK is as a result, less attractive.

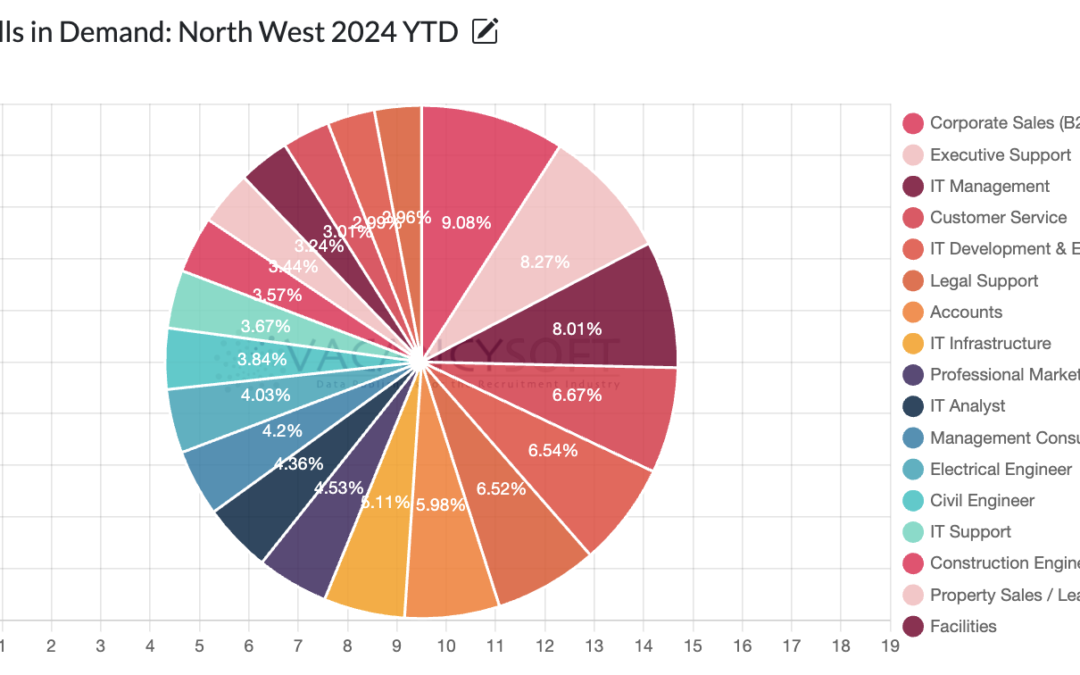

B2B sales in demand across the North West

Now that the economic data released, shows that we are out of recession, as an update on what we are seeing, what is noteworthy as an indicator of market confidence, is that the leading role type being recruited for, now across the region, in 2024 so far, is for corporate b2b sales positions.

