Will the accounting sector come out a winner?

Accountancy and legal services in the UK

The Accountancy services sector is indeed well-developed; Tony Williams from Jomati stated that “this is a very mature market now”. While this translates to slow growth, the size and depth of the UK Accountancy market highlight its dominance in Europe overall. Mr Williams added that while the position of the sector in Europe is often challenged

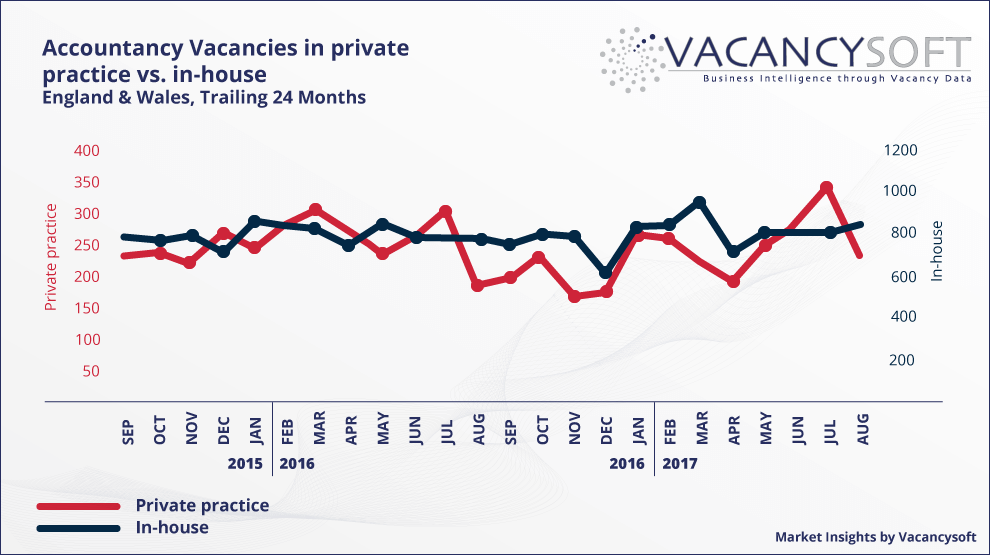

In the graph, data from Vacancysoft outlines the performance of both in-house and private practice vacancies in Accounting in England and Wales over a period of 24 months. A glance at this data shows that in the 12 months following the referendum, the private practice section of the market had underperformed compared to the more stable vacancy patterns that preceded June 2016. However, this was followed by a major spike in July 2017, which was the high point in the data set. Summer months are traditionally busier than usual in terms of openings advertised by Accounting firms as they typically generate smaller workloads, allowing those firms to focus on hiring, as opposed to spring or autumn. In line with the trends we normally see for these vacancies, we can now expect a quieter autumn with another spike in early 2018.

August saw reports of Brexit prospects no longer being a decisive force affecting market activity, “as the Brexit process lurches from one drama to the next, (…) traders have grown immune to the noise surrounding the country’s departure from the EU”. This implies that over the next year and a half, we may see

Recruitment Industry Insights is a free Market Intelligence Tool that can help you to become a thought leader in your niche, increase your brand awareness, and attract clients. Read about this free Market Intelligence Tool here.

Author: Jan Pawlowski