Are retailers moving HQ jobs from London for good?

For retail and consumer goods and services, 2023 has proven to be a challenging year. The impact of the changes to VAT has meant that as tourism has returned, the luxury goods sector has flatlined, despite London having more tourists than ever. At the same time, quantitative tightening has resulted in challenges to household liquidity, which has meant there has been downward pressure on disposable incomes.

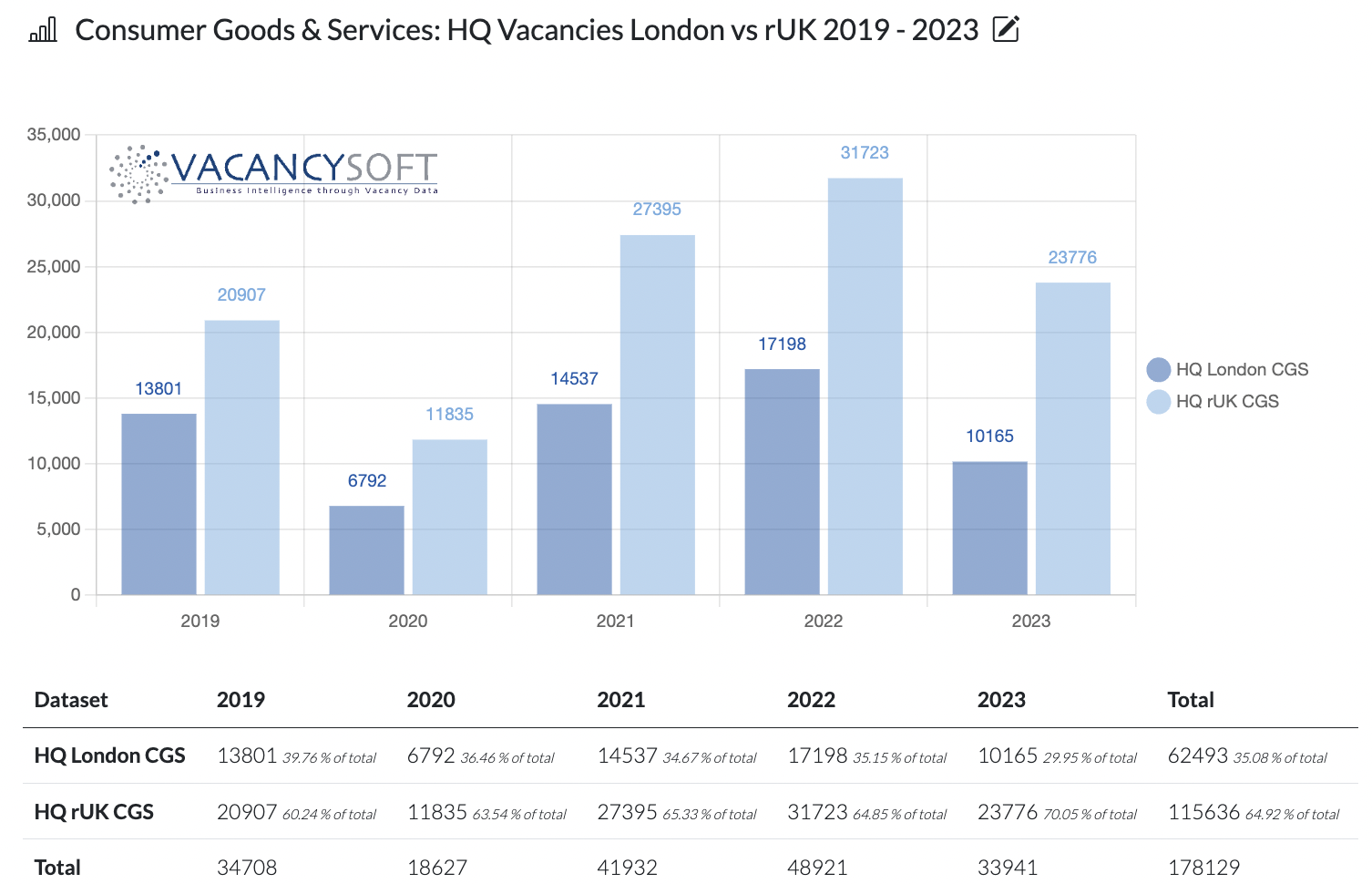

Nonetheless, despite these challenges, vacancies in 2023 broadly mirrored the 2019 totals, meaning that once we discount the pandemic related surge, what we see is the return to equilibrium and being candid this is a trend we have seen across the various business sectors.

What is interesting about retail and consumer goods and services though, compared to other industries, is that here, there has been a marked and profound structural shift of jobs away from London in a way not seen in other sectors. For example, we can see that in 2019 60% of HQ function vacancies were based outside London, where by 2023 this had risen to 70%. But just as importantly, this had been a step by step increase every year. Hybrid working has also leant itself to businesses wanting to downsize their London functions. As a result, we would see this industry as being one of the most heavily influenced by the move towards regionalization.

As a case in point, not all sectors have seen the same trend. For example, in Banking, the share of vacancies falling in the capital arguably is linked more to the cyclical changes, and as corporate finance picks up, so the London based vacancies will pick up. Same applies with say Real Estate or Technology as VC funding picks up.

These are all trends we will be analysing in a new upcoming report we are producing, which will be published in the coming weeks. We will be looking at the trend towards regionalization. Many forecasters are predicting the death of London, but how real is that? Are organizations really pulling jobs out of the capital, or is this just a market cycle?

Similarly, in truth, trends typically aren’t universal, but vary by industry and function, so with that, which industries are seeing the structural shift away from London to the regions other than consumer goods and services? Also which job functions are being shifted out of the capital in the greatest proportion? Finally, what are the companies to watch? Which businesses have had the biggest shift over the period from London to their regional hubs for HQ functions? And which areas do we expect to see London rebound in specifically, and why?

If you would like to request a copy of the report when it goes live, please do write to us, we will make sure to personally send it to you.

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute workshop with us and discover the power of data in shaping the future of your market!

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!