Post-Brexit and the future of UK Life Sciences

Whisper it quietly, but some of those benefits of leaving the EU are actually starting to materialize. For those in Life Sciences, new regulations taking effect have meant that the MHRA can now fast-track applications, where as a result, approvals can happen in certain instances, within 14 days.

For those not familiar with the clinical trials sector, they happen in phases, where phase one is typically the first to involve people. This happens with small sample groups, where people agree to be hospitalized for the duration of the trial (typically 2-3 weeks) and are kept under tight scrutiny. Equally later trials (say phase 3) happen as a final step, involving up to 10,000 people, where they are purely to identify potential reactions which are only occurring with minute percentages of the population.

Historically, the higher risk trials, where people are given experimental drugs for the first time, would be treated with exactly the same process for approval as a lower risk trial, where it is done as a final step involving a large sample group pre-regulatory approval. It is these trials, which the MHRA have decided can be fast-tracked and not subject to the same regulatory scrutiny. Significant numbers of trials are handled by Clinical Research Organisations (CRO’s) who provide outsource services to Pharmaceuticals companies.

The other point is, that the nature of how the NHS works, in centralizing operations, as part of that to do with patient data, means that it is uniquely well placed, to operate in tandem with the pharmaceuticals industry, not just pre-approval, but in terms of R&D too.

For example, when COVID first happened, the data pertaining to how the virus was impacting patients meant that pharmaceuticals companies were able to utilize that data to work on vaccines in record speed. This is in many ways the UK’s USP and is part of the reason why the UK continues to thrive, in Life Sciences, regardless of Brexit.

Equally, COVID did create a backlog of trials seeking approval, hence what we see when analysing job flow is that 2023 has been a quiet year for vacancies in clinical. Nonetheless, there has been a concerted effort to resolve this. Factor that in a typical year, the MHRA would be expected to approve 750 trials. This year, just since July, over 2000 have been approved, in part possible because of the regulatory changes that have now been made, with the UK sitting outside the EU. What this means is we are forecasting 2024 to be a bumper year for the Life Sciences sector, specifically in R&D and Clinical, especially as interest rates come down, capital starts flowing and the private equity firms start scaling up investments into Biotech.

Hence specifically we see:

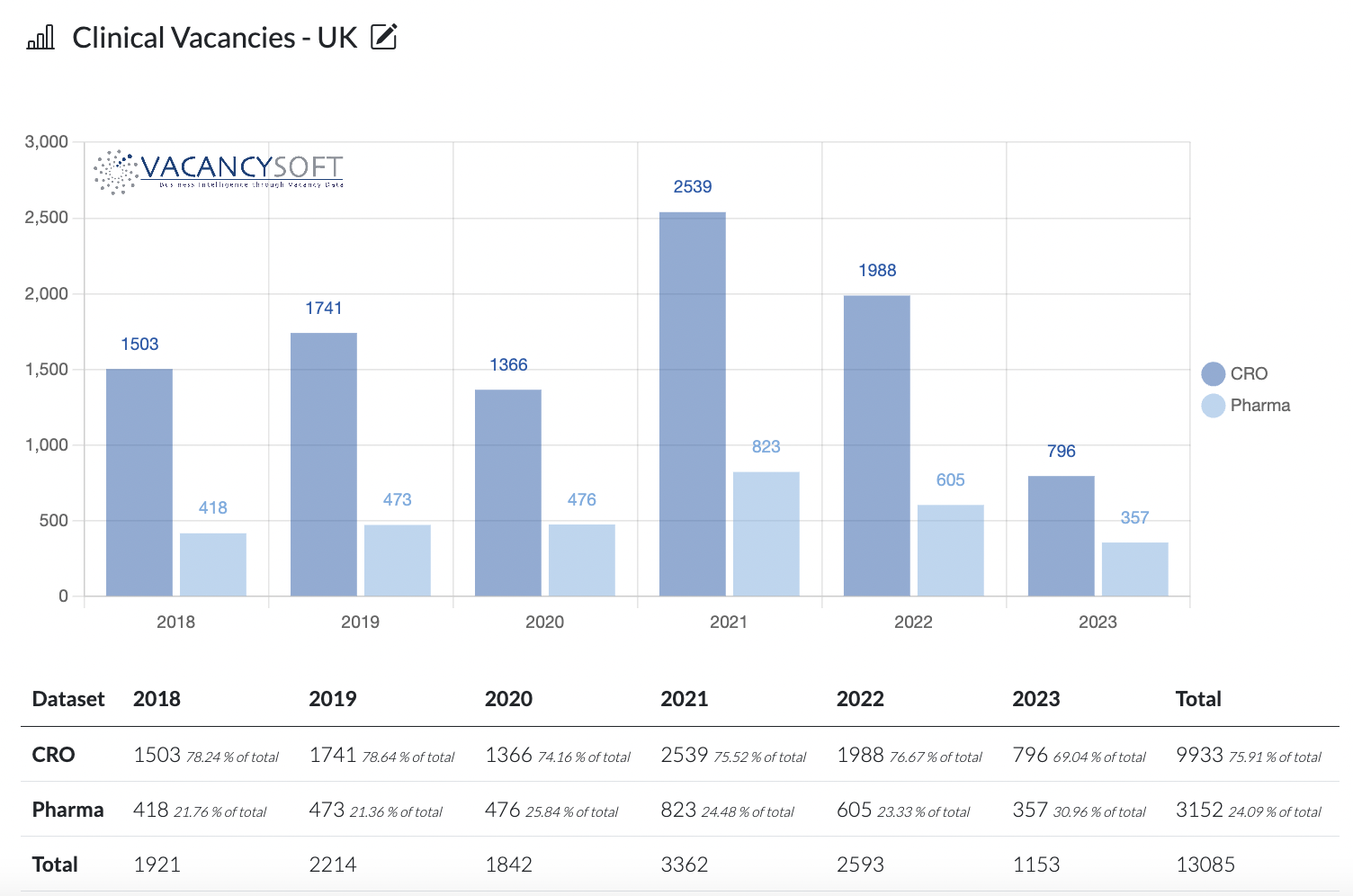

- 2023 seeing a record low in clinical vacancies, within both CROs and Pharma companies over the period

- The fall has happened disproportionately within the CRO’s this year

- Hence as approvals manifest into trials starting, we would expect to see the pick up in the CRO’s first.

As a result, just looking at the historic data, it is reasonable to forecast that 2024 could well see volumes return to 2019 levels, which would mean double the number of clinical vacancies, next year compared to this one, with the biggest surge being within CRO’s.

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute workshop with us and discover the power of data in shaping the future of your market.

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!