With the Labour Party now in-situ, changes are being proposed to employment law which have the potential to be transformative to the UK, where the minimum wage is a key area being scrutinised. The proposal to scrap the tiered structure of the minimum wage, which means that there will be no difference in treatment, between those aged 16 year olds or those over 21 has the potential to cause a significant impact in the job market in terms of entry level roles. The question is, what are the likely second order consequences?

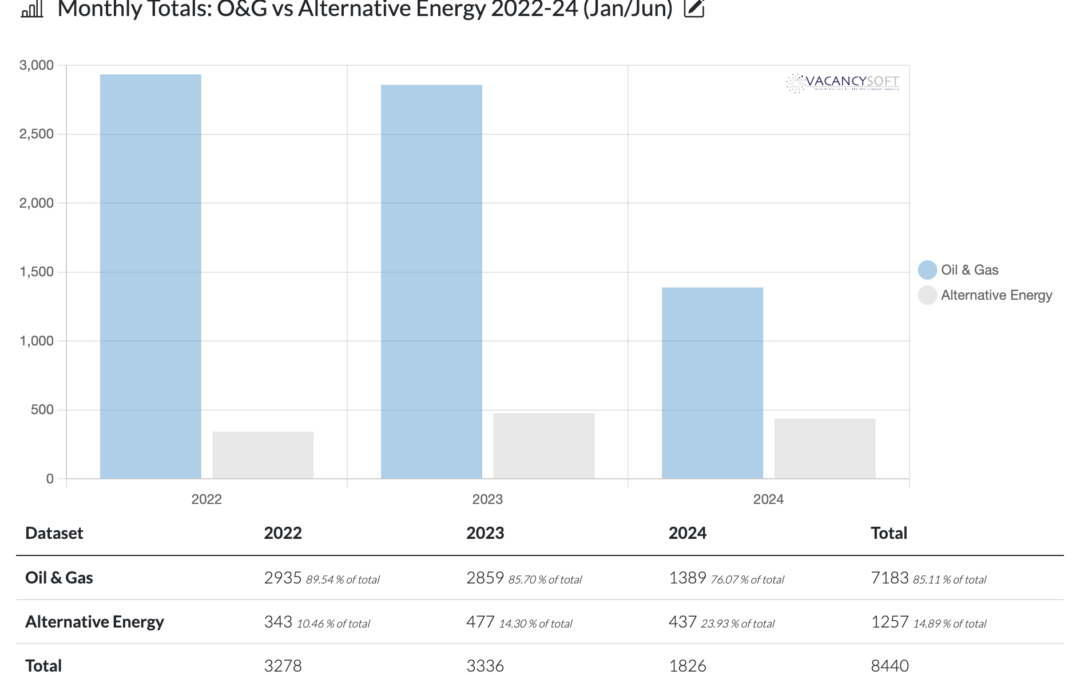

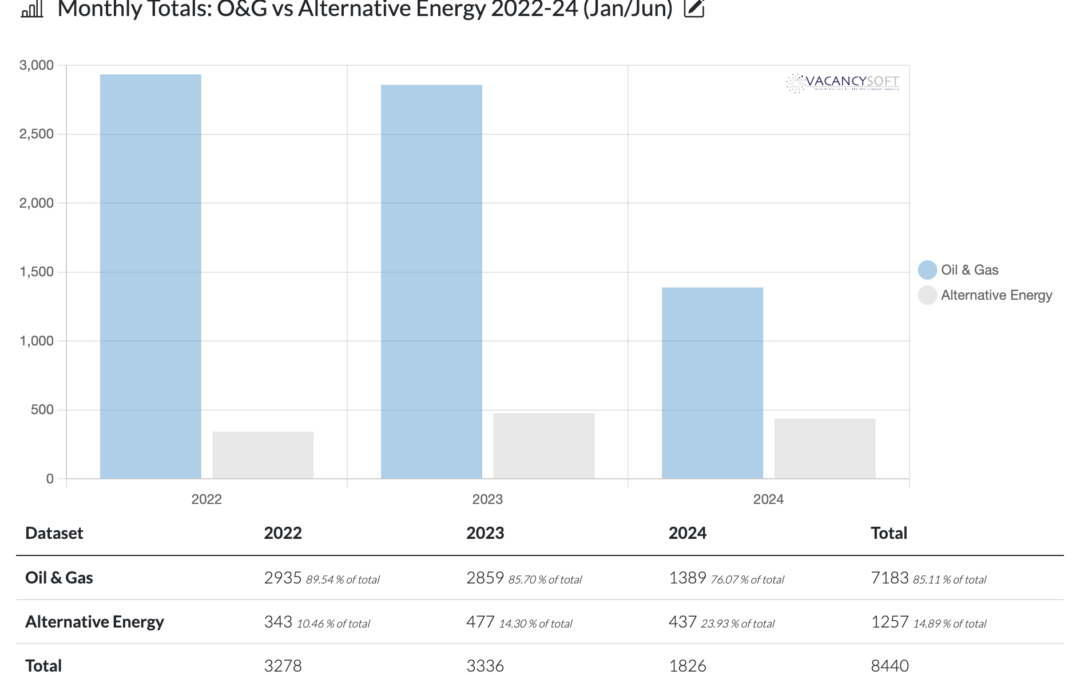

In one stroke of a ministerial pen, the drilling licenses which Sunak had committed to, were cancelled. Miliband for a long time has been an advocate of clean energy and has committed to decarbonizing the national grid, in full, by 2030. At the same time, in a sign this Government are prepared to tackle the NIMBYs head on, previous restrictions regarding on shore wind farms are to be removed and investment into solar power infrastructure is to be trebled.

