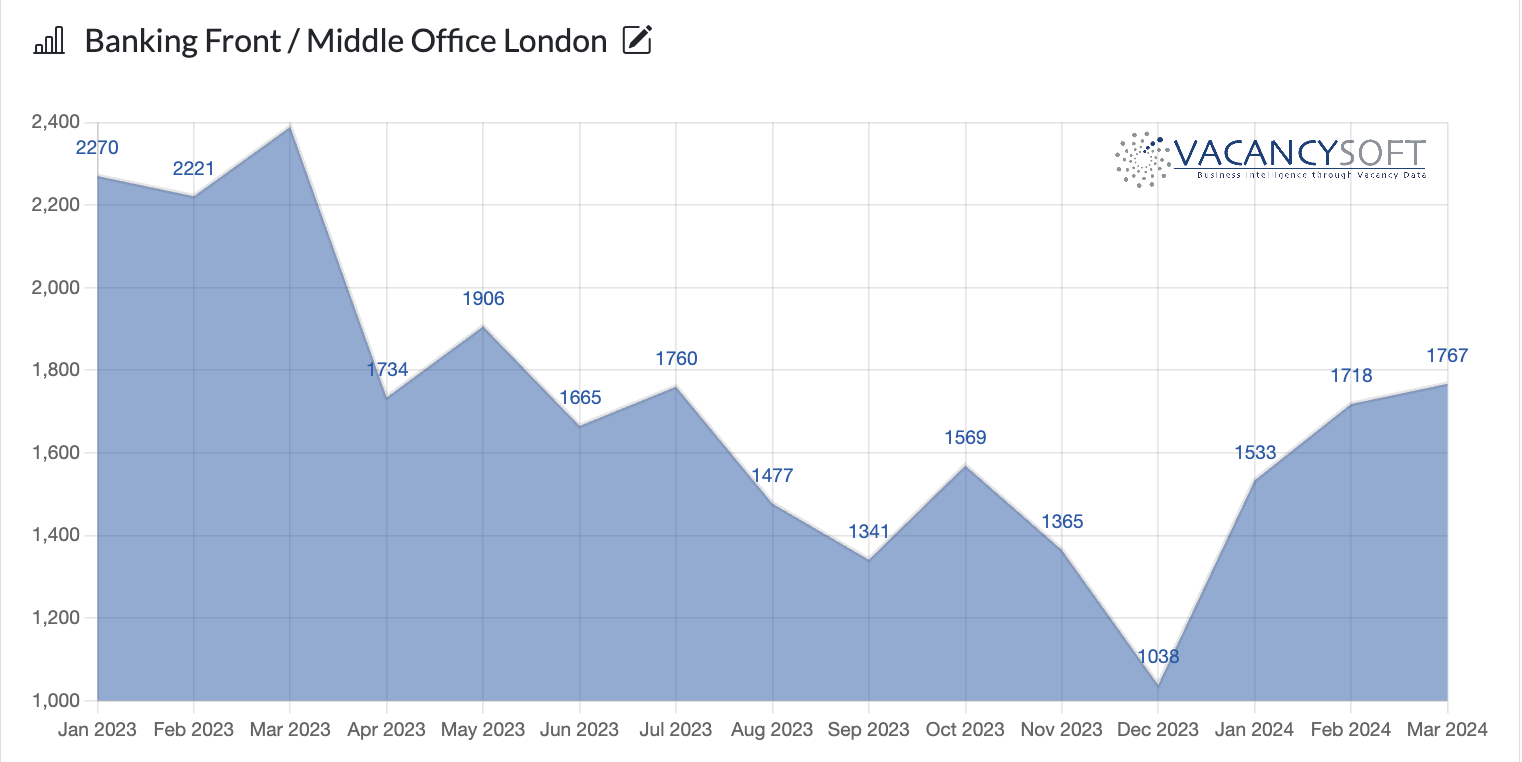

Banking Recruitment in London hits 10 month high

Vacancies in banking hit levels last seen in May last year

Financial Services is one of the largest industries within the UK, and contributes 8.3% to economic output. Overall the Financial Services industry employs over 1m people in the UK, and also runs significant trade surpluses, as a result, what happens in Banking is of direct relevance to the entire economy, and London in particular is of significance.

It is also a sector which is highly sensitive to economic cycles, meaning that when the economy is growing, Financial Services performs better than the average. Hence with recent forecasts that the UK is emerging from recession, it is interesting to see what has been happening with the London Banking sector. On that basis, what we can see is that:

- Q1 2024 had more vacancies than any other sector going back to Q2 2023.

- This quarter has also seen an uplift in vacancies of 26.3% compared to Q4 2023.

- March 2024 has seen the highest vacancy totals, since May 2023.

When analysed further, whilst the vast bulk of roles being generated remain in middle and back office (Risk & Compliance roles have accounted for 16.6% of vacancies in this quarter gone, down from 19% on an annualized basis) there has been an increase in front office vacancies too. Investment management roles for example are on the rise.

For the investment banking community though, the future of London as a financial services hub is becoming a topic of discussion. With ARM relisting and seeing their share price surge, there are fundamental concerns for the future as the number of UK listed IPOs drops to record lows. Challenges include:

- Outside the EU, London no longer has the prestige of being the Financial Services capital of the block

- UK Pensions funds are insufficient as an anchor, accounting for under 5% of holdings of UK listed shares

- In regulatory terms, whilst London is better than some, it is far from the best in class. Amsterdam for example in Europe leads the way here

- Stamp duty on share transactions also feels a step too far when this is not charged in the USA, or Germany, or most of the other exchanges.

Therefore the uptick in jobs in Banking in London is not necessarily indicative of the health of the sector. Looking ahead, we would want to see a significant uplift in front office roles for it to show banking confidence, and as of now, that is yet to materialize in a significant way.

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute workshop with us and discover the power of data in shaping the future of your market!

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!