Vacancysoft is the UK's leading provider of labour market data and analytics.

We provide high-grade lead generation, client intelligence and market analysis solutions for Britain's top recruitment industry firms and others.

Want to be ahead of the market?

- Discover the key positions organisations want to fill

- Drill down by professional area, location and sector

- Create bespoke reports suited to your business

Ready to get started?

- Determine what key businesses are recruiting for

- Drill down by professional area, location and sector

- Build your own bespoke report mapped against your business

Featured in:

The power of data

- Streamline your lead generation

- Spotlight key account activity

- Develop your business strategically

- Build and promote your brand

- Analyse future opportunities

- Accelerate your business growth

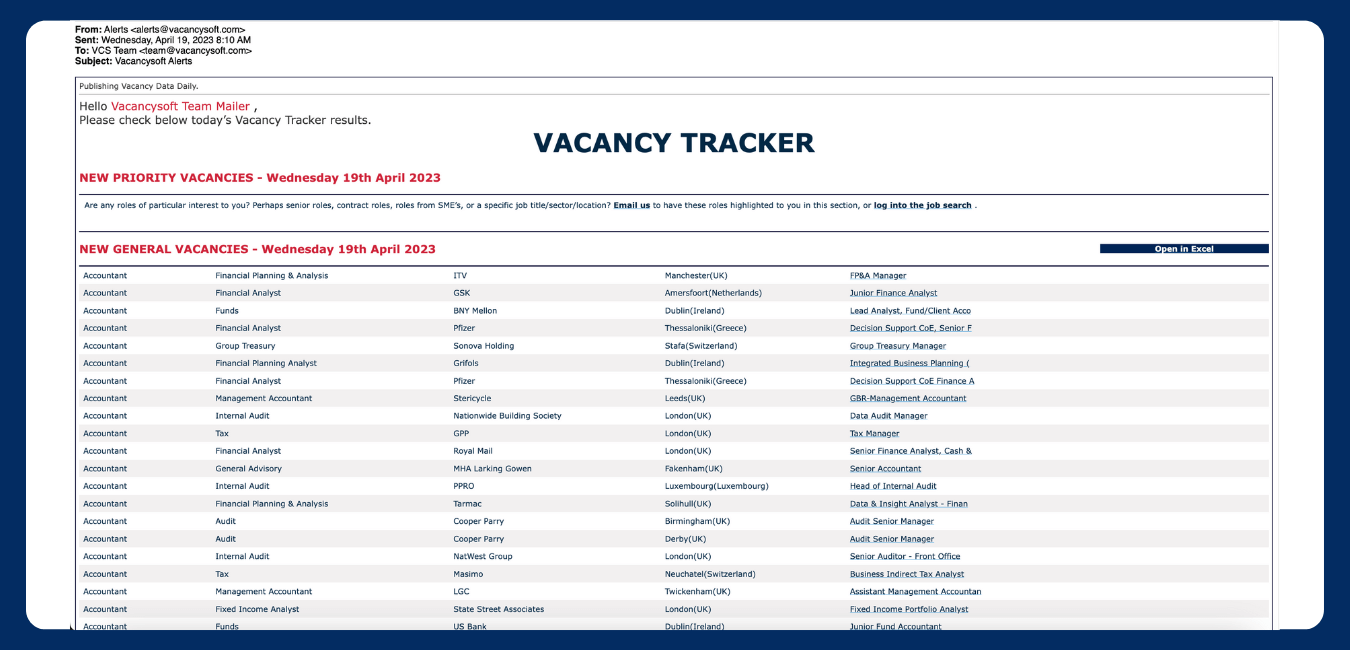

Streamline your lead generation

- Daily email updates containing vacancies filtered to you

