As the covid19 crisis continues, as the new protocols become established, increasingly the conversation is switching from that of the medical crisis, to the economic one. Recent studies project that in the event the UK economy remains locked down, as it is now for three months, the associated downturn will be the greatest in over 300 years, only beaten by the great frost of 1709. With that, the debate on how best to re-open the economy ranges from those who believe there is a real risk of jumping the gun and having a spike in infections at a later date and those who observe that without a plan for reopening, whole swathes of the economy may not recover. Sectors such as travel & leisure need not just assurances but timelines as without that, there is no way of having any forward planning. Put another way, many jobs that are furloughed for now, won’t exist shortly without this. Therefore, when analysing the latest data in terms of Professional Vacancies in London, the most visible trends emerging include the following:

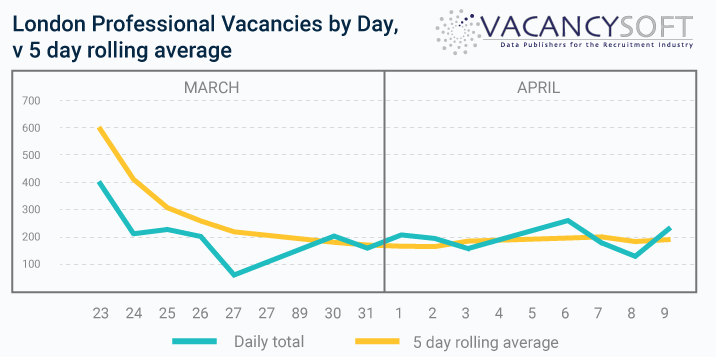

- As Easter has hit, so it seems the market has bottomed out, with new professional vacancies dropping to under 200 per day. With that there are some positives. First of all that there are signs of a small uptick in activity, with the daily average increasing from an all time low of 165 on April 2, to end on 190 on April 9 an increase of 15%.

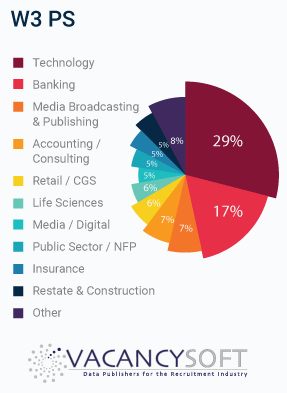

- The share of vacancies coming from NFP and the public sector is also increasing. Normally this would never be in the top ten sectors by volumes, but the depressed nature of other sectors has boosted it up. This is therefore a barometer to keep an eye on, as it drops down. Currently it is eighth by share of vacancies.

- Finally, the technology sector remains the least badly affected, with recruitment still happening there at all levels. Interestingly though in a sign that activity is picking up in other sectors, the total share of vacancies coming from the technology sector is dropping, with it being under 30% now for the first time since this crisis started. For context in a normal market we would expect it to be between 10-15% on any given day.

For more information about any of the above please contact us.