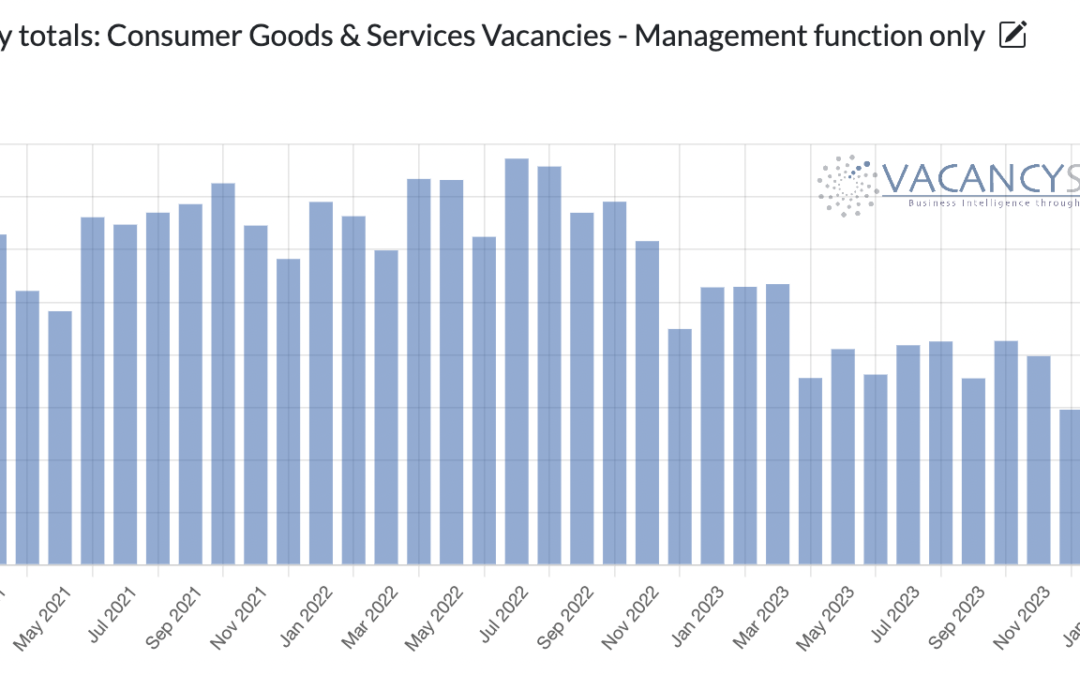

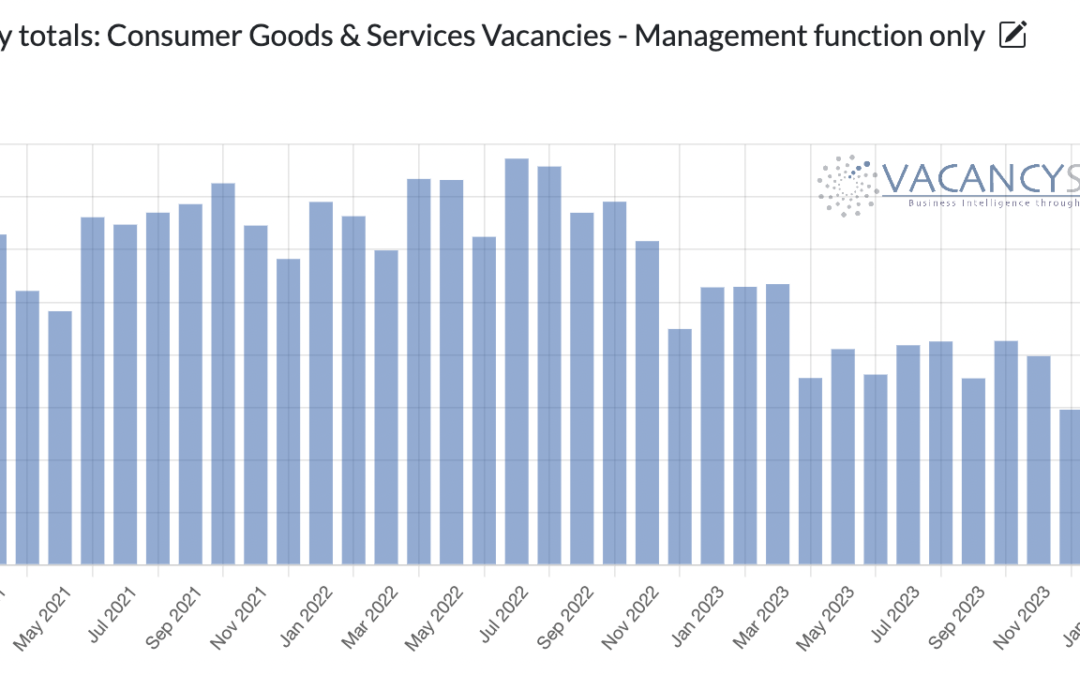

With the clocks changing and the days getting longer, there becomes a tangible shift in the mood of the nation. Typically that translates into a pick-up in activity for retailers. Indeed, Since 2021, the only time that Q2 performed worse than Q1 was last year, equally, that did coincide with the sharp downturn in the economy caused by quantitative tightening, which instantly acted to squeeze the economy.

