Bank of England Votes Narrowly to Cut Rates

Stagflation Risks Grow as Inflation and Unemployment Rise

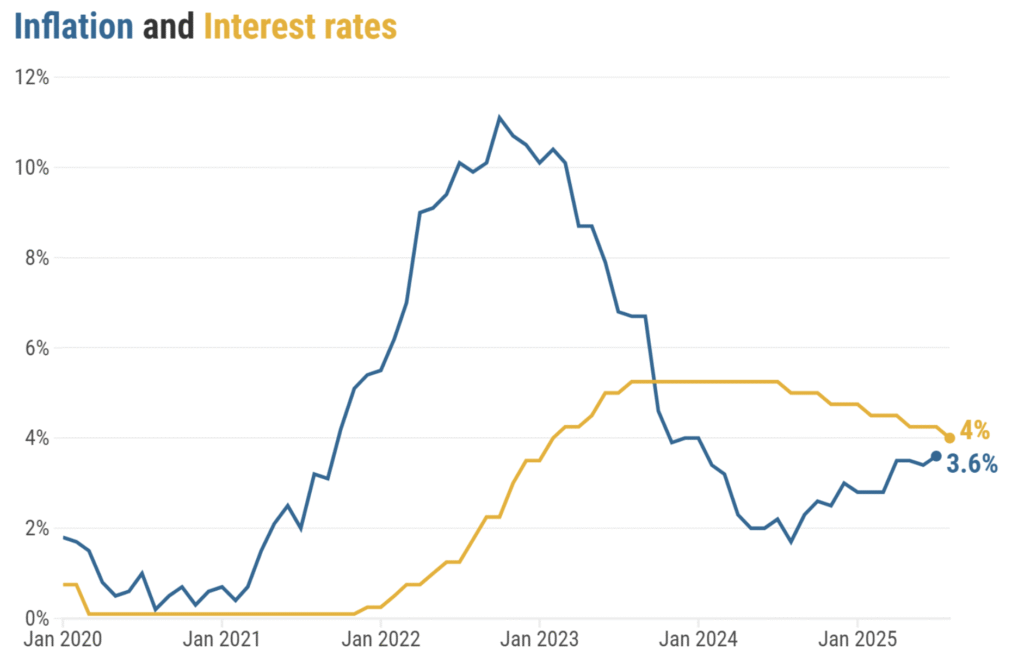

The Bank of England’s decision this week to reduce interest rates to 4% was widely anticipated. However, the narrow margin of the Monetary Policy Committee’s vote, which concluded with a 5 to 4 split in favour, underscored continuing concern over persistent inflationary pressures.

The Bank has raised its inflation forecast, with the headline rate now expected to reach 4% in September, up from a previous estimate of 3.75%. The September figure is used to uprate a range of benefits and pensions, a development that will carry significant fiscal consequences for the Government.

Food price inflation is projected to rise to 5.5% this year, driven by poor harvests, additional costs from new packaging regulations, and higher employment expenses stemming from measures announced in the Autumn Budget. The Governor attributed the increase equally to adverse weather conditions and government policy. When pressed by the media on the main contributor to that increase (poor harvests or government policy,) the governor said: “It’s about 50-50.”

Retailers, particularly supermarkets, are passing on the higher costs associated with increased national insurance contributions and the higher national living wage. Given their reliance on low paid, often part time staff, such businesses are more exposed to changes in the national insurance threshold. This is then leading to unemployment rising. All very predictable.

Food price inflation is among the most sensitive components of the consumer price index, with households allocating approximately 11% of disposable income to food. Increases in this category can disproportionately influence public perceptions of overall inflation, raising the likelihood of wage demands and the potential for a wage price spiral.

With that, at the current rate, Pantheon Macroeconomics projects that inflation will take a minimum of two years to fall below 2.5%. This outlook suggests that further reductions in interest rates are likely to proceed at a slower pace than previously expected, with the probability of a November cut now reduced. The pound strengthened on the news, rising to £1.35 before retreating.

Against this backdrop, the analysis regarding further rate cuts is suggesting that further rate cuts may be slower than thought before, especially if inflation remains high. The jobs, growth and inflation figures all call for different policy prescriptions, and given the uncertainty presented by the conflicting data, it is now less likely we will now see another reduction in November. As a result, this means that pound sterling has appreciated in the last day, jumping up to a peak of 1.35 yesterday, before dropping back.

The challenge overall being as follows:

- The UK economy is barely growing, just 0.1% in Q2

- Unemployment has climbed to 4.1%

- Foreign Direct Investment into the UK is dropping

- Inflation is rising, forecast to go to 4%

The fact unemployment and inflation are both rising simultaneously is especially challenging for the Government, and the fiscal hole which the Government had wanted to address, keeps getting larger, but the Bank of England, whose primary responsibility is to manage inflation, is unlikely to prioritize an policy platform for GDP growth at the expense of inflation.

We will be discussing all these themes and what they mean for business leaders within the industry at our next finance forum event. If you would like to attend, please do register below, please note spaces are limited.

https://vacancysoft.com/events/finance-forum/

Subscribe to our weekly newsletter for clear, timely insights on the political and economic trends shaping the UK labour market:

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute workshop with us and discover the power of data in shaping the future of your market!

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!