Are you ready for 2024?

Looking ahead we are forecasting a fast start to the year, with Q1 projected to be the busiest business quarter of the year in terms of new vacancies.

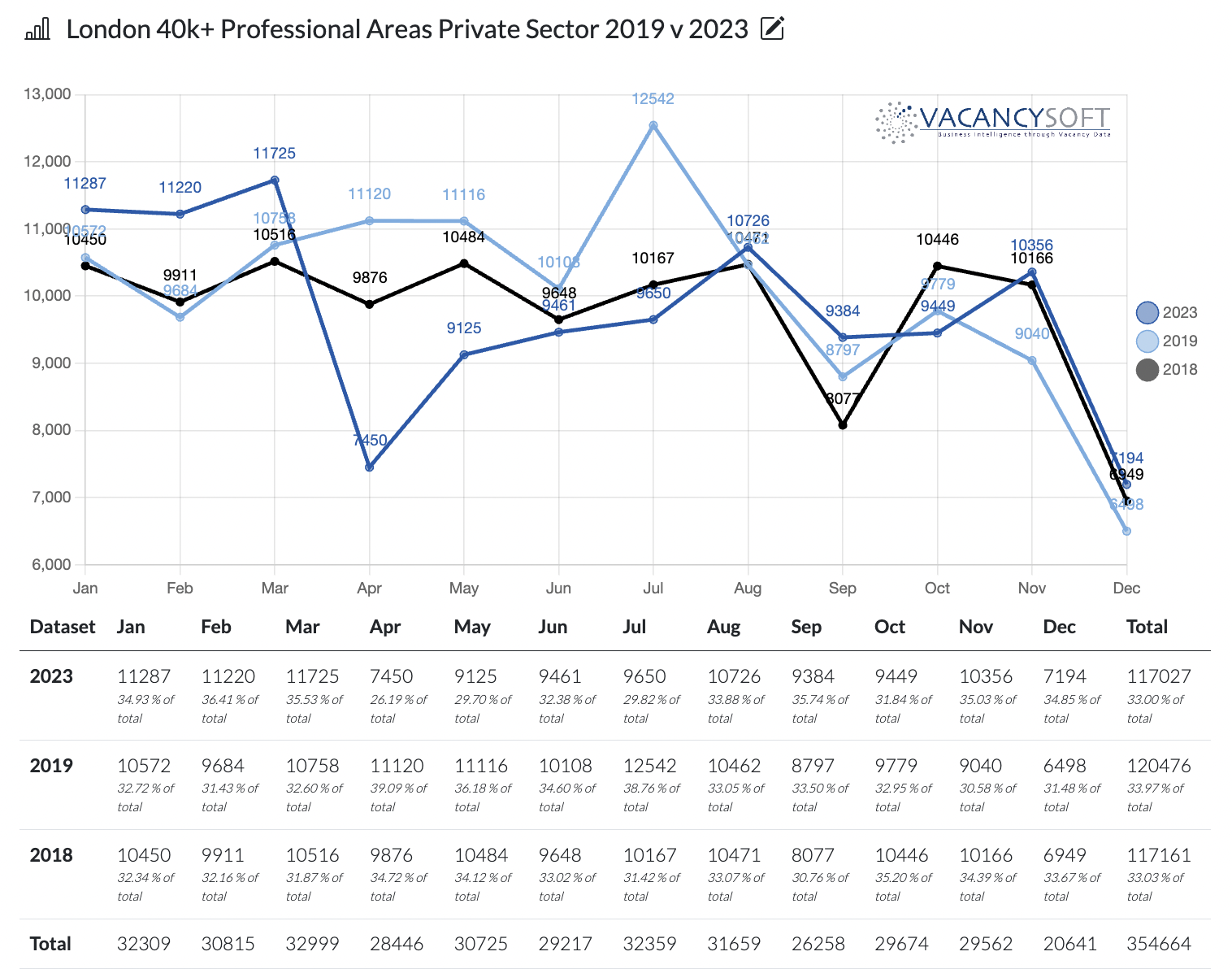

Discounting the pandemic period of 2020-22, what we see when taking three years’ worth of data of the London market, in terms of new vacancies, is that Q1 has averaged 27% of the average annualized total, Q2 and Q3 both account for 25%, whilst Q4 is 22%. What this means therefore, is that the chances are your clients are over the coming months likely to be busier in terms of first phase recruitment than they would be in other business quarters. In fact, looking at the three year average, March is consistently the busiest month in terms of new vacancies. (Inversely, September is one of the quieter months, August seems to be the month where we see a surge of vacancies being posted online)

The question is therefore how ready are you for this?

Underlying economic indicators are positive. Salary rises are outpacing inflation and interest rates are forecast to fall. Mortgage rates are already falling and inflation seems to be dropping to levels not seen since 2020. In the meantime, the pound is forecast to strengthen against the dollar this year and is already at levels not seen since July last year, which will help keep the costs of imports down. Just as importantly, the UK seems to have finally shaken off the disruption caused by the culture wars of the referendum. Polling consistently now points to the fact that other than a small minority, most people are more concerned about competency in Government than whether or not the UK is in the EU. Trumpian candidates therefore are on the wane. Managerial candidates are coming to the fore. With that, the next prime minister, be that Starmer or Sunak holds little fear for third party investors. Contrast that with the US where the outcome of the next presidential election is genuinely consequential. Or France, where the next president could be Marine Le Pen, a right wing Russian sympathizer in favour of FREXIT.

Hence given the relative stability within the UK, we are forecasting that this year will actually beat the three year average. 2018 and 2019 were stifled by political volatility, 2023 was depressed by the market shock of interest rates rising. With these considerations discounted and the size of the UK employment pool rising as the population of the country grows (the population is now estimated at over 68 million, compared to under 67 million in 2020) given that unemployment remains constant, this indicates more people being employed and with a constant churn rate, vacancies increasing as a result.

Within London we expect IT to pick up again, and for vacancies there to surge significantly after the drop off last year, as venture capital and private equity firms pick up. For many recruiters, insofar that last year was a challenging one there will be those who welcome the opportunity to turn the page. Having a fast start therefore is of key importance. Talk to us if you aren’t using us already, we can help you identify which companies are surging in hiring right now, to make sure your business development is focused on the right areas.

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute workshop with us and discover the power of data in shaping the future of your market!

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!