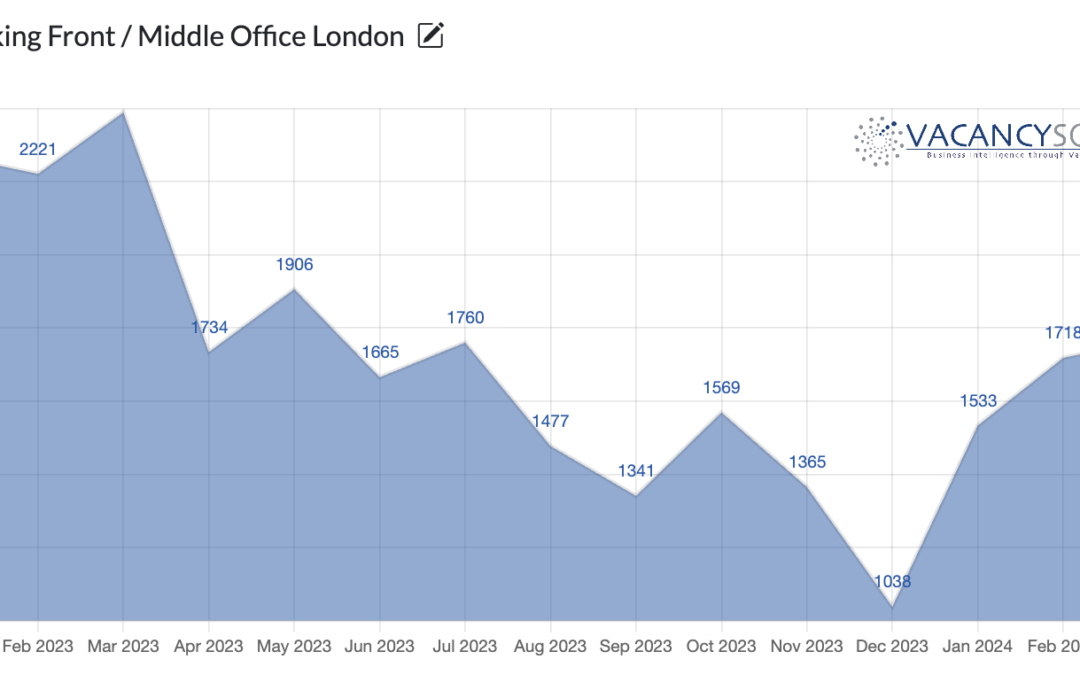

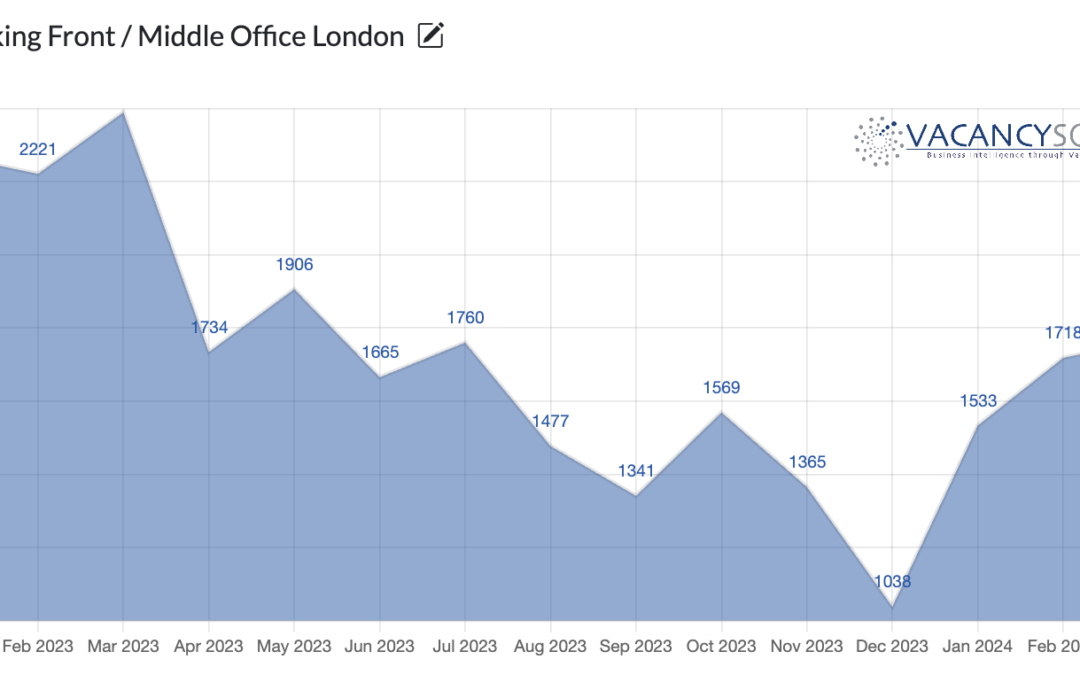

Financial Services is one of the largest industries within the UK, and contributes 8.3% to economic output. Overall the Financial Services industry employs over 1m people in the UK, and also runs significant trade surpluses, as a result, what happens in Banking is of direct relevance to the entire economy, and London in particular is of significance.

