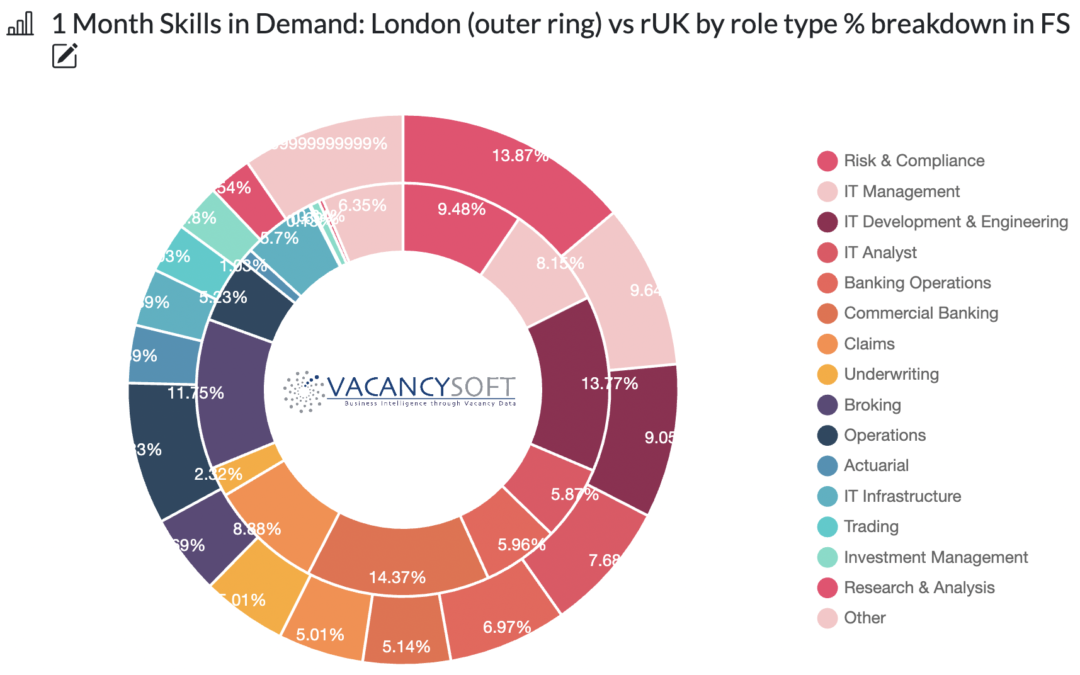

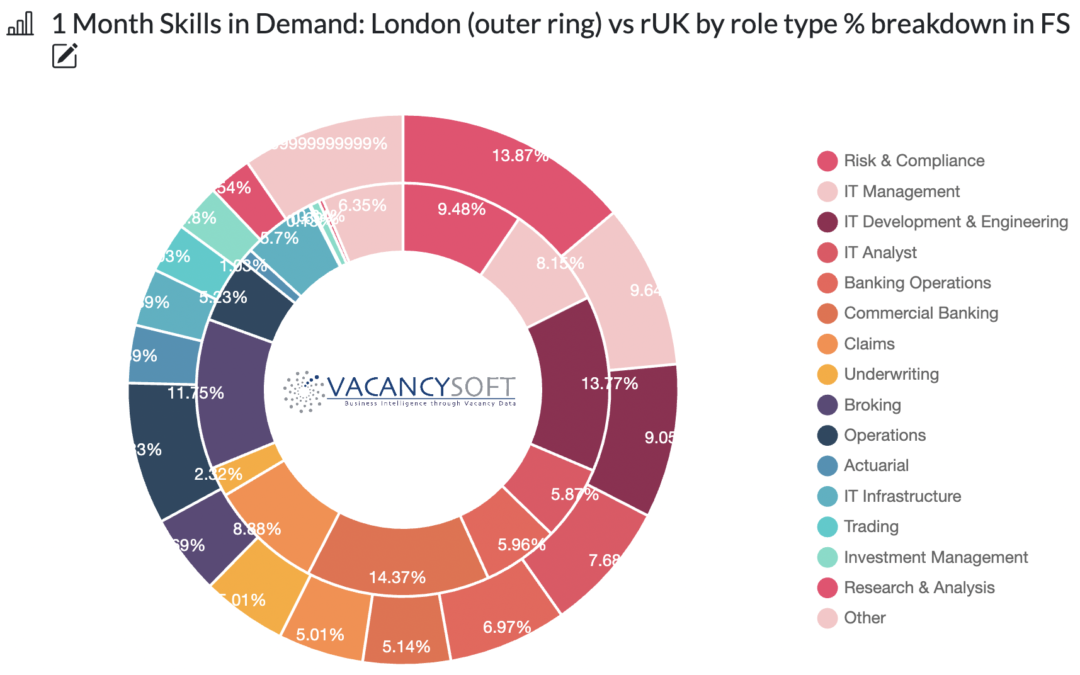

For the UK, Financial Services has a critical part to play, in terms of GDP, our balance of payments and employment. Within the Financial Services industry though, increasingly Fintech is starting to come to the fore. New challengers such as Starling, Monzo, Revolut and Wise have disrupted the incumbents and as a result, the industry has permanently changed.

