For the UK, Financial Services has a critical part to play, in terms of GDP, our balance of payments and employment. Within the Financial Services industry though, increasingly Fintech is starting to come to the fore. New challengers such as Starling, Monzo, Revolut and Wise have disrupted the incumbents and as a result, the industry has permanently changed.

London is witnessing a substantial increase in fintech job vacancies, spurred by renewed investor interest and technological advancements.

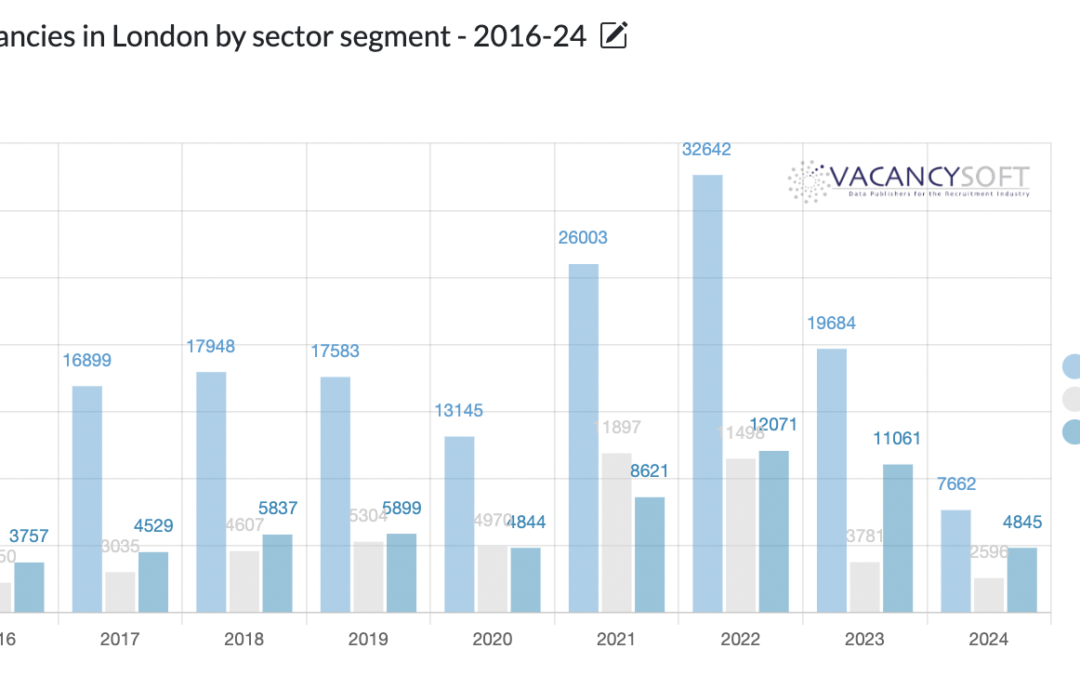

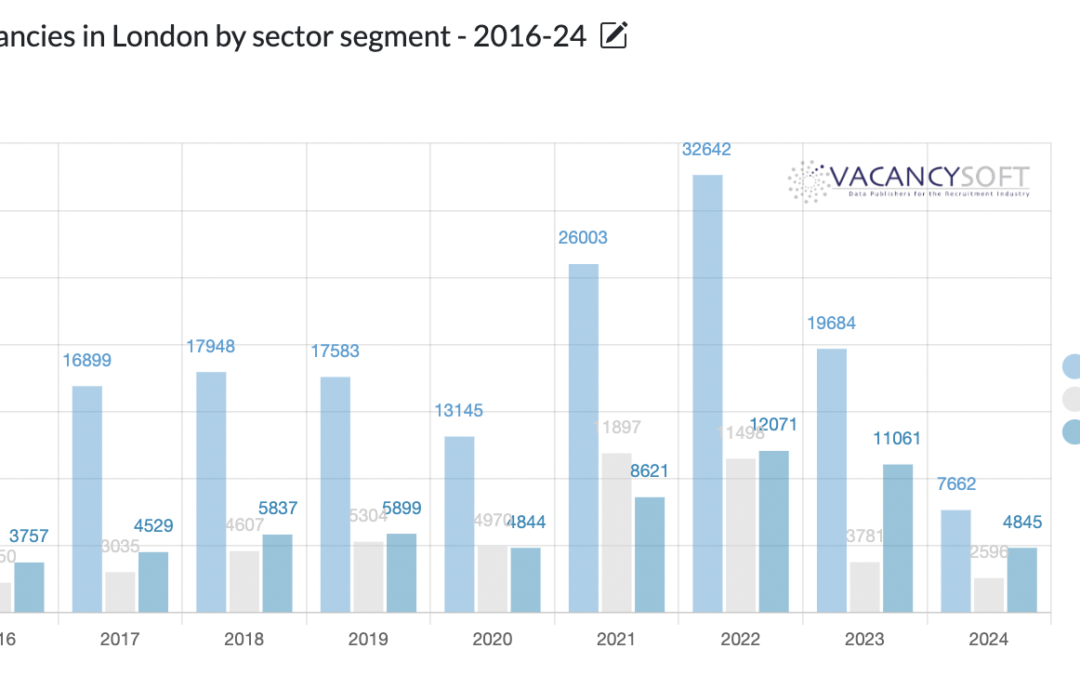

Fintech is dominating the UK financial services sector in 2024, emerging as the top-performing category for job openings. London is at the forefront of this growth, experiencing a significant 61% year-on-year increase in fintech job vacancies from January to April.