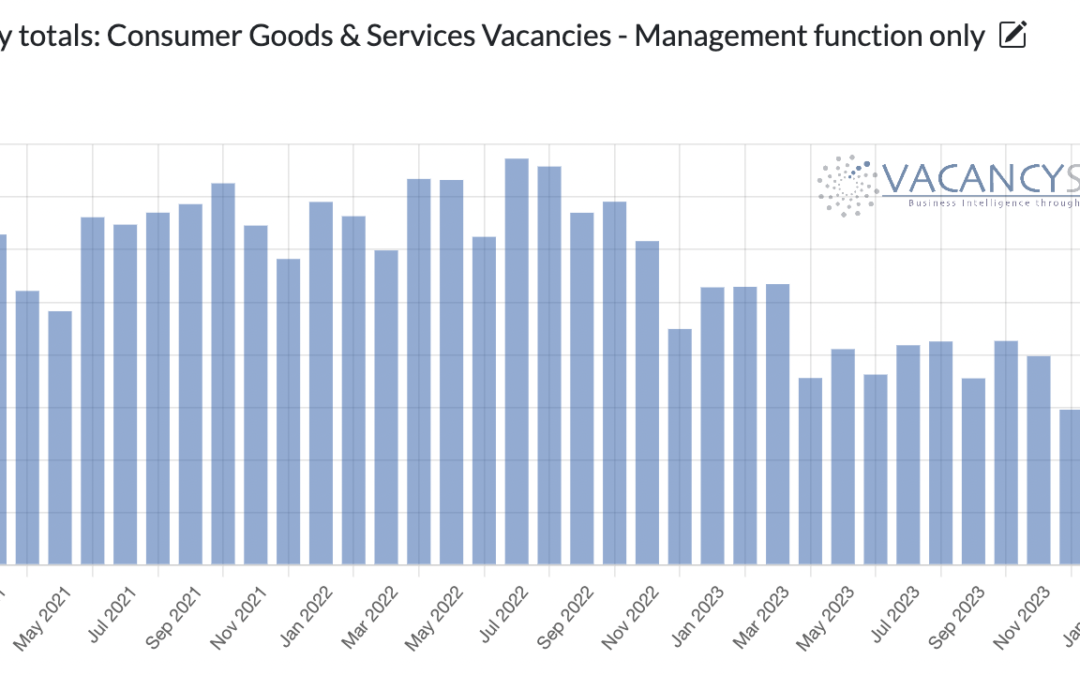

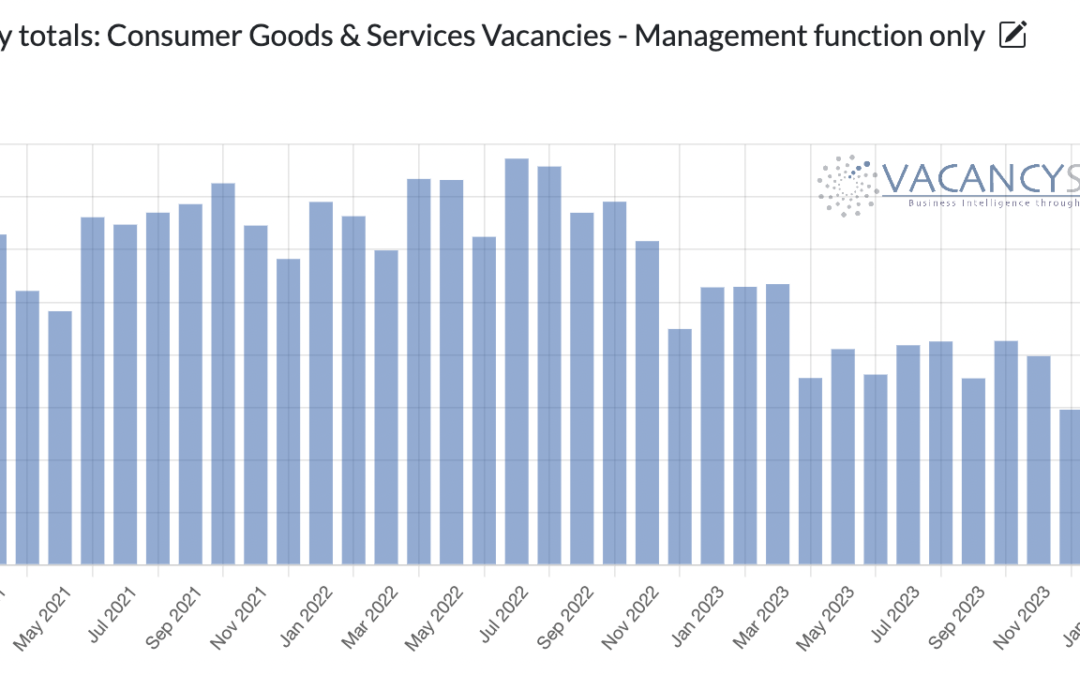

With the clocks changing and the days getting longer, there becomes a tangible shift in the mood of the nation. Typically that translates into a pick-up in activity for retailers. Indeed, Since 2021, the only time that Q2 performed worse than Q1 was last year, equally, that did coincide with the sharp downturn in the economy caused by quantitative tightening, which instantly acted to squeeze the economy.