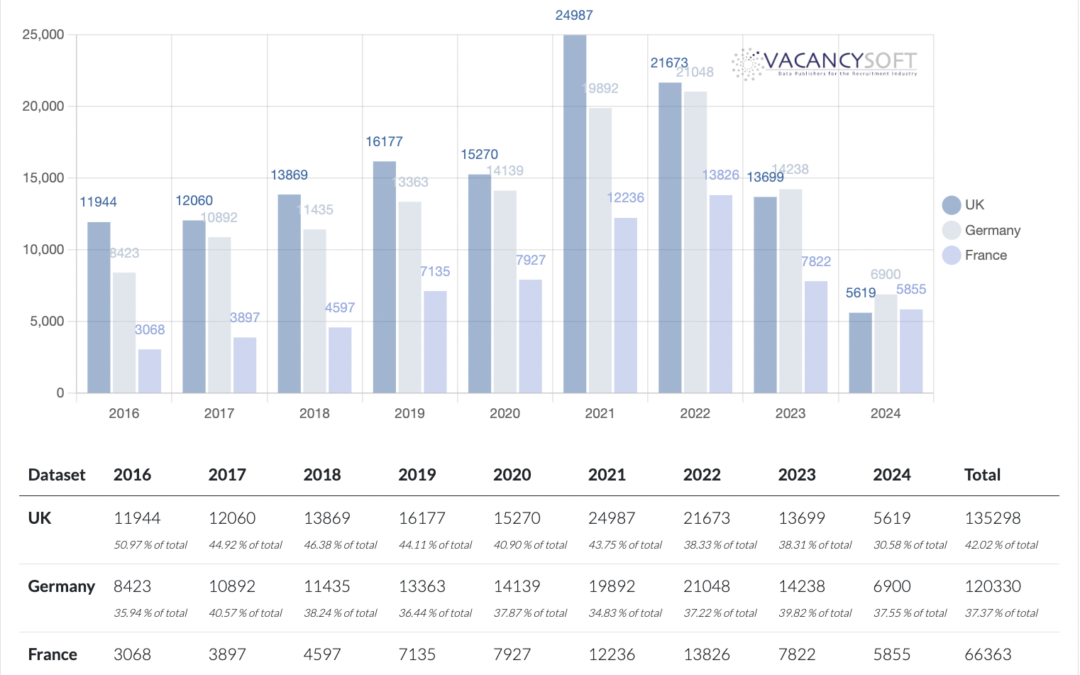

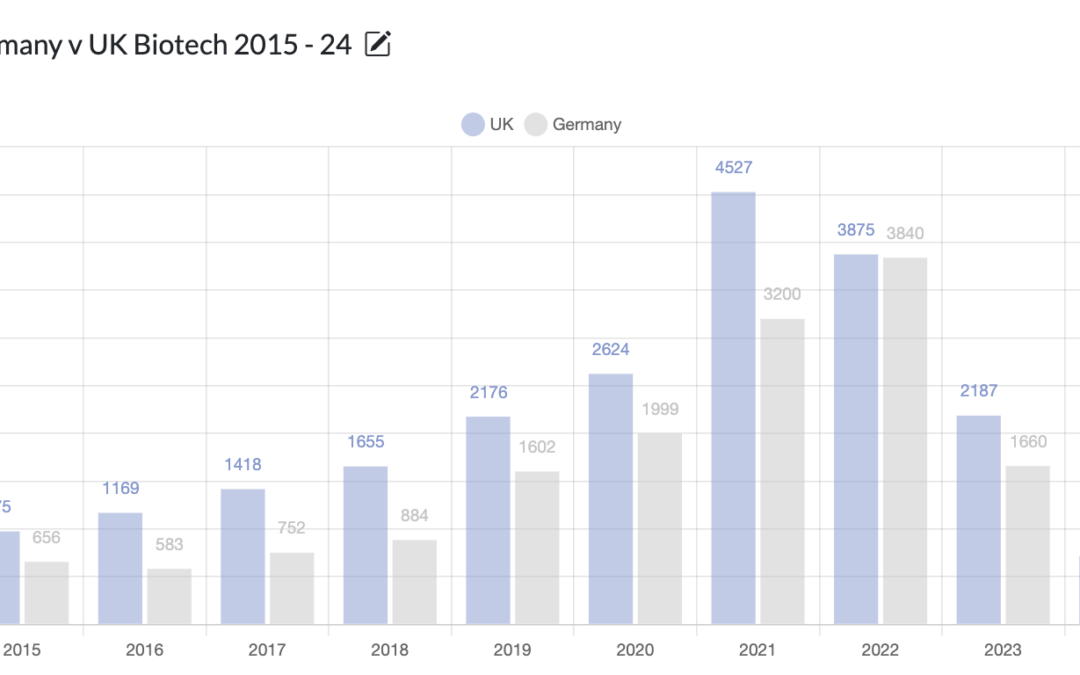

Biotech recruitment in Germany overtakes the UK

If the worst kept secret in politics is that Kier Starmer will be the next Prime Minister, (the latest odds give him an 87% chance of being so) then upon taking power, he will have to make a decision about which Tory policies to continue, and which, to discard. No set of policies are more divisive than those to do with Brexit, hence spotlighting Biotechnology which is now starting to be negatively impacted, following the pandemic period ending and the industry globally returning to equilibrium, as this is an area that Starmer may need to change UK policy on, in order to revitalize.

