Financial Services is one of the largest industries within the UK, and contributes 8.3% to economic output. Overall the Financial Services industry employs over 1m people in the UK, and also runs significant trade surpluses, as a result, what happens in Banking is of direct relevance to the entire economy, and London in particular is of significance.

As Russia re-elected Putin this weekend, the impact on the UK is being seen in more ways than one. Already, Grant Schapps is talking about the need for further defence spending as we move from a post-war to a pre-war world. Meanwhile, the avenues for money to be funnelled into London are slowly closing, and the determination to minimize access is clear. The decision to double the economic crime levy for very large companies from April, to £500,000 per institution is a reflection of that.

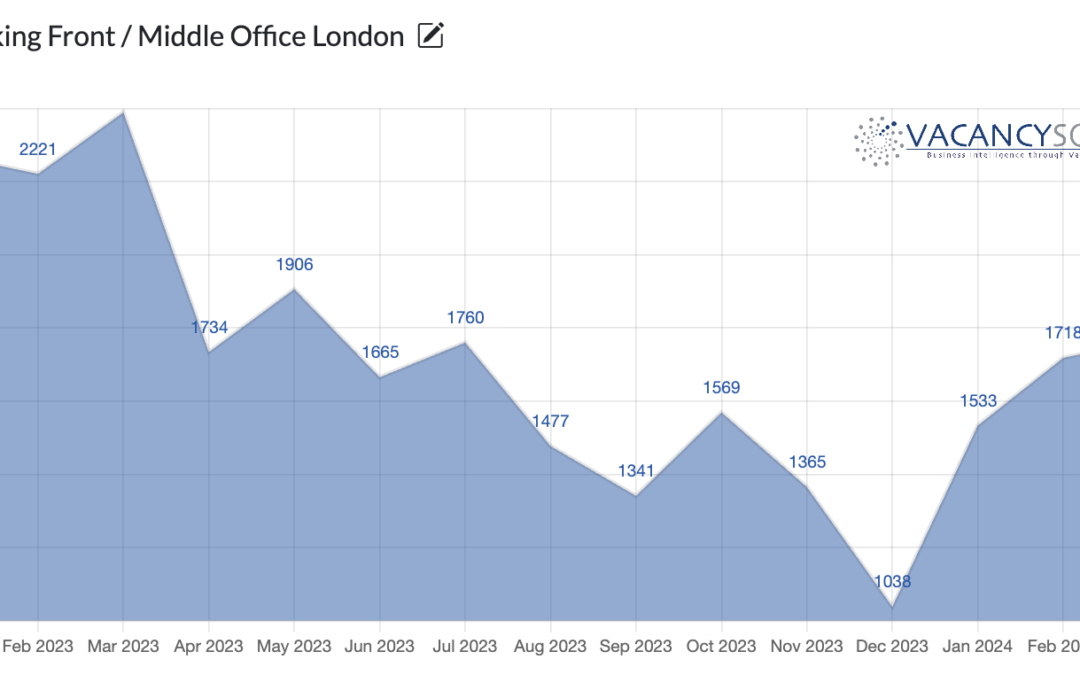

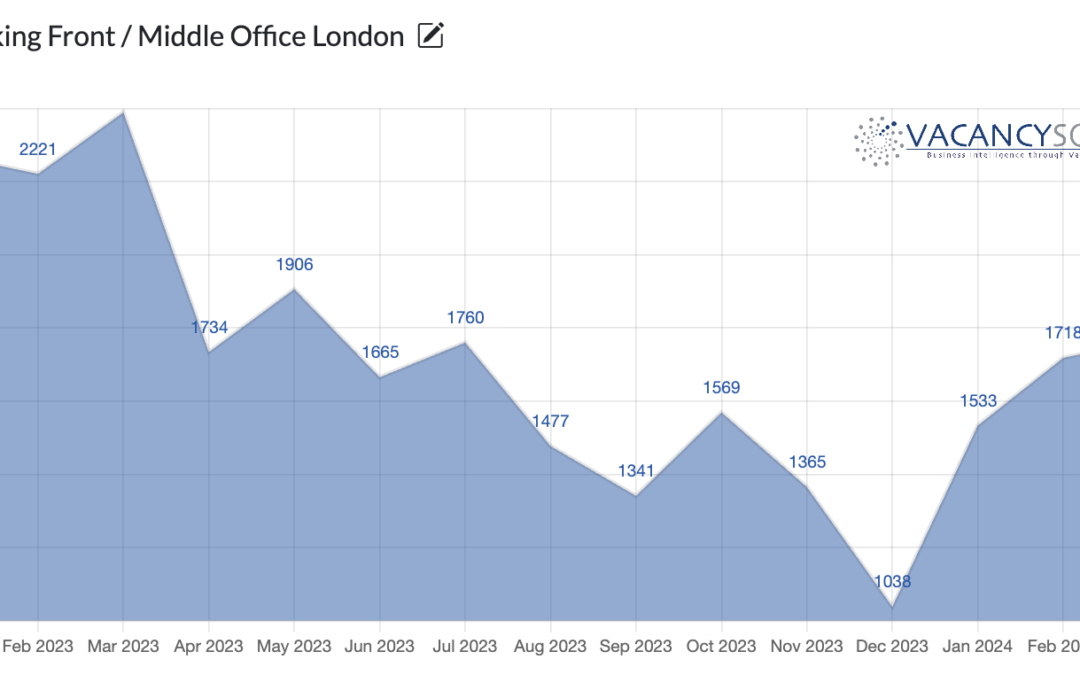

The cyclical nature of Financial Services has meant that as interest rates rose, and the economy appeared on the edge of recession, recruitment slowed down significantly. All this has led to professional vacancies falling in 2023, with a 34% year-on-year decrease from 2022.

Looking back to 2019, the last pre-pandemic year, we observe a staggering 25% increase in marketing vacancies in 2023, with marketing constituting an 8.7% share of all professional vacancies in the sector, surpassing the 8.2% share observed in 2022. What this means is, not just is there a growth in marketing, but it is growing faster than almost any other area. This is according to the latest UK Finance Labour Market Trends report by Morgan Mckinley and market data analysts Vacancysoft.

Discover how the European banking sector has shifted post-Brexit and which cities are emerging as winners in the industry. Explore the impact of Macron’s efforts to boost the French banking sector, and other valuable insights to enchance your recruitment.