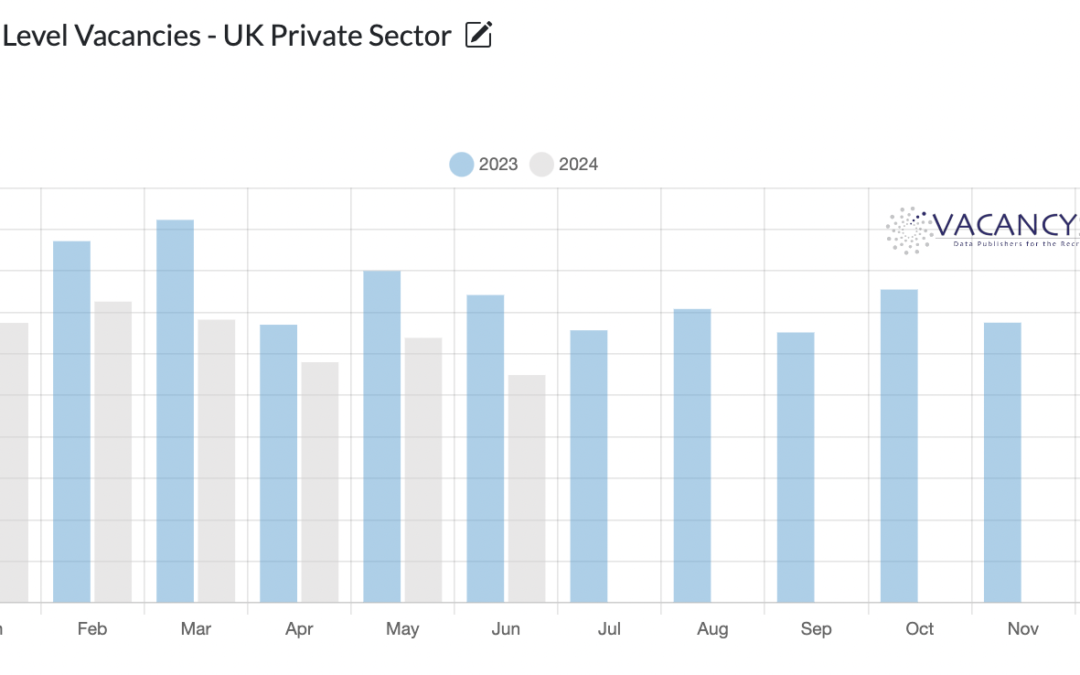

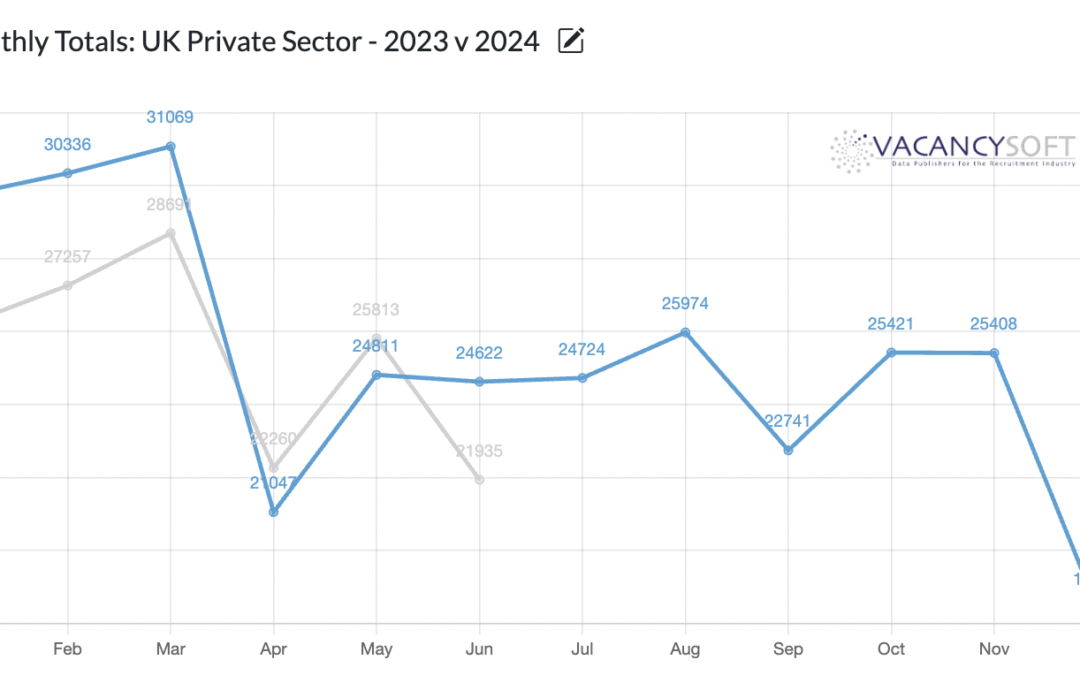

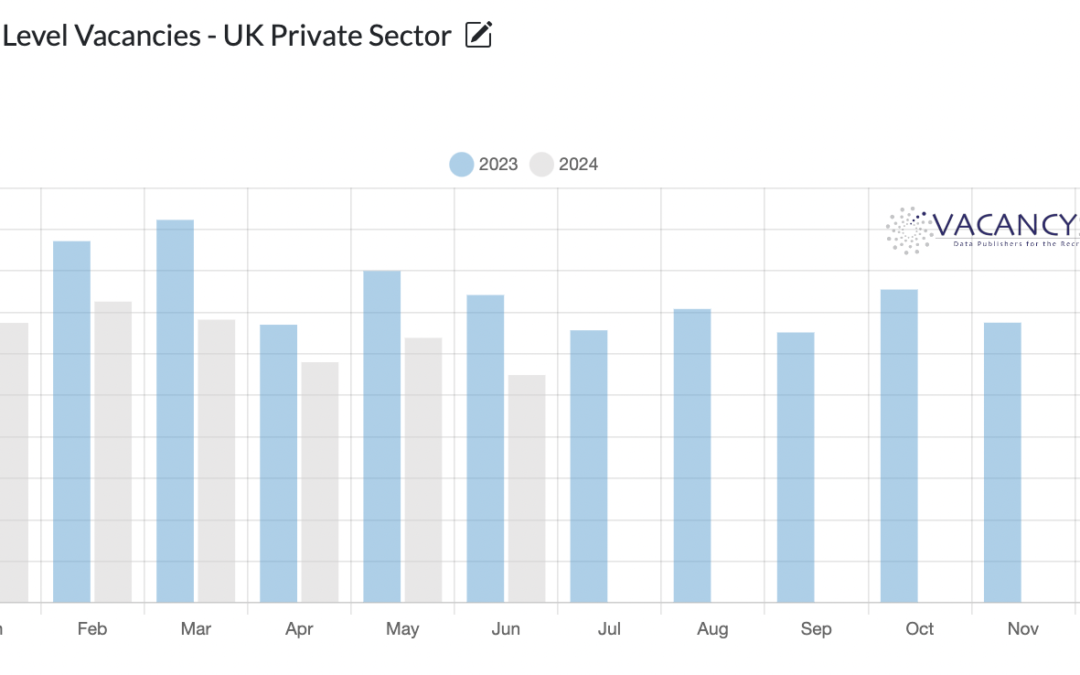

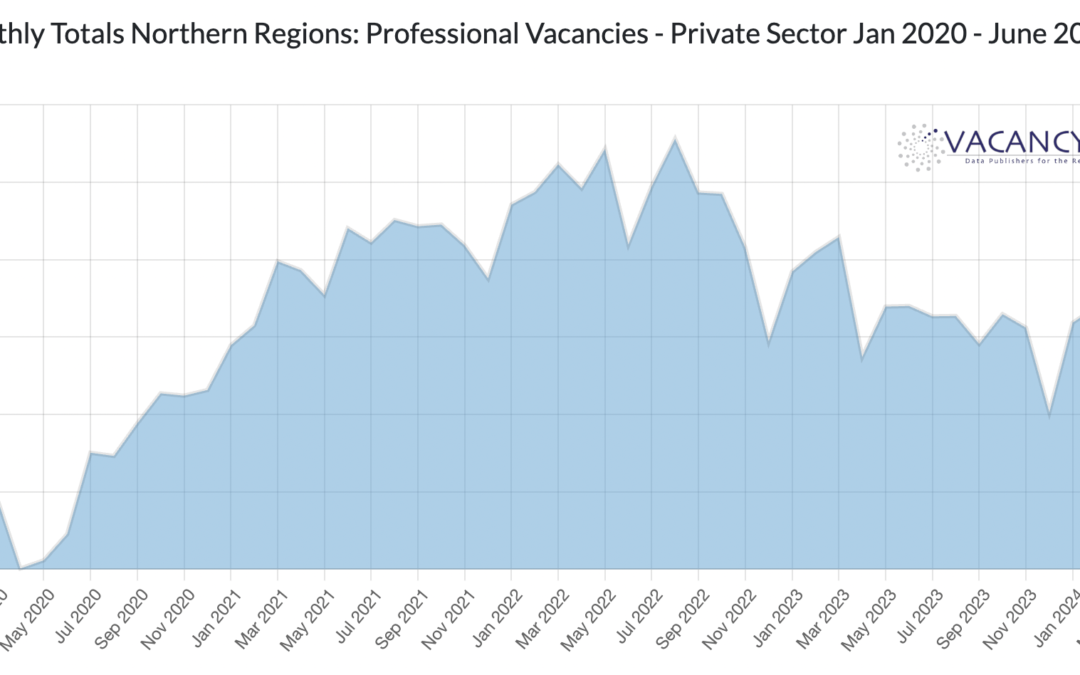

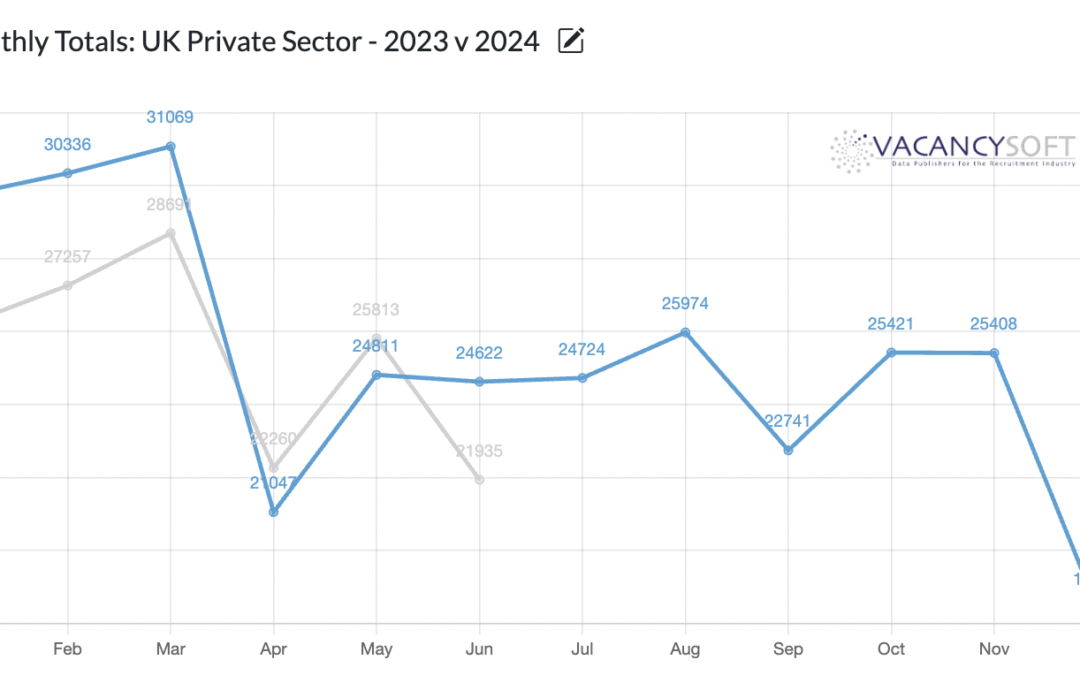

Given the recent general election, it is no surprise that vacancies dropped in June. With Businesses