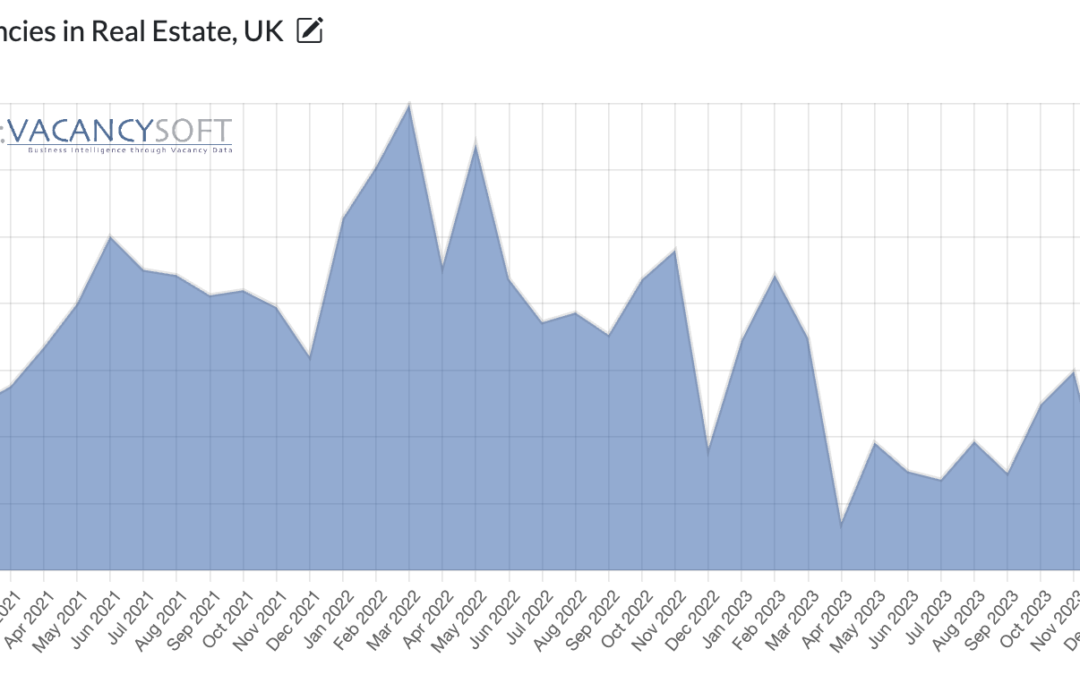

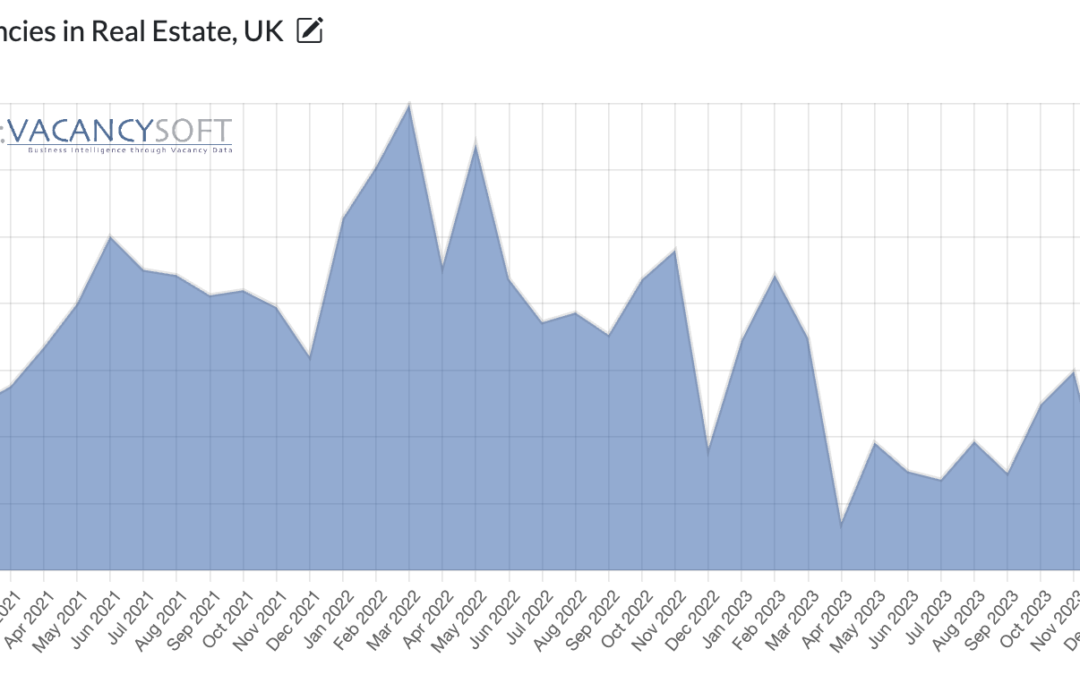

After all, following 2023, the real estate industry is showing signs of picking up as interest rates fall. Residential Property, in part due to the chronic shortage of new houses being built, is already seeing prices rise. With commercial property, there is a deeper question about what kind of work space businesses want, in this new pandemic period. Insofar that nationwide, occupancy is still below pre-pandemic levels, some areas are doing better than others.