- Set filters by role, sector, location or even company size

- No spam — just the jobs you want, received every morning

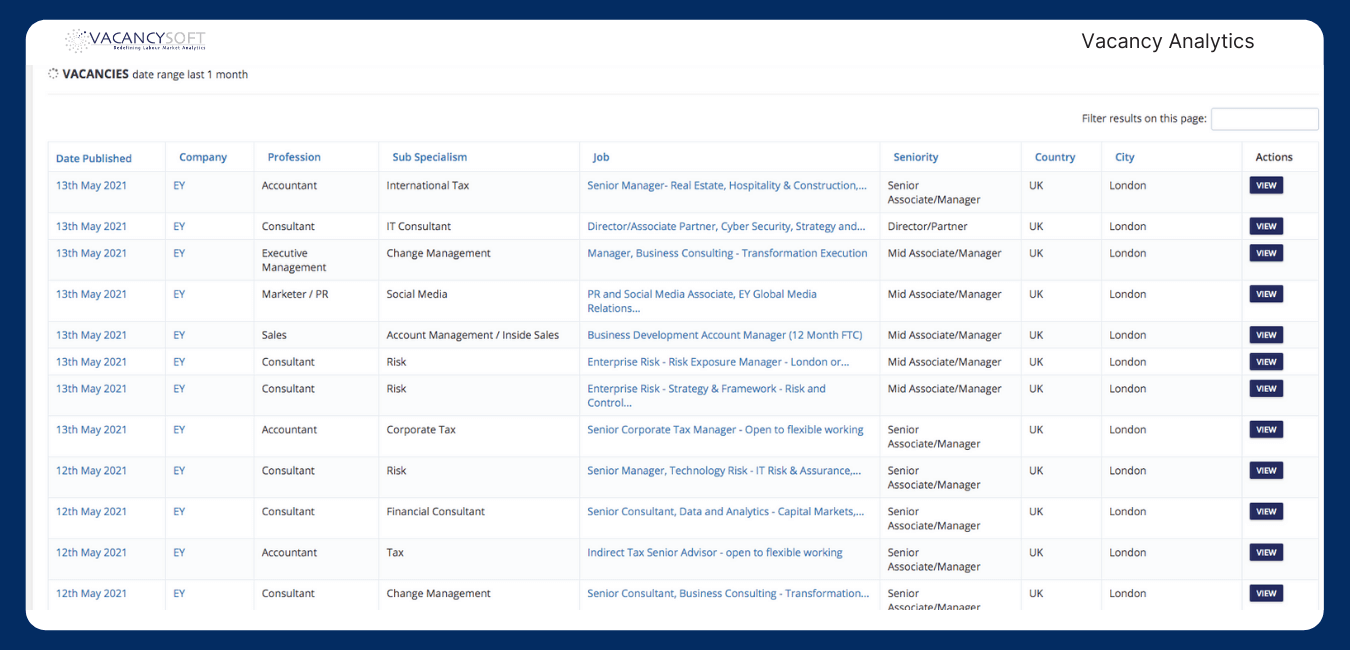

Spotlight key account activity

- Pinpoint every opportunity, strike with confidence, engage with insight

- Get relevant jobs by sector, location, role and company size

- See what positions key accounts are filling with VacancyBank

Develop your business strategically

- Build hit-lists to know when companies start recruiting

- Monitor companies’ recruitment activity, see who is most active and where

- Focus on firms at the beginning (not end) of recruiting cycles

Build and promote your brand

- Be the go-to expert for labour market trends and insights

- Create reports to share on social media, newsletters or your blog

- Apply your own colour scheme and watermark to personalise reports

Analyse future opportunities

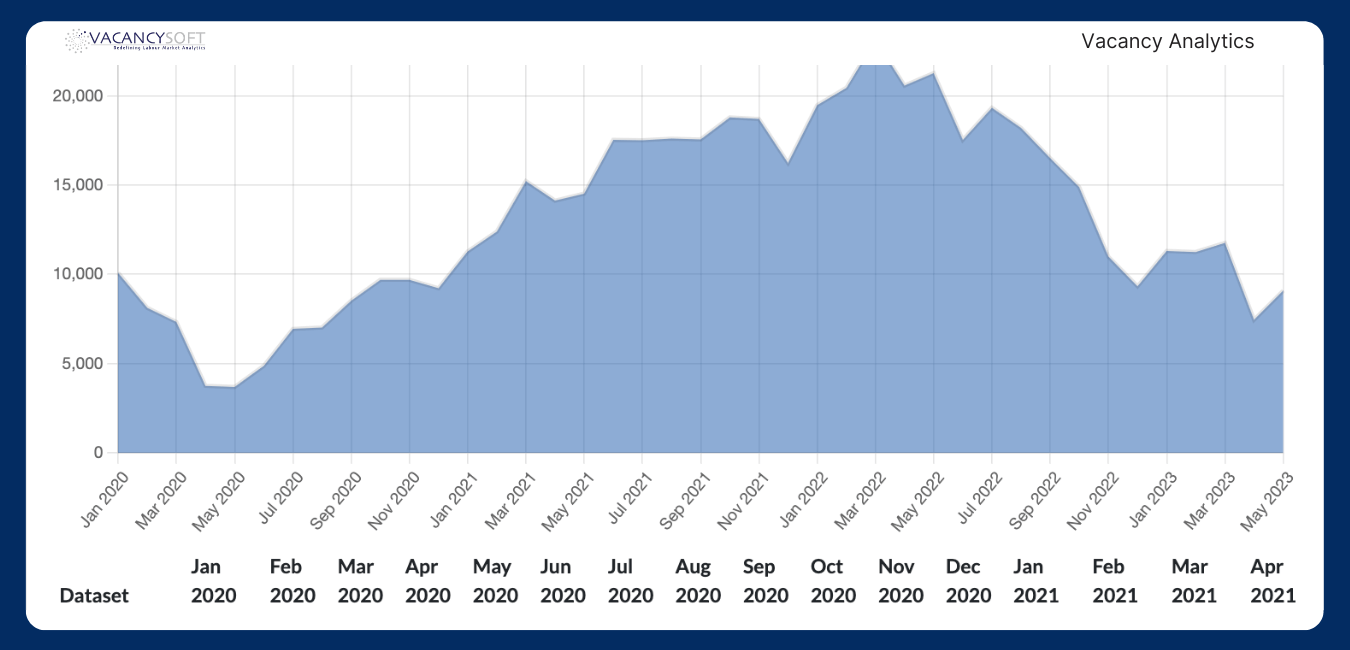

- Get market intelligence that keeps you ahead of the rest

- Monitor key markets to see where hiring hotspots are forming

- Identify real opportunities by sector, location and role

Accelerate your business growth

- Enable your team to win more and better work, faster

- Allocate your resources on the right priority areas

- Target niche markets with the most potential

Why our clients choose us:

- Established in 2006, with a track record of delivering value

- Pricing structure which means you control your expenditure

- Our insights into trends will help you be more client-centric

- Our services will keep you ahead of the competition

Ready to get started?

- Determine what key businesses are recruiting for

- Drill down by professional area, location and sector

- Build your own bespoke report mapped against your business

LondonlovesBusiness: Accountancy and Fintech thrive, banking falters: UK finance jobs report 2025

The accountancy sector saw a strong rebound in 2024, with vacancies rising 29% to their highest level in five years, accounting for 54% of all openings.

