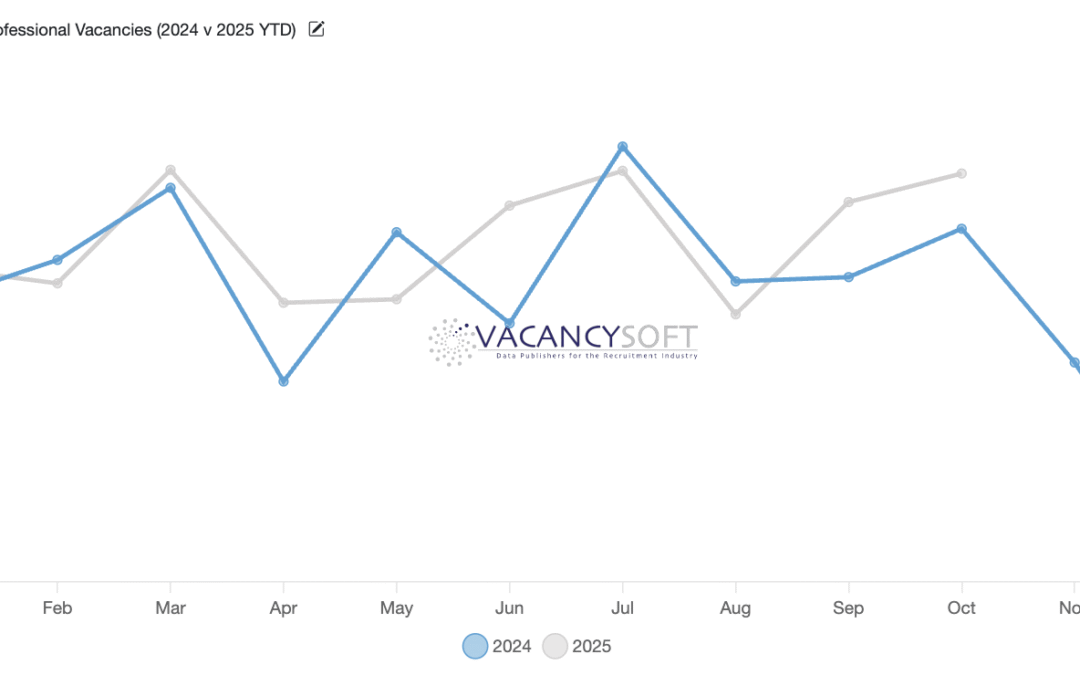

The UK’s £80 billion industrial strategy is driving investment into priority sectors such as artificial intelligence, clean energy, life sciences and telecoms, but early job gains remain concentrated, uneven, and in some cases delayed by regulatory and structural constraints. As geopolitical pressures and political uncertainty grow, questions remain over how widely employment benefits will spread and whether the strategy would survive a future change in government.