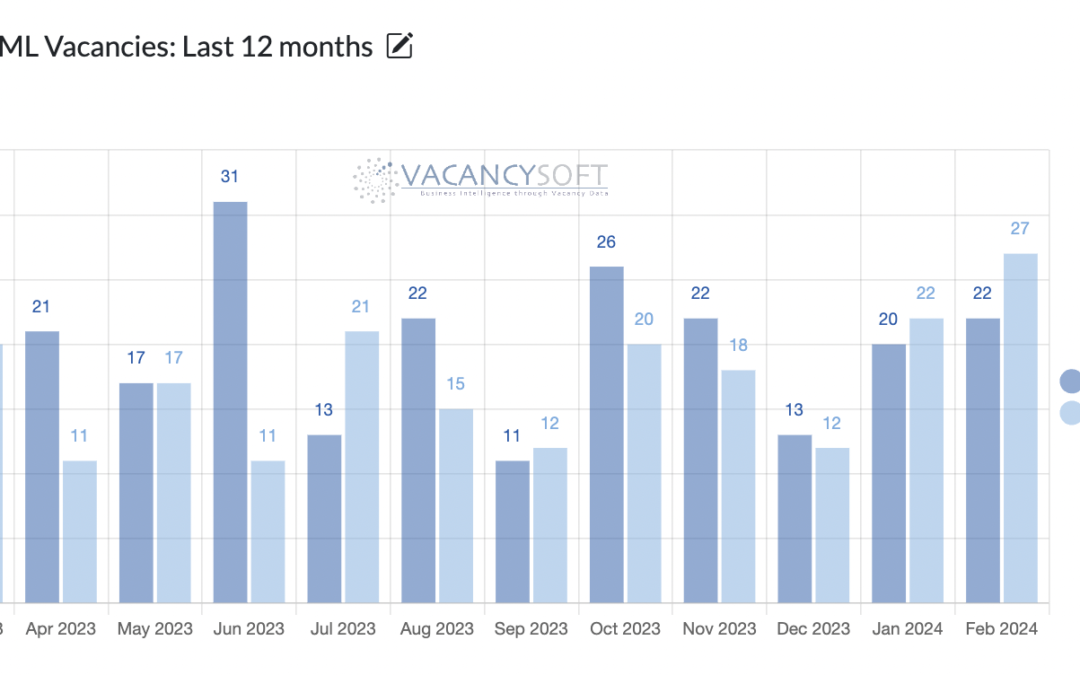

As Russia re-elected Putin this weekend, the impact on the UK is being seen in more ways than one. Already, Grant Schapps is talking about the need for further defence spending as we move from a post-war to a pre-war world. Meanwhile, the avenues for money to be funnelled into London are slowly closing, and the determination to minimize access is clear. The decision to double the economic crime levy for very large companies from April, to £500,000 per institution is a reflection of that.

