Putin tests NATO’s resolve

How secure is the Suwalki Gap?

Poland has triggered Article 4 of the NATO treaty after Russian drones breached its airspace this week, prompting an emergency meeting of the Alliance to determine its response. The move underscores the seriousness of the incident: the last time Article 4 was invoked was during Russia’s full-scale invasion of Ukraine in 2022.

Moscow and Minsk have announced joint military exercises involving 40,000 troops near Poland’s border. Warsaw has responded in kind, deploying a similar number of troops to its frontier with Belarus, closing border crossings, and staging drills with Lithuania.

Despite mounting economic strain, Russia has avoided the collapse that many in Europe once hoped would constrain the Kremlin’s war machine. The assumption in some European capitals that the crisis might simply ebb away now looks increasingly like wishful thinking. If anything, the likelihood is that the conflict will widen.

Early speculation held that the drone incursions were designed to confuse Ukrainian air defences in Lviv. Increasingly, however, Western analysts suspect they were a calculated probe of NATO’s response times in the Suwałki Gap, the narrow corridor linking Poland and Lithuania that separates Belarus from the Russian exclave of Kaliningrad.

This strip of land has long been a strategic flashpoint. Sanctions have heightened tensions over Russian freight that once transited through it. Should Moscow seize the corridor, it would sever the land link between Poland and the Baltic states, severely complicating any attempt to defend Estonia, Latvia or Lithuania.

A Growing List of Problems for NATO

- Escalation from Moscow: President Putin appears intent on further escalation, driven by domestic economic pressures and the diminishing prospect of a quick victory in Ukraine.

- Vulnerability of the Suwałki Gap: NATO planners warn that Russian and Belarusian forces could seize the corridor in under 72 hours. Russian electronic warfare systems in Kaliningrad have already demonstrated their reach, reportedly grounding the EU Commission president’s plane by jamming GPS signals.

- Drone warfare gap: NATO air defences are using missiles costing hundreds of thousands of dollars to shoot down drones worth a fraction of that, even as Russia produces up to 5,000 drones a day. Europe has yet to field a scalable countermeasure.

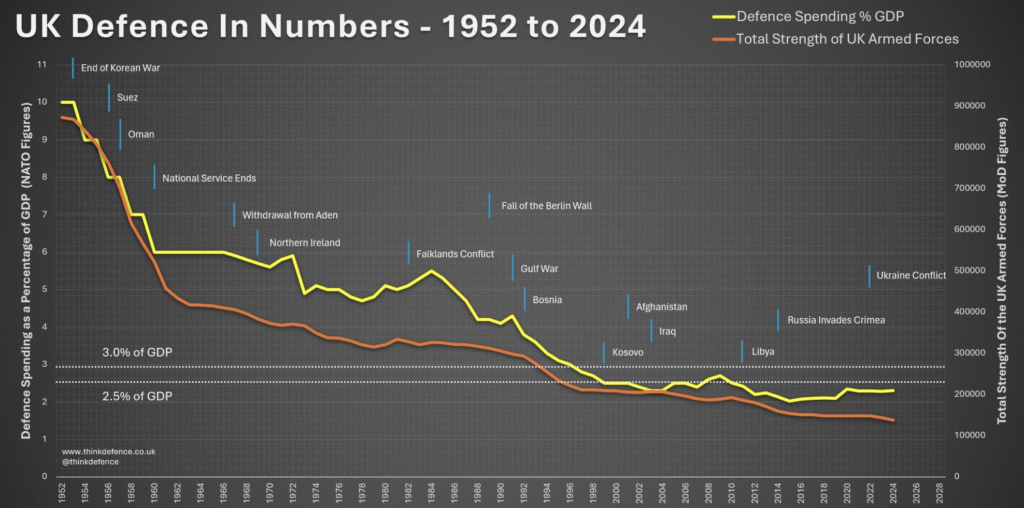

- American uncertainty: Questions persist over whether Donald Trump would honour NATO’s Article 5 commitment. While Poland and Germany are rapidly rearming, others (including the UK) have made only token increases in defence spending. U.S. officials are increasingly sceptical of defending allies who will not defend themselves.

Any Russian incursion would most likely come via Lithuania, where the railway linking Kaliningrad to Belarus runs. With Ukraine’s manpower dwindling, the Kremlin may see an opening to stretch NATO’s resolve while Kyiv remains tied down.

Russia continues to draw on support from sympathetic states, whether through the supply of raw materials, dual-use technology or manpower. When Ukraine launched a counteroffensive into Kursk last year, it was reportedly repelled in part by Korean fighters aiding Russian forces.

It now appears less a question of if Moscow will test NATO, and more of when. Once Russian troops are inside NATO territory, forcing them back could be costly and politically fraught, especially as nuclear options are off the table. For the Alliance, the logical course therefore is to fortify its eastern frontier now rather than risk having to recapture it later.

For the UK, the gathering storm poses an uncomfortable dilemma. With the Labour government grappling with soaring deficits, militant unions, faltering private investment and spiralling welfare costs, the instinct will be to defer major defence spending. But that luxury may no longer exist. The question confronting ministers is no longer whether to rearm, but what must be sacrificed to pay for it.

Subscribe to our weekly newsletter for clear, timely insights on the political and economic trends shaping the UK labour market:

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute workshop with us and discover the power of data in shaping the future of your market!

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!