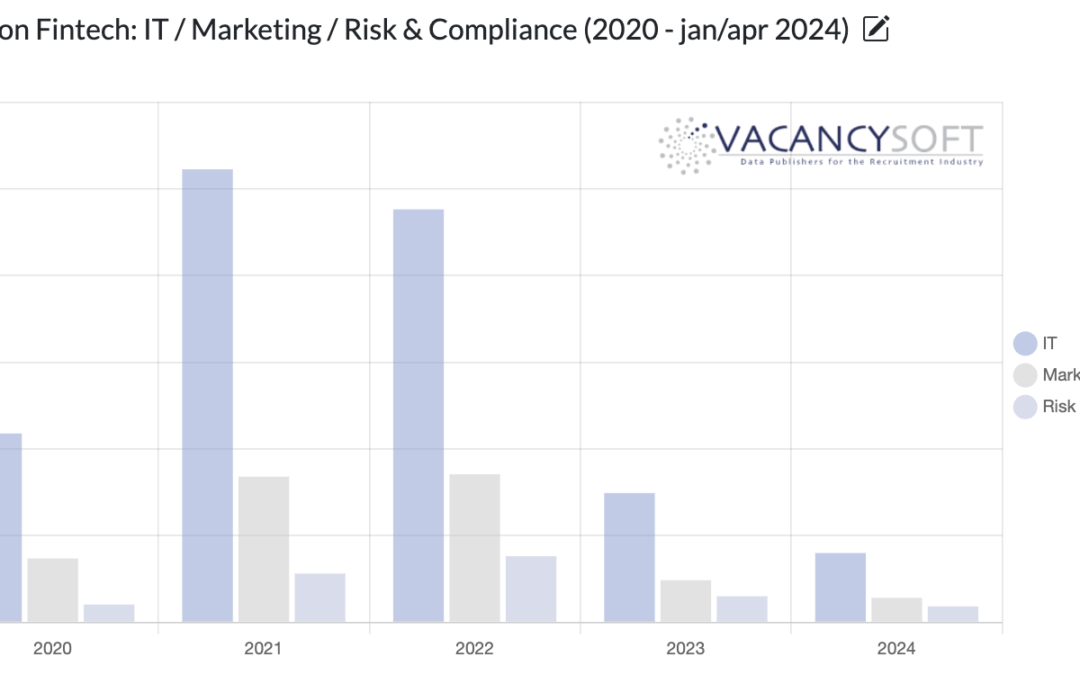

Fintech bounces back as VC funding increases

After a torrid 2023, the signs are positive for Fintech as VC funding into the sector accelerates. According to a recent report by Dealroom and HSBC, in Q1 of 2024, there were 73 rounds completed in Q1 of this year, totalling $1.4BN, making it the leading sector for investment, this year so far.

