Is London about to bounce back?

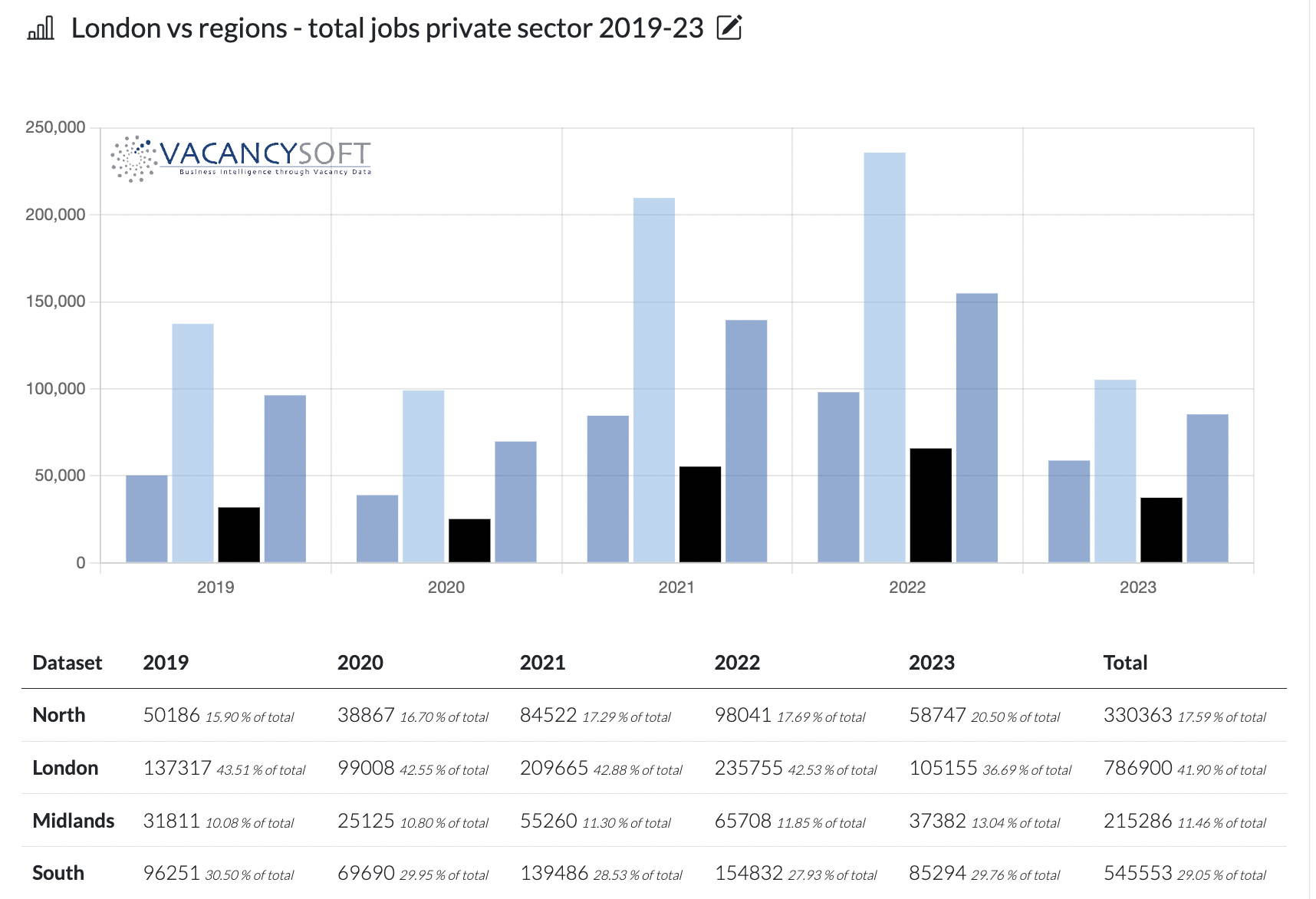

As the dust settles on the decision to cancel HS2, while the political fallout may prove high across the regions, the economic consequences are still unclear. By the same token, what is clear is the fact that over the past five years, the trend of regionalisation has taken effect and increasingly, businesses are expanding teams away from the capital. In 2023 this trend has seen a high point, in the sense that 64% of all vacancies in the private sector can now be found outside the capital, up from 56% pre-pandemic. Part of this is structural and can be accounted for by businesses implementing cost savings by scaling back London, similarly, the impact of technology is also a factor. Telecommunications and video conferencing has meant that the requirement for proximity is not what it once was. Nonetheless, a big reason why London has dropped to a record low point of share is also cyclical. The quantitative tightening cycle hitting the global economy has disproportionately impacted London, in that corporate finance has slowed to levels not seen (outside the pandemic) in a decade. As this has happened, so all the secondary sectors that thrive in a buoyant M&A market have slowed, where for the Consultants, Lawyers and other professional advisors, 2023 has proven to be a fallow year.

Nonetheless, there are some green shoots. The forward guidance given by the Bank of England yesterday that interest rates are likely to come down next year, combined with the pressure an election will bring on the Tories, to reduce the tax take and stimulate the economy, is likely to see a spurt in growth and consumption. This is combined with the fact that in the USA the economy is already picking up steam and this should lead to a secondary wave of investment into the UK. The Government is also deregulating financial services to make it more attractive and what is key, from an investment perspective, is that the UK is one of the only countries across the West, where there is a broad consensus between the main and opposition parties on what the next steps for the economy should be. Looking at the culture wars in the USA where whatever happens, there will be a divided country after the next election, causes problems. Similarly in France, Le Pen is likely to be the next President, with everything that means. The Germans are still struggling to adjust to an industrial strategy where they don’t have cheap Russian Gas. The Italians have to roll over debt at an interest rate which makes it unaffordable. Suffice it to say, there are problems in both the EU and the USA.

Against that backdrop, the UK has been investing into a high-tech industrial strategy, expanding capabilities across Energy, Telecoms, Life sciences, IT and Defence, where this bodes well for the future, specifically when it comes to IPOs and M&A. The new AI revolution also has potential opportunities in ways we are still fathoming, and the UK is one of the global leaders in this space. It also remains one of the leading destinations in the world for raising finance with US 20BN raised in 2022 alone. Fintech as well is on the rise, with more funds raised here than in any other city, worldwide. If there is a dark cloud on the horizon, it will be the commercial property world, which in the face of high interest rates will face its own challenges, to do with writing down value books. WeWork is the canary, but the REIT industry in London is massive, and could pull everything around it into recession. The strategy for London therefore is clear, Innovate and create the technology solutions of tomorrow, and build the businesses that can scale globally. Easier said than done, but the signs are positive. As that starts to take shape, expect London to start to bounce back once more and dominate the UK job market again.

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute workshop with us and discover the power of data in shaping the future of your market.

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!