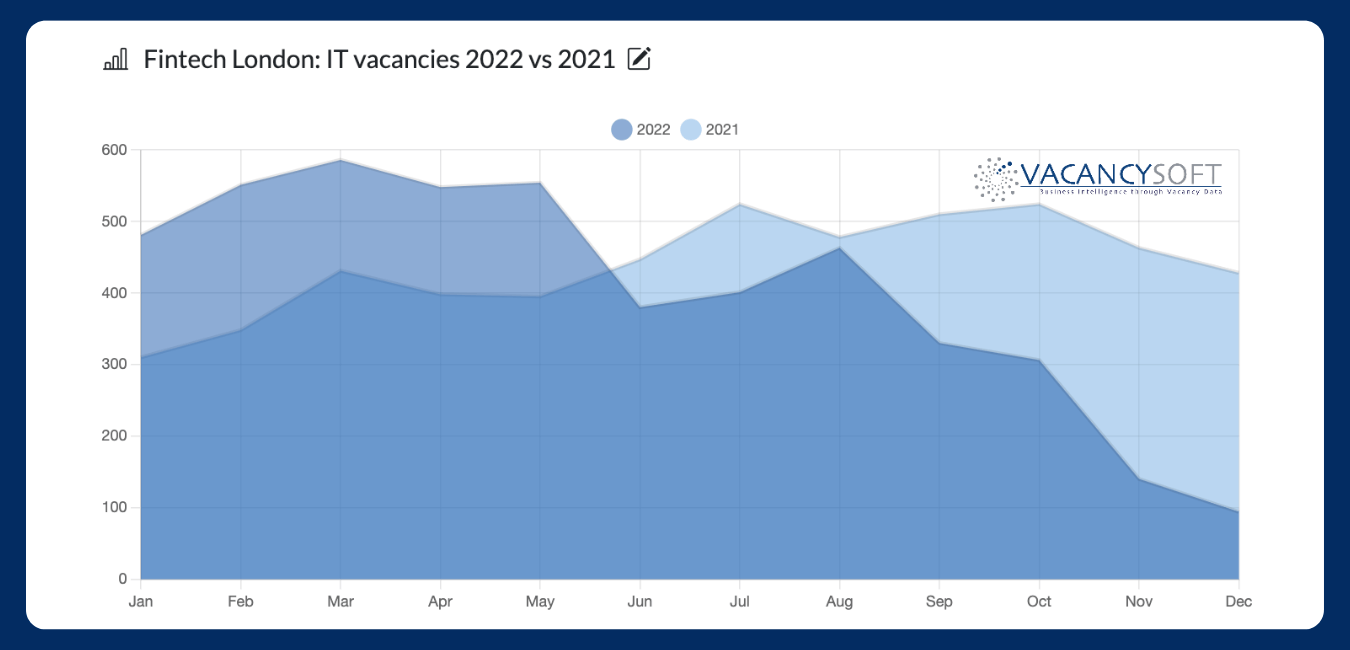

Finextra: UK fintech jobs market booms

Fintech vacancies surged to 12,519 in 2024, up from 8,672 the previous year, driven by increased venture capital funding, AI adoption, and industry fragmentation, according to a report by Morgan McKinley and Vacancysoft.

The Fintech Times: Capital Funding and AI Adoption Drive Fintech Hiring Growth, as Banks Vacancy Numbers Fall

Nearly two-thirds (63%) of UK financial institutions now invest in AI, up from 32% in 2023, according to a new market trends report by Morgan McKinley and Vacancysoft

Reports

Download our reports, written with industry partners, that analyse the trends driving UK staffing.

London – UK Regional Labour Market Trends, December 2025

This report examines London’s stronger-than-average job growth in 2025, driven by rising demand for tech and executive roles. It highlights a shift toward digital skills as leading employers expand despite wider economic caution.

Fintech – UK Legal Labour Market Trends, December 2025

This report examines the sharp rebound in UK FinTech hiring, with vacancies set to rise 36.9% and London accounting for nearly three-quarters of all roles. It highlights accelerating demand for specialist technology, compliance and credit risk talent, driven by fast-scaling firms and a sector increasingly focused on regulation, resilience and platform innovation.

Medical Affairs – UK Life Sciences Labour Market Trends, November 2025

This report examines how global pricing pressure is driving a 9.6% decline in UK Medical Affairs hiring for 2025, with London remaining resilient and Wales surging. It highlights the contraction among major pharma, contrasted with growth in CROs and biotechs, and shows how AI is reshaping support roles while core scientific expertise remains in demand.