The Government’s Spring 2024 budget has changed the shape of taxation in the UK for high net-worth individuals who are not UK-domiciled. The implications of this change are yet to be seen properly; therefore, when looking at the recruitment patterns, we are forecasting an increase in tax vacancies this year compared to last year’s 32% in London, and 46% regionally.

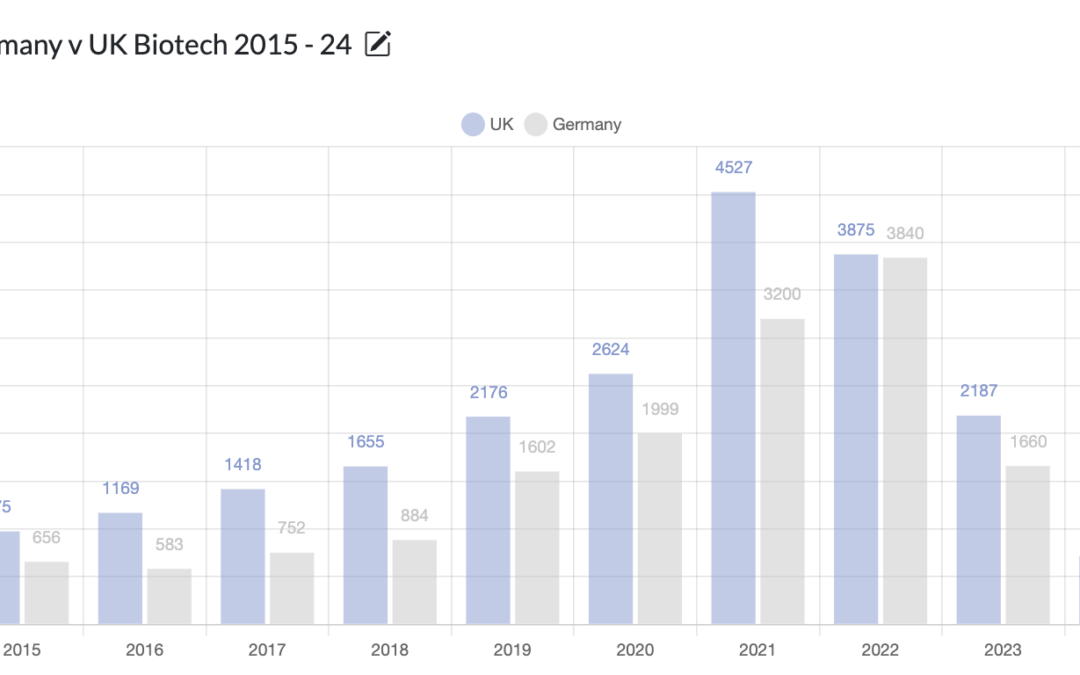

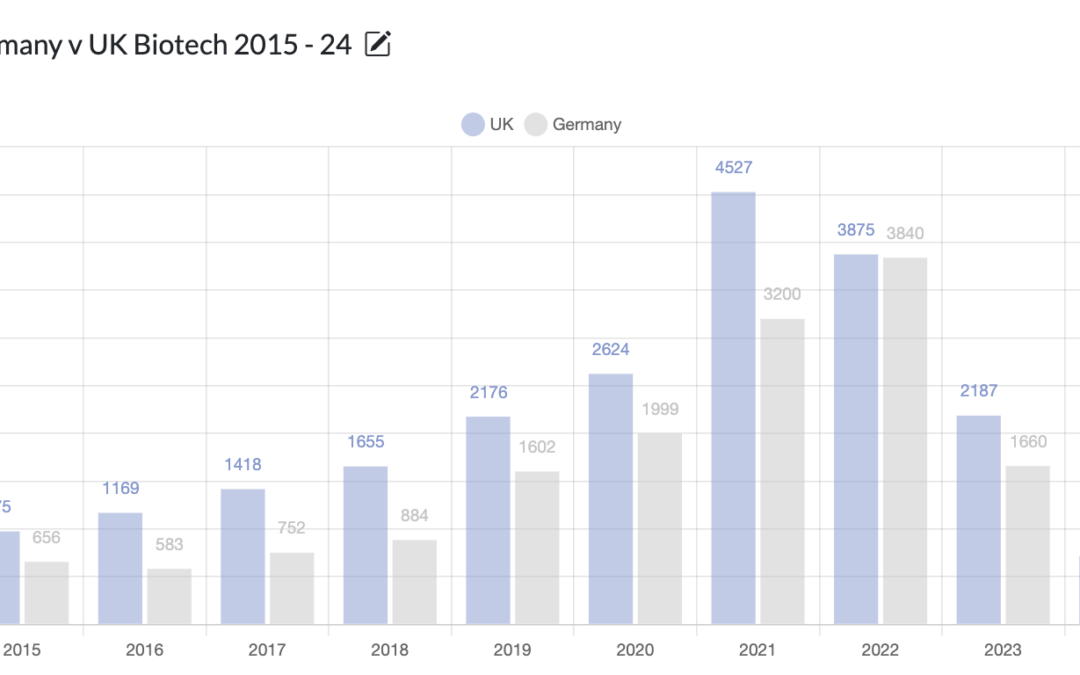

If the worst kept secret in politics is that Kier Starmer will be the next Prime Minister, (the latest odds give him an 87% chance of being so) then upon taking power, he will have to make a decision about which Tory policies to continue, and which, to discard. No set of policies are more divisive than those to do with Brexit, hence spotlighting Biotechnology which is now starting to be negatively impacted, following the pandemic period ending and the industry globally returning to equilibrium, as this is an area that Starmer may need to change UK policy on, in order to revitalize.