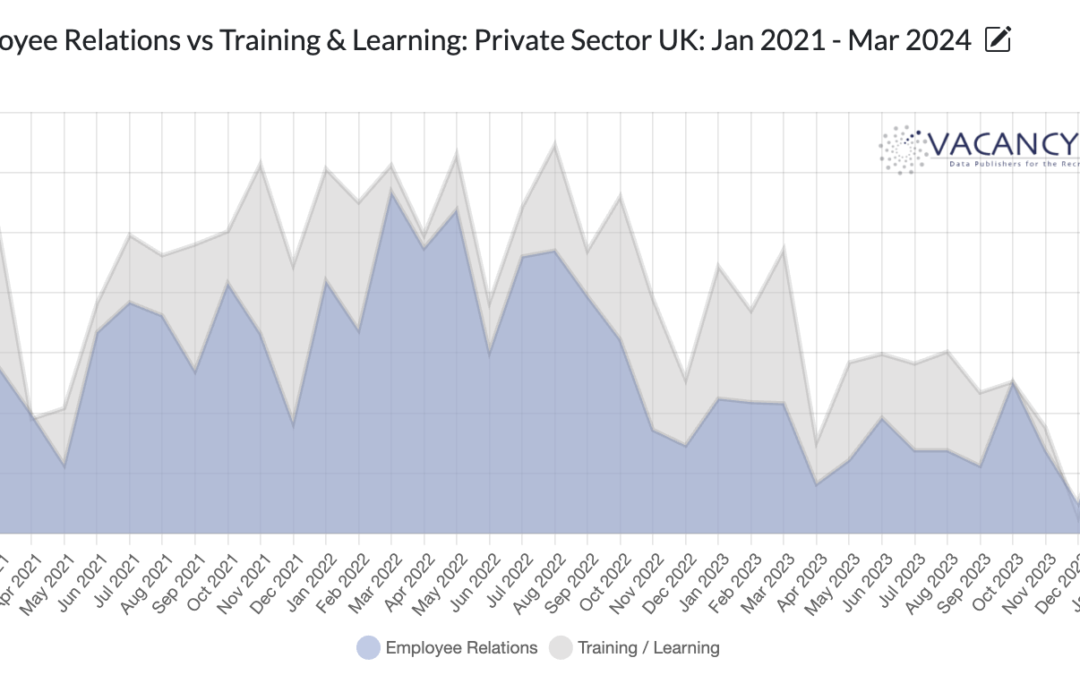

Why are Employee Relations specialists suddenly in Demand?

For the first time in over three years, this March, there were more vacancies for employee relations specialists than training/learning across the private sector in the UK. While this was just one month, the signs are that in April, it is set to repeat, at which point this could indicate corporations are shifting their priorities when it comes to their staff.

