The Energy Boom is coming

This week, it was reported that the economic downturn in Q4 had meant the UK is in recession. Hardly the news Sunak needed on the eve of two by-elections. Hunt was quick off the mark talking about the fact that overall the economic indicators are positive looking ahead, which is fair comment, equally the fact salary inflation remains high, has led to suggestions that any hope of interest rates coming down in the first half of the year are fanciful. Similarly, economic headwinds mean that his capabilities to do anything meaningful in the spring budget are going to be more limited than he had hoped. All in all, the prevailing winds are not going Sunak’s way, which means that for anyone looking at long-term investment into the UK, they need to be looking not to the current Government but to Rachel Reeves and Kier Starmer.

That however should not be a cause for concern. I have touched on this before, that the UK has gone through its culture war with Brexit, and has come through it, not necessarily happily, equally politically there is a pragmatic attitude, that we need to make best with what we have, and look forwards. Hence in many ways, the UK may well be entering a new era of Butskellism. For readers unfamiliar with the term, it dates back to the 1950’s when the Labour and Conservative Governments of the day, had so little between their economic policies, they were almost interchangeable. The actual term was coined through combining the names of the two chancellors of the era, Rab Butler (Conservative) and Hugh Gaitskell (Labour.) Rachel Reeves is on a mission to prove to the city that Labour will be tough on the budget deficit and will work to maintain fiscal discipline. With her track record, she should be believed. So what does this mean?

Well, in our annual magazine, (you can request a copy: support@vacancysoft.com) we have talked at length about the future of the UK economy, and how the country needs to accept that by being out of the EU, it is no longer the Financial Services capital of the block and as such, the London Stock Exchange will not be what it was which means that for the country to grow and flourish, it needs to pivot. To be fair to Sunak, he has recognized this already, hence we saw the AI / High Tech summit at Bletchley Park, which is his way of looking to position the UK as global leaders in this space. Similarly, the UK is one of the global leaders in terms of Nuclear Fusion, Life Sciences, Telecoms, Aerospace & Defence and across the high-tech industry generally. For businesses in these industries, they invest though in decade long cycles, so the advantage the UK can have, is that whereas in the US, the next president could be Trump, or in France, it could be Le Pen, where with both, this would lead to high levels of volatility, in the UK Starmer constitutes in some ways, continuity, even if he is the leader of a different party.

Hence, for people looking ahead, they shouldn’t fear a Labour Government, nonetheless, we should be aware of what they have in mind in terms of their industrial strategy. Probably the centre piece of this will be the formation of a new publicly owned Energy & Utilities company, to be called “Great British Energy” which will be focused on investing into renewables, with the objective to:

- Reduce the cost of energy for consumers – so make disposable incomes available in other areas

- Create local employment – so we should see pockets of surges of hiring, where they set up

- Secure energy independence and security – take significant market share

Whilst other policies of Labour have some way to go, this for me is the most fully fleshed, and is the one which is likely to hit the ground running. What does it mean for people in the industry?

- Expect a hiring boom in the industry as Billions get invested by the State, into a State owned company. Scotland will be the biggest beneficiary, as the HQ will be there. The key point being the previous energy strategy had been to create our own energy over summer on renewables, selling the excess to the continent and then buy in energy during the winter, when we need it. The shock to energy prices caused by the Ukraine war has put paid to that, which means the UK will rely less on external energy as the declared strategy is energy independence, and will employ more people to achieve that.

- Equally, there will be wider benefits across industry, as energy costs become ever lower. For context, commercial enterprises will suddenly be competing against a state monolith, with a mission to bring down prices. The UK has some of the highest energy prices per capita in the Western world. Bringing them down would only benefit consumers and consumption as a result.

- Finally, we should also see a wave of venture capital and innovation through public / private initiatives, especially into experimental technologies, for example, there are now satellites able to beam energy down to base stations from orbit. Could the UK take the lead here?

