Despite the fact vacancies have dropped in 2023 versus 2022, we see this as a temporary lull, as the attack vector is bigger than ever before. IT security vacancies are expected to total approximately 4,187 for the year, marking a 30.7% decrease from the 6,045 vacancies observed in 2022. Equally, at the same time, IT security has increased in share of all IT vacancies, from 4.1% last year, to 4.7%, making it one of the fastest-growing segments. This is according to the latest UK Technology Labour Market Trends report by Robert Walters and market data analysts Vacancysoft.

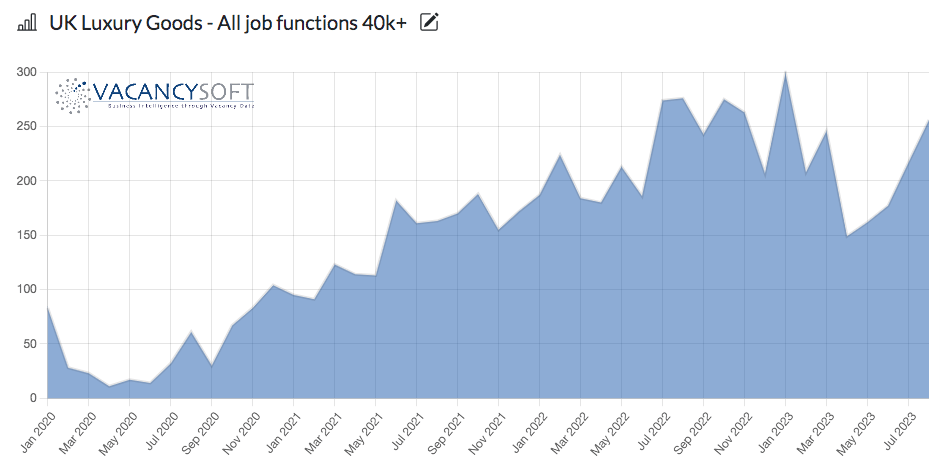

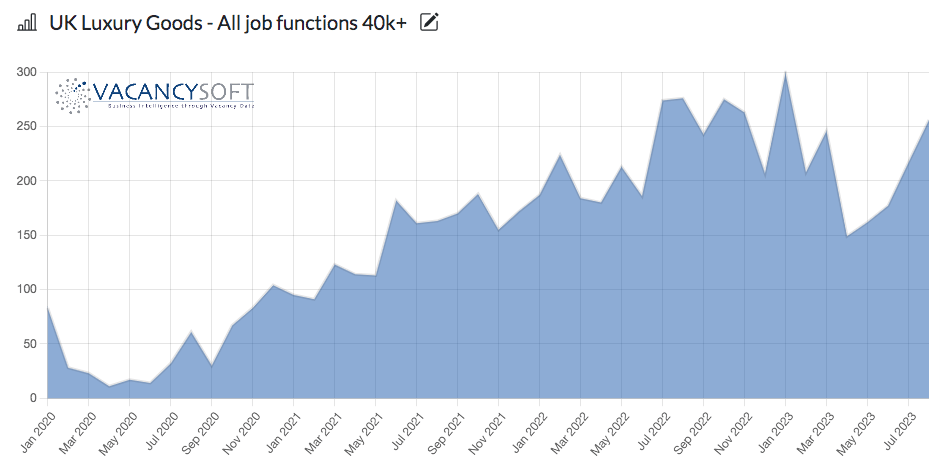

As the UK economy teeters between anaemic growth, a cost of living crisis, strikes over pay crippling the public sector along with interest rates at generational highs leading to recruitment slowing down significantly when compared to 2022, it can be easy to be negative. Nonetheless, as business leaders, the challenge is to find a way to succeed regardless. In recruitment, that starts with identifying markets which are outperforming others, and segments that still seeing buoyant demand. With that in mind, this week, we have highlighted Luxury Goods as a sector to watch. Why?

