The Autumn Statement and 2024

If the Conservative Party are to win the next election, they will need not just a serious implosion within the Labour Party, but also for the UK economy to pick up in a way where they can take the credit. Longer term, the UK remains mired in the same issues that it has had for some time now, limited productivity increases, an ever-increasing national debt (we last ran a budget surplus over 15 years ago) and ultimately most importantly, GDP per capita falling.

It is the GDP per capita falling which is at the root of so much of the trouble the Conservative party is having, Whilst the media may report on the economy having growth and avoiding recession, if the population is increasing faster than the GDP as a percentage, what it means is, per person we get poorer. This is what we see and feel when we look at issues to do with school class sizes, NHS waiting lists and public services generally. The kneejerk reaction has been to clamp down on immigration, but that is not going to work in materially changing how people feel about their personal financial situation. So what can?

Hence within the Autumn statement is a commitment to supply side investment, where the Government is committing to:

- Make full expensing permanent

- Bringing forward a comprehensive package of pension reform and driving private investment from insurers into infrastructure by legislating for key reforms to Solvency II

- Make £4.5 billion available in strategic manufacturing sectors – auto, aerospace, life sciences and clean energy – from 2025 for five years.

- New Investment Zones and plans for deepening and extending devolution

Against that backdrop, probably for me, the most interesting is the plan to invest into strategic manufacturing sectors. Indeed, it could be said, for the first time I can remember, the Government has a clear Industrial strategy. Life Sciences is being deregulated to fast track trials, the Energy industry is getting new permits for drilling for Oil & Gas, Nuclear Fusion is on the cusp of being a reality with the UK leading the way, the Defence industry is about to see a boon as increasing amounts of budget get allocated there, meanwhile, clean tech is starting to solve problems, cost-effectively. What is consistent across all these sectors, is that the UK does not have enough people with the skills required. How the Government squares this circle, is the problem they will need to address.

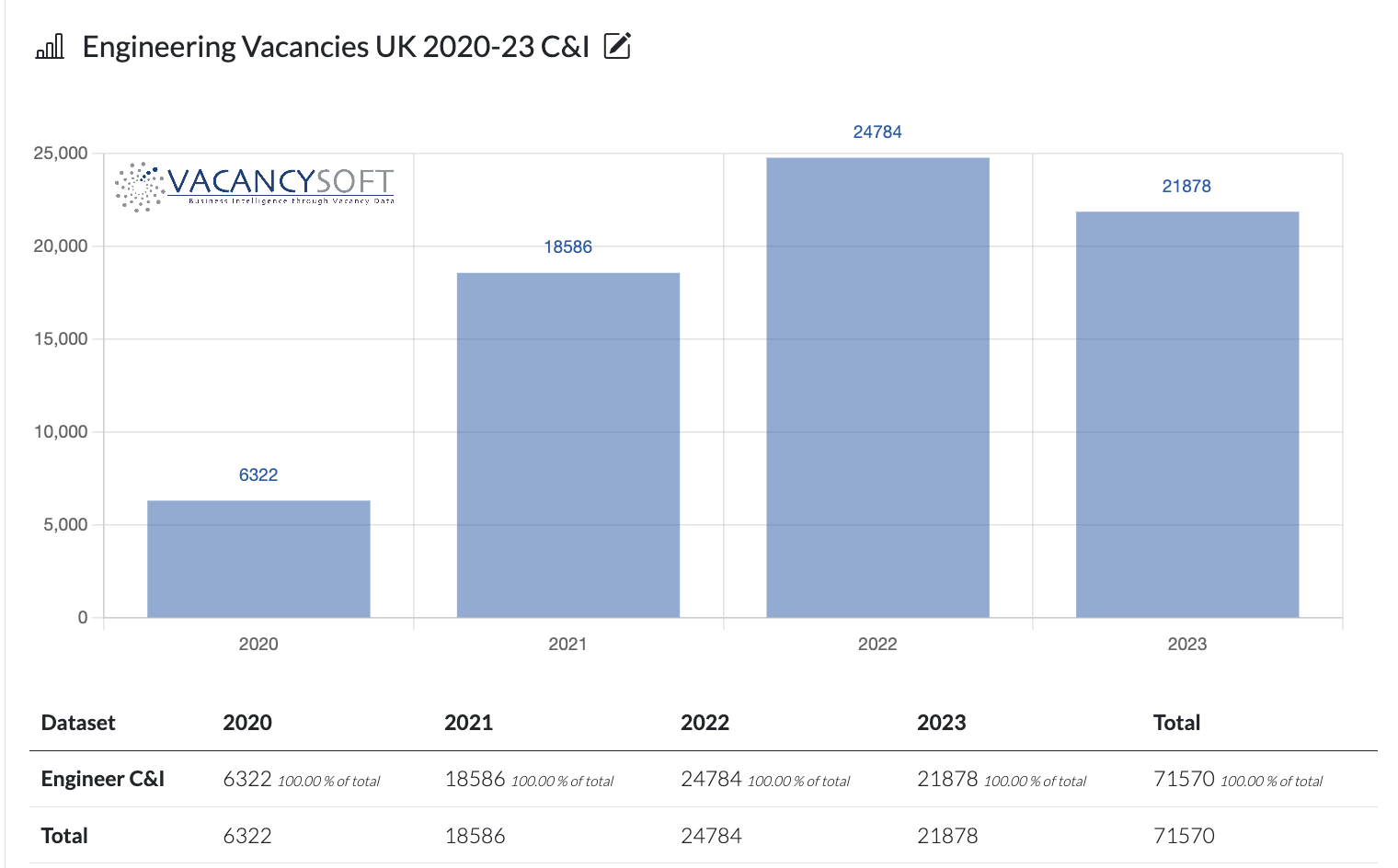

As a case study, I have profiled vacancies for Engineers, across all industries. 2023 is broadly seeing similar levels to 2022, which was already a record year, and on the basis of the investment into the hi-tech industry, we are expecting this to be even higher next year. Over 25,000 vacancies for Engineers specifically is distinctly possible. At the same time, the UK produces only 46,000 graduates per year, where not all go into the profession, others choose to be focused on interim projects. In short, the estimate is for the UK to self-supply its human capital needs, we need to double the number of engineering graduates, and potentially even more in light of this investment, or source candidates from overseas in order to realise the value of this investment into hi-tech industry.

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute workshop with us and discover the power of data in shaping the future of your market.

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!