After the technical recession in 2023, which led to vacancies dropping in the region compared to 2022, we have seen a bounce back in Q1 so far, culminating in an uplift of 7.6% which compares favorably to the national figures (+5.4%.) As a result, the region now accounts for 6.7% of the national total in terms of vacancies, up from 5.8% in 2022.

Insurance companies face new risks due to economic volatility, higher interest rates, geopolitical uncertainty, and climate change. This has led to a rise in demand for risk professionals, with vacancies up by 11.4% in 2024 compared to last year. March 2024 had the highest number of risk vacancies in over a year, indicating a continuing trend.

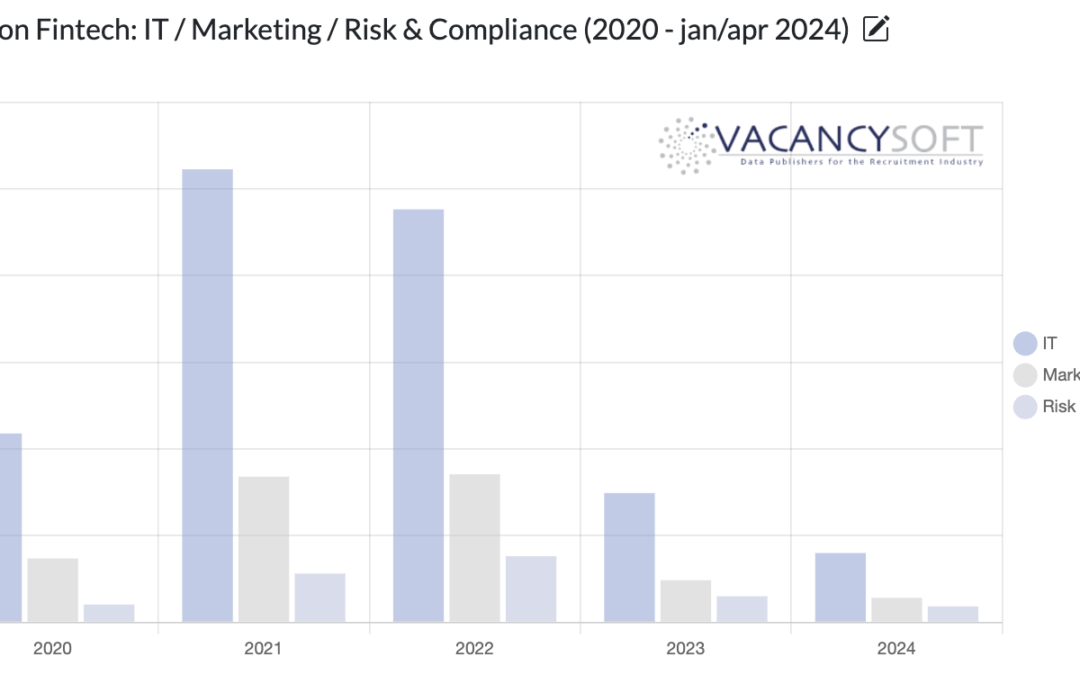

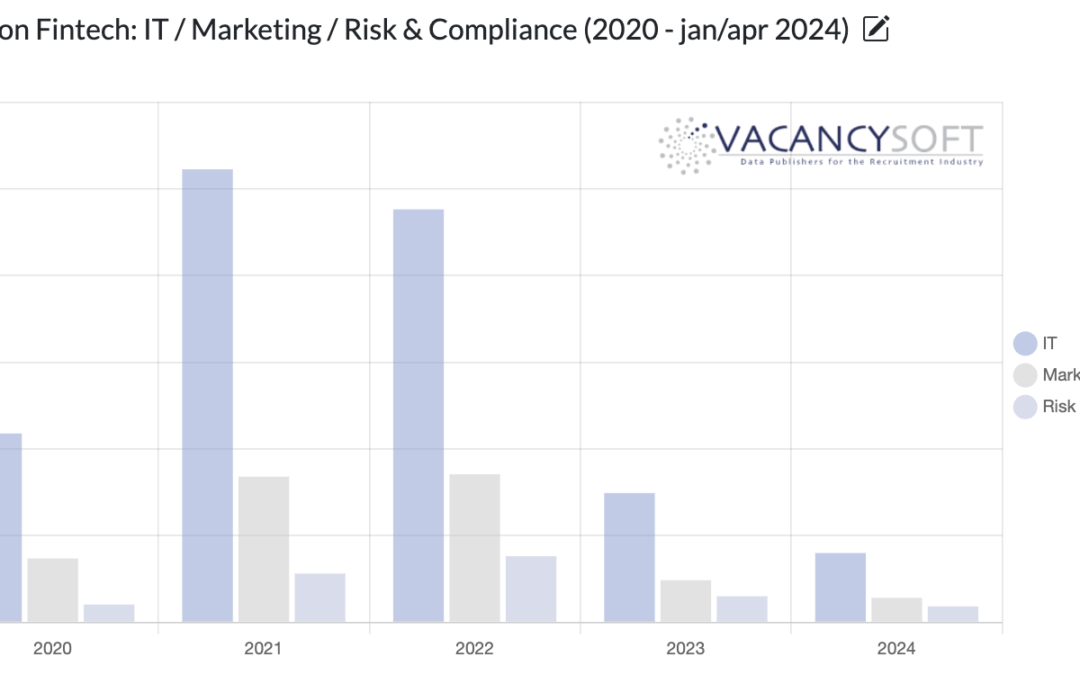

After a torrid 2023, the signs are positive for Fintech as VC funding into the sector accelerates. According to a recent report by Dealroom and HSBC, in Q1 of 2024, there were 73 rounds completed in Q1 of this year, totalling $1.4BN, making it the leading sector for investment, this year so far.