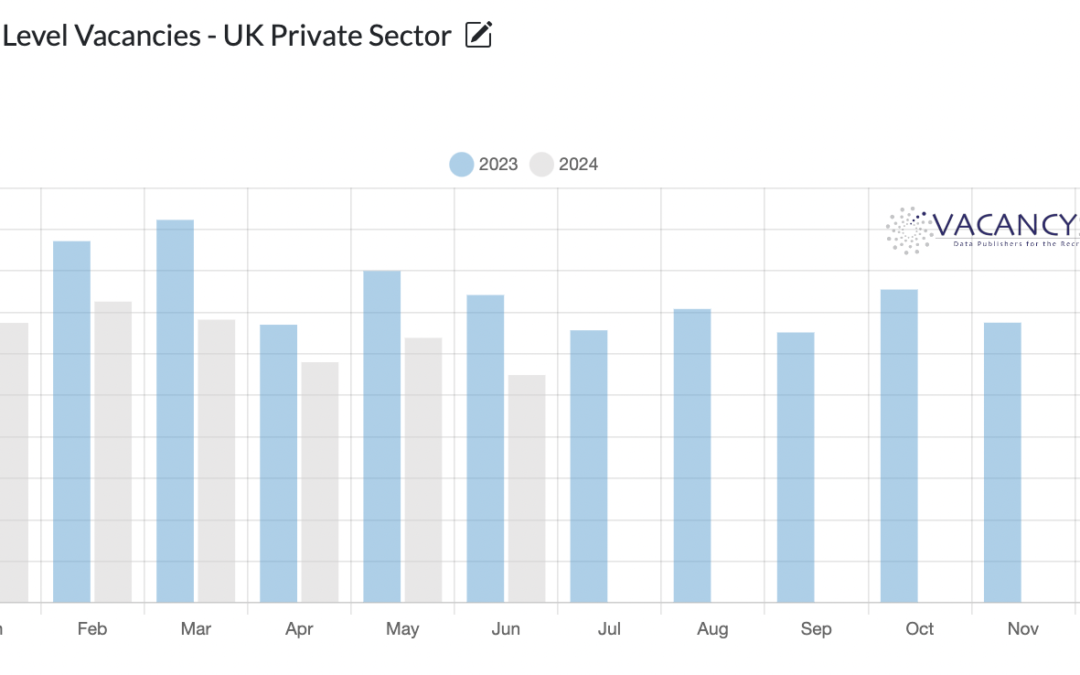

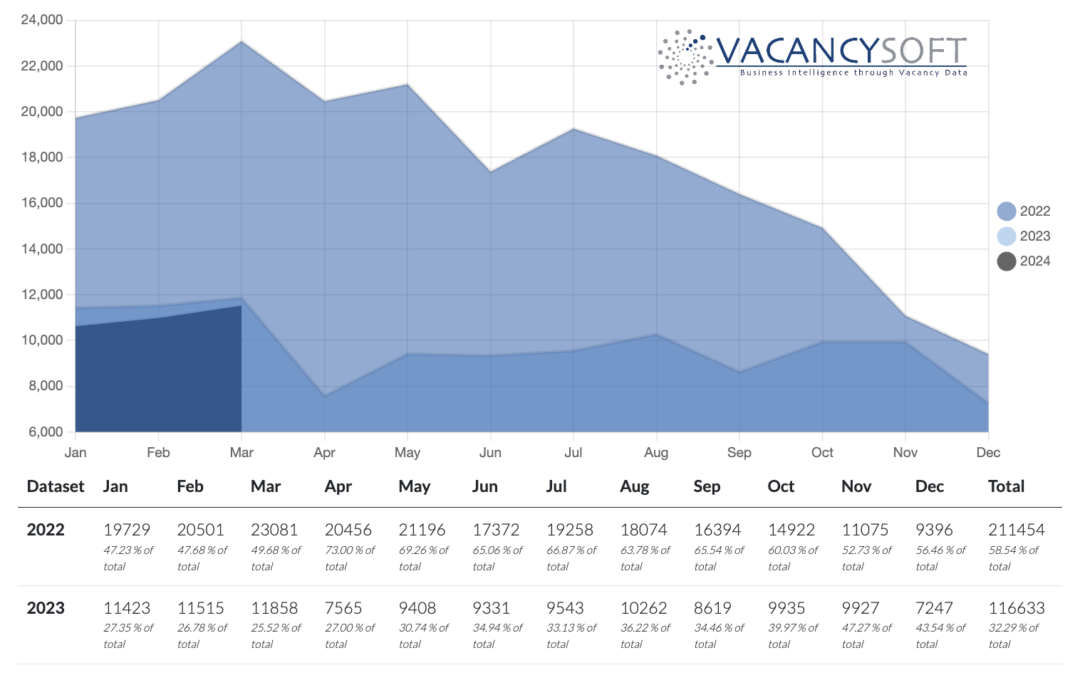

Beware the false dawn

As we approach the end of April, the general consensus is that the market is on the up, that Q1 was a busy quarter and there is positive sentiment, looking ahead. When you compare Q1 2024 to Q4 2023, it is not surprising for sentiment to be as such, after all, there was an 18% increase in vacancies quarter on quarter!

