As Europe’s most advanced e-commerce market, the UK has approximately 60 million e-commerce users. With that, shopping online has become the norm, which has had implications for retailers on the high street, especially outside of main shopping hubs, where the pandemic period had resulted in a significant surge in activity. Now, post-pandemic, there has been a slowdown as the market has normalized, which has meant that when looking at e-commerce, there has been a drop of 42.5% in IT vacancies compared to 2022, according to the latest UK Tech Report by Talent Alpha and Vacancysoft.

The slowdown in the technology sector has generally also been felt in gaming, with this year being 55.8% down on last year. Nonetheless, 2023 is 31% up on 2019, showing the underlying trend is upward. As a result, Gaming has hit 5.4% of all vacancies across tech companies, up from 3.5% in 2019 according to the latest UK Technology Labour market trends report by Talent Alpha and market data analysts Vacancysoft.

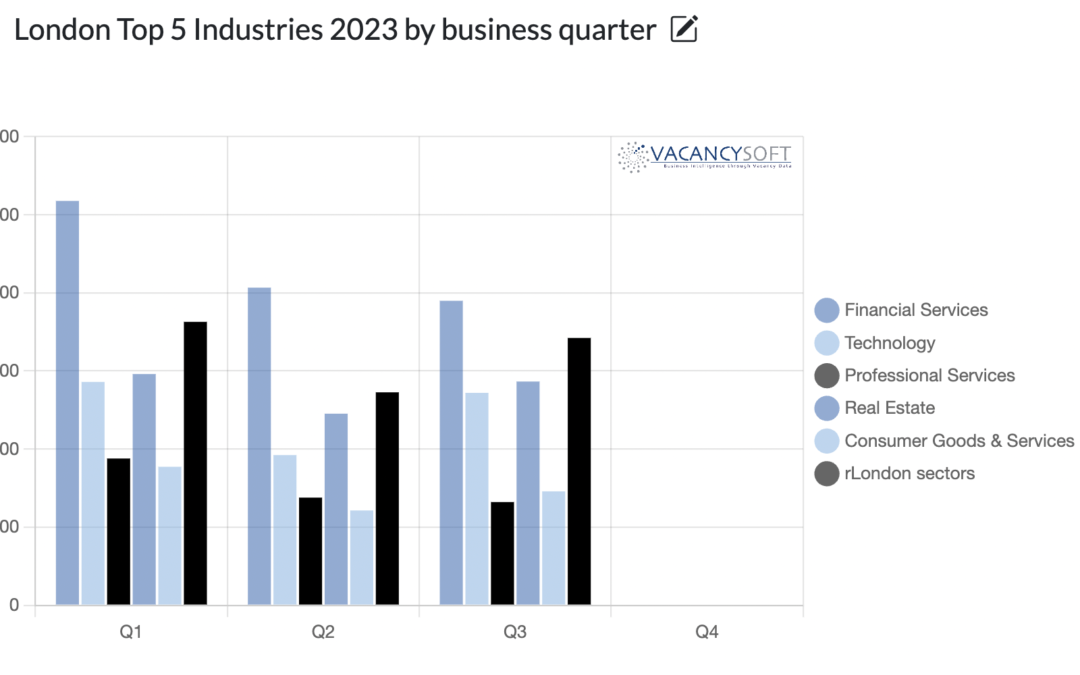

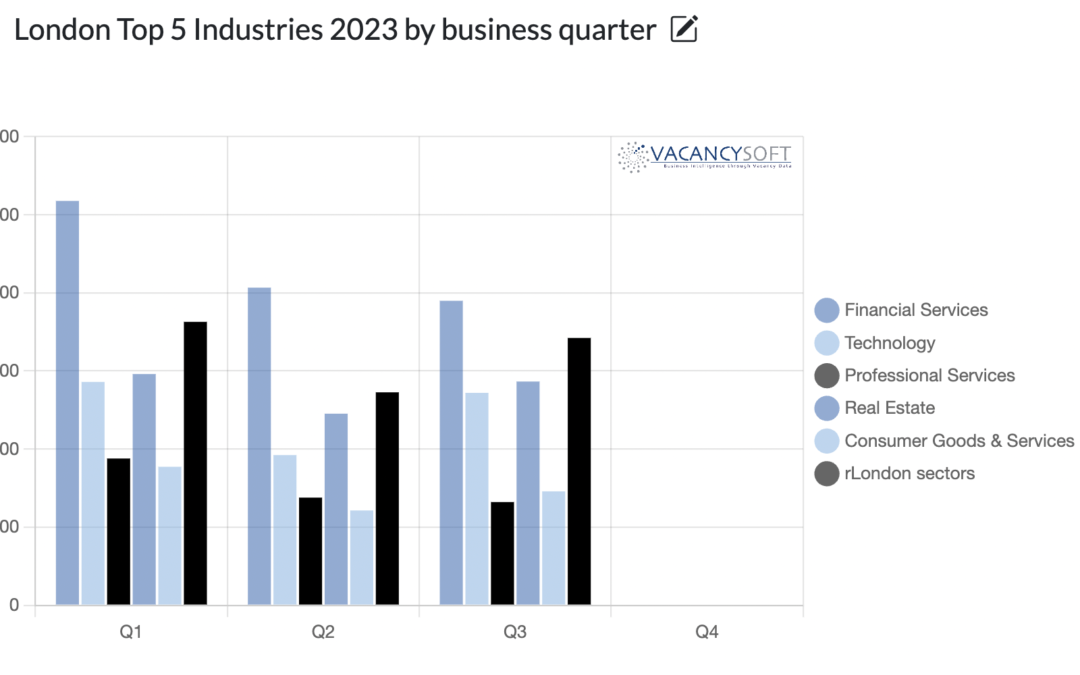

As we enter the final quarter of the year, for many people, 2023 has been challenging in a way not seen for several years. Job flow has slowed down, and as a result, for recruiters, revenues have dropped too. In previous posts we have touched on, how vacancies have dropped year on year, equally what is interesting when looking at 2023, is the variance by sector. For some markets, there should now be signs of optimism, where for others, Q3 saw the lowest job totals posted in the year to date.