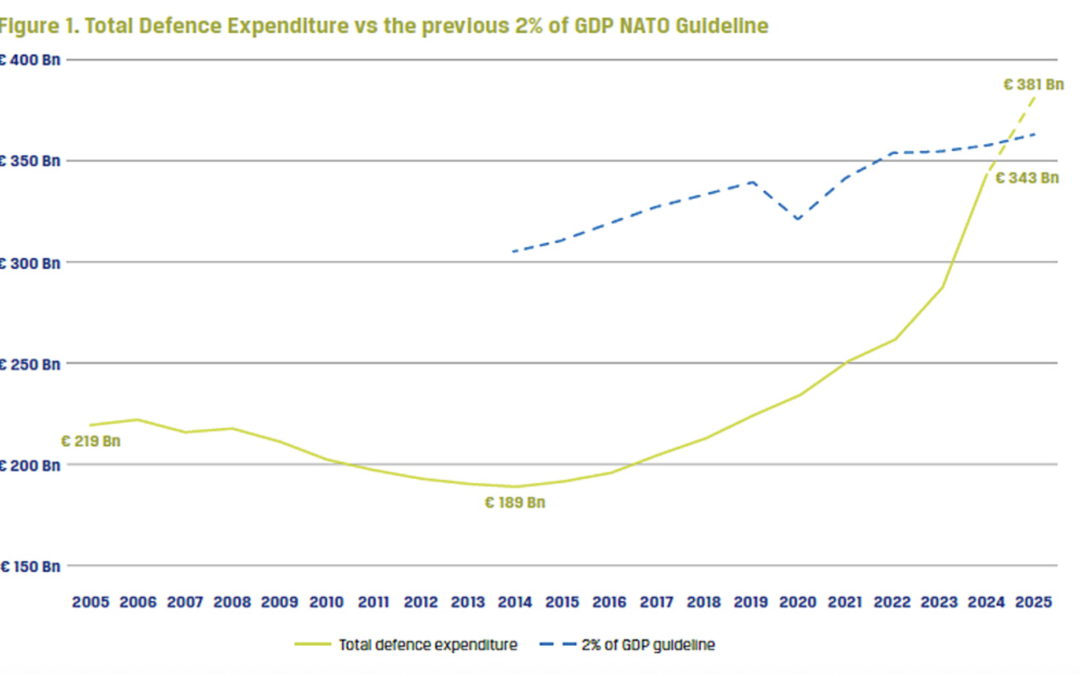

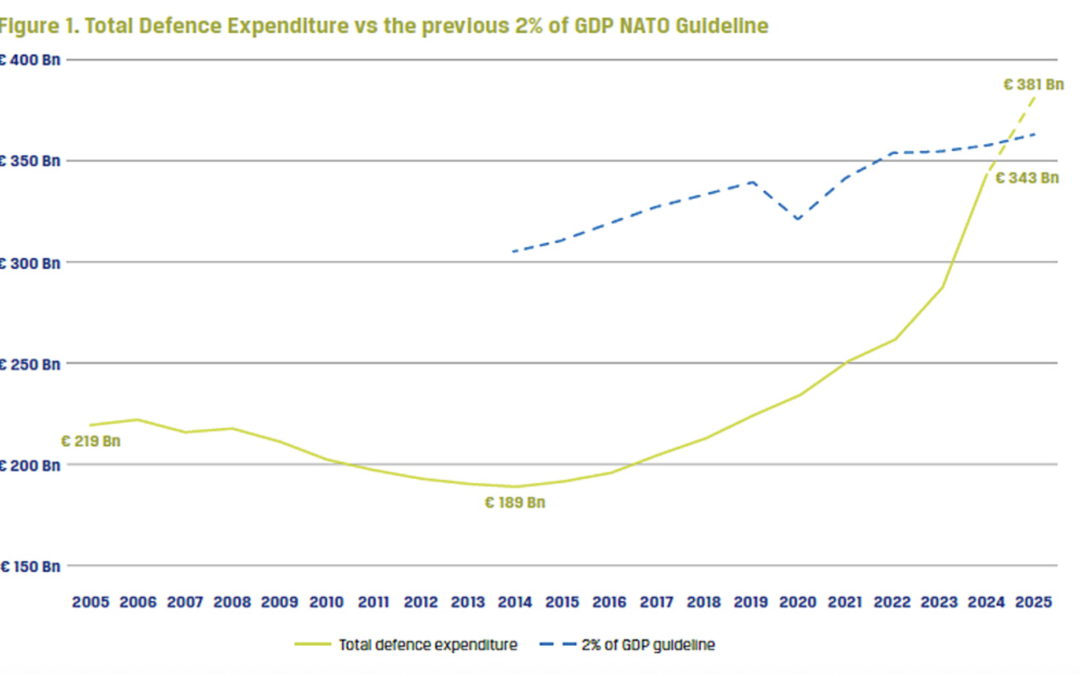

Trump’s stance on NATO and Greenland signals a potential collapse of US security guarantees to Europe, forcing the EU to pursue military self-reliance amid a historic transatlantic rupture. For Britain, this shift brings economic risk but may open the door to closer ties with the EU as global alliances realign.