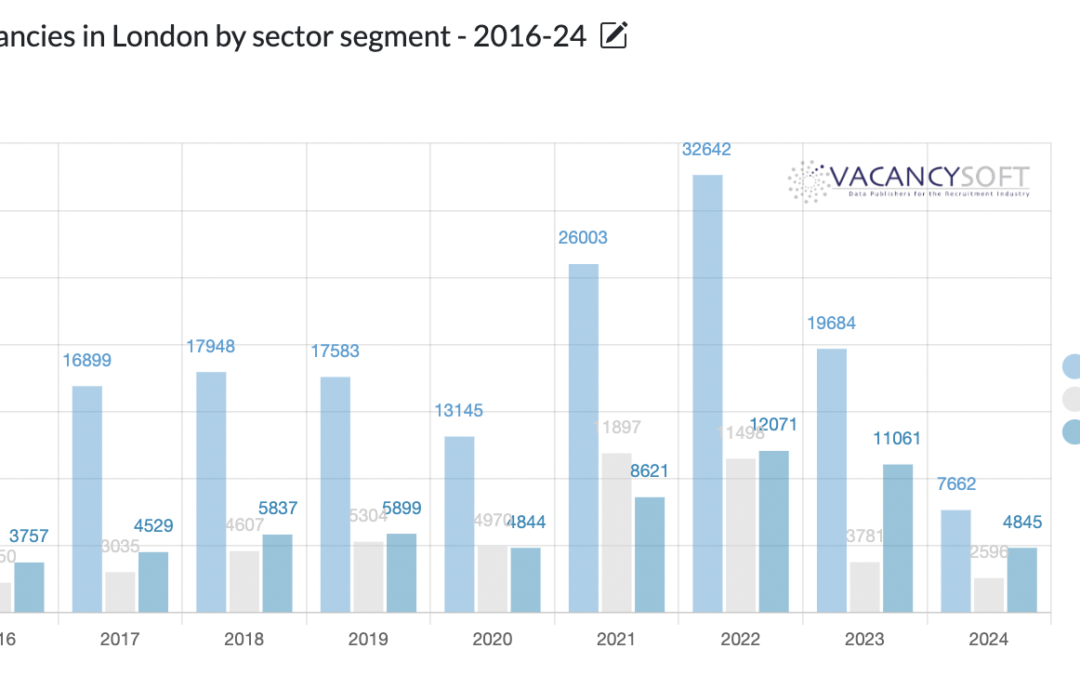

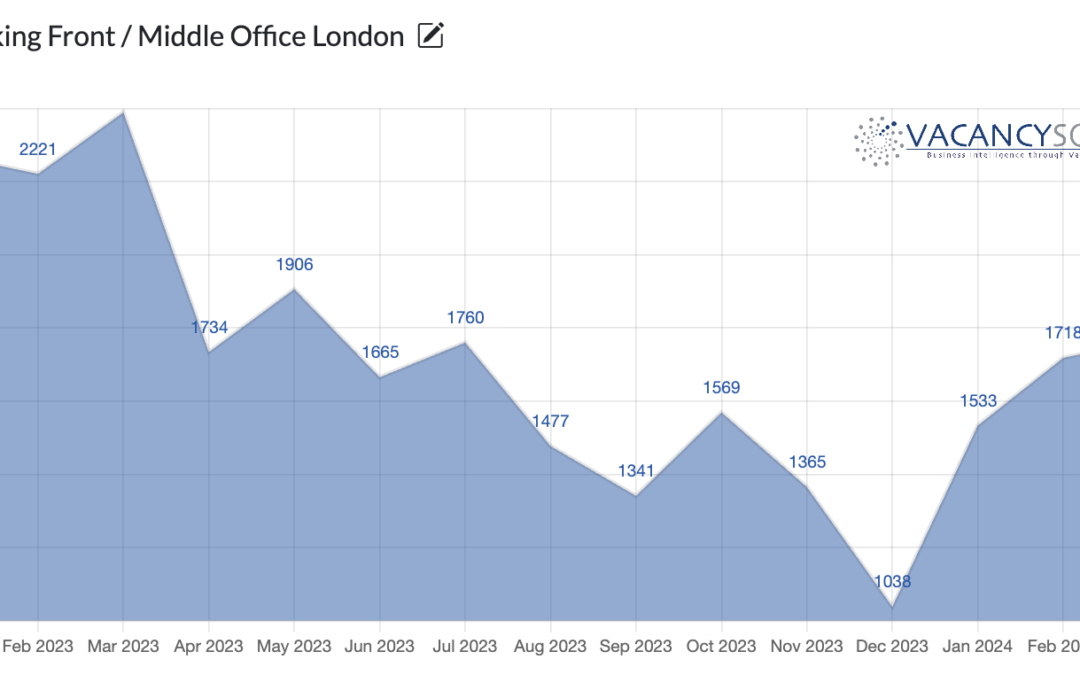

Banking Recruitment in London hits 10 month high

Financial Services is one of the largest industries within the UK, and contributes 8.3% to economic output. Overall the Financial Services industry employs over 1m people in the UK, and also runs significant trade surpluses, as a result, what happens in Banking is of direct relevance to the entire economy, and London in particular is of significance.

Is retail about to surge?

With the clocks changing and the days getting longer, there becomes a tangible shift in the mood of the nation. Typically that translates into a pick-up in activity for retailers. Indeed, Since 2021, the only time that Q2 performed worse than Q1 was last year, equally, that did coincide with the sharp downturn in the economy caused by quantitative tightening, which instantly acted to squeeze the economy.