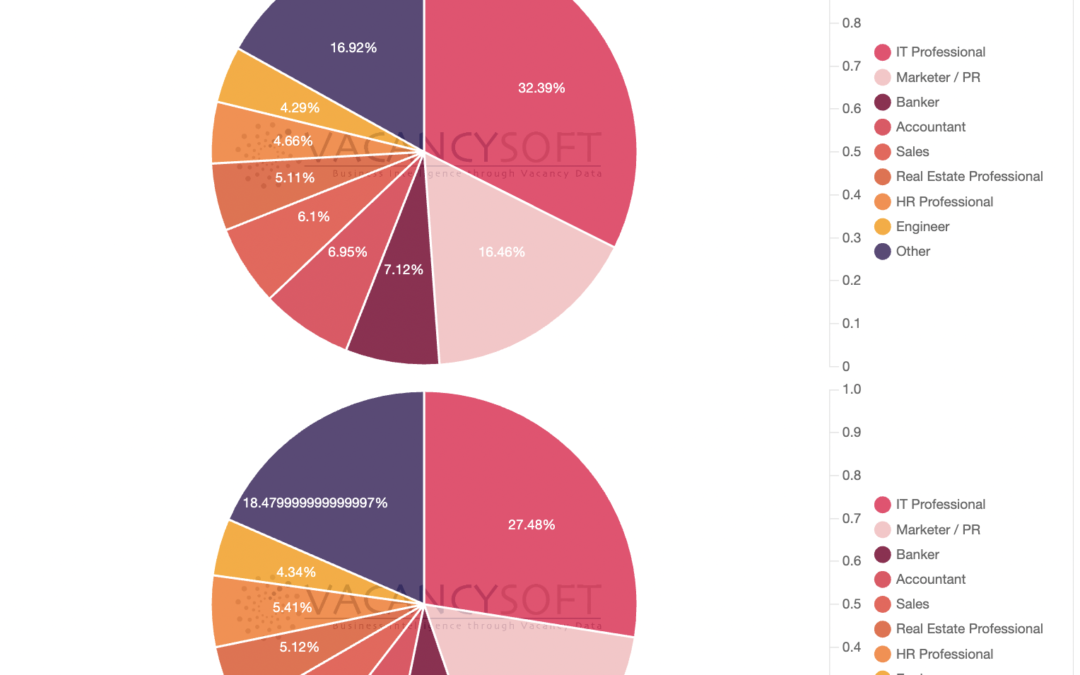

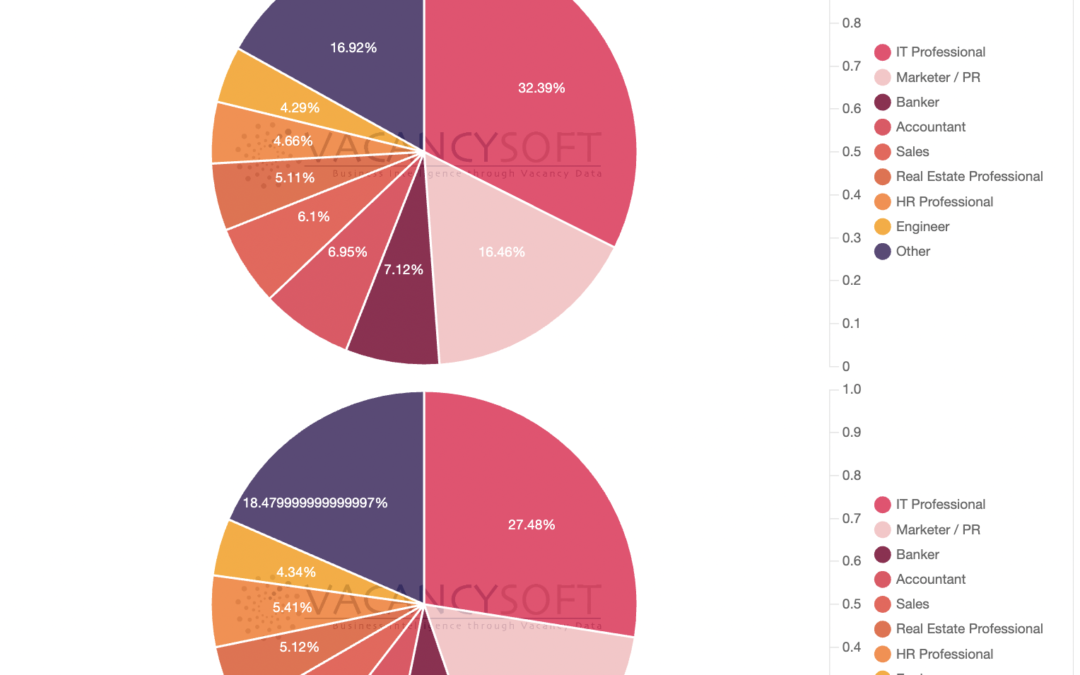

Looking back to 2019, the last pre-pandemic year, we observe a staggering 25% increase in marketing vacancies in 2023, with marketing constituting an 8.7% share of all professional vacancies in the sector, surpassing the 8.2% share observed in 2022. What this means is, not just is there a growth in marketing, but it is growing faster than almost any other area. This is according to the latest UK Finance Labour Market Trends report by Morgan Mckinley and market data analysts Vacancysoft.

