The UK’s political landscape is particularly noteworthy with Europe facing a series of summer elections. If it gains power, the Labour Party has explicitly stated its intention to improve trade relations with the EU. Although specific plans have not been detailed, any shift in this direction could alleviate the sectoral dampening caused by Brexit.

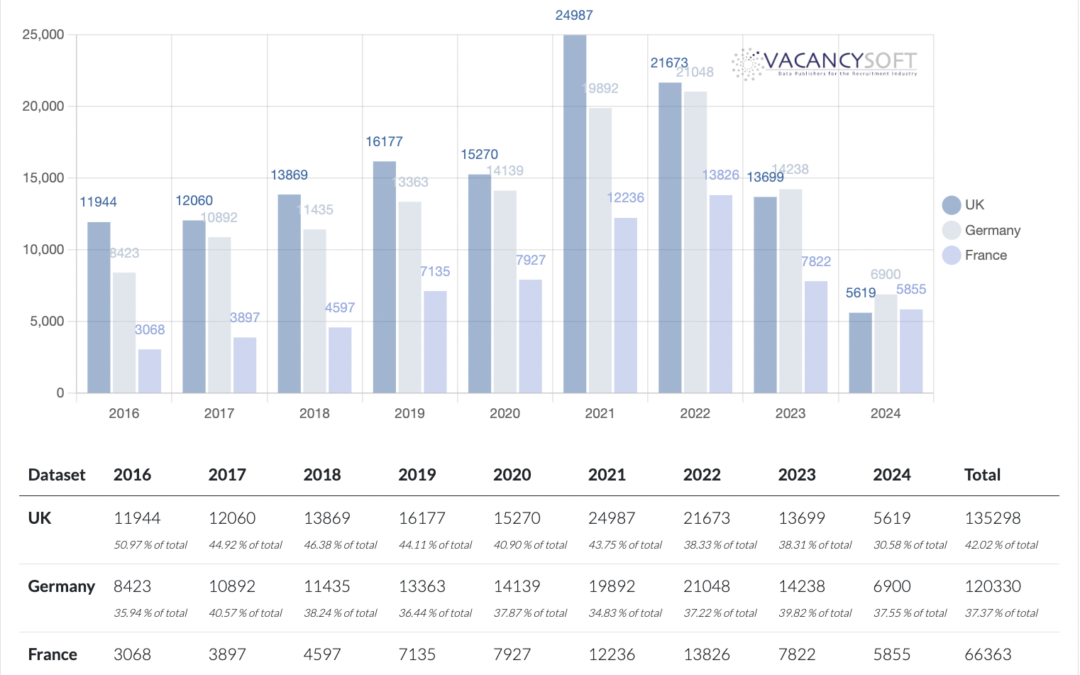

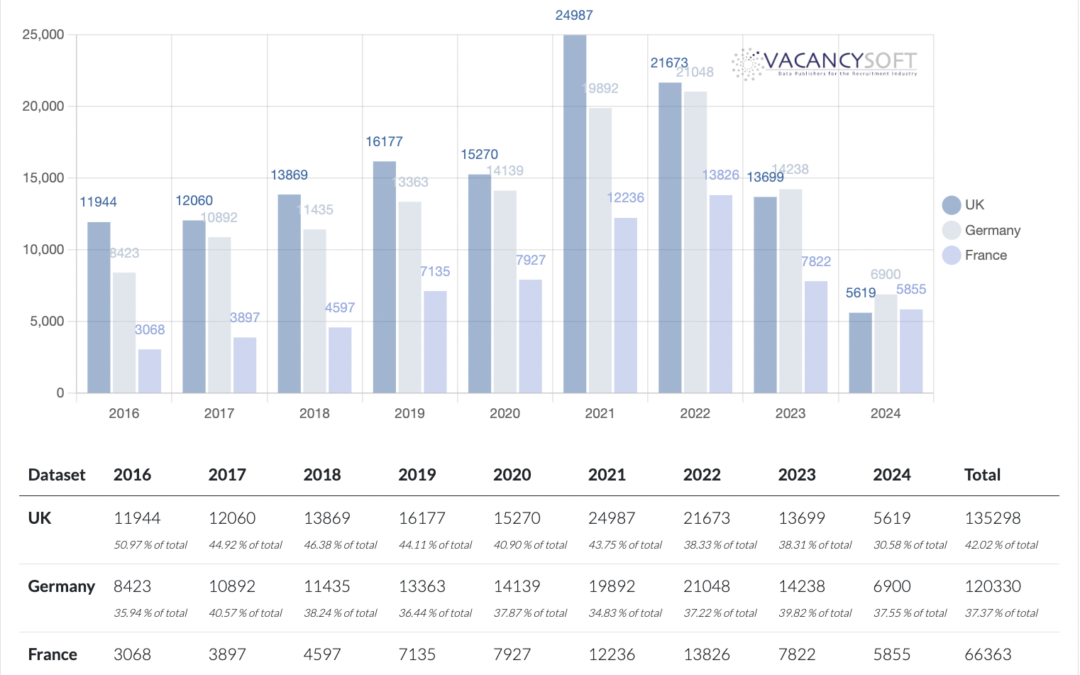

As the UK moves past the pandemic, the life sciences industry is still adjusting to the challenges associated with the post-Brexit regime. This, combined with the slowdown in trials during the pandemic, has resulted in a slowdown in recruitment within the sector, particularly affecting regulatory affairs professionals.

For the UK Pharmaceuticals industry, the headwinds are real. The post pandemic hangover, at first caused by clinical trials being delayed on approval, so that COVID-19 related drugs could be prioritised meant that as the pandemic subsided, the pipeline of other drugs going to clinical trials had slowed to a trickle. The MHRA was supposedly tasked with creating a fast track regime to overcome this, equally even now, the EMA is approving drugs faster. Hence for pharmaceuticals companies looking at where they should organise trials, the UK is as a result, less attractive.

With the slump in the pharmaceutical sector set to continue, the long-awaited reforms to the MHRA have yet to materialise. As a result, drug approval in the UK lags behind the EU, further depressing the sector. 2023 seems to be the low point in that there has been an uptick in Q1 so far, and if this continues, it will increase by 9.1% this year compared to last. The recovery has been in London specifically, with volumes up 26.1% on last year.