Despite the fact vacancies have dropped in 2023 versus 2022, we see this as a temporary lull, as the attack vector is bigger than ever before. IT security vacancies are expected to total approximately 4,187 for the year, marking a 30.7% decrease from the 6,045 vacancies observed in 2022. Equally, at the same time, IT security has increased in share of all IT vacancies, from 4.1% last year, to 4.7%, making it one of the fastest-growing segments. This is according to the latest UK Technology Labour Market Trends report by Robert Walters and market data analysts Vacancysoft.

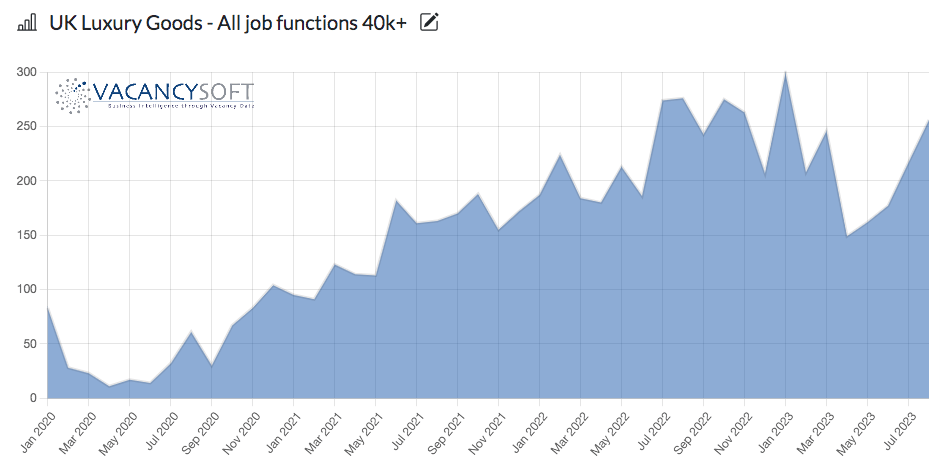

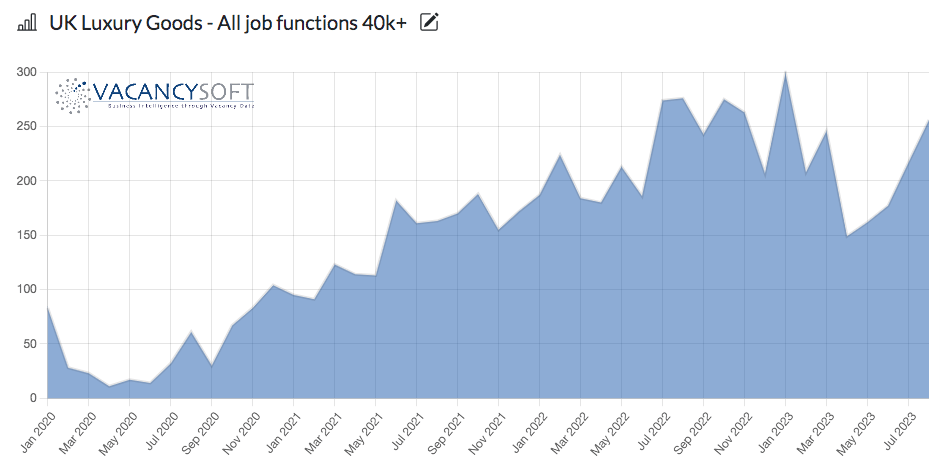

As the UK economy teeters between anaemic growth, a cost of living crisis, strikes over pay crippling the public sector along with interest rates at generational highs leading to recruitment slowing down significantly when compared to 2022, it can be easy to be negative. Nonetheless, as business leaders, the challenge is to find a way to succeed regardless. In recruitment, that starts with identifying markets which are outperforming others, and segments that still seeing buoyant demand. With that in mind, this week, we have highlighted Luxury Goods as a sector to watch. Why?