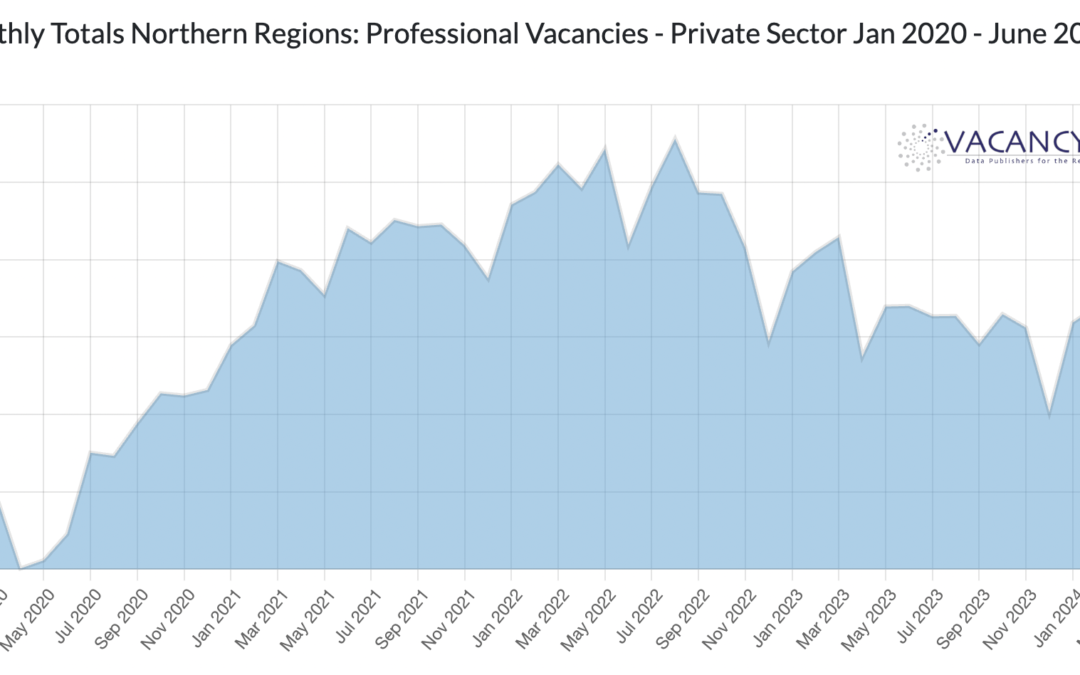

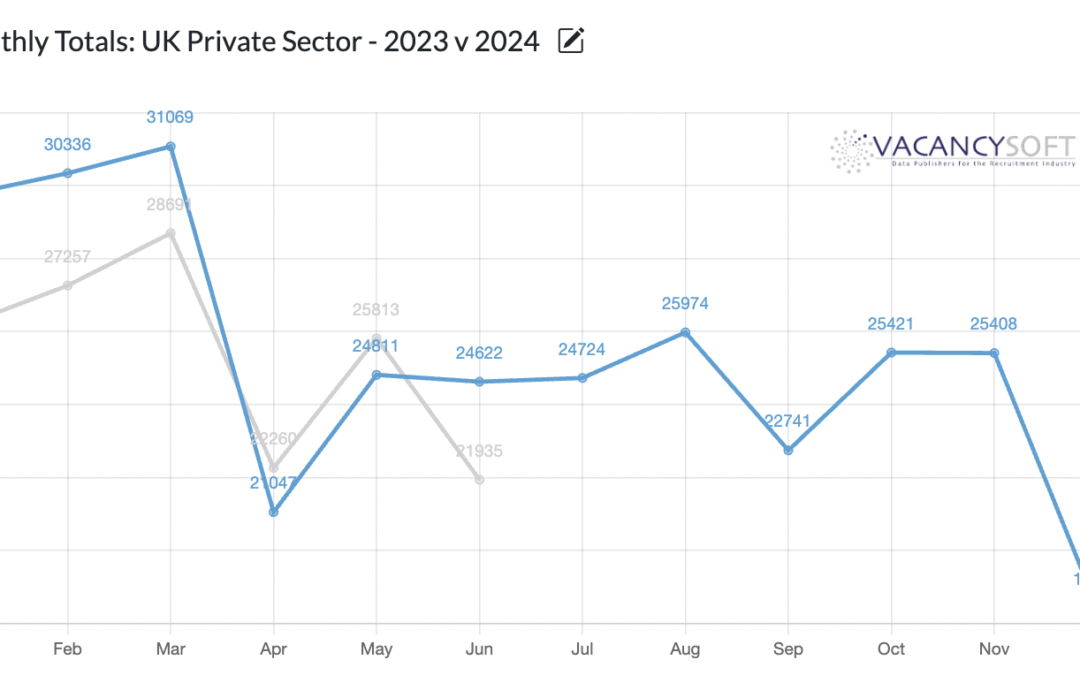

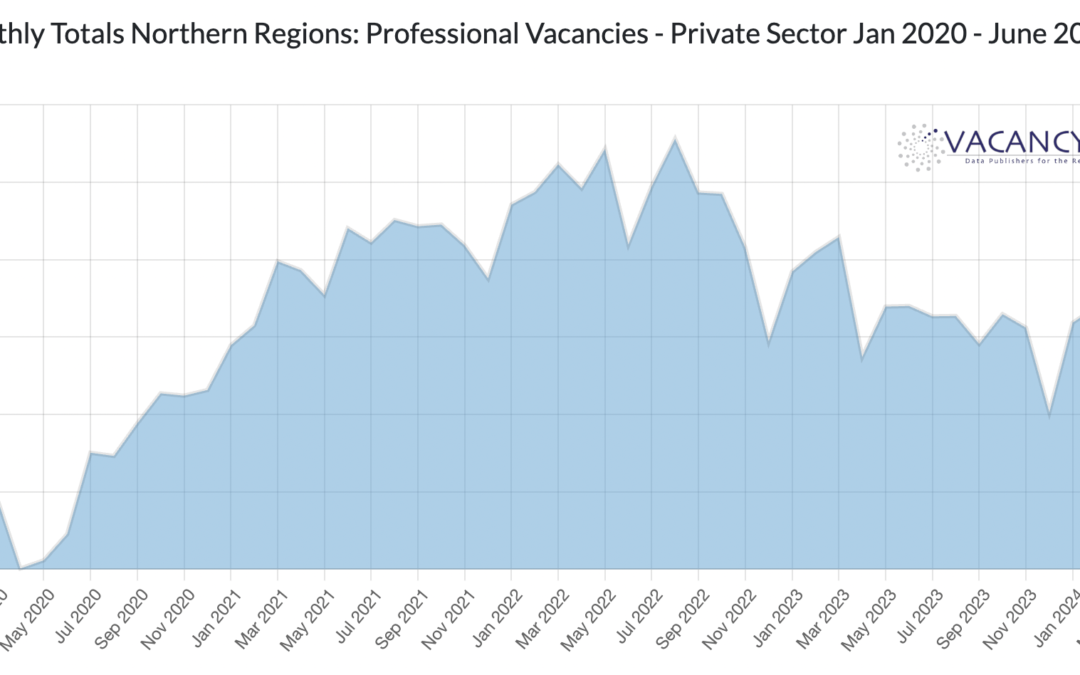

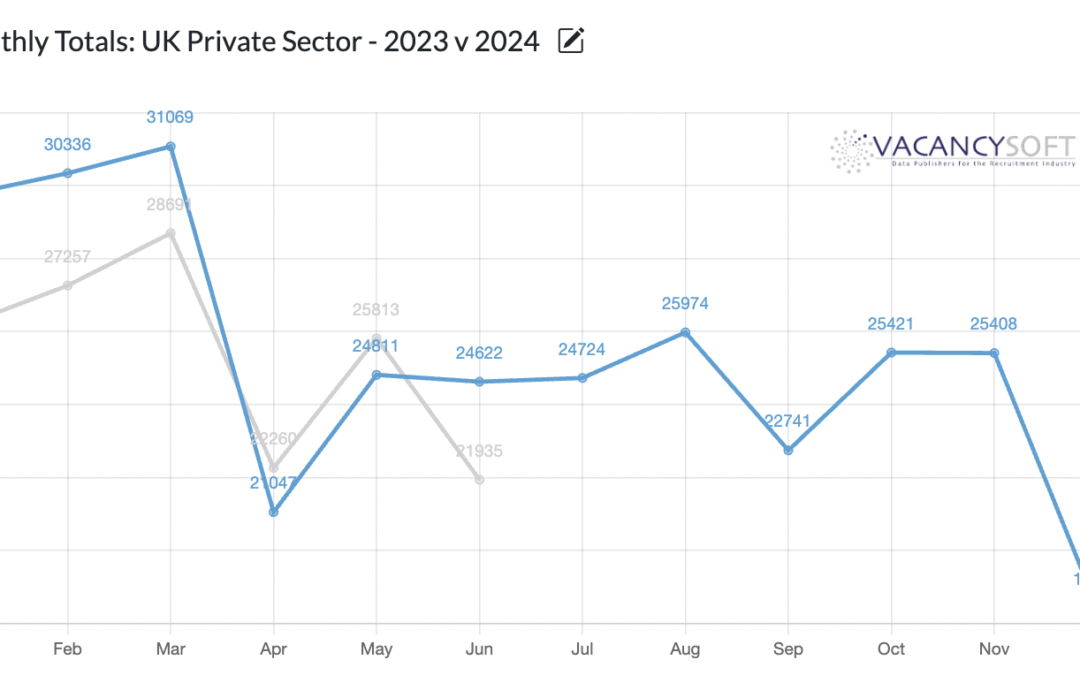

Given the recent general election, it is no surprise that vacancies dropped in June. With Businesses waiting on the outcome of the election, whilst Labour winning was a given, the coming weeks will now see a blitz of policy announcements, which will give greater clarity when it comes to investment.

Is it the responsibility of Government to directly stimulate economic growth, or is it for them to create the environment where businesses invest themselves? Statism, or interventionist supply side policies