As the Covid19 crisis continues, the immediate impact has been seen in the almost instant recruitment freezes. To help recruiters have a better picture of the macro economic outlook, we have compiled analysis of the London market, spotlighting professional vacancies posted on company career portals (not job boards) with salaries of £40k+ or more, as an indicator of underlying confidence. With that, we can see the following:

-

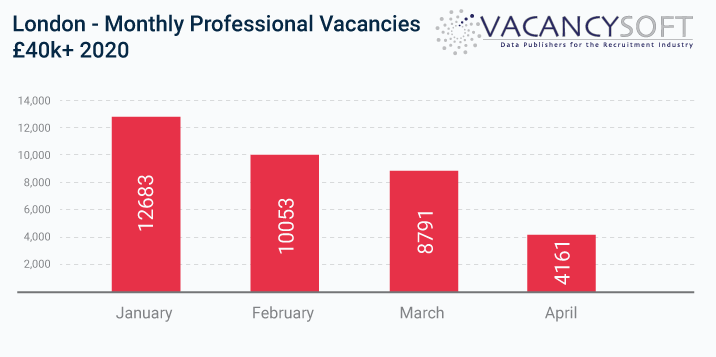

- In Chart 1 we see that across all sectors, there were 31,527 professional vacancies in London with salaries of £40k or more in the first business quarter, making a monthly average of 10509. In contrast, in April this had dropped to 4161 professional vacancies, where volumes were down nearly 70% compared to January.

-

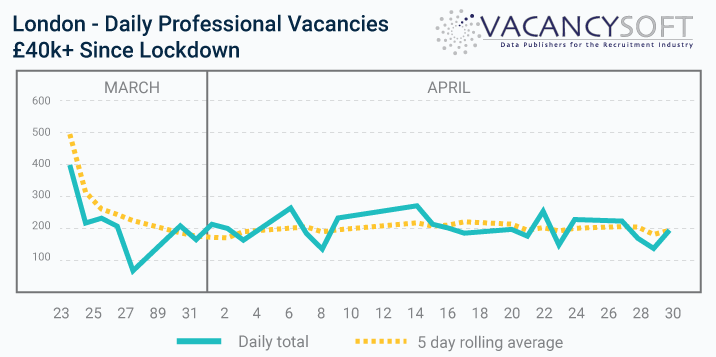

- Through the month of April, volumes have remained stubbornly low, with the five-day rolling average of daily professional vacancies staying around 200. In contrast, in January the daily average was over 600.

-

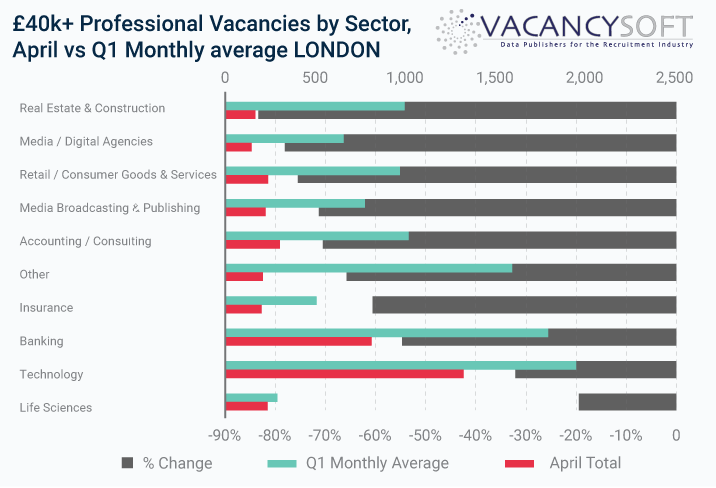

- By Sector, we quickly see which areas have been most heavily impacted. Perhaps unsurprisingly, the Real Estate & Construction industry has seen recruitment collapse, with volumes down 83.5%. In contrast, recruiting in the Life Sciences Industry has continued with only a small drop in volumes compared to the Q1 monthly average (-19.5%.) For context, normally Life Sciences would not even feature in the most active top ten sectors in London, let alone top five, as it was in April.

- When analysing activity by company, the most active in London in April was Amazon, perhaps unsurprising as the Covid19 crisis gives their business model a turbo boost. Even more noteworthy is that Salesforce were number three, as they make the UK their second highest priority growth market.

- In a sign of how the London economy is pivoting to IT, we can see that the top five SME’s recruiting in London in April were all in the Technology industry, across sub-sectors such as AI, Fintech and Gaming. One to watch here is EchoBox, whose solution is now seen as a must for the media industry.

- The fact that IT/Technology has been holding up better than nearly all other areas can be seen in the share of vacancies by professional area. For context, in Q1, commercial roles encompassing sales and marketing were the single largest block for hiring, accounting for 27% of all professional vacancies £40k+ in London. In contrast, IT accounted for 24%. However in April the collapse in other areas has meant that 35% of all professional vacancies in London were in IT.

Anecdotally, the feedback from the people we have spoken to is that the immediate freeze is thawing, insofar that offers are being made, albeit with delays on start dates. With that, businesses will then need to look at how they resume their operations especially now the Government has announced their intention to phase out furloughing and to re-start the economy.

For more information about any of the above please contact us.