After the technical recession in 2023, which led to vacancies dropping in the region compared to 2022, we have seen a bounce back in Q1 so far, culminating in an uplift of 7.6% which compares favorably to the national figures (+5.4%.) As a result, the region now accounts for 6.7% of the national total in terms of vacancies, up from 5.8% in 2022.

Insurance companies face new risks due to economic volatility, higher interest rates, geopolitical uncertainty, and climate change. This has led to a rise in demand for risk professionals, with vacancies up by 11.4% in 2024 compared to last year. March 2024 had the highest number of risk vacancies in over a year, indicating a continuing trend.

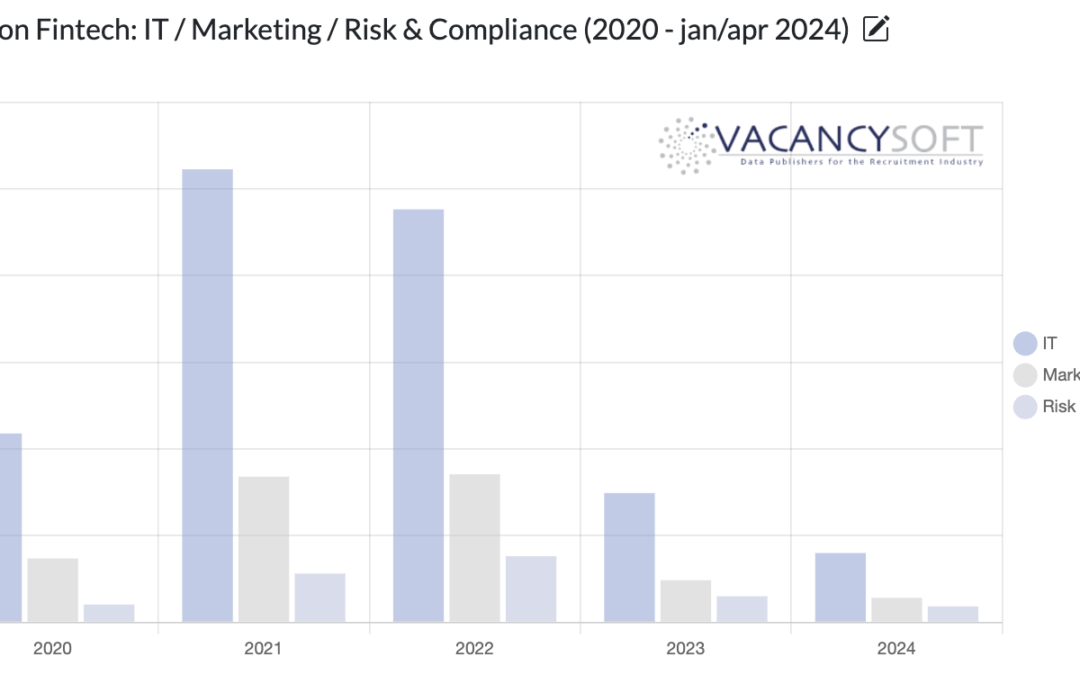

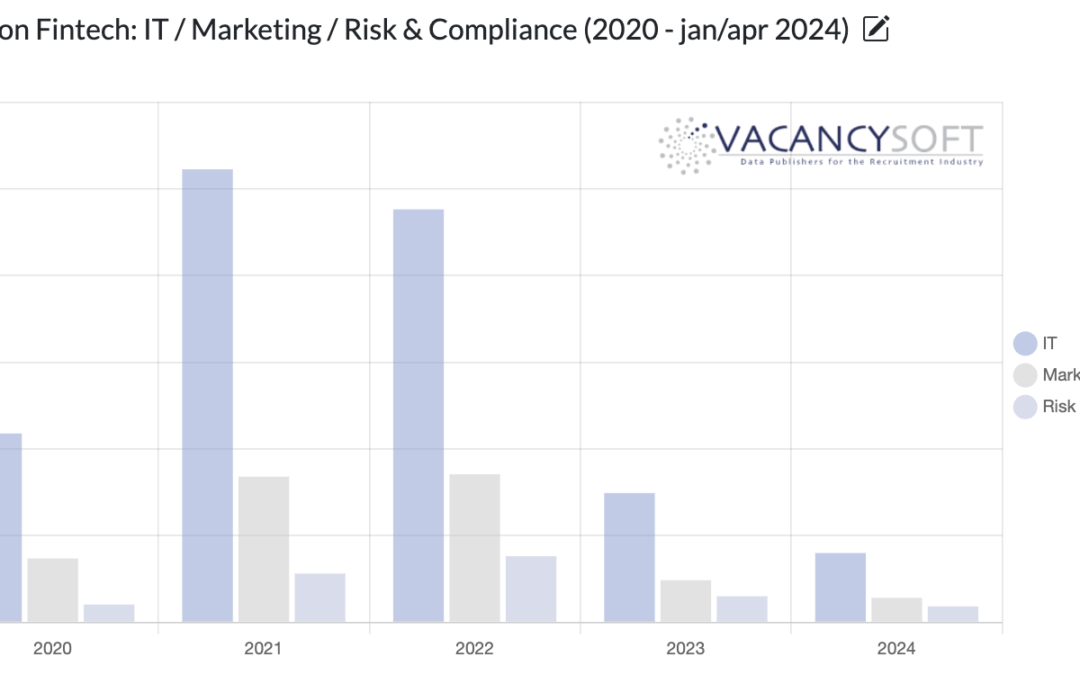

After a torrid 2023, the signs are positive for Fintech as VC funding into the sector accelerates. According to a recent report by Dealroom and HSBC, in Q1 of 2024, there were 73 rounds completed in Q1 of this year, totalling $1.4BN, making it the leading sector for investment, this year so far.