Vacancy Data in Q3 2017 – Overview

In April 2017, Vacancysoft released an overview of the first quarter, laying out what to expect in the following quarters based on activity in the professional vacancy market. Now that Q3 is over, how have those predictions reflected reality, and what new developments arose that affect forecasts?

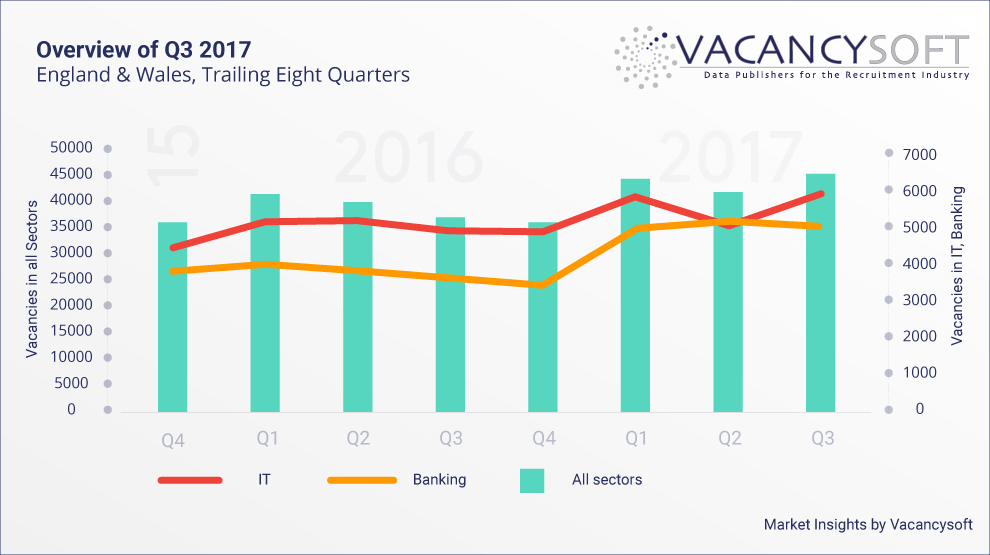

Generally, the trend we are seeing indicates continued growth in the vacancy market. Comparing the three-quarter period of Q1-Q3 in both years, 2017 grew by 10.6% versus 2016. This is in line with the April overview which emphasized the Q1 2017 spike and noted that “despite pessimistic forecasts, the effects of Brexit, which have been widely predicted to bring about a significant economic slow-down, have not yet fully kicked in.”

While every quarter in 2017 has seen more new professional vacancies than in 2016, it was Q3 that saw the most significant rise. Q3 in 2017 brought 21.7% more new vacancies versus Q3 2016, whereas growth year-on-year in Q1 and Q2 oscillated around 5%. Growth patterns become more volatile when broken down by month, with some months seeing lower volumes than their counterparts in 2016, such as April, with volumes lower by 5.4% in 2017. March 2017 was the busiest month in the 24-month dataset, but it was September that boasted the largest increase year-on-year, up by 24.5% from 2016.

Key sectors are performing relatively well; the Banking sector saw a significant uptick at the start of the year, and the trend is keeping up despite a minor decrease by 2% between Q2 and Q3. IT was more volatile this year, seeing increased vacancy volumes in both Q1 and Q3.

The overall outlook for the upcoming quarters is cautious but positive. While in the long run some degree of Brexit-related stagnation is predicted, in Q3 UK economic growth surpassed expectations, adding to the likelihood of the Bank of England increasing interest rates in early November. The unemployment rate remained at a record low, and reports show that long-term unemployed and those over the age of 50 have been securing jobs more easily in the past year; the CIPD commented that “The good news is that the UK labour market continues to go from strength to strength”.

Recruitment Industry Insights is a free Market Intelligence Tool that can help you to become a thought leader in your niche, increase your brand awareness, and attract clients. Read about this free Market Intelligence Tool here.

Author: Jan Pawlowski

Data Analyst