Energy, the Ukraine war and the post Brexit dividend

To say the war in Ukraine has caused the dysfunction in the UK’s energy strategy to be exposed is an understatement. Renewable energies, whilst in unit cost terms are coming down, don’t generate sufficient power all year round to be viable. What this had meant is the UK would be generating a surplus over summer, whilst buying power from the continent over the winter. Up until the Ukraine war, that had worked and had meant the long-term storage facilities at rough had been shut down for example, as power had always been available from the continent.

However, as Putin started to put the squeeze on, spot prices surged and well, we know what happened next. Inflation busting energy price rises, accentuating the cost of living crisis. Giving credit where it is due, the Government has responded with decisive steps since then, including opening new fields for drilling, whilst reopening and expanding the rough storage for natural gas. As a result, whilst energy prices this winter are expected to high compared to the long-term average, they will be sufficiently lower than last year. Good news.

With that, what has happened is that as this war in Ukraine has demonstrated, the challenge of hyperconnected just-in-time models, is that market shocks will cause disproportionate disruption, as there is no capacity to handle them. The UK in order to save hundreds of millions, may have ended up spending billions on excess energy charges last winter to keep the lights on. The phrase penny wise, pound foolish springs to mind.

Hence what we are starting to see is the formation of a new industrial energy strategy, for the first time in the UK for a generation. For context, it was Gordon Brown who in one of his last acts as Prime Minister sought to put in place an extensive nuclear power plan for investment, to handle the energy shortfall caused by diminishing returns in the North Sea. The irony won’t be lost in the fact that if that had not been cancelled, it would have been fully live in 2022. A point made by Nick Clegg when the coalition came to power, arguing the time taken before any ROI made it not worth pursuing…

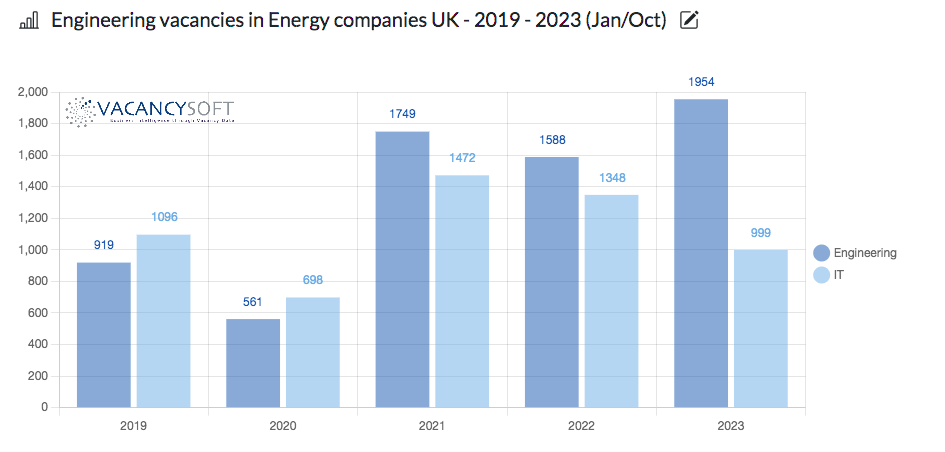

Long-term investment planning in the UK…, a running joke amongst our international peers, just look at the cost overrun on HS2 and the cancellation. Can the UK even do state-led investment into Infrastructure is a question some ask? None the less, for the private sector, what it needs is the security and certainty that comes from Government making a commitment to invest. Hence, what we see is that since the first time over the period, in Energy companies, we are seeing more permanent full-time jobs for Engineers, than for IT professionals. Quite honestly, the surge is noteworthy. We have seen:

- Nearly three times more engineering vacancies in energy companies in 2023 than in 2019, in contrast, IT is up but only marginally.

- The ratio of vacancies between engineering and IT over the period switching from 45%/54% in 2019 to 66%/33% this year.

- The forecast is that this will continue further as new energy projects get signed off and go live.

More significant long-term is the investment now planned into Nuclear Fusion. In the headline of this article, I eluded to a Brexit dividend. Now whilst in most areas of the economy, it is fair to say Brexit has acted as a dampener on economic activity, energy may well be the exception. Fusion is the diamond the UK could be on the verge on leading the world in, ironically thanks to Brexit.

Where this starts is with ITER, a consortium designed to invest into nuclear fusion, involving China, the EU, India, Japan, Korea, Russia and the United States. When the UK left the EU, attempts to remain involved with ITER were rebuffed, which was noteworthy given that within the continent, the UK was already the trailblazer. But for the political reasons, the decision was made. Brexit means Brexit. In that moment, the UK was frozen out, where countries like Russia and China, were still invited to be involved. For context in the words of Sir Ian Chapman, head of the UK Atomic Energy Authority “we have on our soil the only operating deuterium-tritium tokamak in the world at the moment.”

So what now? The UK could reapply to be involved in ITER as a sovereign nation but to say the negotiations would be tortuous, is an understatement. Along with that, the initial scientific analysis is suggesting that the basis of the ITER modelling is flawed, and it is lasers, so inertial fusion, not magnets that hold the key. The UK is already a global leader in this technology, whilst Brussels remains rooted with the approach set out in its doctrine. Would the UK have been able to cut loose and focus on its own strategy centred around fusion based on lasers within the EU? Questionable, as the consensus rules.

What does that mean? Outside the EU, the UK now has the opportunity to forge a path as a standalone energy super-power through its expertise in the areas it has developed. And as the technology goes live, this will have implications globally. The current geopolitics is in part, triggered by issues over energy security. But what if energy was unlimited and almost free. What would that mean for the world of tomorrow? The UK has been at the vanguard of freedom for the last century. Perhaps through prototyping viable fusion solutions, it can finally make that possible globally. And in terms of the job market, if this comes to play, expect energy and engineering to take an ever growing share.

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute workshop with us and discover the power of data in shaping the future of your market.

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!