The Regionalisation of Financial Services in the UK

Last month TheCityUK and PWC released a report titled ‘A vision for a transformed, world-leading industry’. The report outlines a scenario in which the GVA of the UK’s Financial Services industry grows by 9% by 2025 from its current size, primarily by maintaining industry competitiveness nationally and internationally, and by emphasizing innovation in FinServ and FinTech while factoring in the challenges posed by Brexit.

One of the factors the report counts on for this success is regionalisation. It predicts

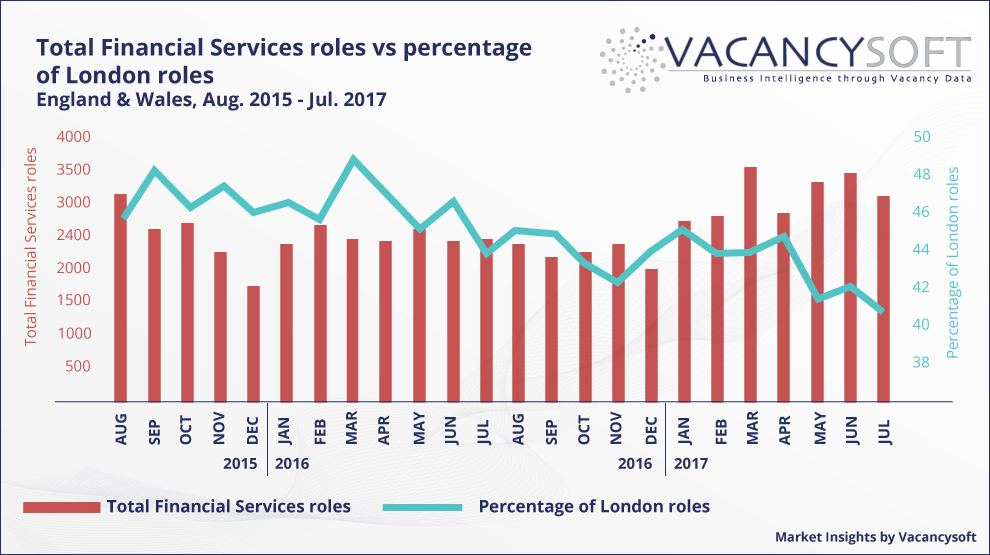

Vacancy data confirms that these trends already exist: while net FinServ vacancy volumes have been on the rise so far in 2017 (up by 25% between January and July this year compared to the same period last year), the percentage of London-based jobs was down, with London

The report lists the Midlands, the North East, and Yorkshire & the Humber as the regions with the highest predicted growth. Looking at vacancy data, we find that these regions saw a 22.8% net increase in FinServ vacancies between the most recent 12-month period and the preceding 12-month period, while such vacancies in England & Wales overall saw period-on-period growth of 10.7%, and with London growing by only 3%.

Trends visible in the data at the regional level contradict some of the forecasts made last year suggesting that operations in the industry will relocate from the UK en masse. However, if visions like the one described by TheCityUK and PWC are realistically applied, we could see a change in forecasts, and the industry may go into the next decade in a winning position.

Recruitment Industry Insights is a free Market Intelligence Tool that can help you to become a thought leader in your niche, increase your brand awareness, and attract clients. Read about this free Market Intelligence Tool here.

Author: Jan Pawlowski

Data Analyst