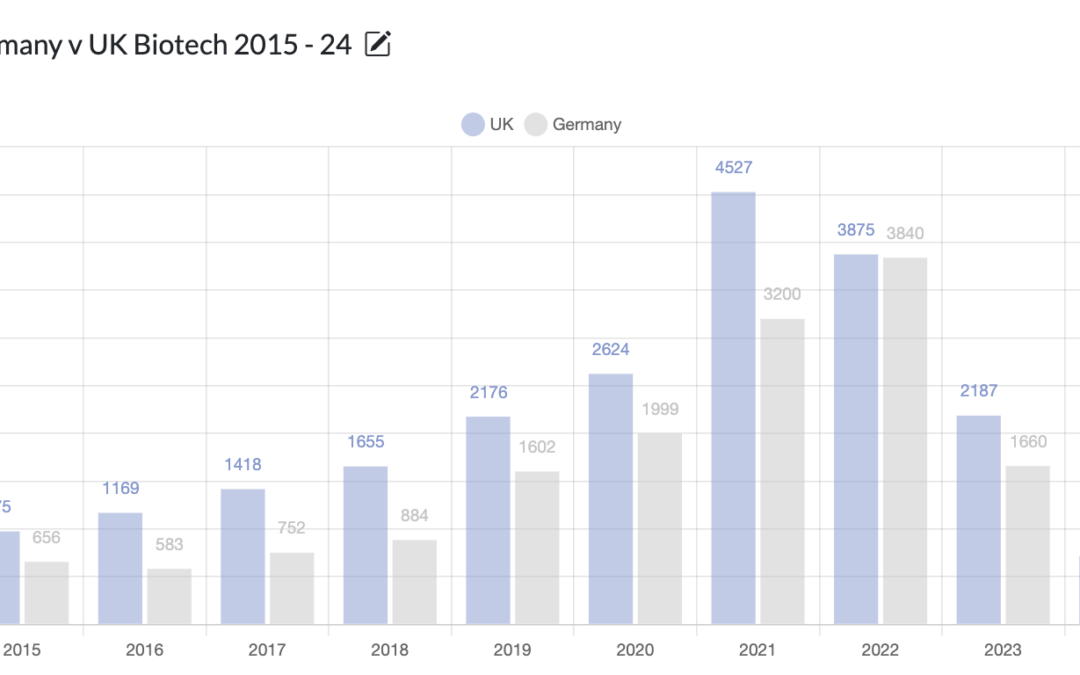

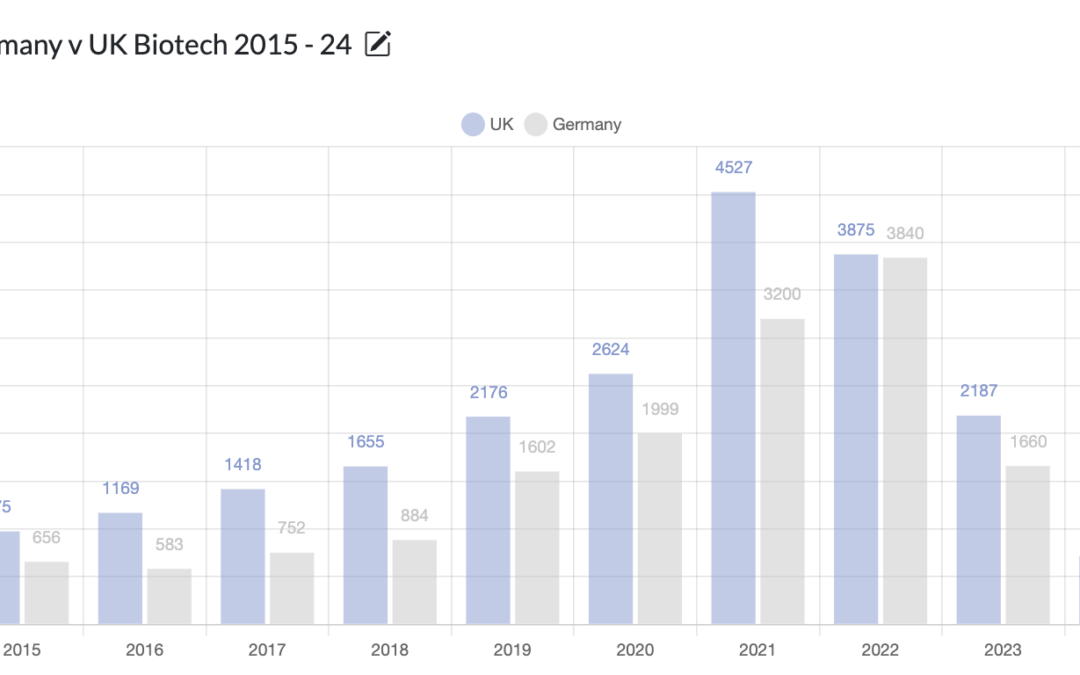

If the worst kept secret in politics is that Kier Starmer will be the next Prime Minister, (the latest odds give him an 87% chance of being so) then upon taking power, he will have to make a decision about which Tory policies to continue, and which, to discard. No set of policies are more divisive than those to do with Brexit, hence spotlighting Biotechnology which is now starting to be negatively impacted, following the pandemic period ending and the industry globally returning to equilibrium, as this is an area that Starmer may need to change UK policy on, in order to revitalize.