When others are fearful, be bold

At first glance, 2023 looks pretty bleak. After all, there has been a dip in vacancies, year on year, of 34% in terms of the monthly average. Businesses which for the last two years were just non-stop recruiting, this year have suddenly slowed down and for recruiters, there are many who are still adapting to this reality. Amplify that with the constant negative media, to do with interest rate rises, mortgage rates rising whilst the economy is only a pip from being in recession, and it is not a surprise that for many recruitment businesses, the logical response is to cut back and batten down the hatches. As an economics graduate from Manchester University, I would argue the opposite. Indeed my stance would be this:

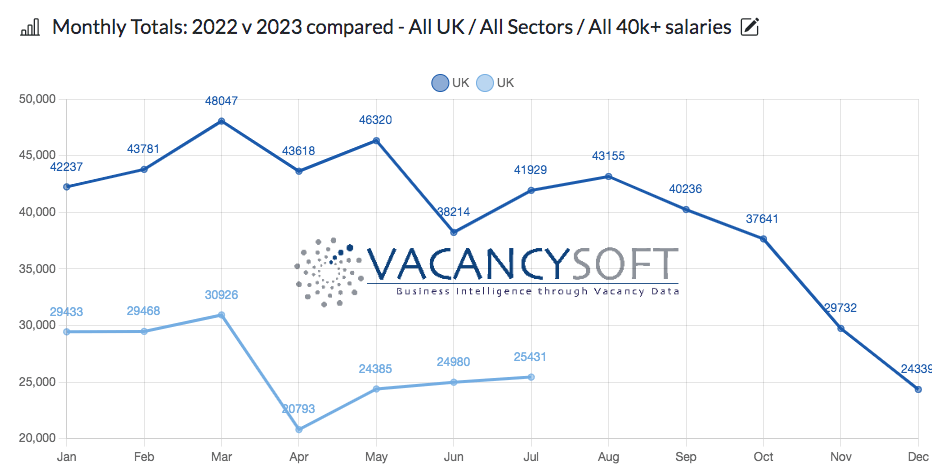

When companies post vacancies, a certain proportion is churn, to replace people leaving, equally a percentage is to do with companies investing into growth. Whilst we can’t accurately determine for any given vacancy we publish, which is which, what we can see is the underlying trend. With that in mind, in the chart I have displayed on this post, we can see that whilst Q2 on the one hand, saw vacancies hit a record low over the period, the flip side is that we have now seen three consecutive months of growth, since the low point in April 2023.

Similarly, whilst we would expect August to be quiet, the signs are positive for Autumn. Already the mid-term guidance is that interest rates will come down, and long-term fixes are being revised downwards accordingly. Just as importantly, average wages are now increasing at a higher pace than general inflation, which means disposable income is on the way up. Such is the consumption-led nature of our economy, this should then translate into a virtuous cycle. Just as importantly, the fact that there is a general election on the way, will focus the minds of policymakers on what needs to be done, to ensure the economy is in a good place. That starts with putting in place the policies so the Bank of England reduces interest rates. As the price of money then falls, what we would also expect to see happen is a pick up in the Corporate Finance and M&A market, which is so important for the London economy.

Looking at the wider economy, the surges in the technology industry in recruitment post lockdown arguably were so extreme, that now that they are levelling, we are seeing a more balanced market. As mentioned in my post last week therefore, 2023 is on track to broadly mirror 2019. Therefore for recruitment firms who recorded record profits in 2021 and 2022, now is the time I would say to you, back yourself, be bold, and invest into the next phase of your growth.

Vacancy Analytics can help you with this. By highlighting which market segments are growing the fastest, we can ensure you align your growth plan to the market overall. For example, by spotlighting which companies are surging in hiring, grow your business by working with the companies growing the fastest. Alternatively, if you are expanding regionally, identify through us, which regions to prioritise and businesses to focus on. Our reporting platform is widely used, by the BI analysts in the largest recruitment firms, so if you would like a free workshop where we can profile your market, to see what the opportunities for growth are you should be aware of, just get in touch.

Stay ahead of the curve and schedule your workshop today!

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!