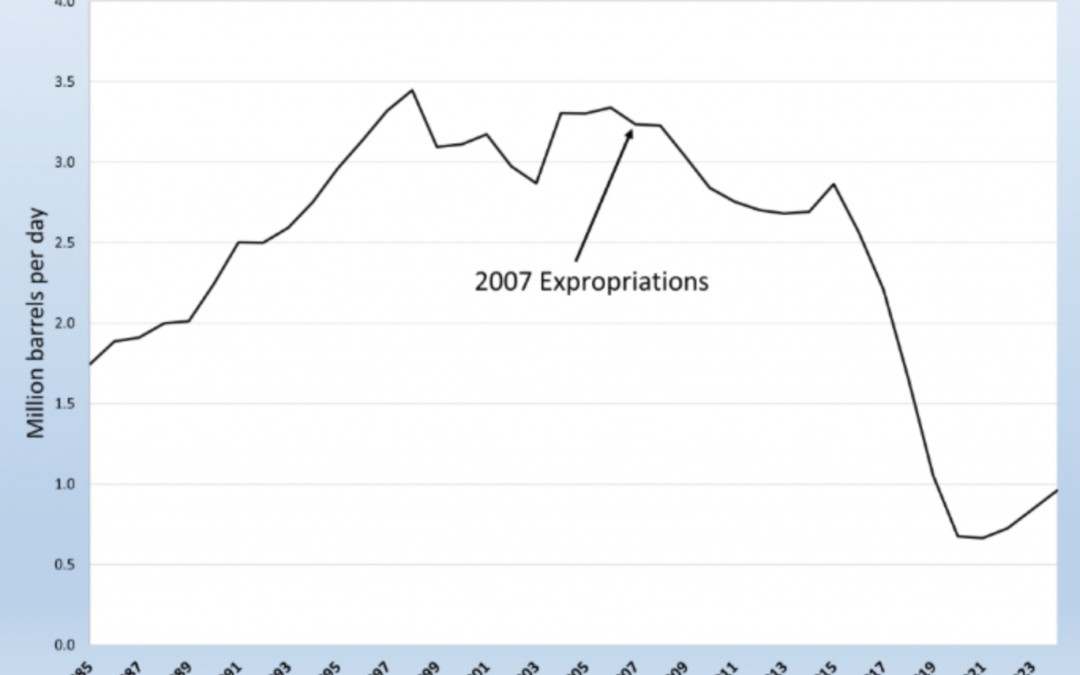

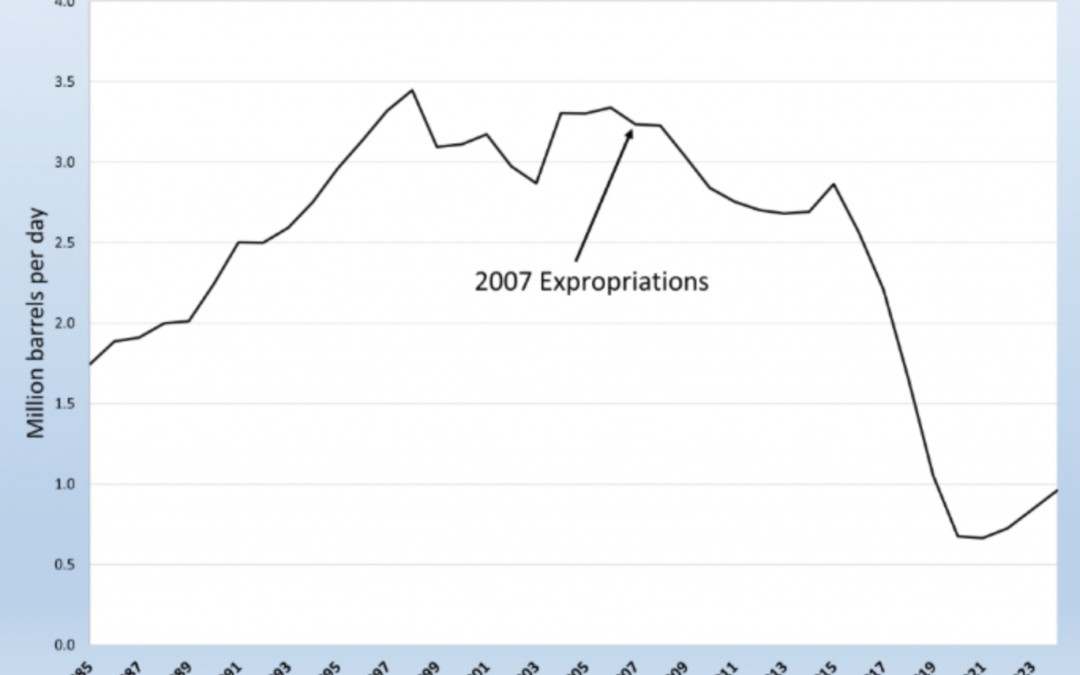

Venezuela’s collapse stems from political failure, not lack of resources, and that reviving oil production with US backing could rapidly restore growth. It suggests outcomes ranging from new elections to the controversial but plausible scenario of Venezuela becoming a US protectorate to ensure stability and investment.

