Time to pivot to STEM?

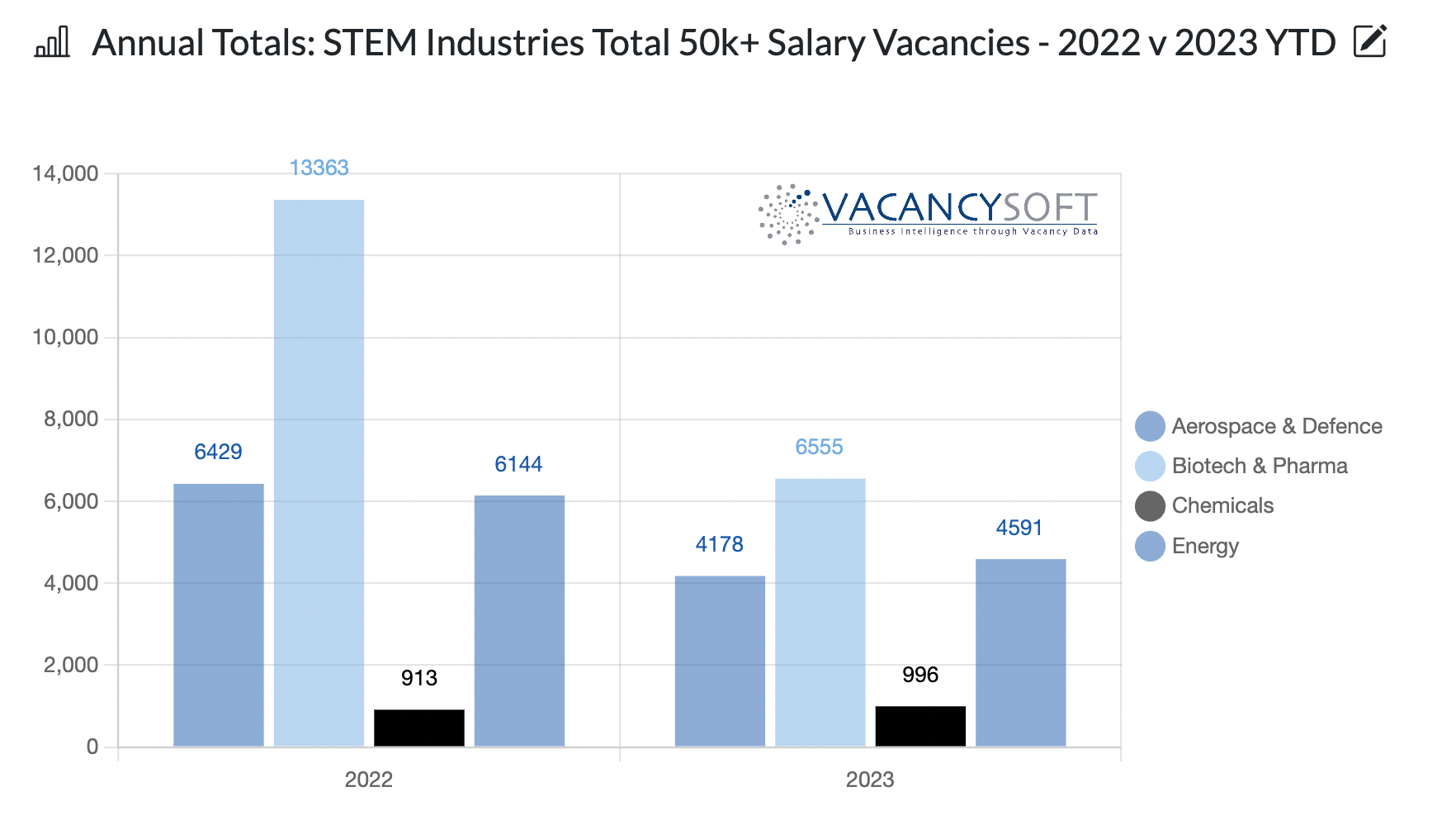

In contrast to most other sectors, businesses in Energy and Defence are on track to post more vacancies this year than last.

