Could Pensions Funds be the solution for IPOs?

First ARM relists to the NASDAQ and sees their share price double since their IPO. Now more companies are being targeted as the UK struggles to compete in a new world order, where it is no longer able to operate as the financial services capital of the EU. Indeed when you consider that since 2010, whilst on average per year there have been on average 78 IPO’s per year, the trend in the last few years has been downwards, in fact, in the last two years there have been under 78 in total across the period. Markets are cyclical, this is true, equally what ARM has shown is that the UK can ill afford to rest on its laurels and the FTSE is vulnerable, especially whilst the share price stamp tax remains. (No such tax applies in NYC)

The challenge facing businesses has been in securing the scale up funding required, to be able to grow to where they are big enough to justify listing, hence the Government have announced an initiative designed to stimulate UK pension scheme investment into venture, growth and other private capital funds as part of a diversified portfolio. Please note, according to the City of London Corporation, only 0.5% of UK DC pension assets are invested in unlisted UK equities such as venture capital and growth equity. The objective with this initiative would be to increase this to 5%, where Britain’s pension industry is the biggest in Europe with assets under management coming in at £2.5 trillion. At a time when pension funds are under pressure to deliver better returns, this is also an opportunity for them. Figures provided by the British Venture Capital Association suggest that investing into private capital produces a 10 year horizon return of 17 percent, compared with a 6.5 percent return from the FTSE All Share index.

And which kinds of companies would benefit? The hope would be mid-size, fast growing technology companies, which are looking for sizeable investments to enable them to become global players. For the UK Pension funds, the opportunity to invest in such companies, where they then IPO into London at a later date when they are ready, could be a catalyst to kickstart the FTSE. At the moment, the challenge is these companies are at risk of being bought due to lack of liquidity at which point they are absorbed by larger multi-national companies, hence the thinking behind this strategy is also defensive, so ensuring executive teams have multiple options, including getting scale up funding via pension funds, along with a cash exit. For founders, raising venture capital funding is understandably challenging. This initiative is designed to simplify that.

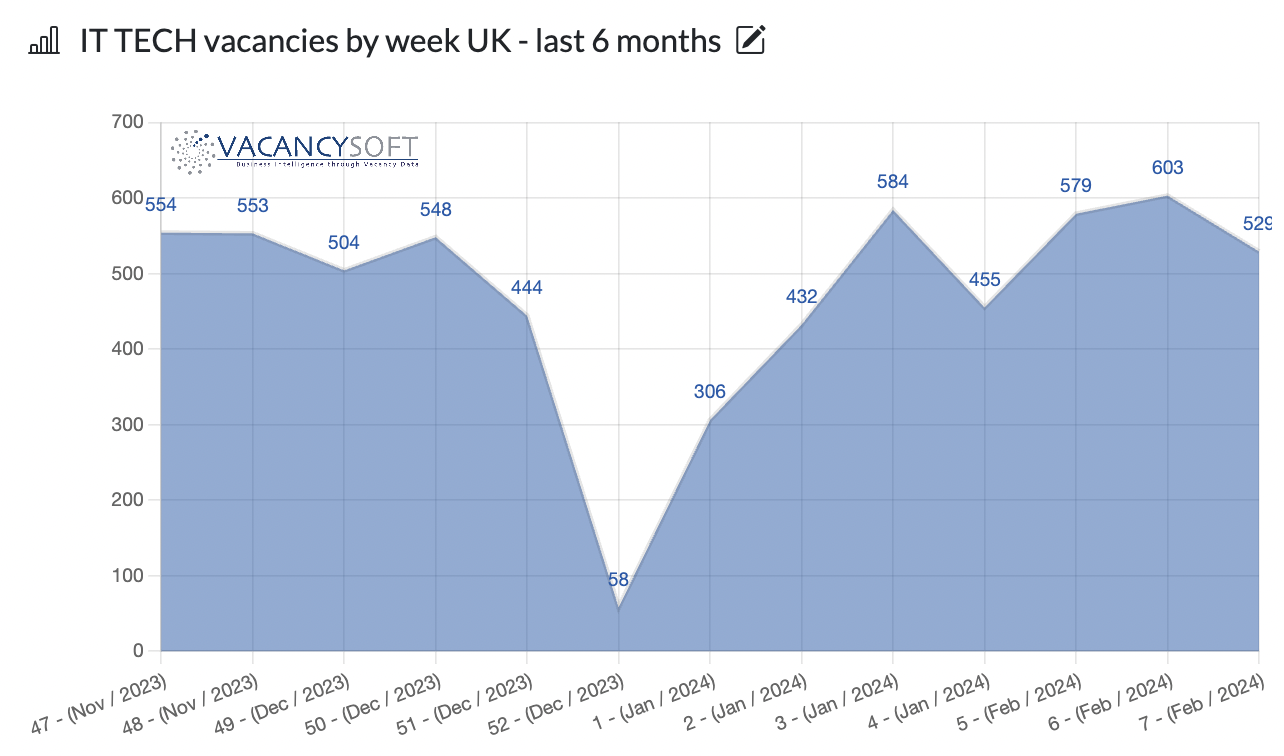

And what would this mean for the job market? Well, if this was applied universally across the asset managers, we would see upwards of £100 billion invested into the industry which would lead to hundreds of thousands of jobs in the UK, in highly paid areas. With that, is tech about to boom again? The signs in 2024 are already positive, indeed, when looking at the last month, we saw a record week in February, with vacancies hitting record levels over the 6 month period. But is that just the beginning? Time will tell.

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute workshop with us and discover the power of data in shaping the future of your market!

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!