The Real Estate Industry is starting to hit headwinds not seen in a generation, as interest rates start to rise. Insofar as the long-term average interest rate has been around 4-5%, the last decade has seen low rates and unprecedented amounts of quantitative easing which as they have ended, have meant the industry is under pressure.

When examining the overall half-year totals for 2023, we can see a substantial 54.2% decrease when compared to the same period in 2022, where across all sectors, companies have been slowing down.

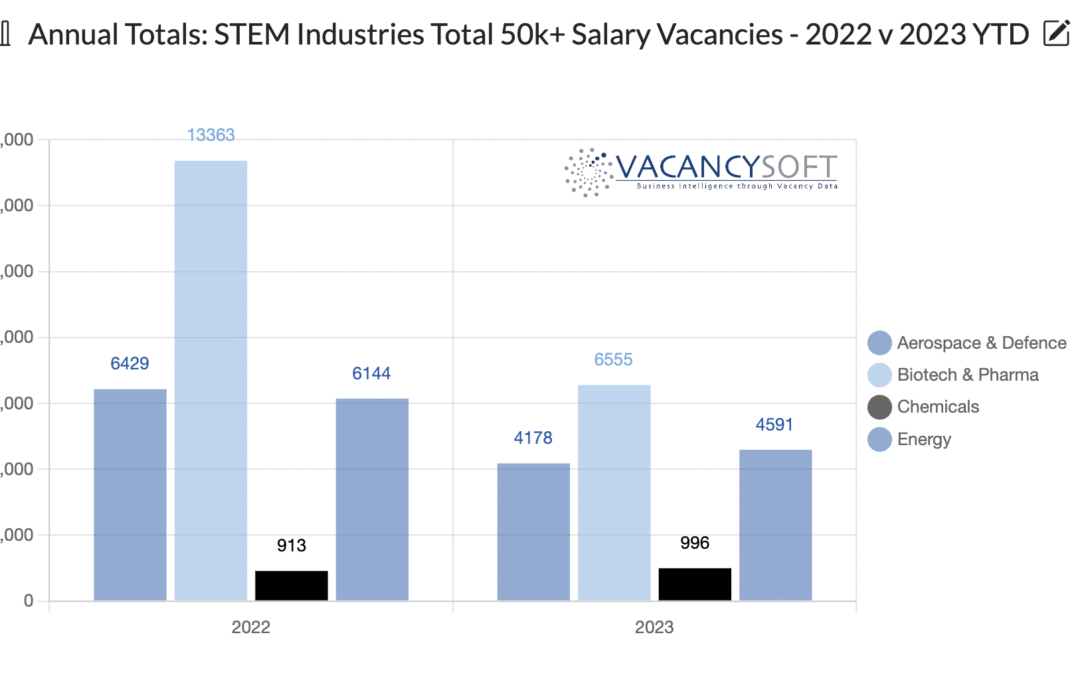

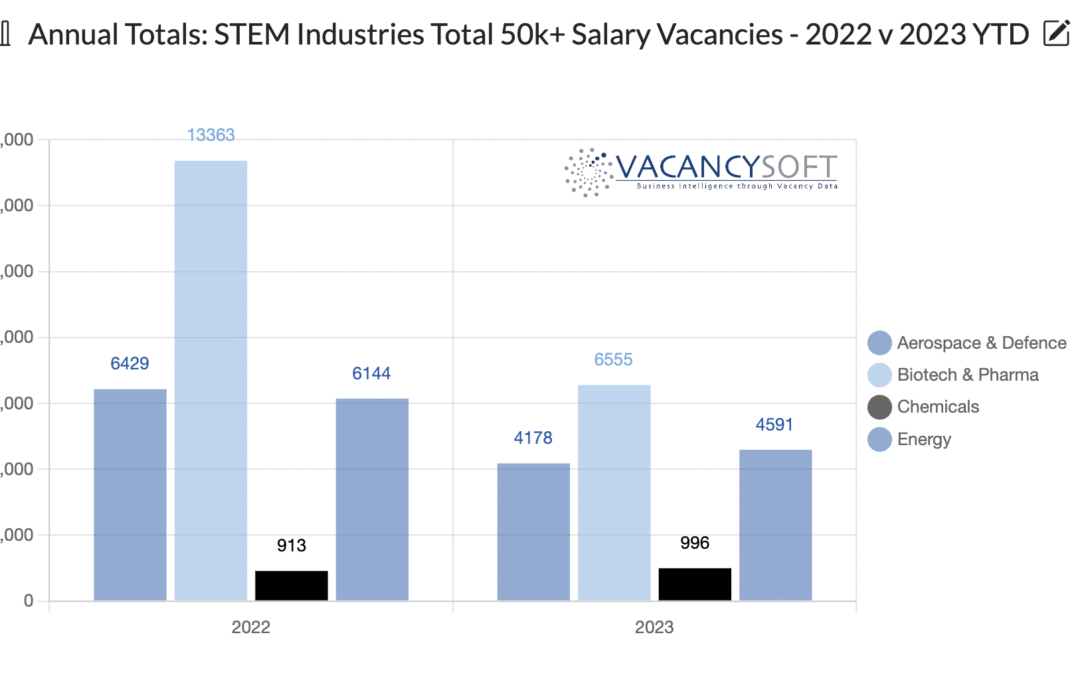

In contrast to most other sectors, businesses in Energy and Defence are on track to post more vacancies this year than last.

