The end of the property boom

What next for house prices?

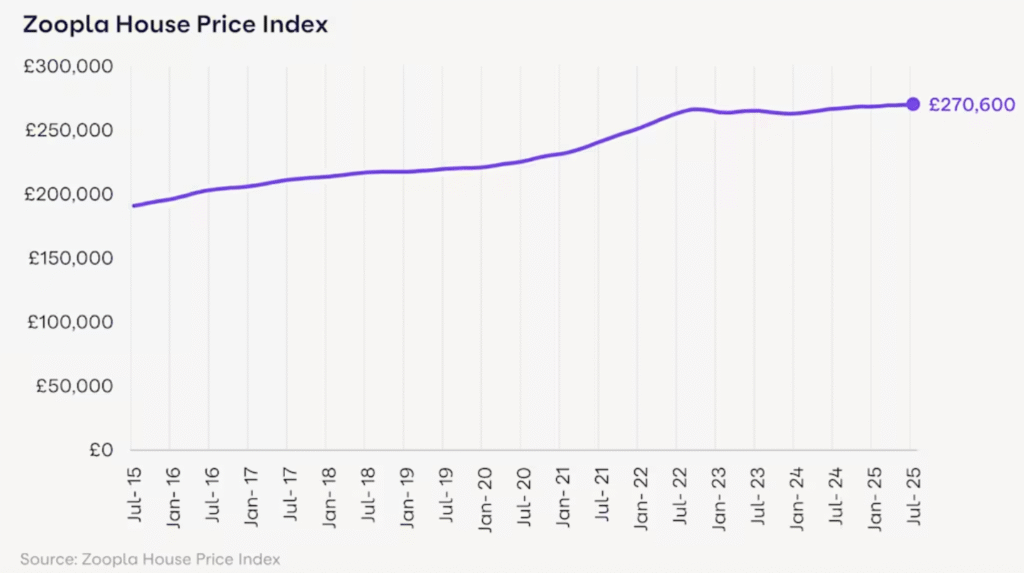

The combination of interest rates increasing, stamp duty increases, changes to taxation generally and greater regulations on landlords are leading to house prices stalling in the UK, with Central London being hit the hardest and actually declining.

With that, it is worth analysing the changes happening in the buy-to-let sector. As of 2024, there were approximately 2.86 million unincorporated landlords in the UK who declared income from renting property, according to the latest government statistics GOV.UK . Additionally, the number of buy-to-let (BTL) companies has surged to over 400,000, making them the most registered business type in the UK. However, the overall buy-to-let market is experiencing significant challenges:

It is worth noting that the pending Renters rights bill will mean that evicting tenants will be harder, also all privately rented homes would need to have an EPC rating of C, by 2030, which could cost thousands of pounds per property.

As a result we are seeing:

- Declining Number of Mortgages: The number of outstanding BTL mortgages decreased from 2.039 million in Q1 2023 to 1.98 million in Q1 2024

- Reduced Property Purchases: Whilst in 2024, landlords purchased 113,630 new rental properties, over the last five years, more properties have been sold, than bought.

- Property prices falling: In some parts of London prices have fallen by 15%, and across the country, the reporting from RICS is that prices are flat or falling.

Now there are proposals for a new wealth tax on property, where there would be an annual charge paid to HMRC on the value of the property over 500k, which if enacted, will further act to dampen the property market, which is likely to have several implications for housebuilders, including:

- Pressure on Profit Margins: Housebuilders rely on selling homes at a price that exceeds construction costs. If prices are flat while construction costs, materials, and labor costs continue to rise, profit margins will be squeezed. Builders may delay new projects or scale down developments to avoid losses.

- Reduced Incentive to Build: Flat prices reduce the potential return on investment for new projects. This may lead to slower housing delivery, exacerbating long-term supply shortages. Developers might focus on smaller developments or renovations rather than large-scale builds.

- Shift in Product Mix: Builders may target higher-margin segments, such as luxury homes or bespoke properties, where buyers are less price-sensitive. More affordable or mid-market homes could be deprioritized unless subsidized by government schemes.

- Potential Consolidation: Smaller or financially weaker builders may struggle to survive, leading to industry consolidation. Larger builders with access to capital and diversified portfolios are likely to gain market share.

This is likely to then impact the labour market in the following ways:

- Fewer projects mean less demand for construction labor, including tradespeople, site managers, architects, and engineers.

- Real estate agents, brokers, and sales teams may see lower commissions and reduced hiring.

- Mortgage brokers, surveyors, and insurance specialists may see reduced transaction volumes, though some offset by refinancing or rental-related work.

- If people are priced out of buying, demand for rentals may grow, benefiting letting agents, property managers, and landlords’ service providers.

Nonetheless, the warning signs are flashing for the Government. If house prices are flat, that will also directly impact consumer confidence, at a time when interest rates and inflation remain high. For Reeves, the property sector may be ripe for targeting for additional tax, but the danger is, in doing so, permanent damage is done to the UK economy.

Subscribe to our weekly newsletter for clear, timely insights on the political and economic trends shaping the UK labour market:

The data referenced above has been sourced from Vacancy Analytics, a cutting-edge Business Intelligence tool that tracks recruitment industry trends and identifies emerging hotspots. With 17 years of experience, we have a deep understanding of market activities in the UK and globally.

Want to unlock the full potential of Vacancy Analytics to fuel your business growth?

Book a 30-minute workshop with us and discover the power of data in shaping the future of your market!

p.s. By the way, if you are a fantasy football fan, why not join our league this season? With over 50 people already registered, we will be doing prizes for the winner and for the manager of the month if we hit 100+. Get involved!