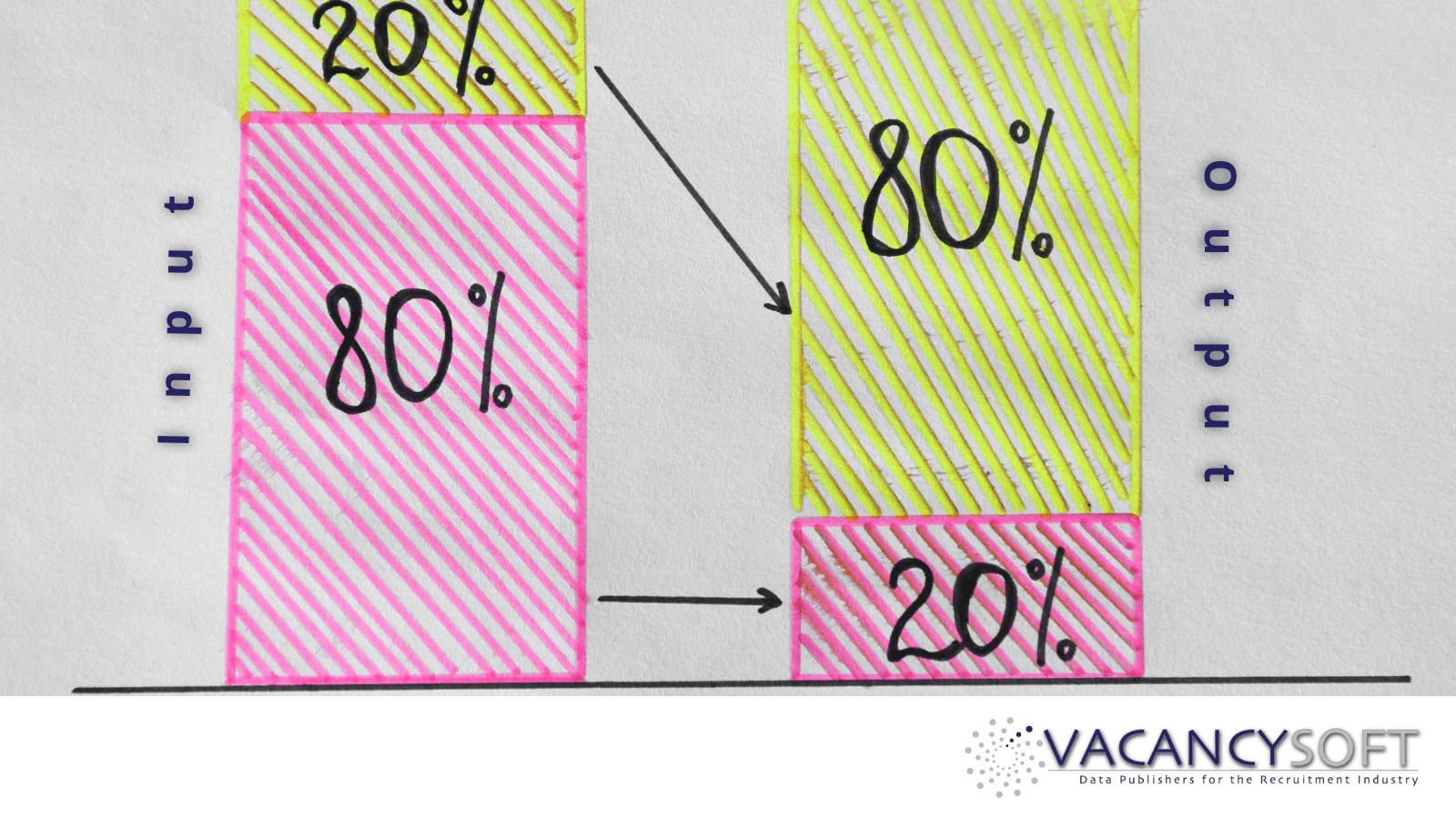

The Pareto principle states that 80% of your output will come from 20% of your inputs. If applied to a recruitment business, this could mean:

- 80% of your fee income comes from 20% of your billing consultants;

- 80% of your revenues

comes from 20% of your clients; - 80% of the time spent by your consultants is spent on 20% of your clients.

However, without having hard data on what is happening in your business, it is impossible to say which, if any, of those

With the first statement, this should be straightforward enough to analyse. Every recruitment business has a

What is much harder is understanding where time is being spent on a by-client basis and what that translates to in terms of monetisable return.

For example, if you are working on an instruction but there are five other recruitment companies competing for the same pitch, that means that arguably you have a 16.6% chance of completion, potentially lower if the company has its own candidate pool which it can draw upon by using internal recruiters. In this

Given that perhaps only 20% of your clients are likely to work with you on a retained or exclusive basis, this then makes sense, but should that be acceptable? Should a recruitment firm knowingly operate a dual service standard between exclusive and non-exclusive instructions? Why should a client look to work with a recruitment firm exclusively if their experience of working with you is normally one involving shoddy service?

Instead reflect on this: given that there is always demand for top-tier talent, focus on acting as the professional advisor of choice for star candidates, those who will always be hireable. Operating as their career advisor regardless of whether they are looking or not means that when the time that they are looking to make a change comes along, they will only want to work through you. If you can be sufficiently well briefed on market activity that they feel they can trust you to advise them on what their options are, that would then mean you can approach any target company and suggest that person as being a suitable candidate, where it doesn’t matter how many other agencies are competing, as that candidate is only working with you.

Applying this strategy – treating the candidate as the client – may seem difficult at first, but factor in this: if someone is a genuinely good candidate, as long as they understand that the energy and investment you put into them is on the basis of sole representation, you are guaranteed to get the fee when they next move. Even if a key client gives you a role exclusively, you have no such guarantee. Assuming a professional changes jobs every three years, this means that each consultant having 100 candidates who they solely represent will result in them always beating their monthly targets, and it becomes far easier to charge higher fees as the reliance on key clients falls.

Over the last ten

Image contribution: designed by Yurlick / Freepik