Private sector growth falters as Unemployment Rises

Targeted policies needed to restore confidence, stimulate growth

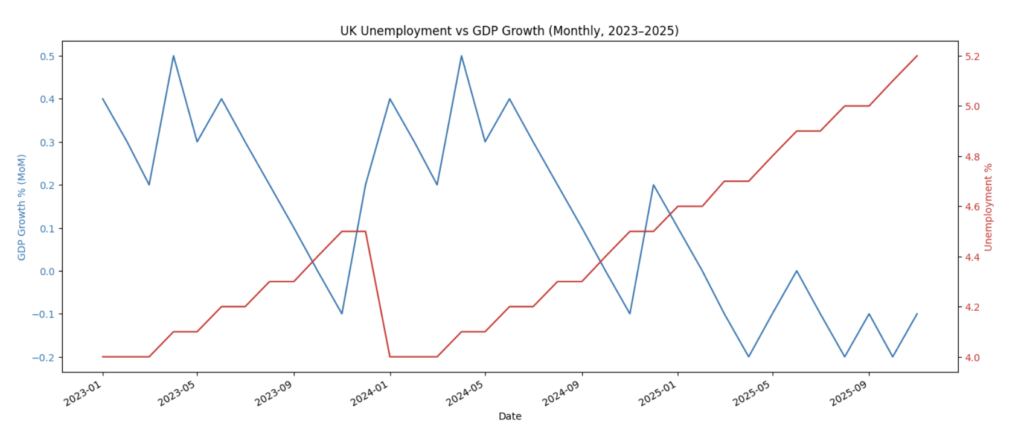

The lights are flashing red for Rachel Reeves and the Labour government. The UK economy is shrinking while other major economies are growing. Unemployment is rising and inflation remains stubbornly above the 2% target. The trade deficit is widening, putting even more pressure on households and businesses.

Business confidence is at historic lows. The Institute of Directors’ Economic Confidence Index fell to around negative seventy-three to negative seventy-four in October and November 2025. This is close to the lowest level ever recorded, showing that directors are extremely pessimistic about the future. Companies are holding back on investment and hiring because they lack confidence in the government’s economic policies.

Private sector growth is slowing. Recent Purchasing Managers’ Index data show the economy is still technically expanding, but the pace has slowed compared with earlier this year. Both services and manufacturing are struggling to gain momentum.

Labour’s industrial strategy is meant to be the solution. The plan aims to support key industries, boost investment, and create high-quality jobs. Yet businesses remain hesitant. High taxes, regulatory uncertainty, and rising costs are preventing the strategy from delivering real results. For example Life Sciences despite being deemed an industry of strategic importance, is still floundering post Brexit, with the MHRA lagging behind the EMA still on drug approvals, leading to industry turning away from the UK.

The economic malaise also raises political stakes for Keir Starmer. Poor economic performance and falling public confidence put pressure on party leaders, and continued weakness could give rivals reason to push for a leadership review. Financial markets would also watch closely. If a more left-wing Labour politician became Prime Minister, bond investors might expect higher spending and interventionist policies, pushing yields higher and increasing borrowing costs.

At the same time, the rise of the Reform Party adds another layer of pressure. With the largest party membership in the country, Reform is positioning itself as the party of economic competence and small government. Their growing influence could amplify scrutiny on Labour, limiting its ability to enact bold policies without political backlash. For Labour, this is not just an economic challenge but a political one: restoring confidence in the economy is essential to maintaining support in a rapidly shifting party landscape.

To address the economic challenges, Labour could consider a mix of short-term and structural policies. These could include targeted tax relief for small and medium-sized businesses to encourage investment and hiring, measures to reduce energy costs for industry and households, and clearer, more predictable regulation to restore confidence. Investment in infrastructure and skills training could strengthen productivity and competitiveness, while targeted support for export-oriented sectors could help narrow the trade deficit. A more proactive industrial strategy, coupled with credible fiscal management, could reassure both businesses and financial markets and help the UK return to sustainable growth.

Subscribe to our weekly newsletter for clear, timely insights on the political and economic trends shaping the UK labour market:

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute workshop with us and discover the power of data in shaping the future of your market!

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!