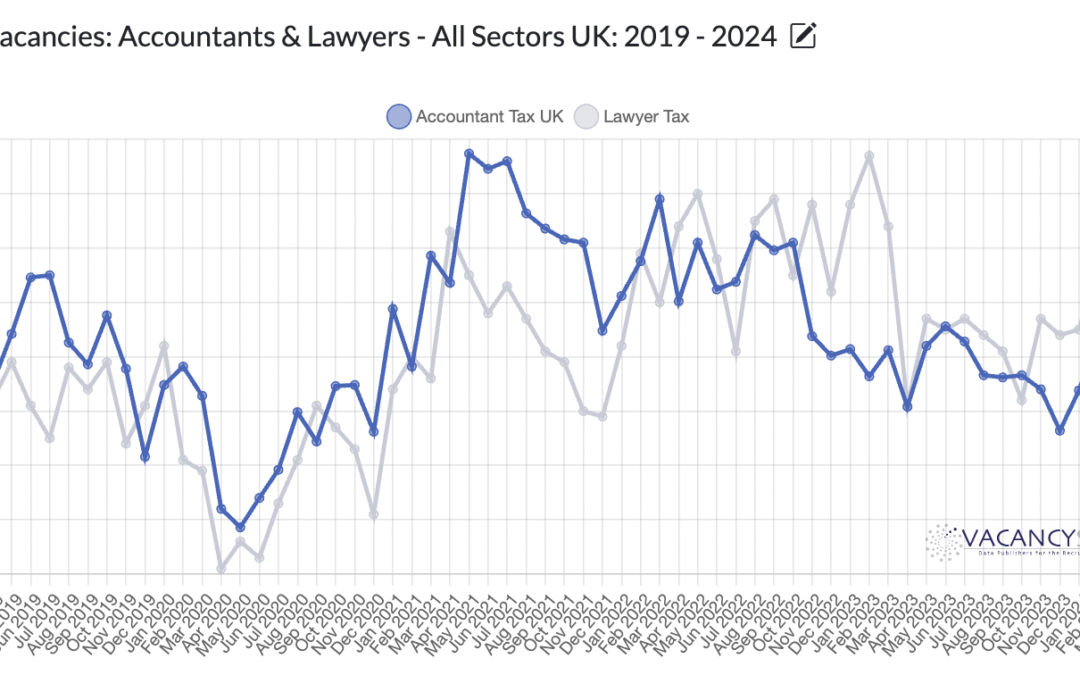

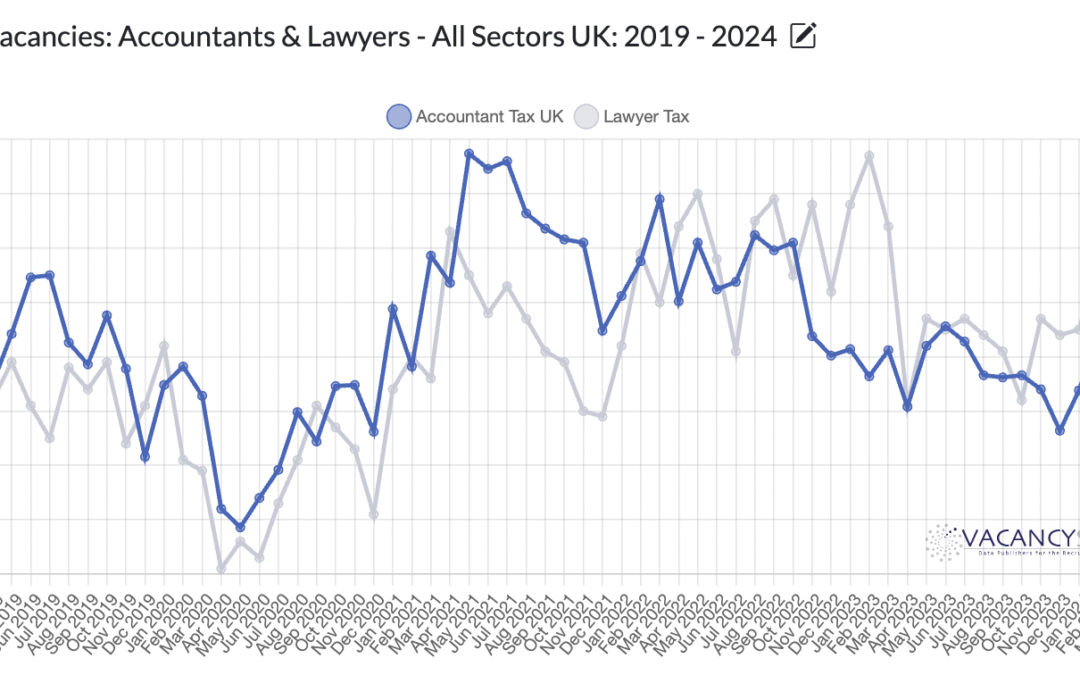

The impact of the budget on tax recruitment is apparent. March 2024 was the record month for tax vacancies going back to January 2019, beating even the peak post pandemic months in 2021. At the same time, in a recent report featured in Bloomberg, the UK is set to see 9,500 millionaires repatriate away, which is more than any other country globally, with the exception of China.

Personal tax vacancies have experienced the most significant growth, with a fivefold increase in the monthly average compared to 2023. London remains the largest area for vacancies overall.

VC funding into the technology industry is on the rise again, bringing relief to policymakers. In the UK, FinTech is a major beneficiary of this increased investment, which is directly translating into heightened recruitment activity. FinTech stands out as the best-performing segment within Financial Services this year. If the current pace of recruitment continues, the number of FinTech vacancies in 2024 will be 36.7% higher nationwide compared to last year.

The Government’s Spring 2024 budget has changed the shape of taxation in the UK for high net-worth individuals who are not UK-domiciled. The implications of this change are yet to be seen properly; therefore, when looking at the recruitment patterns, we are forecasting an increase in tax vacancies this year compared to last year’s 32% in London, and 46% regionally.

February saw Law firms post more vacancies for tax lawyers nationally than any other month over the prior two years. Furthermore, we expect a surge of 32.5% by the end of 2024. Factoring the regionalization happening within the sector, where the regions retain 80.5% of the national share, there has also been a noticeable shift in 2024 to date, with hiring in London on the rise.