waiting on the outcome of the election, whilst Labour winning was a given, the coming weeks will now see a blitz of policy announcements, which will give greater clarity when it comes to investment.

The UK’s political landscape is particularly noteworthy with Europe facing a series of summer elections. If it gains power, the Labour Party has explicitly stated its intention to improve trade relations with the EU. Although specific plans have not been detailed, any shift in this direction could alleviate the sectoral dampening caused by Brexit.

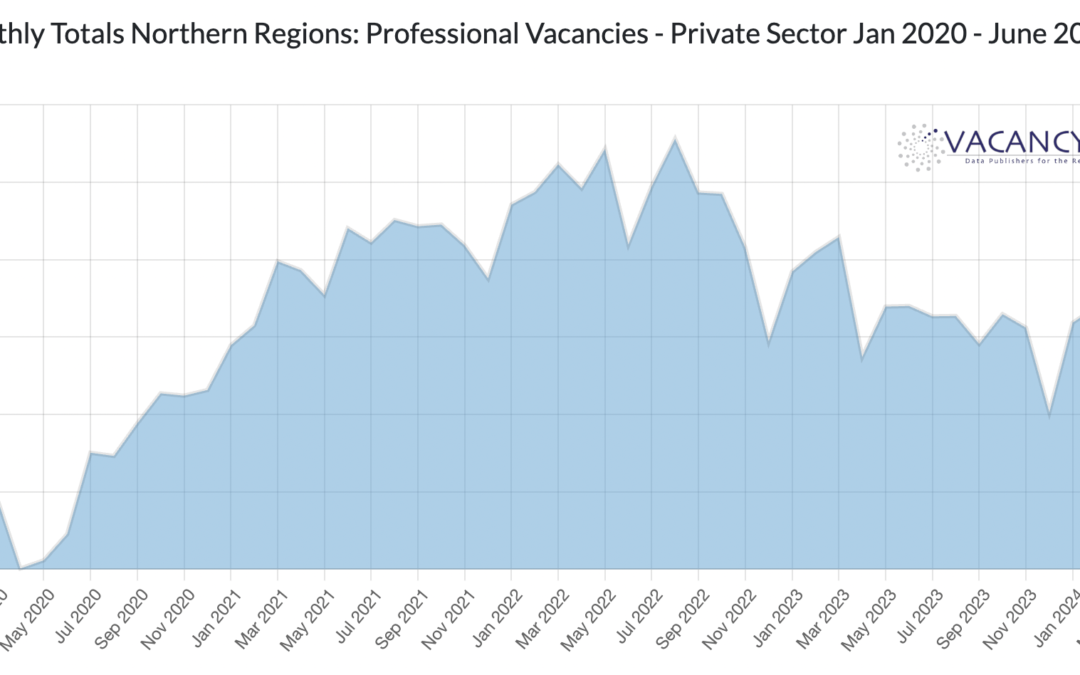

Is it the responsibility of Government to directly stimulate economic growth, or is it for them to create the environment where businesses invest themselves? Statism, or interventionist supply side policies are coming to the fore once more, and for the incoming Labour Government, there are a myriad of policy proposals designed to achieve growth.