Are corporations scaling up talent teams again?

As we have touched on before many times, 2023 has been quiet compared to the mania of the last few years and job volumes have been significantly lower. This has led to talent teams within businesses being scaled back and given this is the most critical function for businesses looking to hire, it acts as a good indicator as to business confidence. When businesses increase hiring into internal recruiters, there is confidence in growth, when vacancies drop, this means there will be less hiring.

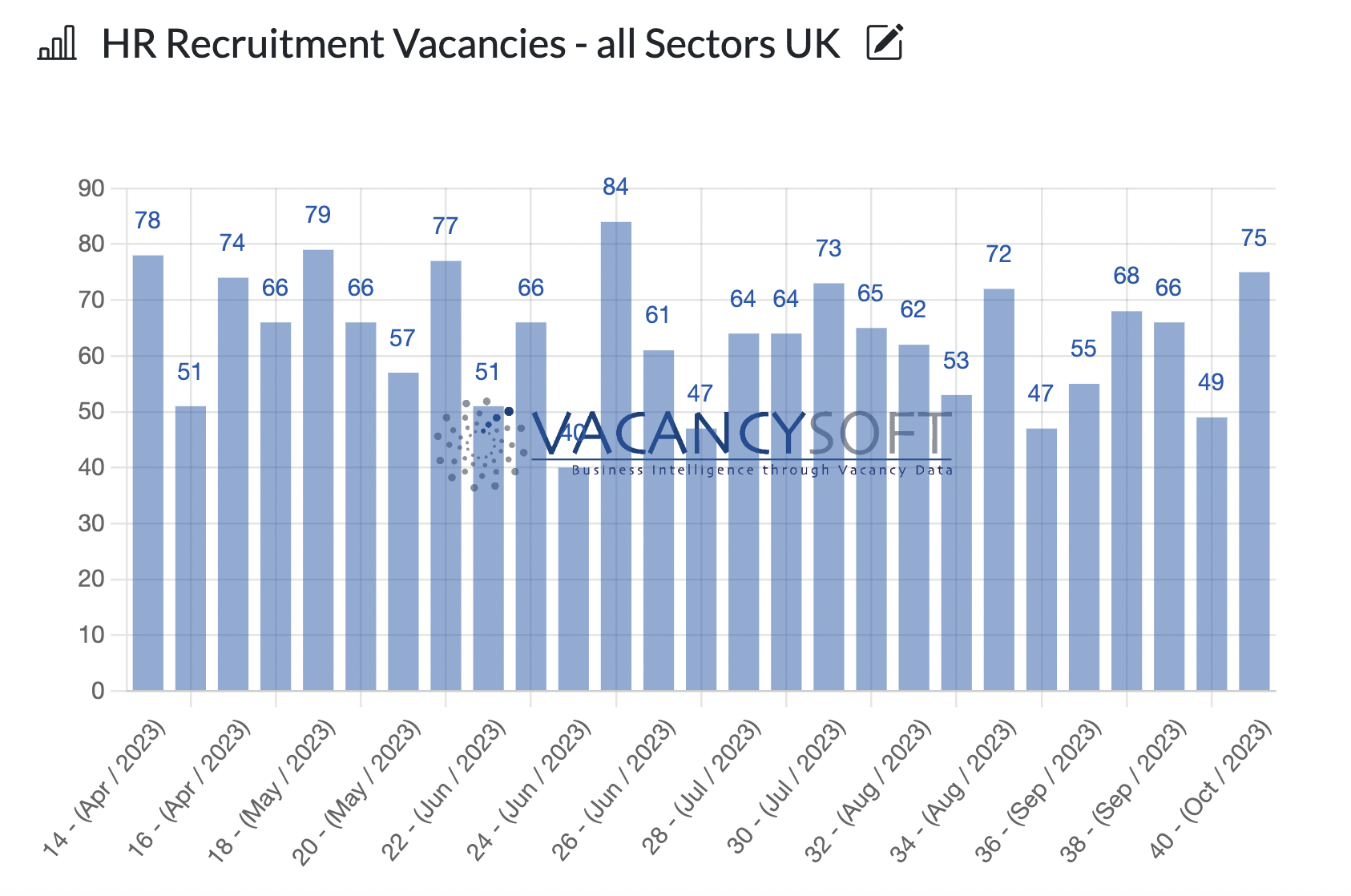

Hence looking at the period since Easter is interesting as we see that October has kicked off with a bang. Last week saw the record number of internal recruiter vacancies since June. Meaning there were more vacancies for internal recruiters last week than in any week in Q3. In terms of the hotspots within this:

- By Industry, Tech, Media & Telco firms are surging again. For context, over the last 6 months they account for 16% of the internal recruiter vacancies. Over the last month, this has risen to 27%.

- By Sector, travel & leisure is the no1 sector hiring for internal recruiters right now, and the share has been growing (12.4% of all internal recruiter vacancies have been in travel & leisure over the last month.)

- London is starting to bounce back – over the period, 32% of the vacancies were in the capital, whereas in the last month, that has risen to 36%.

- Leeds is now the fourth largest city for internal recruiter vacancies at the moment, and the share is rising. (6.7% last month vs 5.7% over the last six months.)

For the London market to bounce back properly, it needs Corporate Finance to swing back. Therefore the real data point to watch will be internal recruiter vacancies within banking and financial services. In 2022 there were 1026 internal recruiter vacancies whereas this year to date, there have been 410. Annualized therefore we anticipate this to rise around 550. This would be a 50% drop on last year. However, when we compare that to the number of internal recruiter vacancies across Banking & Financial Services in 2019, we see that total was 527. Hence what we are seeing is the activity now, is broadly mirroring 2019 in the way we are seeing with the national picture. This we would argue is a positive sign and shows the bottom of the market has been reached and it should be upwards from here.

Nonetheless, the coming weeks will be critical for determining if this week is just a one off, or is the beginning of an upward trend. Weekly reporting on vacancy analytics is now one of the most widely used functions, for this very reason. When we see an uptick in the market, is it a one off or is it a trend? The factor we gather jobs from company websites (not job boards) meaning internal talent teams are posting there before briefing agency means we are typically a week or two ahead. Hence when we start to see a trend emerge, the reporting we provide can inform you ahead of your competition.

To find out more and have a free workshop, please do get in touch.

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute workshop with us and discover the power of data in shaping the future of your market.

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!