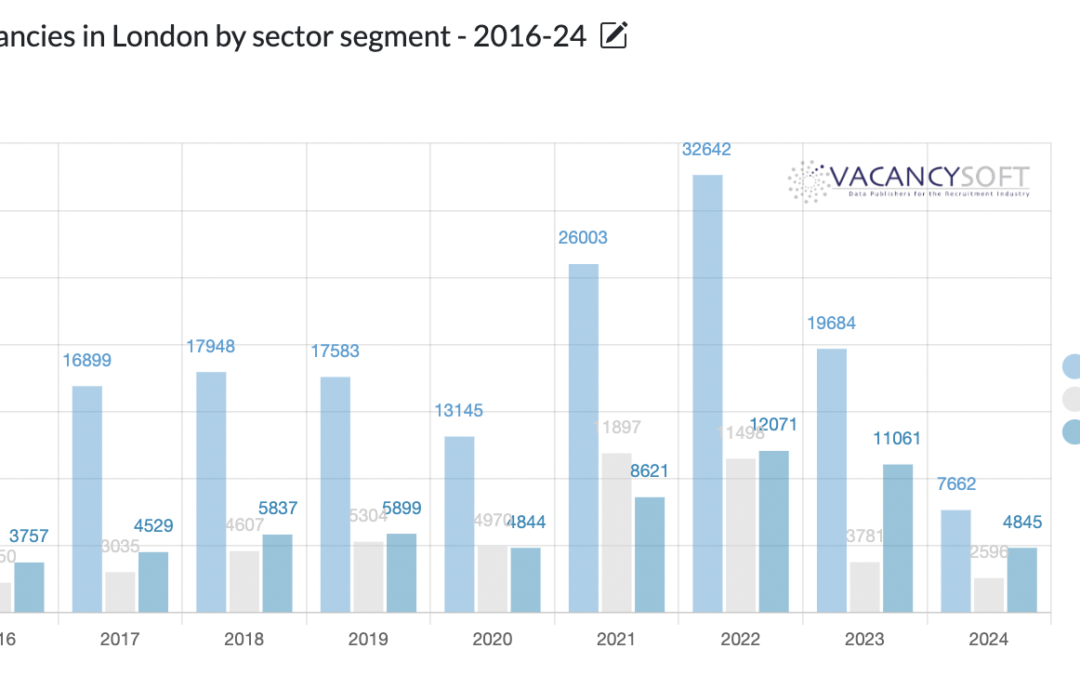

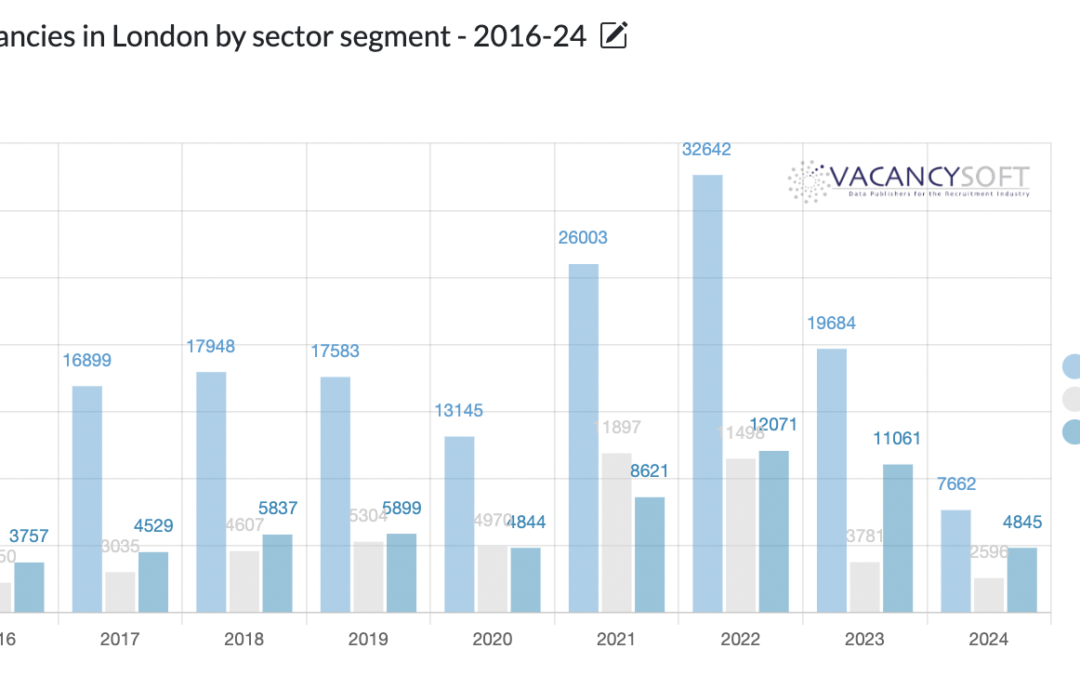

Financial Services is one of the largest industries within the UK, and contributes 8.3% to economic output. Overall the Financial Services industry employs over 1m people in the UK, and also runs significant trade surpluses, as a result, what happens in Banking is of direct relevance to the entire economy, and London in particular is of significance.