are coming to the fore once more, and for the incoming Labour Government, there are a myriad of policy proposals designed to achieve growth.

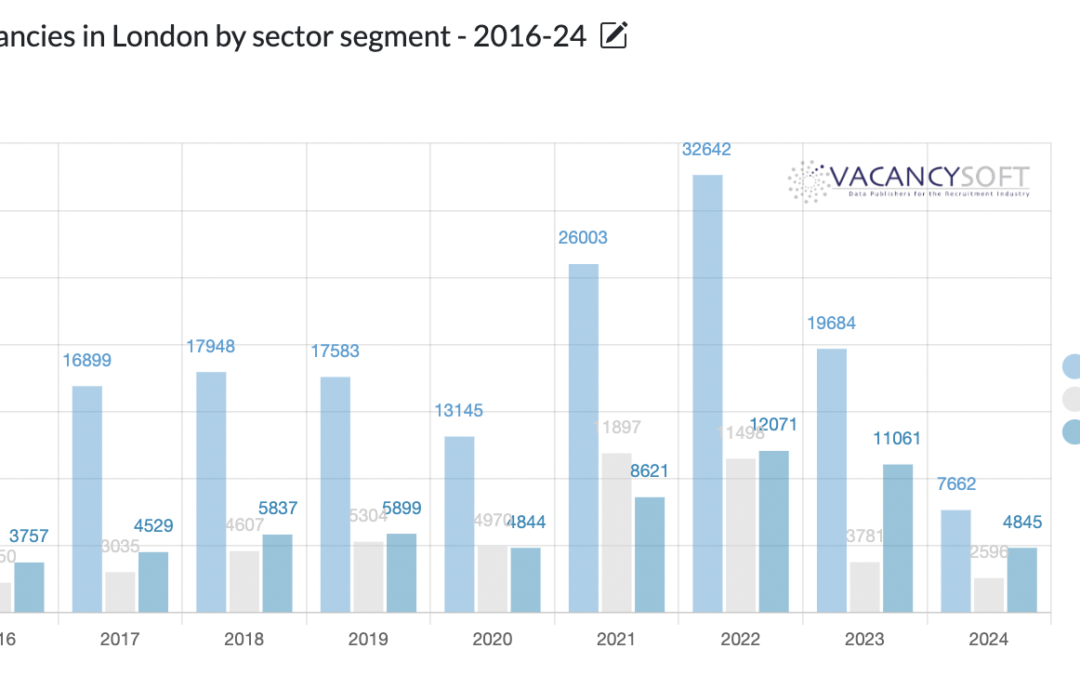

For the UK, Financial Services has a critical part to play, in terms of GDP, our balance of payments and employment. Within the Financial Services industry though, increasingly Fintech is starting to come to the fore. New challengers such as Starling, Monzo, Revolut and Wise have disrupted the incumbents and as a result, the industry has permanently changed.

Analysis shows that SAP vacancies are projected to decrease by 34.1% in 2024 compared to 2023 (comparatively, in the 2022 to 2023 data analysis, vacancies decreased by 2.1%). Similarly, regional SAP vacancies are on track for two consecutive years of decline. This trend decline in SAP hiring reflects the broader slowdown impacting the technology sector as it adapts to the transition to a more rigid financial discipline.

Every generation bears witness to a technological jump which has the capacity to change the way we work. For example, from the first generation of mobile phones in the 1980s, through to smart phones and mobile devices this has transformed the way we do business. Nonetheless, we have seen increasing numbers of jobs displaced as different technologies have achieved scale.