There was a 5 % rise in insurance claims vacancies nationally compared with 2022, with recruitment volumes in 2024 remaining stable thus far. While claims handling remains the dominant skill, constituting 59% of the total, it recorded a decline, falling to 46%.

UK businesses are relocating jobs outside of London due to rising living and housing costs. London-based executive management, HR, and marketing roles have decreased by 41%, while remote work opportunities have doubled.

Claims continue to grow, with recruitment within insurance firms persisting across all sectors. The escalating impact of climate change on the property sector is evidenced by a long-term increase in insurance claims payouts, surpassing those of a decade ago.

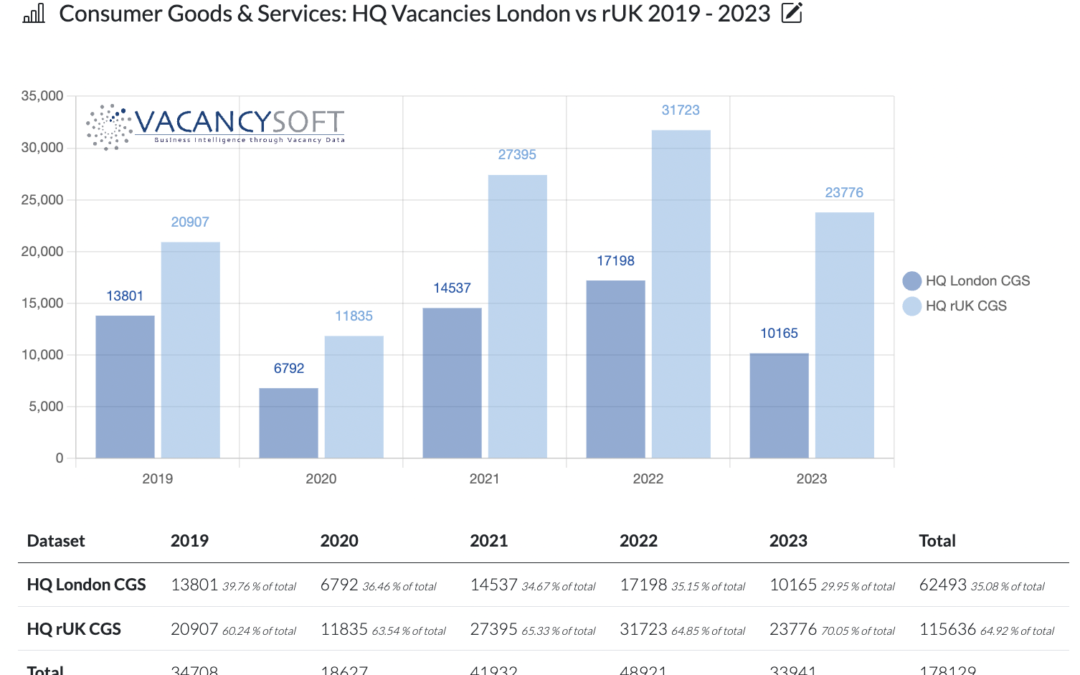

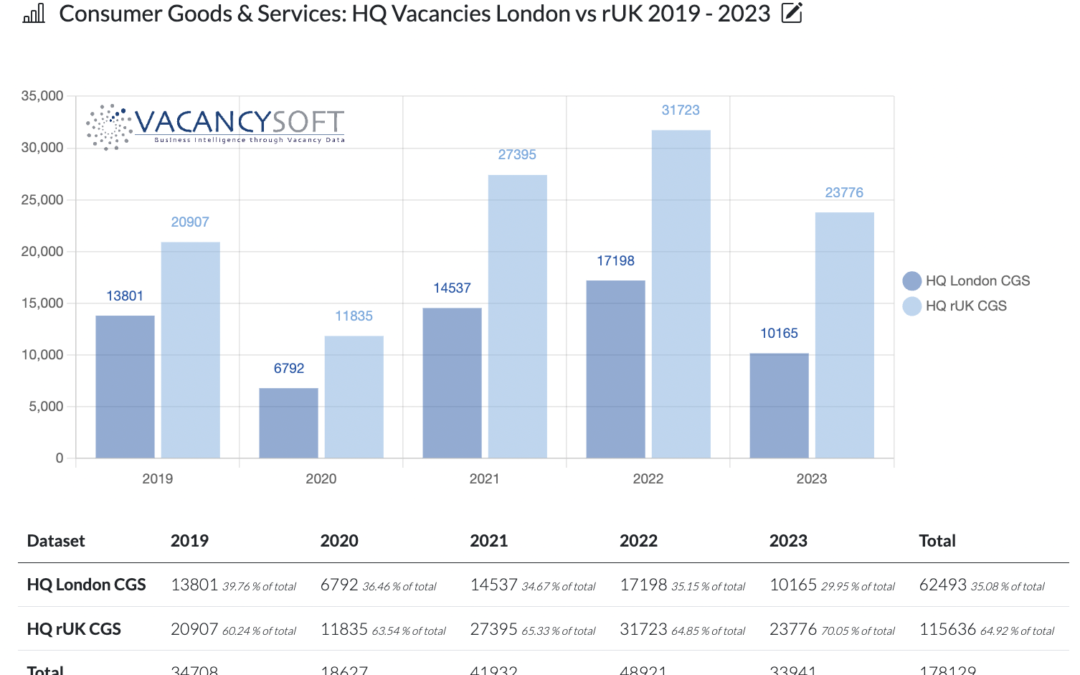

For retail and consumer goods and services, 2023 has proven to be a challenging year. The impact of the changes to VAT has meant that as tourism has returned, the luxury goods sector has flatlined, despite London having more tourists than ever. At the same time, quantitative tightening has resulted in challenges to household liquidity, which has meant there has been downward pressure on disposable incomes.

Every generation bears witness to a technological jump which has the capacity to change the way we work. For example, from the first generation of mobile phones in the 1980s, through to smart phones and mobile devices this has transformed the way we do business. Nonetheless, we have seen increasing numbers of jobs displaced as different technologies have achieved scale.