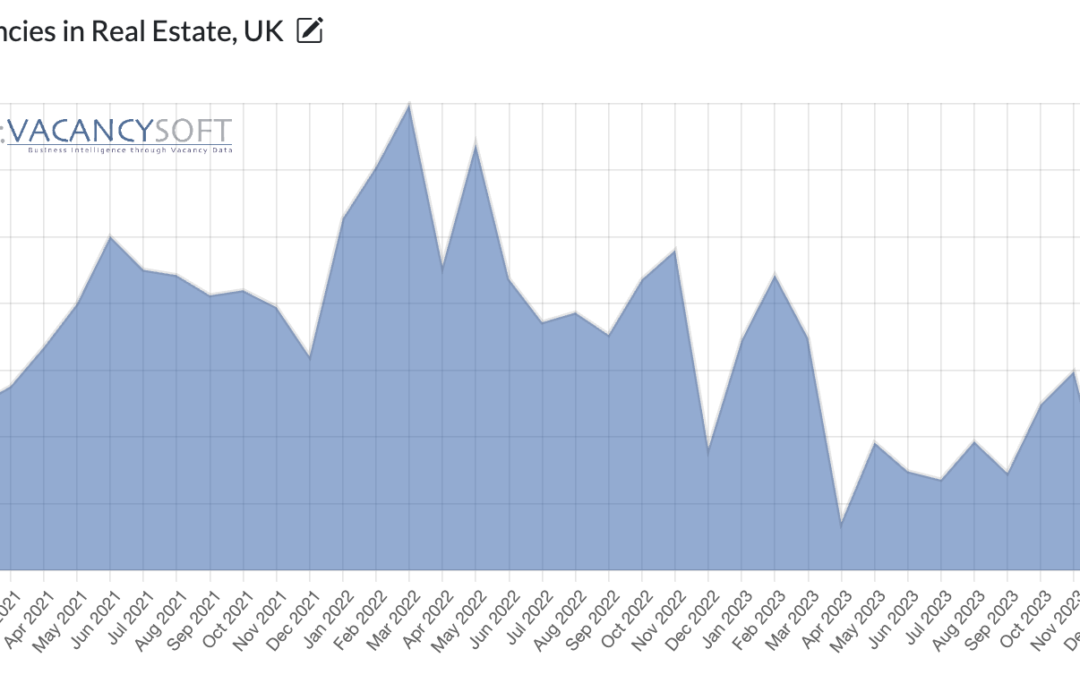

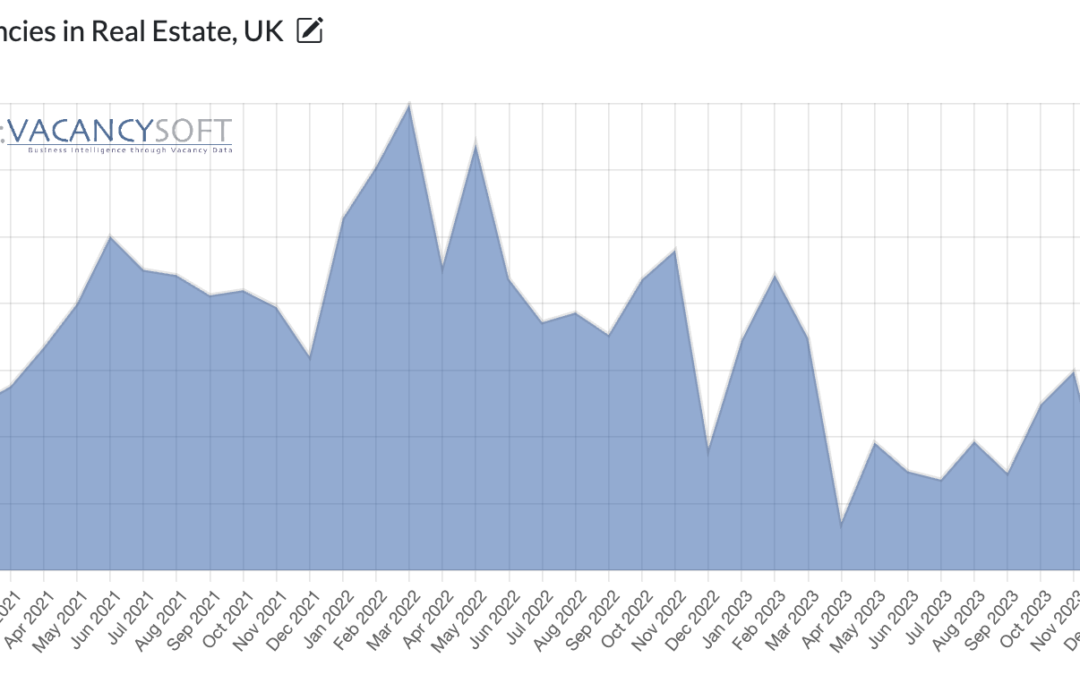

After all, following 2023, the real estate industry is showing signs of picking up as interest rates fall. Residential Property, in part due to the chronic shortage of new houses being built, is already seeing prices rise. With commercial property, there is a deeper question about what kind of work space businesses want, in this new pandemic period. Insofar that nationwide, occupancy is still below pre-pandemic levels, some areas are doing better than others.

The Architecture and Design labour market, which reached its zenith in 2022, is now poised for a significant decline in 2023, with an estimated -10.9% decrease in professional vacancies, bringing the total to 3,983 positions. Indeed, the increase in interest rates and the subsequent implications on borrowing costs for developers means that with the cost of capital going up, there has been a slight dip. That combined with the Conservative party scrapping housing targets, has also led to a slowdown in demand, according to the latest UK Real Estate Labour Market Trends report by market data analysts Vacancysoft.

The Real Estate Industry is starting to hit headwinds not seen in a generation, as interest rates start to rise. Insofar as the long-term average interest rate has been around 4-5%, the last decade has seen low rates and unprecedented amounts of quantitative easing which as they have ended, have meant the industry is under pressure.