Fintech has emerged as the top-performing segment in financial services this year. If the current recruitment trends persist, fintech job vacancies in 2024 are projected to be 37% higher nationwide compared to the previous year. Technology roles dominate the recruitment landscape within the fintech sector, making up 41% of all job vacancies this year.

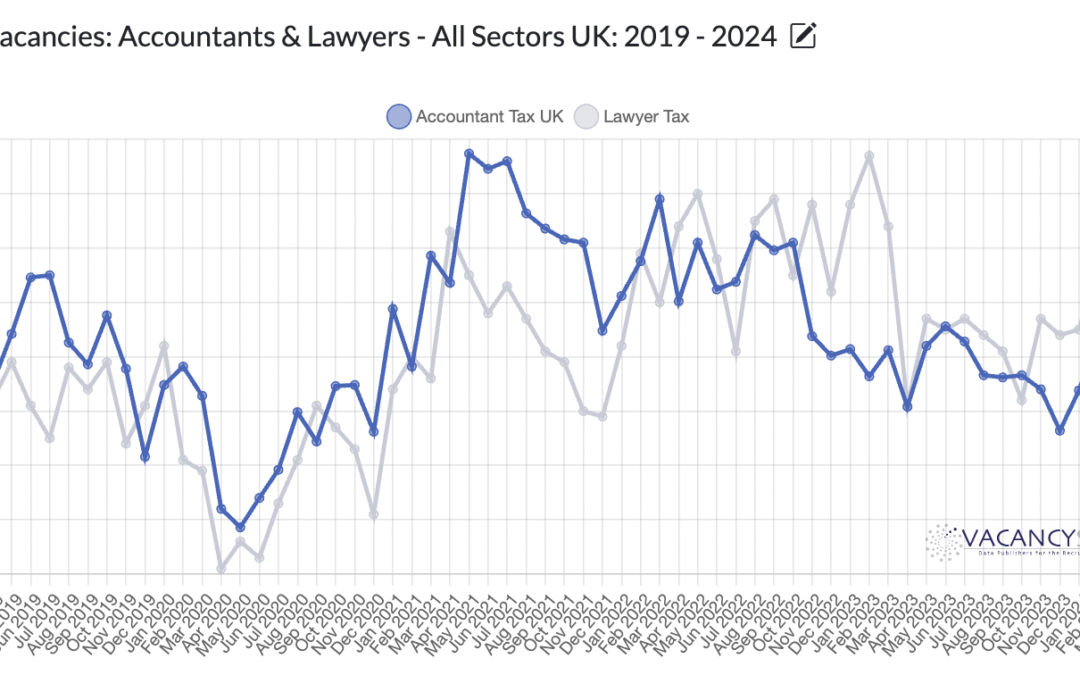

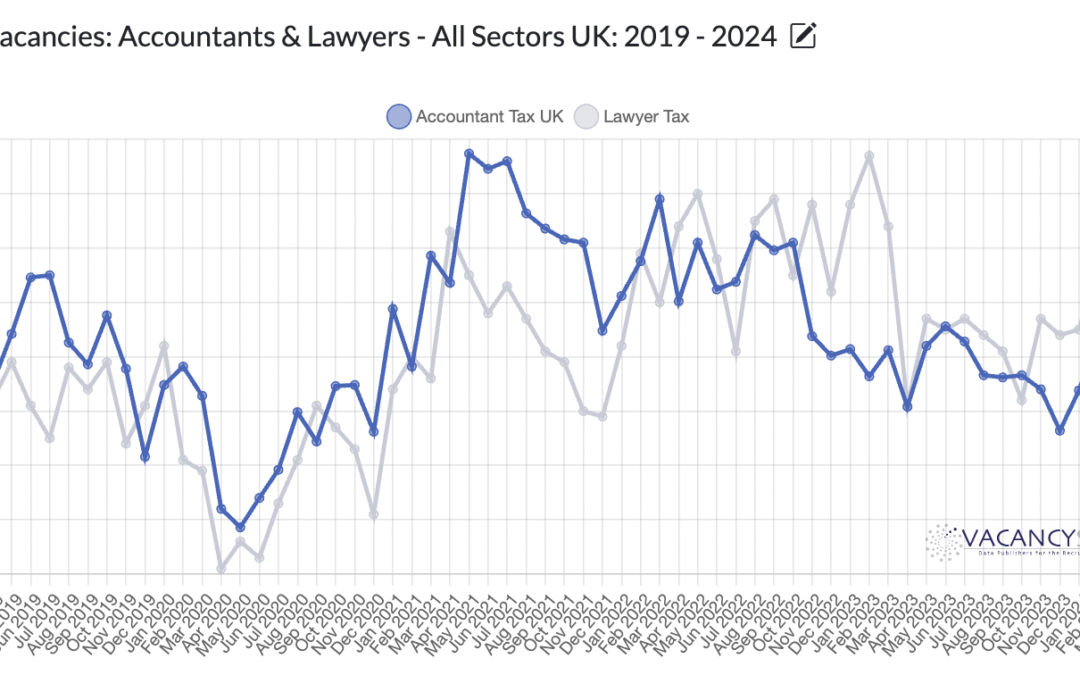

The impact of the budget on tax recruitment is apparent. March 2024 was the record month for tax vacancies going back to January 2019, beating even the peak post pandemic months in 2021. At the same time, in a recent report featured in Bloomberg, the UK is set to see 9,500 millionaires repatriate away, which is more than any other country globally, with the exception of China.