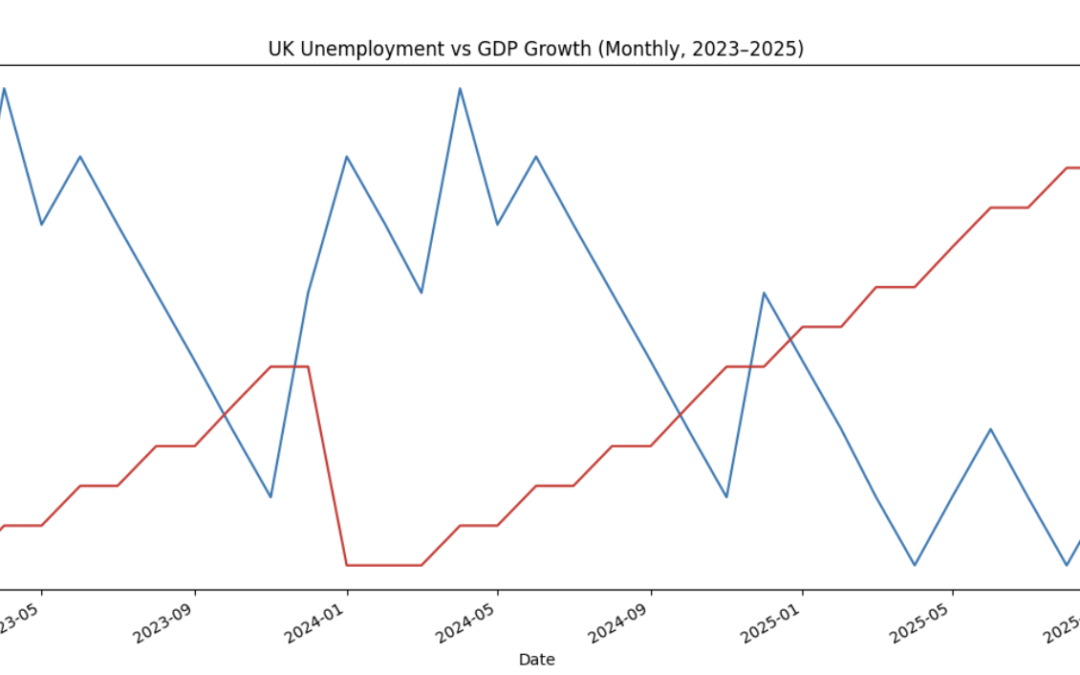

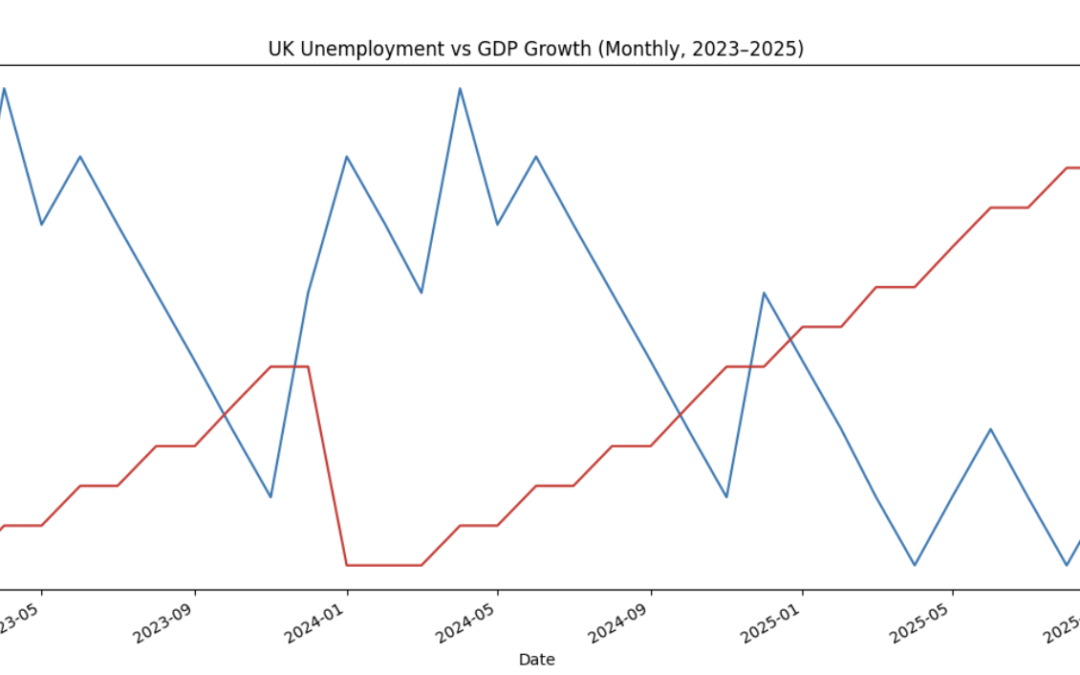

The UK economy is faltering, with rising unemployment, weak private-sector growth, and record-low business confidence. Labour’s industrial strategy has yet to deliver, leaving economic and political pressure mounting. Restoring confidence will require targeted business support, clearer regulation, and credible pro-growth policies.

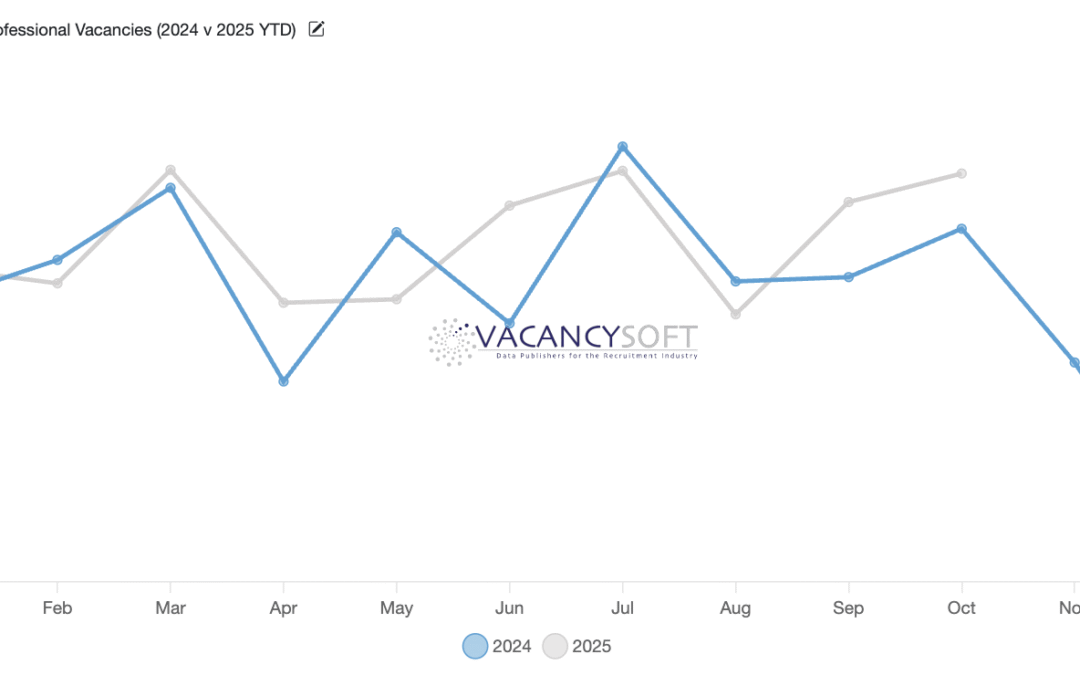

The UK’s new Industrial Strategy (IS-8), launched in June 2025, commits over £86 billion to boost productivity, innovation and competitiveness across eight key sectors — from Clean Energy to Life Sciences. Early indicators show rising investment and job creation, particularly in AI, Energy and Defence, as the government accelerates efforts to drive industrial growth.

Ukraine’s defence sector is rapidly transforming amid ongoing conflict, with homegrown technologies like the long-range “Flamingo” missile boosting military autonomy and shifting the strategic balance. As Russia’s economy weakens under falling energy revenues and rising costs, pressure is mounting for a ceasefire — especially if the rouble again breaches 100 to the dollar, a threshold that could make continued war unsustainable.