The Political Parties are now polarising on Economic Policy

Which prescription is the best solution?

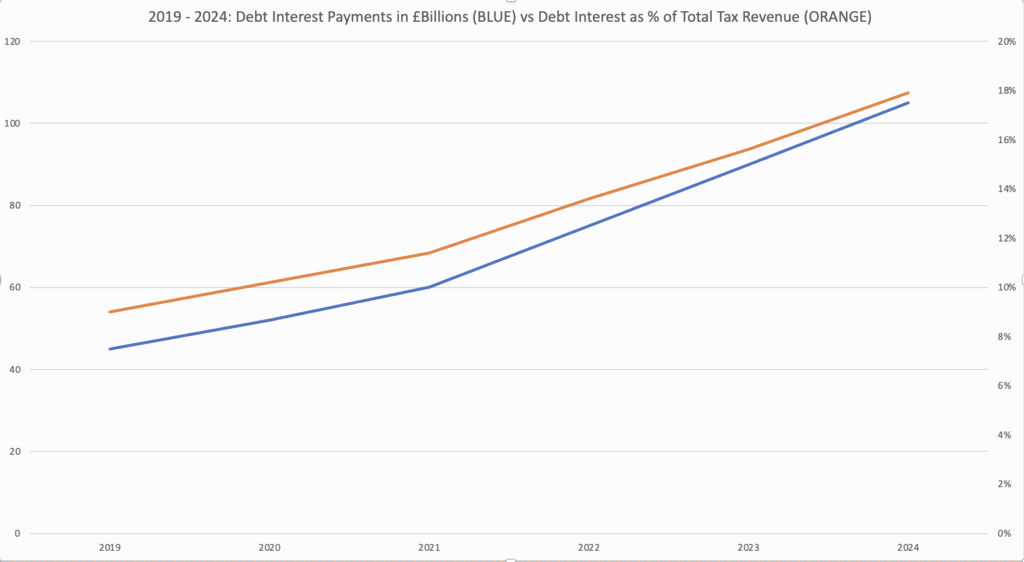

The cost of long-dated UK government borrowing has surged to 5.7%, its highest level in 27 years, raising alarm across financial markets. Economists warn of a potential “doom loop”, where rising debt leads to higher interest payments, consuming a growing share of tax revenues and exacerbating fiscal pressures. With that, factor debt interest payments in 2019 were already making up 9% of the total tax revenue. As of 2024, this had risen to 17.9%.

Unlike many of its peers, the UK has a substantial proportion of inflation-linked bonds, which now account for a quarter of government debt. When inflation was low and stable, these instruments had little impact on public finances. But over the past three years, higher inflation has pushed up interest payments on both existing and newly issued bonds. By comparison, index-linked debt constitutes 12% of Italy’s borrowings, 11% of France’s, 8% of the US’s, and just 1% of Japan’s.

The strain comes at a time when the UK is set to record a £137.3 billion deficit in 2024–25, equivalent to 4.8% of GDP, with debt interest costs projected to reach £105.2 billion. Much of the government’s spending is locked into so-called “holy cows”: the NHS, pensions, and welfare, which together account for nearly 60% of the budget. Welfare costs alone have risen sharply since the pandemic, from £251 billion in 2019 to £303.3 billion last year.

This leaves a primary budget shortfall of £32 billion, independent of debt servicing, a gap that has spooked bond markets. The government is effectively living beyond its means, raising concerns that any new borrowing will carry a premium. Chancellor Rachel Reeves has signalled tax increases to bridge the gap, but analysts caution that her proposed measures may dampen private sector growth.

Economic expansion in the UK is increasingly reliant on public sector spending and immigration, while the private sector slows. The promised UK–US trade deal has yet to deliver meaningful benefits. Reeves’s “war on wealth” risks curbing investment and deterring high-net-worth individuals, a trend already visible in London’s property, retail, and hospitality sectors.

Conservative figures are offering alternative prescriptions. In her conference speech, Kemi Badenoch outlined plans to save £47 billion a year through cuts to welfare, the civil service, and foreign aid. A proposed rule would earmark half of all future savings for deficit reduction. Yet the party remains politically fragile, with Tory polling showing limited traction. The Liberal Democrats, meanwhile, languish at 13% in the Poll of Polls, with membership halving in five years. Their conference proposals fail to address the structural deficit, offering neither sufficient tax rises nor spending cuts.

Nigel Farage’s Reform party has taken a different tack, prioritising public spending reductions over tax cuts. A former trader, Farage understands market sensitivities and is now promising £70 billion of annual cuts over a parliamentary term, still, this is only roughly half the current deficit.

Despite holding a sizeable majority following last year’s election, the Labour government faces a potentially pivotal budget. Should markets lose confidence in Rachel Reeves’s fiscal strategy, borrowing costs could surge, risking broader economic instability. A change in leadership within Labour is, however, difficult and slow, and no obvious successor exists within the parliamentary party. The most likely scenario is that the government will simply muddle through. Yet the mounting debt burden threatens to spiral further, placing additional pressure on the private sector, dampening investment and pushing up unemployment. In the longer term, this could erode Labour’s electoral prospects, where increasingly, the safe money is on the next prime minister being Nigel Farage. What happens to the UK from there, is an open question.

Subscribe to our weekly newsletter for clear, timely insights on the political and economic trends shaping the UK labour market:

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute workshop with us and discover the power of data in shaping the future of your market!

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!