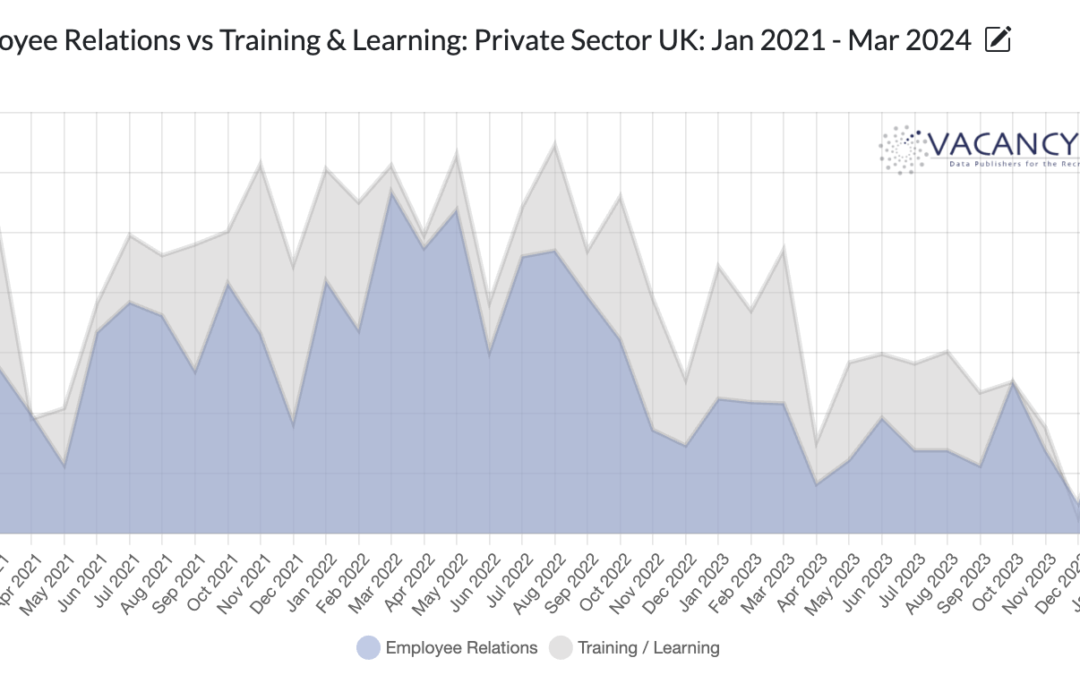

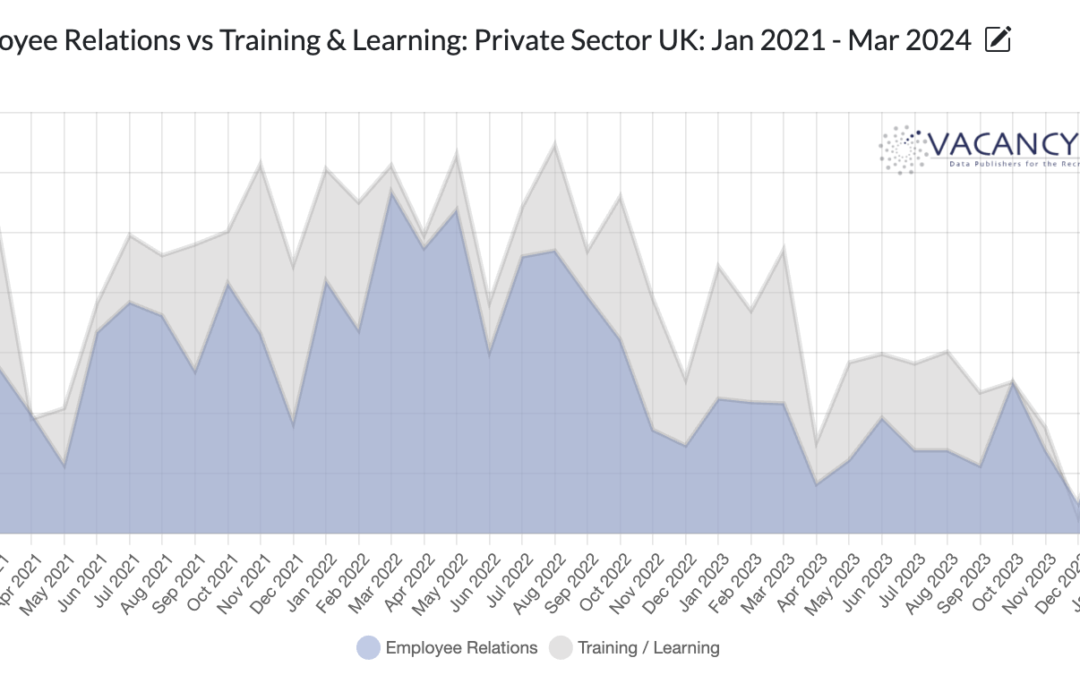

For the first time in over three years, this March, there were more vacancies for employee relations specialists than training/learning across the private sector in the UK. While this was just one month, the signs are that in April, it is set to repeat, at which point this could indicate corporations are shifting their priorities when it comes to their staff.

Post-pandemic economy shifting from London: HQ function vacancies down to 41.2% from 47.8% in 2019.