Unprecedented Growth in Claims Vacancies and How Insurance and Actuarial Recruiters Can Benefit

Harness the Power of Vacancy Analytics.

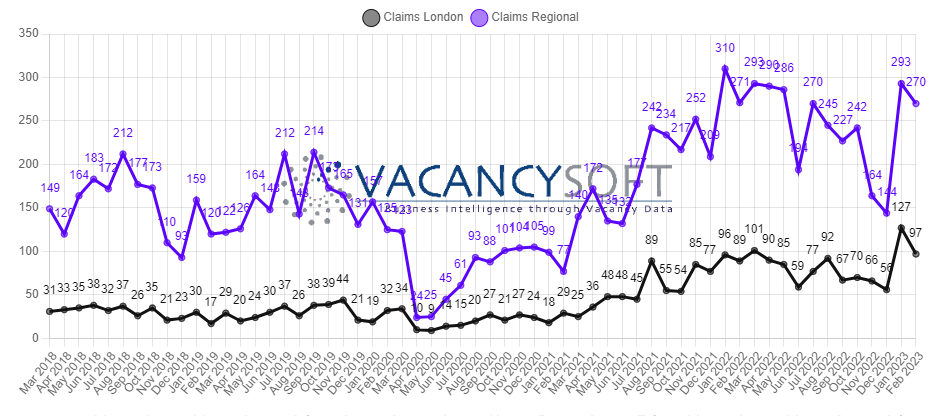

The insurance and actuarial recruitment landscape is experiencing a significant change. Data from Vacancy Analytics reveals a staggering 130% increase in Claims vacancies from the end of Q4 2022 to Q1 2023 so far. This increase mirrors the numbers seen in Q2 and Q3 of 2022.

In this blog post, we’ll explore how you, as an Actuarial & Insurance recruiter, can leverage this data and the power of Vacancy Analytics to generate insights and grow your businesses.

Identifying Opportunities

The sharp increase in Claims vacancies presents a golden opportunity for you to expand your services. By focusing on Claims roles, you, as a recruiter, can build a strong network of candidates and capitalise on the high demand for professionals in this field.

Tailoring Marketing Efforts

As a recruiter, you can use this data to target your marketing and promotional efforts towards Claims positions. Showcasing domain expertise will attract clients and candidates seeking assistance in this area, ultimately helping you grow the business.

Enhancing the Candidate Pool

Invest in building a robust database of Claims professionals by sourcing candidates from various channels like job boards, social media, and referrals. A readily available pool of talented candidates will enable you to fill vacancies quickly and efficiently.

Providing Industry Insights to Clients

Be able to offer valuable advice and insights to your clients, such as salary benchmarks, in-demand skills, and hiring timelines. This expertise helps clients make better decisions and fosters long-term relationships.

Gaining a Competitive Advantage

Focusing on the Claims sector during this period of high demand will differentiate you from your competitors. Clients are more likely to choose a specialised recruiter with a strong track record in the industry.

Upscaling Existing Candidates

Help your candidates become more marketable by providing guidance on the skills and certifications currently in high demand within the Claims sector. Offer workshops and webinars, or recommend relevant training programs to enhance their professional profiles. This benefits both the candidates and the quality of your talent pool, making it easier to fill vacancies with well-qualified applicants.

Analysing Talent Acquisition Strategies

Assess the effectiveness of your current talent acquisition strategies and make necessary adjustments. If your sourcing methods are not yielding a sufficient number of Claims professionals, consider exploring new channels or partnerships to improve your reach.

Establishing Partnerships

Forge strategic partnerships with industry organisations, educational institutions, and certification providers. These partnerships can help you gain better access to potential candidates and facilitate a more efficient recruitment process.

Developing Long-term Growth Plans

Identify patterns and trends in the job market to develop long-term growth strategies for your business. Understanding the dynamics of the Claims sector allows you to make informed decisions about resource allocation and the direction of your business.

Staying Informed and Adaptable

Constantly stay informed about the latest trends and changes in the job market. By keeping a close eye on industry developments, you can swiftly adapt to shifts in demand and ensure your business remains agile and responsive to the needs of your clients and candidates.

As an Actuarial & Insurance recruiter, you can use Vacancy Analytics to generate invaluable insights that drive business growth. By leveraging the data on Claims vacancies and staying informed about industry trends, you can make strategic decisions that differentiate your services and provide value to clients and candidates. Stay ahead of the curve and harness the power of Vacancy Analytics to elevate your recruitment game in the insurance and actuarial sectors.