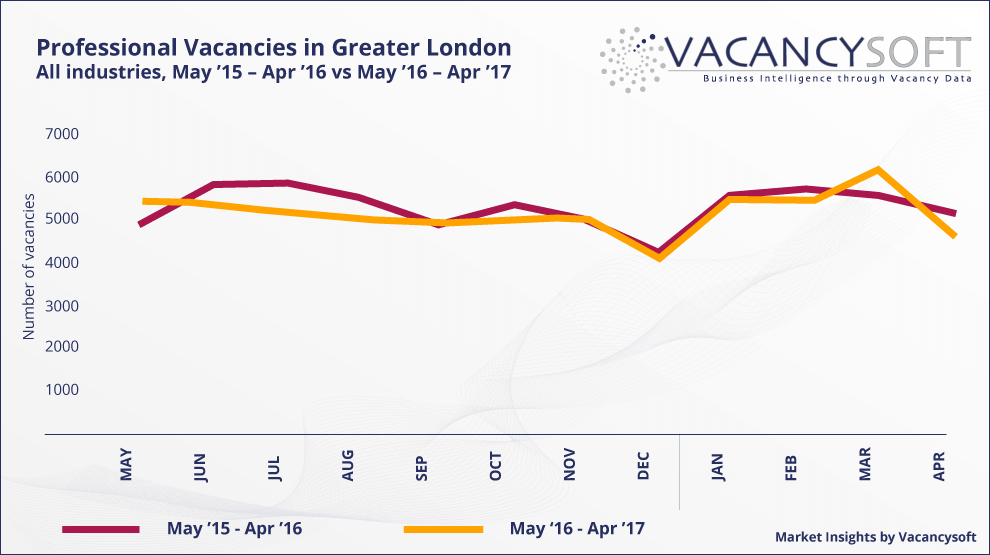

The London job market in April

Professional vacancy levels in London have displayed a significant degree of volatility in recent months. Q1 2017 had the highest amount of activity of the last eight quarters and March 2017 was the best month in the last 24 months. However, excluding December 2015 and December 2016, which both suffered from the traditional holiday-related drop-offs in activity, April 2017 was the worst single month in the data in terms of

In the Greater London

While the April bank holiday could have been a factor in this drop, it seems that such behaviour may be expected given this market’s current volatility. Other developments that might affect future vacancy levels in London may include key players in Financial Services confirming intended staff relocations to the continent, and the recent crystallisation of Brexit negotiation plans. London businesses expressed concern about Brexit affecting their importance as “the engine of the UK economy”, with the London Chamber of Commerce and Industry recommending, inter alia, that the authorities allow current EU workers to stay on in their positions. Meeting the needs of a growing population, set to surpass 10 million by 2030, and a shaky real estate market is yet another challenge London must face to retain its key position in the UK, Europe and the world.

Recruitment Industry Insights is a free Market Intelligence Tool that can help you to become a thought leader in your niche, increase your brand awareness, and attract clients. Read about this free Market Intelligence Tool here.

Author: Jan Pawlowski

Data Analyst