UK Risks Falling Behind In Global AI Race

Industry crippled by high Energy costs

Britain is discovering the hard way that artificial intelligence and clean energy do not sit comfortably together. Ministers have promised to make the country a global leader in AI while sticking to net zero, but the electricity needed to power this ambition is straining an ageing grid and leaving industry questioning whether the numbers add up.

Data centres, the factories of the AI era, are voracious consumers of power. The National Energy System Operator estimates that Britain’s electricity demand will rise from 319 terawatt hours this year to 450 TWh by 2035, with data centres tripling their share. The government’s new “AI Growth Zones” will require each bidder to guarantee at least 500 megawatts of power by 2030. That is the sort of load normally associated with heavy industry. Building the substations and lines to deliver it takes years, not months.

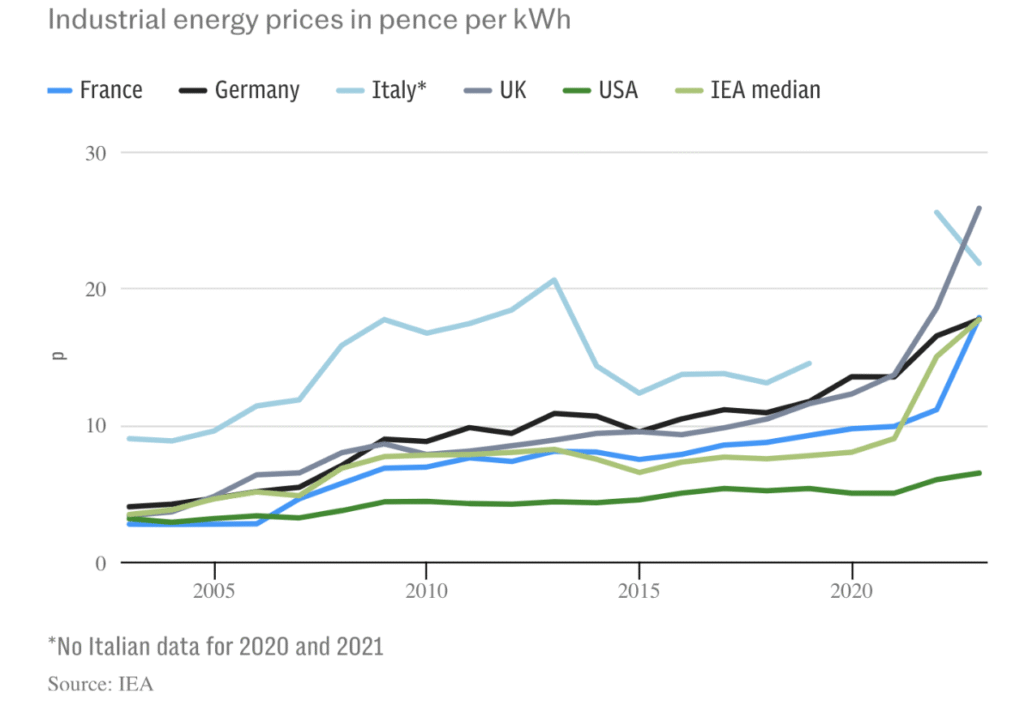

The problem is compounded by cost. Wholesale electricity in Britain averaged $115 per megawatt hour in the first half of 2025, up 40% in a year. That compares with $100 in Germany, $73 in France, $48 in the United States and $45 in China, highlighting the premium British businesses pay for power. Cold weather and poor wind output forced reliance on gas-fired generation, exposing households and companies to global price swings. Ministers insist that more offshore wind, nuclear and interconnectors will bring stability, but in the meantime the transition is making power the most expensive, in the G8.

For context, UK industrial electricity costs are approximately 46% above the average in International Energy Agency (IEA) member states, making them some of the highest globally. And in terms of case studies, Ørsted, the Danish developer, has halted a 2.4 gigawatt wind farm because the sums no longer worked. Sizewell C, the flagship nuclear project, is already running to a £38 billion bill, almost twice the original estimate.

Industry is not waiting. At government round tables this summer, executives from US tech giants floated the idea of natural gas fuel cells to provide stopgap power for new sites. Officials did not endorse the suggestion but pointedly refused to rule it out. The risk is obvious, interim fossil fuel solutions become permanent. The government’s claim to climate leadership would be difficult to square with a new wave of gas-fed server halls.

Other ideas are gathering pace. Equinix, a major operator, has signed a deal in the Netherlands to draw power from Rolls-Royce’s small modular reactors once they are built. SMRs are compact, can be sited close to demand and offer steady, low-carbon baseload power, just what energy-hungry data centres need. Google and Amazon are backing similar projects in America. Britain has its own SMR programme and could use it to anchor its AI strategy, pairing reactors with designated growth zones.

Yet even this would not solve the political dilemma. Britain’s centralised power market is underpinned by subsidies and contracts that critics say inflate costs. Liberalising the system and leaving it to the market might drive efficiency, but few in Whitehall are ready to surrender control of such a strategic asset. Passing the cost of investment through consumer bills is already unpopular. Funding it through taxation would be no easier.

Time is short. AI demand is accelerating now, but the benefits of new offshore wind farms, nuclear reactors and grid upgrades will not be felt until the next decade. Without credible short-term fixes, Britain risks being priced out of the AI race while undermining its green credentials. The implications go beyond energy policy. A failure to secure affordable power could see data centre investment, and the high-value jobs in AI development, cloud computing and digital infrastructure, migrate overseas. Higher electricity costs also threaten traditional industries from steel to chemicals, squeezing margins and jobs in sectors that already feel left behind.

The economic consequences could be severe. AI investment drives growth not only through direct employment but also by boosting productivity across the wider economy. If Britain cannot provide competitive, reliable power, it risks stifling innovation and slowing the expansion of digital industries at a time when other nations, from the US to China, are scaling rapidly. Meanwhile, rising energy bills act as a drag on household spending and industrial competitiveness, leaving the labour market caught in a double bind, with too few of the new technology roles Britain hopes to attract and added pressure on established sectors. Ministers want the country to be both a climate leader and an AI superpower. Unless they find a way to reconcile the two, it could end up being neither, and British workers and the wider economy may pay the price.

Subscribe to our weekly newsletter for clear, timely insights on the political and economic trends shaping the UK labour market:

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute workshop with us and discover the power of data in shaping the future of your market!

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!