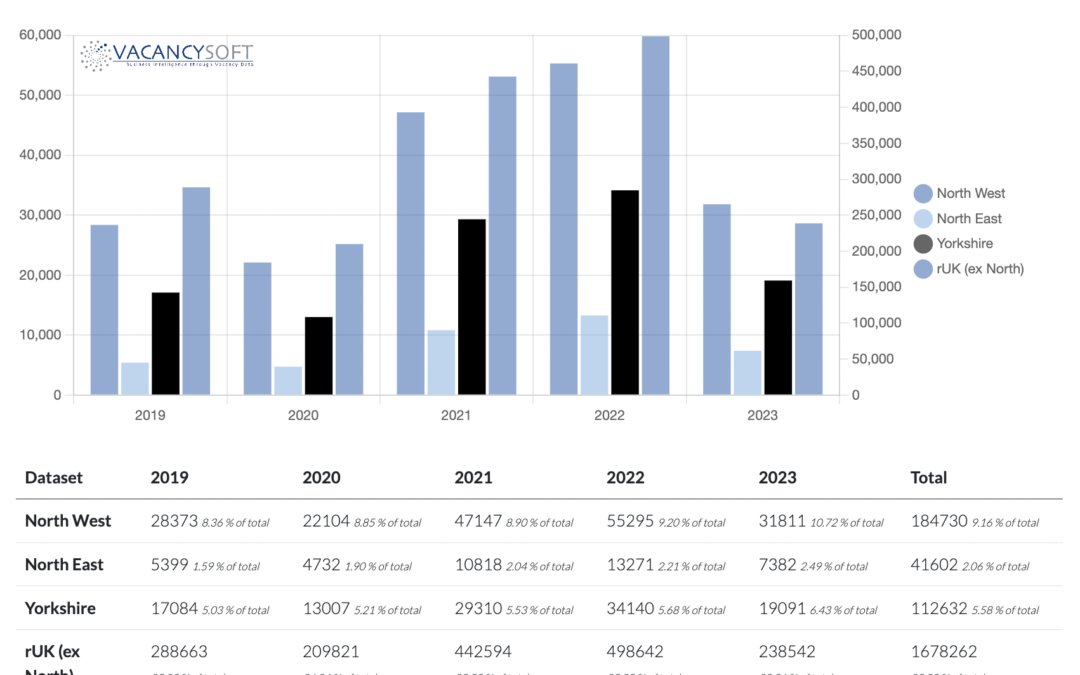

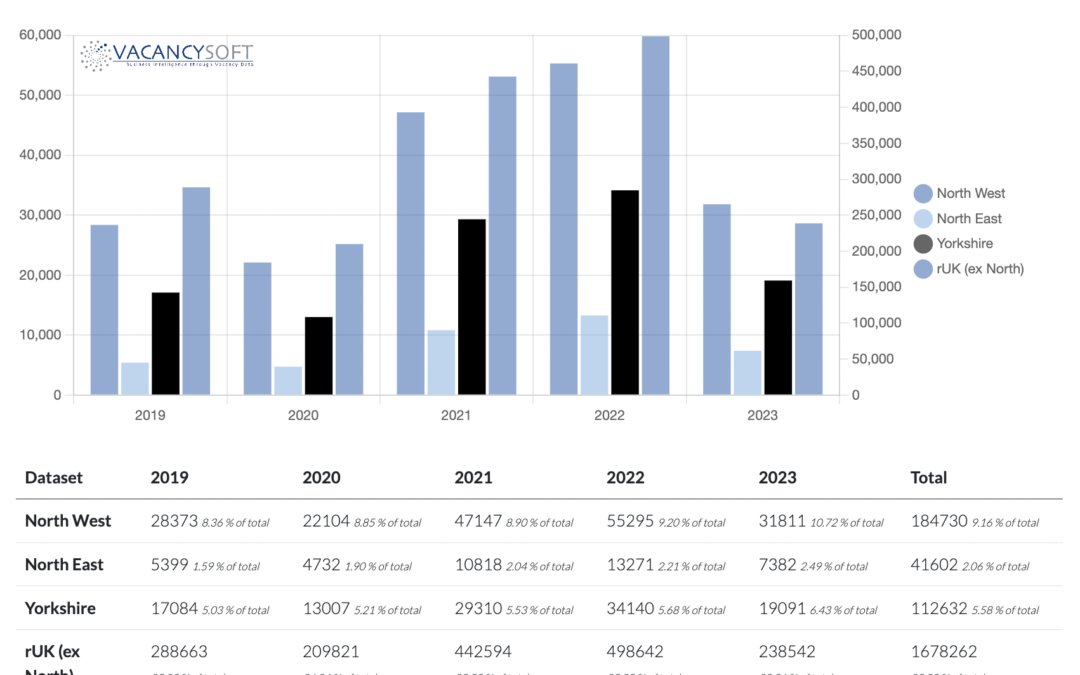

In June 2014, the British Government of the time, announced their headline scheme to power growth in the north. “The Northern Powerhouse” was meant to bring together cities across the North, so that they collectively could ‘take on the world’ in the words of George Osborne, who announced the initiative. Upon it being announced, a swathe of initiatives were introduced, to stimulate investment, including the Greater Manchester devolution deal along with the Northern Transport strategy. With that, what we have seen, is a geographic area that had when it was launched, accounted for 16.7% of the population of the country and 13% of the vacancies, see their share of the vacancy market rise to 20% now. Put simply, in terms of job creation, the North is outperforming the rest of the country.

“In a boom market, anyone can make money, to grow when the economy turns, that’s the real challenge.”

The latest economic data to be released, will be of concern for recruiters, more than anyone. The economy is contracting. Whilst there has been a bounce in hiring over summer, this should give room for pause, for businesses, thinking about their next twelve months. Stick or twist, expand or contract? But even if recruitment is tidal, can a recruiter beat the tide? I would argue, with data, they can.