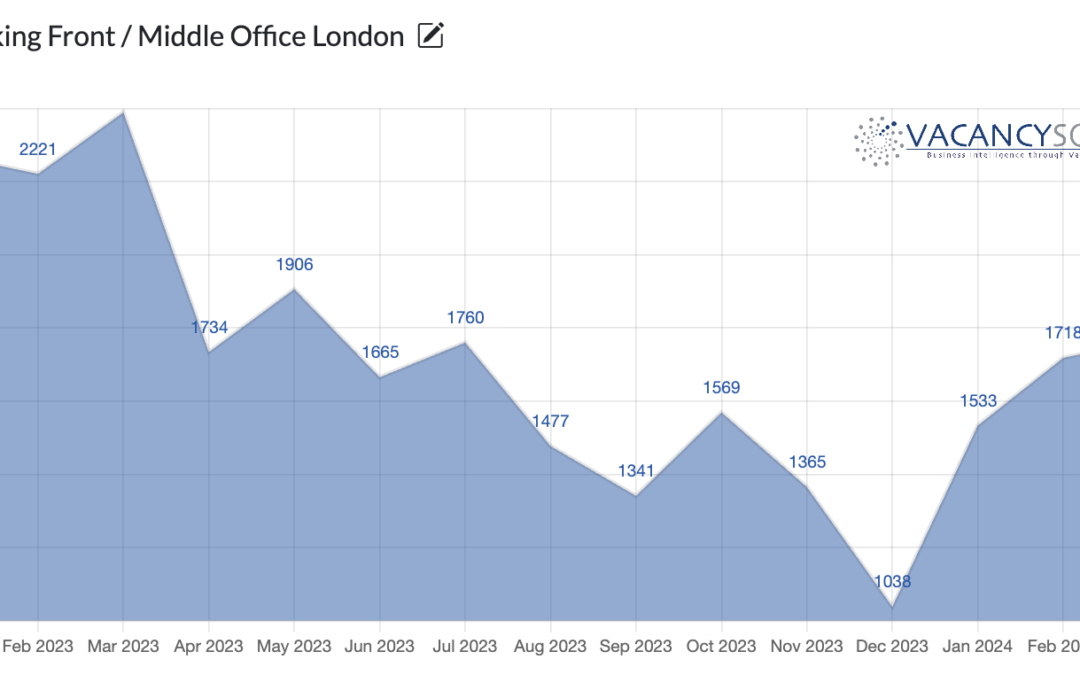

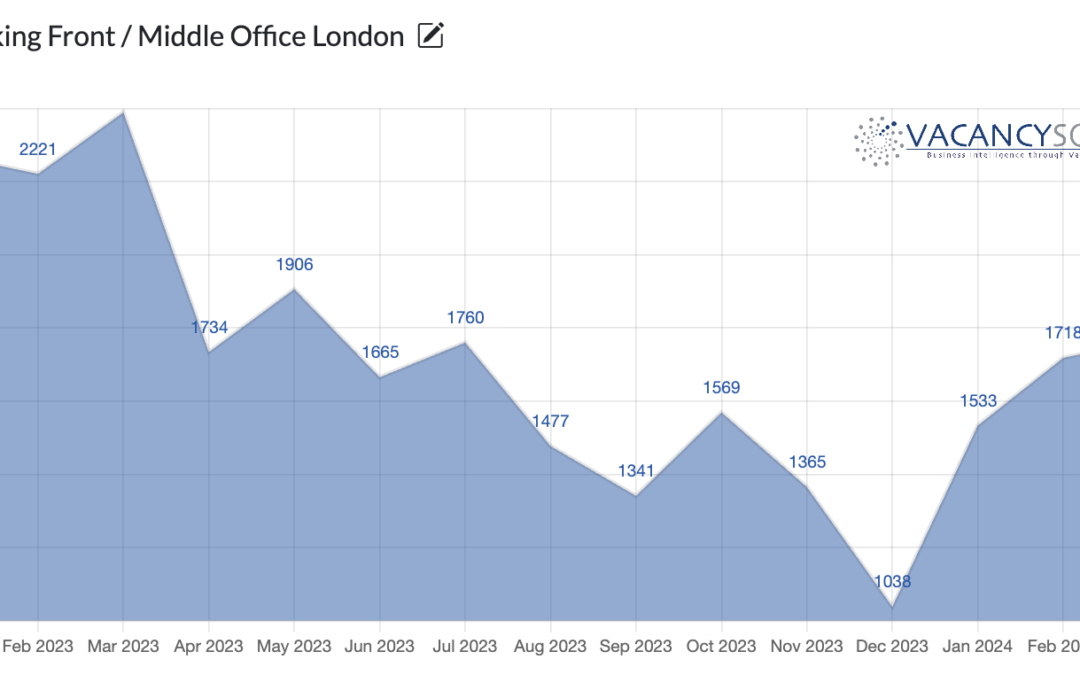

The long-term impact of COVID has yet to be felt on the economy. Equally, the societal change is already here. Work from home and hybrid is now becoming de-rigeur, where for people with London based jobs, it is increasingly a pre-requisite, especially when factoring the commute times. This is creating its own conflict within Financial Services, especially, as banks push for people to be back to work, equally are increasingly flexible about which work location is used. For example, HSBC now employs more people in Birmingham than in London.