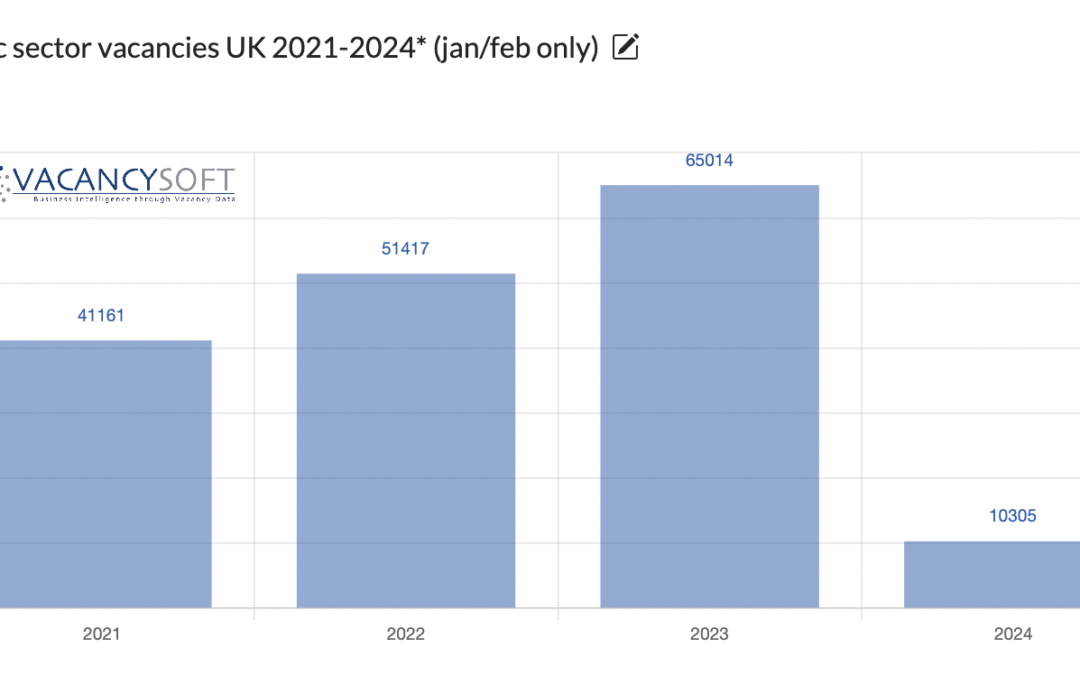

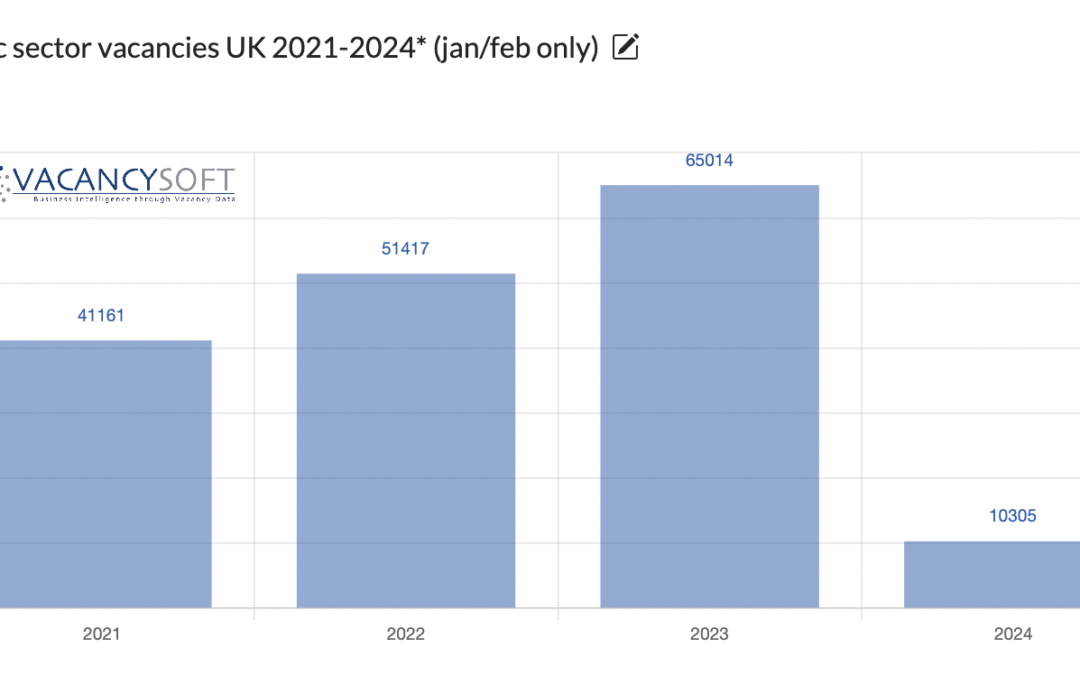

Government pressure on public sector spending sees vacancies drop. At the last count it was estimated there were nearly 5.9m people employed in the public sector, where just as importantly, that number has grown significantly over the last seven years.