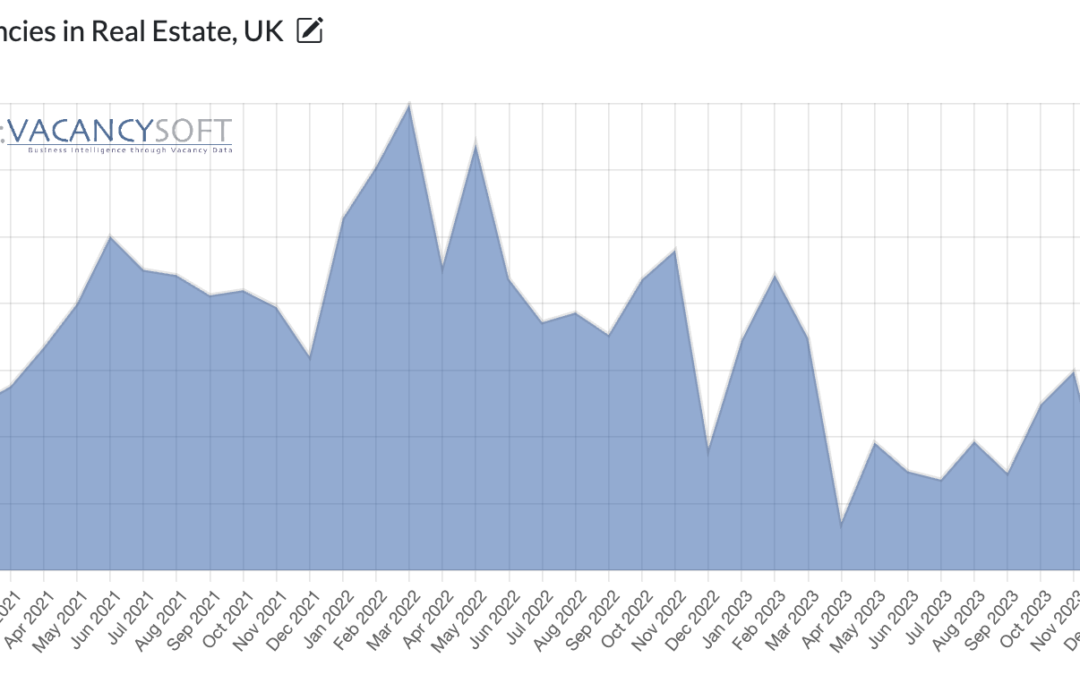

Property picks up as interest rates fall

After all, following 2023, the real estate industry is showing signs of picking up as interest rates fall. Residential Property, in part due to the chronic shortage of new houses being built, is already seeing prices rise. With commercial property, there is a deeper question about what kind of work space businesses want, in this new pandemic period. Insofar that nationwide, occupancy is still below pre-pandemic levels, some areas are doing better than others.