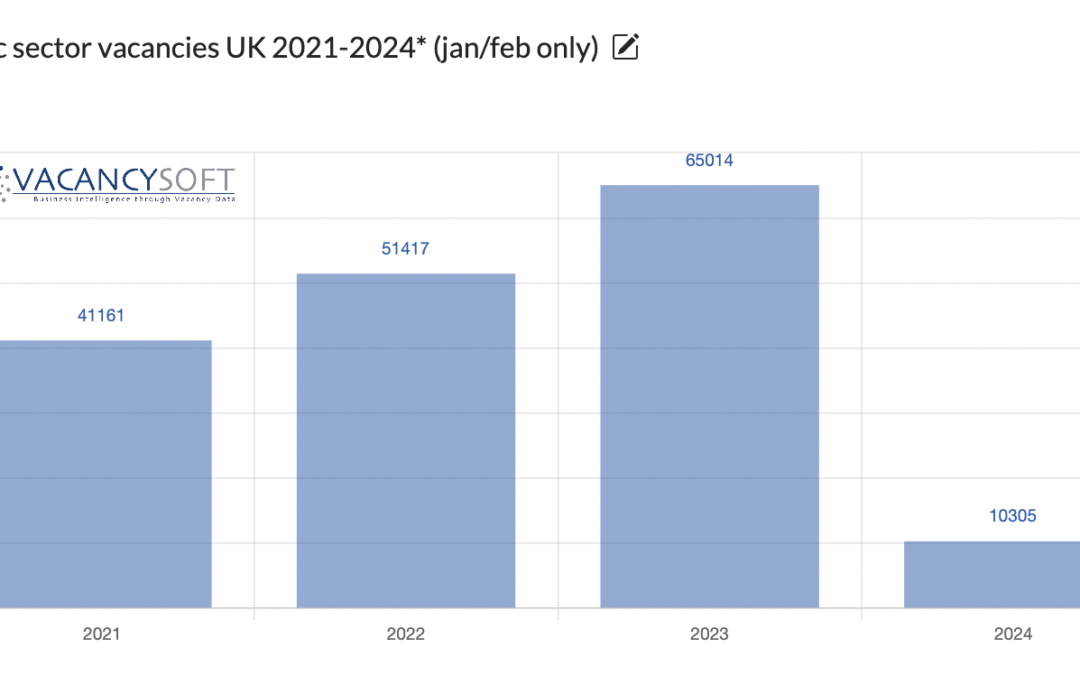

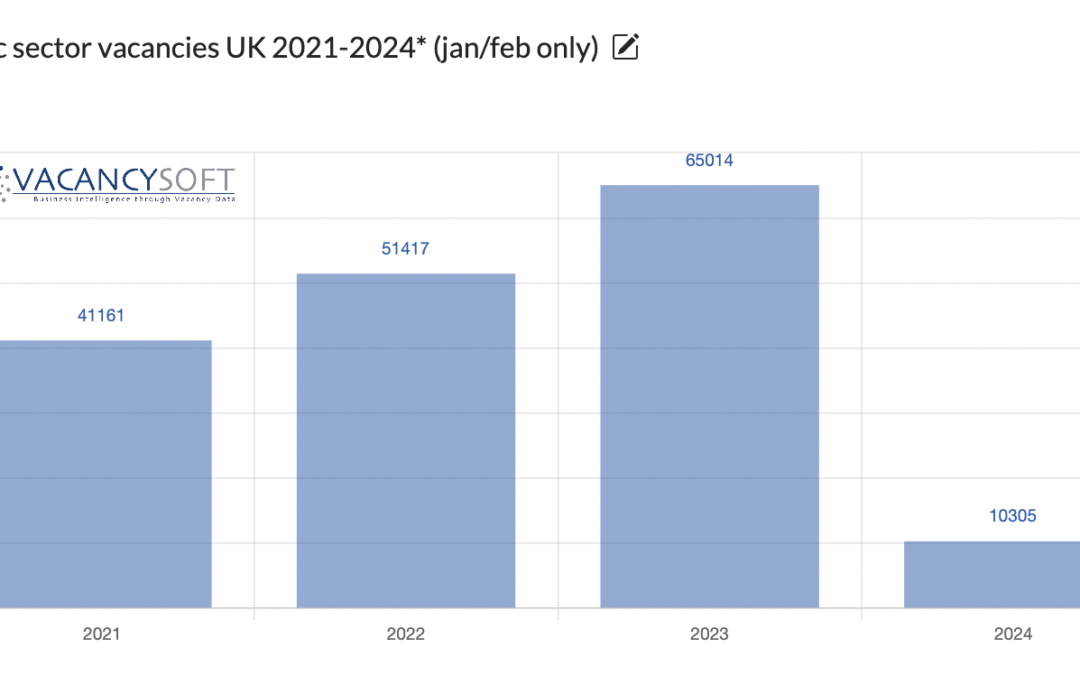

Government pressure on public sector spending sees vacancies drop. At the last count it was estimated there were nearly 5.9m people employed in the public sector, where just as importantly, that number has grown significantly over the last seven years.