Is London losing it’s competitiveness?

As salaries surge to match inflation, businesses are shifting hiring away from the capital. In my previous post, recruitment is tidal, I referenced that in terms of macro job flow, what we are seeing is that 2023 is now mirroring 2019. However, there is one key distinction in that whilst activity in London is flat (vacancies in 2023 are currently on track to match 2019 exactly) outside the capital, we are seeing growth of 25.6% in terms of the monthly average, when comparing this year, to 2019, before COVID.

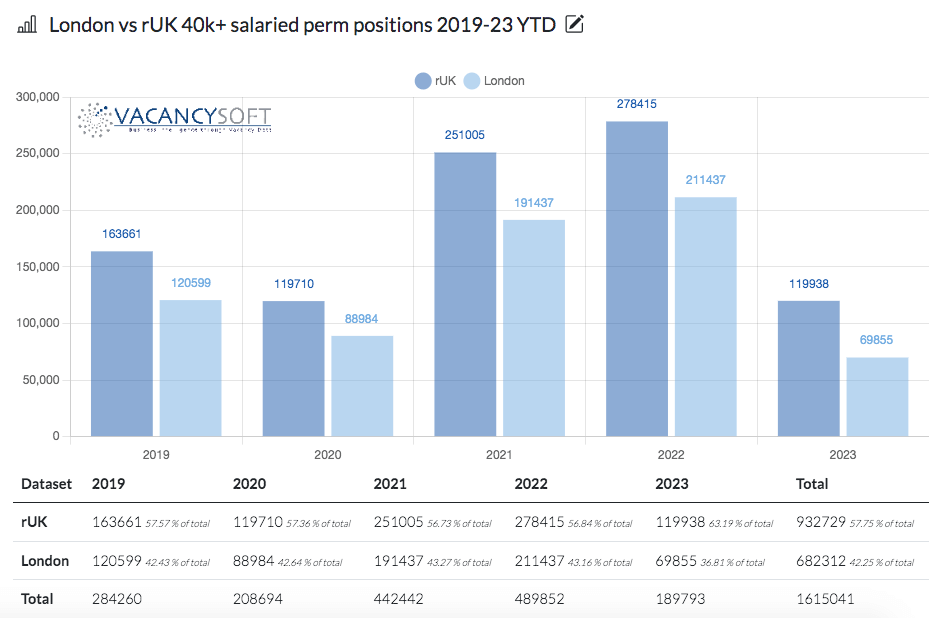

Hence, when comparing the split of vacancies between London and the rest of the country, between 2019-22, we see 42%-43% of the vacancies were in the capital, whereas this year so far, that has fallen to 36.8%. Put another way, London is on track for a 43.4% drop in terms of vacancies, this year compared to last, whereas when analysing the rest of the country, the fall has been significantly less, so down 26.2%. For anyone wanting a breakdown on what we have seen nationally, we recently published a report with APSCo, highlighting regions benefiting.

Super trends driving this change are well known. Businesses reorganising themselves to have a smaller London footprint as more people seek to work remotely or in a hybrid capacity. Regionalisation within the UK, as other cities take a larger share of the the economy. For example, the transformation within Manchester is marked. Similarly, the slowdown in the finance industry as a result of quantitative easing is meaning that the Banks are also muted. We touched on this in our recent report with Morgan Mckinley, for example. This has also impacted the corporate Law Firms in London, as analysed in our report with Search. Also, the slowdown in the technology industry has hit London hardest, in that businesses that would get VC funding, would be most likely to be in the capital. As funding has slowed down, so has the hiring. See our recent report with Robert Walters on that.

Certain sectors are bucking the trend. Insurance remains buoyant and if anything, we are seeing a shift towards hiring in the capital, as opposed to the regions, but this is an outlier. Equally, for a deep dive here, see our recent report with Harrison Holgate. Another sector to buck the trend is Life Sciences. After all, especially with an ageing society, this sector is set to continue to grow. For more information about what we are witnessing there, see our latest report with CPL.

This is all against the backdrop of what is an uncertain economy. The latest S&P Global PMI report suggests a recession is on the way, as for the first time in six months, a negative reading was given. The recent uptick in activity in the last few months has been a good sign, but in truth, the UK economy is still heavily dependent on Financial Services, and for that industry to do well, Corporate Finance is key. The recent decision by AIM to look to relist in the USA will be a concern, as for London to continue to compete as a global hub, it has to be a place businesses want to list at. Between the stock exchange capitalisation falling (through delistings and a general bear market on equities as interest rates rise) and the recalibration of the commercial property market (e.g. Canary Wharf) the outlook for London is challenging. Does London just have to become cheaper in order to become globally competitive again? And how does that even happen?

If you’re keen to delve into trend analysis within your niche, feel free to book a consultation with us

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!