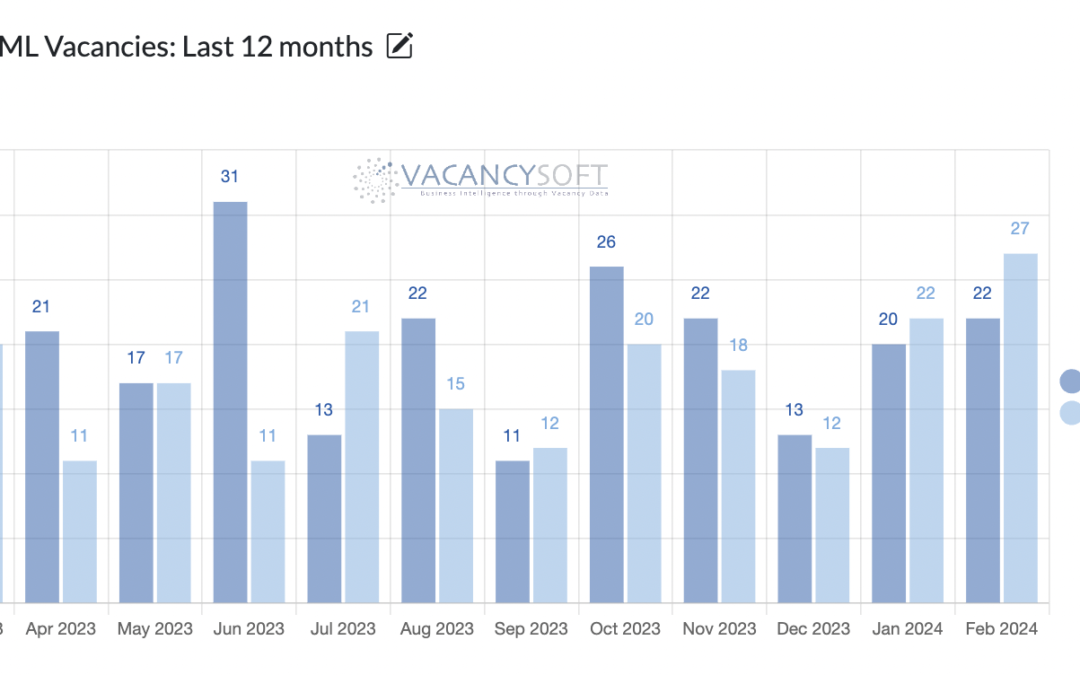

Anti-Money Laundering Vacancies hit 12 month high

As Russia re-elected Putin this weekend, the impact on the UK is being seen in more ways than one. Already, Grant Schapps is talking about the need for further defence spending as we move from a post-war to a pre-war world. Meanwhile, the avenues for money to be funnelled into London are slowly closing, and the determination to minimize access is clear. The decision to double the economic crime levy for very large companies from April, to £500,000 per institution is a reflection of that.

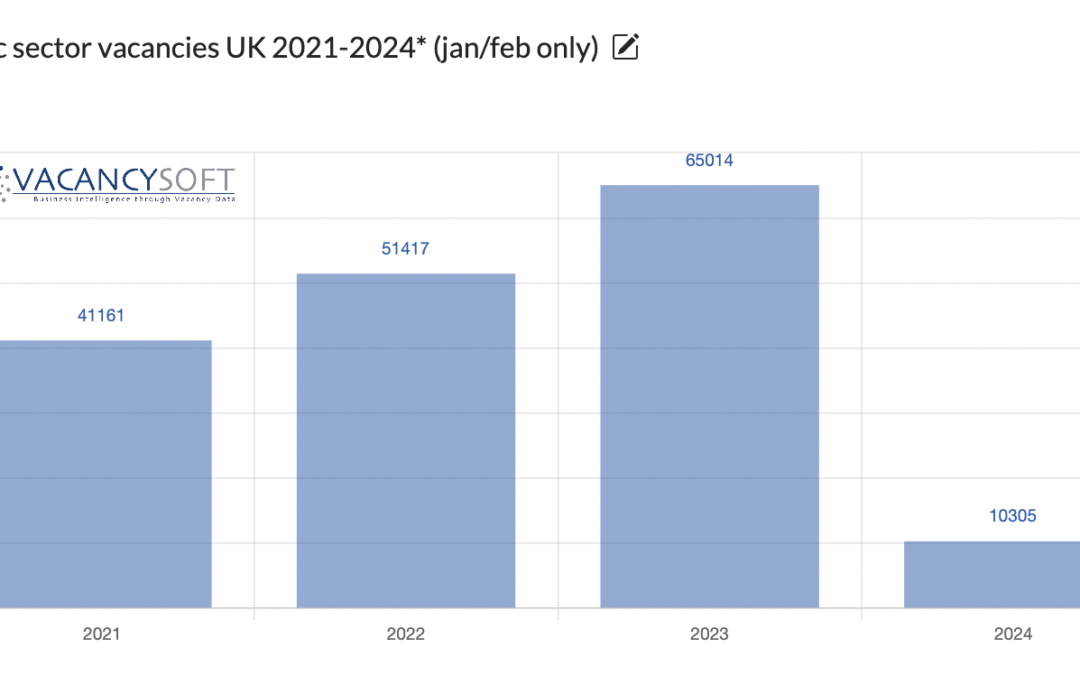

The public sector looks set to shrink this year, what next?

Government pressure on public sector spending sees vacancies drop. At the last count it was estimated there were nearly 5.9m people employed in the public sector, where just as importantly, that number has grown significantly over the last seven years.