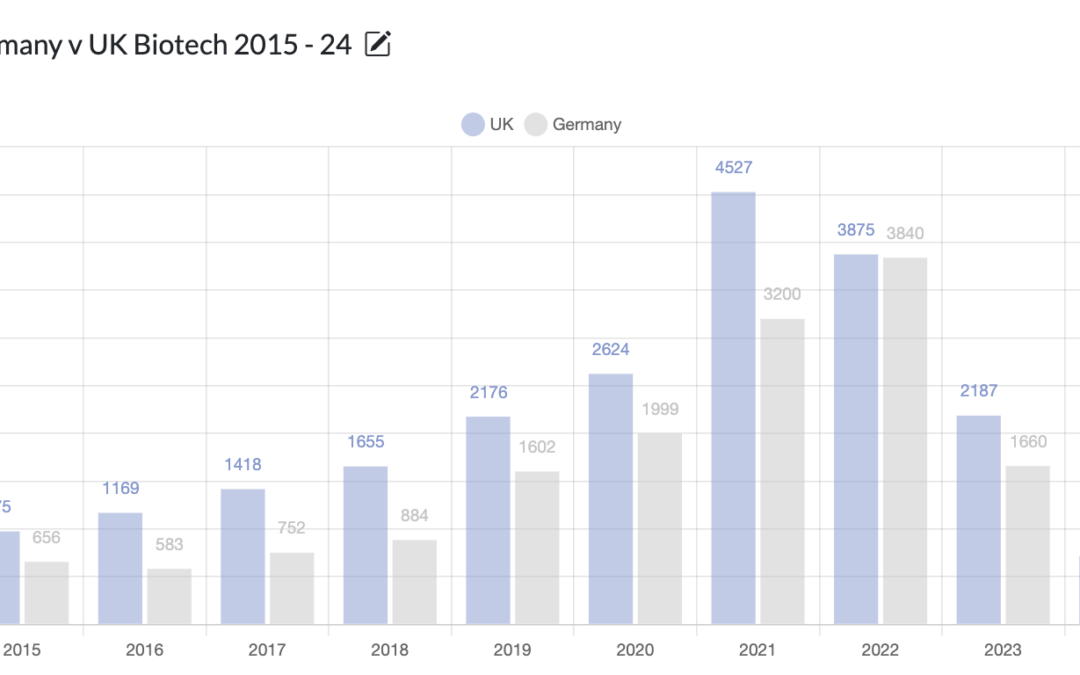

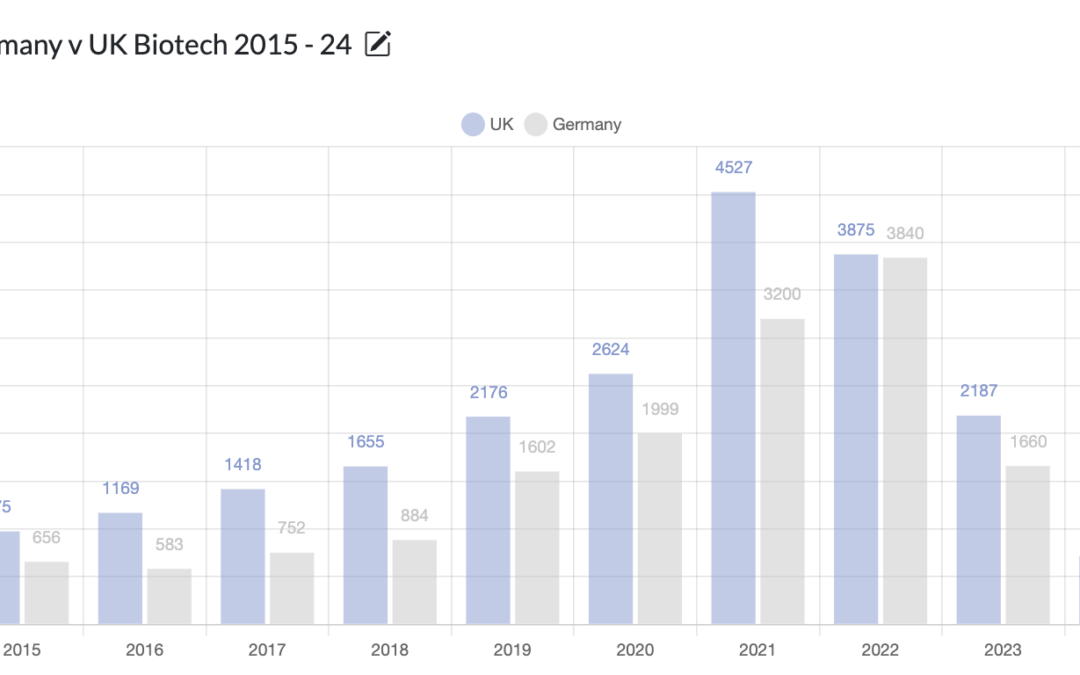

If the worst kept secret in politics is that Kier Starmer will be the next Prime Minister, (the latest odds give him an 87% chance of being so) then upon taking power, he will have to make a decision about which Tory policies to continue, and which, to discard. No set of policies are more divisive than those to do with Brexit, hence spotlighting Biotechnology which is now starting to be negatively impacted, following the pandemic period ending and the industry globally returning to equilibrium, as this is an area that Starmer may need to change UK policy on, in order to revitalize.

Perhaps inevitably, the post-pandemic period has resulted in a hangover for the sector, as the combination of quantitative tightening leading to a slowdown in funding for emerging biotechnology firms, combined with the delays associated with getting new trials approved over the period, has meant that in recruitment terms, 2023 really was a slow year. Indeed, vacancies in 2023 were 42.6% lower than in 2022.

The biotech sector has been on a downward trend this year, with vacancies down 34% in 2023. With that, the first quarter saw the highest concentration of job postings, tallying 351 vacancies. Indeed, January and March were the top two months in 2023, with 131 and 123 vacancies respectively. This is according to the latest Life Sciences Labour Market Trends report by CPL and market data analysts Vacancysoft.

When analyzing trends in Med Tech, we see 2023 is set to witness a substantial 27.9% increase in vacancies compared to 2019, indicating steady and robust growth. Similarly, in 2023, scientific jobs are projected to represent a 21.2% share of all vacancies, marking a notable improvement compared to the 14.2% share recorded in 2022, according to the latest Life Sciences Labour Market Trends report by CPL and market data analysts Vacancysoft.

Fixed-Term Contract Scientific vacancies remain relatively stable, maintaining a 5.3% share of all scientific vacancies. Equally, this represents the highest share observed since 2021, suggesting a continued demand for temporary scientific roles, despite a sharp fall in perm vacancies, according to the latest Life Sciences Labour Market Trends report with CPL and Vacancysoft.