The war in Ukraine has had a part to play in this, as seen in the energy prices in the UK last winter where, as a result, storage facilities at Rough have not only been re-opened but are now on track to be doubled in size. Up until the invasion of Ukraine, the Rough storage had been seen as uneconomic and unnecessary, as the UK was connected to the continent and had always been able to buy on the spot market when necessary. Last winter showed a flaw in that model, and as a result, thousands of jobs have been created. Similarly, the war in Ukraine arguably accelerated the investment into Sizewell C, creating 10,000 new highly skilled jobs in the UK. This is alongside the plans to create sixteen SMRs over the next twenty-five years, where the initiative is expected to create up to 40,000 new jobs over the coming decades. The UK is also leading the way on CleanTech, with over 40% of all energy being generated coming from renewables currently. Meanwhile, the Government has now granted over a hundred new licenses for oil and gas exploration and production in the North Sea, which is expected to create tens of thousands of jobs in the here and now.

This is already manifesting in terms of new vacancies being created in the industry, with volumes up 22% on last year, in terms of the monthly average. With that, such is the impact of these initiatives, we believe the industry will continue to grow and employ ever more people.

Before analysing the Aerospace & Defence industry, it is worth mentioning Biotech & Pharma remains the largest segment within the STEM family, equally volumes are significantly down on 2022. Biotechnology, in particular, is very sensitive to VC funding, and the slowdown in this area since last year has hit the sector hard. However, the signs are that the market for VC funding is picking up once again, so we expect the coming year to end up being better than this one.

Anyway, looking at the Aerospace & Defence industry, the war in Ukraine has also been an accelerator. For businesses like BAE Systems, 2023 has seen a record year for military equipment orders. Indeed, shares in BAE systems have increased by over 50% since the war began. What the war has also brought into focus is the importance of the nascent space industry in future conflicts. Starlink has hit the headlines for the way it has meant that the Ukrainian army can operate at a level that previously would not have been viable. Hence, OneWeb is also one to watch, which, like Starlink, plans to operate at a low earth orbit, and already has over 500 satellites in orbit. Now, with its merger with Eutelsat, it has the potential to be the leading European business in this field, where the British Government retains 10% and a seat on the board. Similarly, the UK Space Agency is committed to the project by Rolls Royce, to create a small nuclear-powered reactor that could serve as an energy source for a future lunar base. The UK space tech sector is already valued at £16 Billion overall, and this is set to grow, going forward.

Hence, when analysing the monthly volumes in 2023, we can already see that vacancies are up 11% on last year for Aerospace & Defence businesses.

In summary, it is easy to find bad news. For example, we know London is quieter than it was. We can see that Corporate Finance is down. With that, it is debatable whether the finance industry in the UK will ever fully recover to the size it was when within the EU. Pre Brexit, London was the financial services capital of the EU and was challenging New York as the pre-eminent hub in the world. Now, businesses are de-listing and moving to the NYSE due to the perceived favourable conditions and capital markets (e.g. ARM.) To a certain extent, we need to accept that while London can still have a significant and meaningful financial services function which is globally competitive, it will be smaller than it would have been within the EU, acting as the centre for the block.

The only way to counter this is for the UK to become an innovation hub, creating companies on the cutting edge of science, technology and engineering, which act to attract capital to the country and become profitable enterprises which then downstream generate positive cash flow and profits. Interest rates returning to their long-term average levels means that investment strategies will no longer be distorted by cheap money but by the value of the proposition.

With that in mind, I am quite bullish for the mid-term UK outlook as we are, for the first time in maybe a decade, reaching a consensus in economic policy between the leading political parties. In truth, whether the Conservatives remain in power after the next election or are replaced by Labour, I see little major change in the industrial strategy happening, which can only be a good thing. Compare that to the political turmoil across the US and Europe. Trump could be president again, and then what? Similarly, Le Pen could be the next French President, which would be potentially just as disruptive given her anti-EU rhetoric. China could well be on the verge of economic collapse.

The point being Investment to happen needs clarity and consistency around long-term government strategy. The UK, I believe, finally has this, which puts it on a good footing to compete and grow looking ahead.

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute consultation with us and discover the power of data in shaping the future of your market.

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!