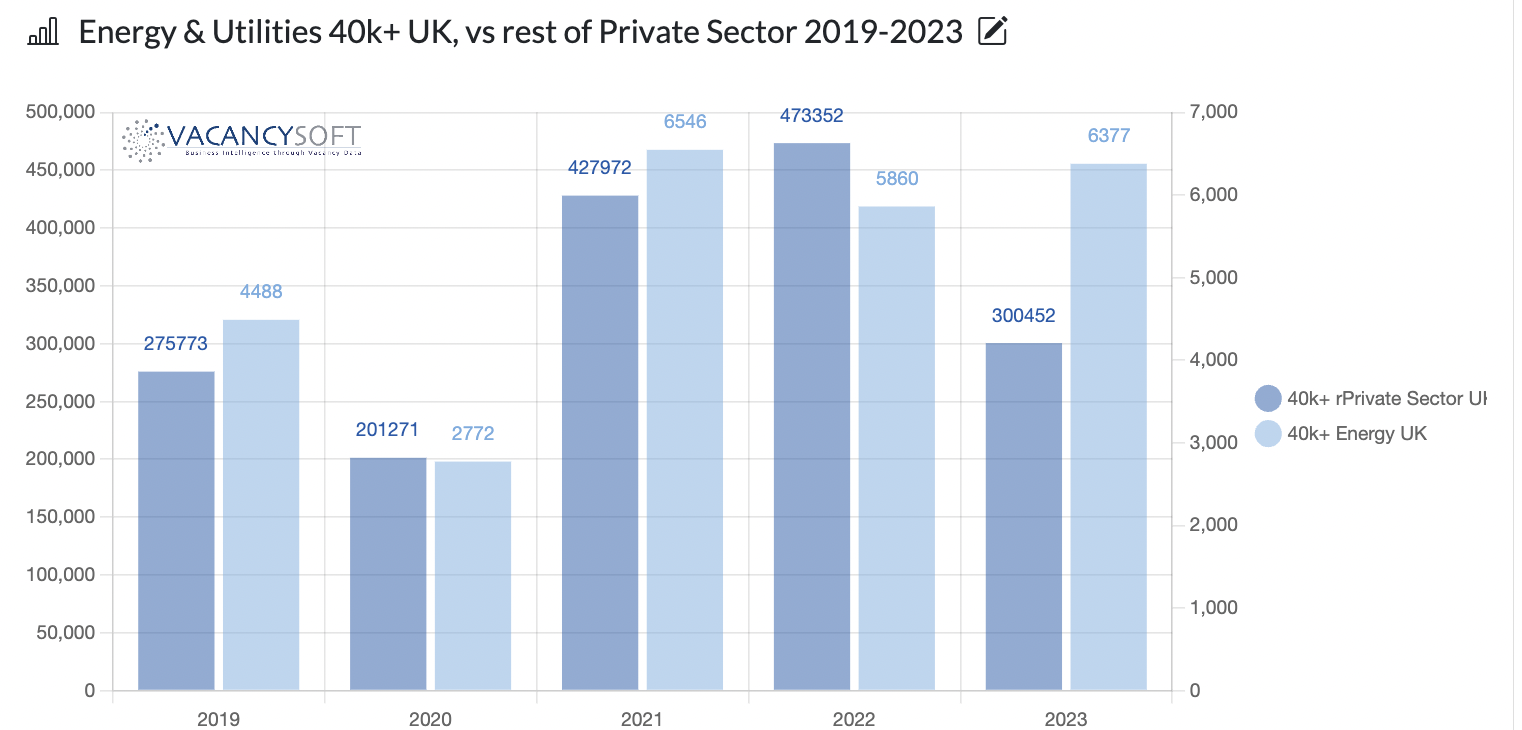

Hence, looking at the job data, 2023 was already at 50% higher levels than 2019, the last year pre-covid, as the shock waves of the war in Ukraine permeated through, resulting in rough being reopened, drilling licenses being issued in the North Sea, and nuclear being given extra investment.

Put another way, in 2019, the Energy & Utilities industry accounted for 1.6% of total permanent vacancies in the year, across all professional functions in the private sector. This past year, that share had risen to 2%. Equally, for the UK to achieve its stated aim of energy independence, that would mean increasing our domestic production by over 50%. (Approx 1/3 of energy consumption is imported currently.) If that translated into the job market, factor nearly 750,000 people are employed within the Energy Industry in the UK currently (according to Energy UK) so we would be talking about potentially, in order to make that vision happen, up to 400,000 new jobs being created directly and indirectly, from Engineers to Accountants, Marketers or IT People, should that strategy be implemented.

Watch this space.

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute workshop with us and discover the power of data in shaping the future of your market!

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!