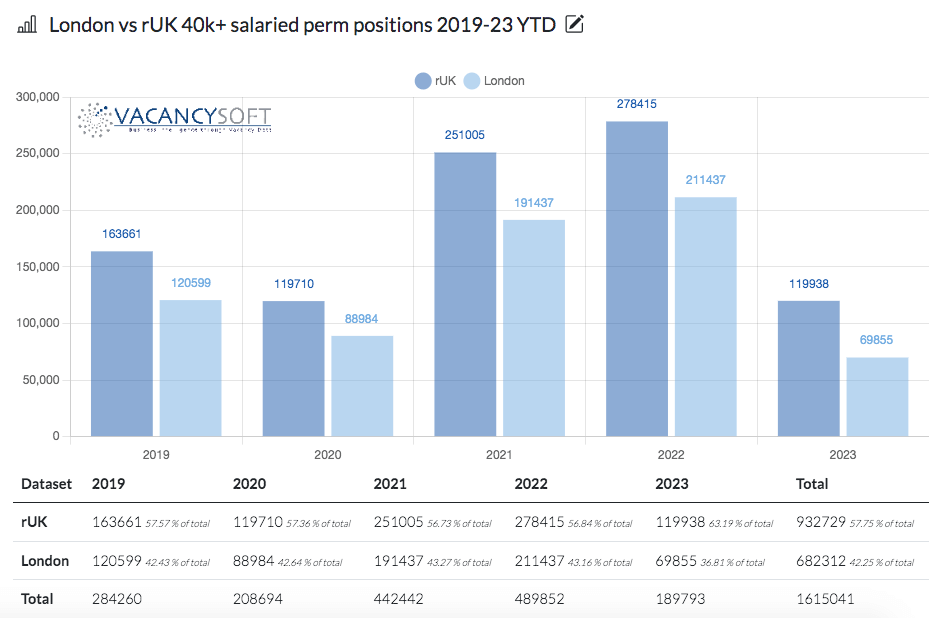

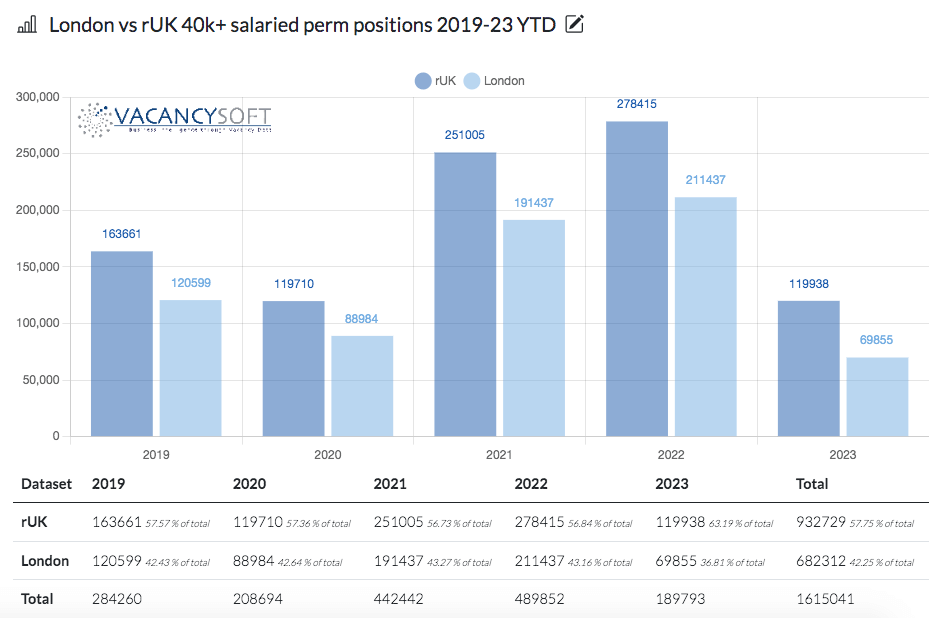

As salaries surge to match inflation, so businesses are shifting hiring away from the capital. In my previous post, recruitment is tidal, I referenced that in terms of macro job flow, what we are seeing is that 2023 is now mirroring 2019. However, there is one key distinction in that whilst activity in London is flat (vacancies in 2023 are currently on track to match 2019 exactly) outside the capital, we are seeing growth of 25.6% in terms of the monthly average, when comparing this year, to 2019, before COVID.