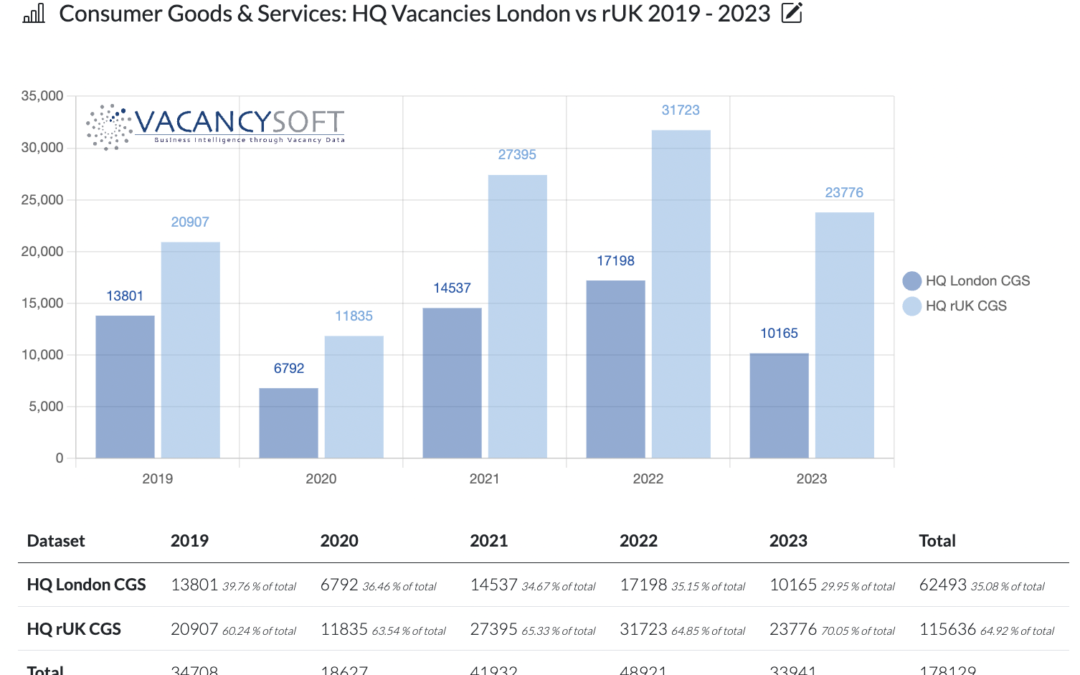

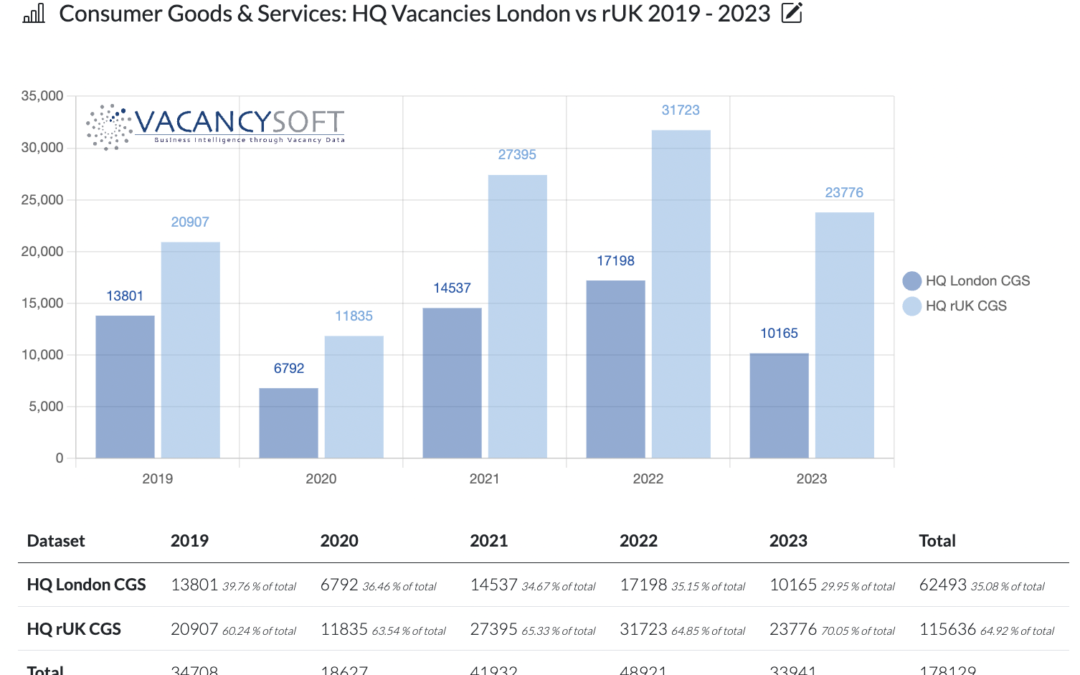

For retail and consumer goods and services, 2023 has proven to be a challenging year. The impact of the changes to VAT has meant that as tourism has returned, the luxury goods sector has flatlined, despite London having more tourists than ever. At the same time, quantitative tightening has resulted in challenges to household liquidity, which has meant there has been downward pressure on disposable incomes.

The deceleration of tech-centric sectors in London during 2023 mirrors the broader downturn experienced across the UK, with IT vacancies plummeting by 50.5% in the capital compared to 36.3% regionally. Hence the fact that demand for IT professionals has fallen 42.8% compared to the peaks seen in 2022, is a temporary blip.

At a time when the sector has been depressed by the cyclical downturn due to quantitative tightening, this has led to a drop of 34.8% in London and 19.4% regionally. Within law firms, real estate remains the top skill in demand, although its market share has slipped from 22% in 2022 to 18% in 2023. This is partly due to a hefty 37% fall in vacancies in this area in 2023 as the commercial property sector has slowed down.

The cyclical nature of Financial Services has meant that as interest rates rose, and the economy appeared on the edge of recession, recruitment slowed down significantly. All this has led to professional vacancies falling in 2023, with a 34% year-on-year decrease from 2022.