The UK banking sector is set for an 11% rise in vacancies in 2025, led by London with 15% growth. AI-driven IT and operations roles are powering demand, while regional hubs like Glasgow and Belfast are seeing the fastest expansion. The report highlights how digital transformation is reshaping hiring strategies across the industry.

The first Labour Government in a generation, the biggest increase in taxes since 1993. A bold maneuver to bolster growth, or a misstep, which will cost Labour at the next election? The challenge facing policy makers is real. The size of the national debt is so large, that interest payments alone are now larger than the entire policing budget. And in order to prevent the national debt to stop increasing relative to GDP, the country needs annual growth of 2.5% or more.

Stay informed with the latest insights on labour market shifts, hiring patterns, and industry-specific analytics. Our Snapshots highlight key developments across multiple sectors, helping you navigate the evolving recruitment landscape.

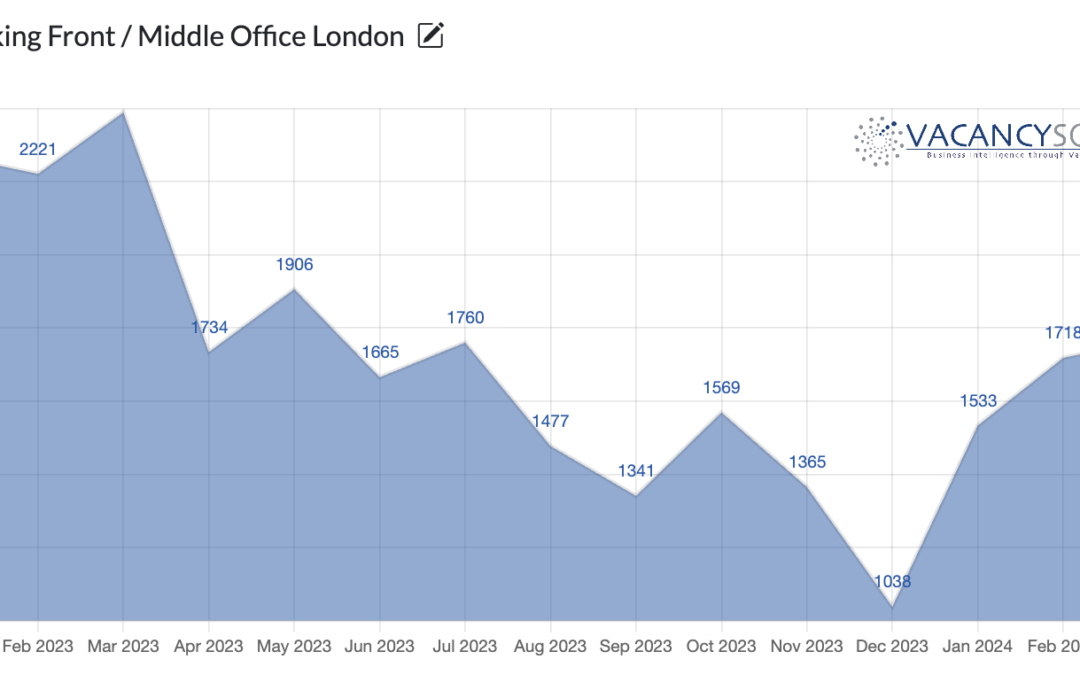

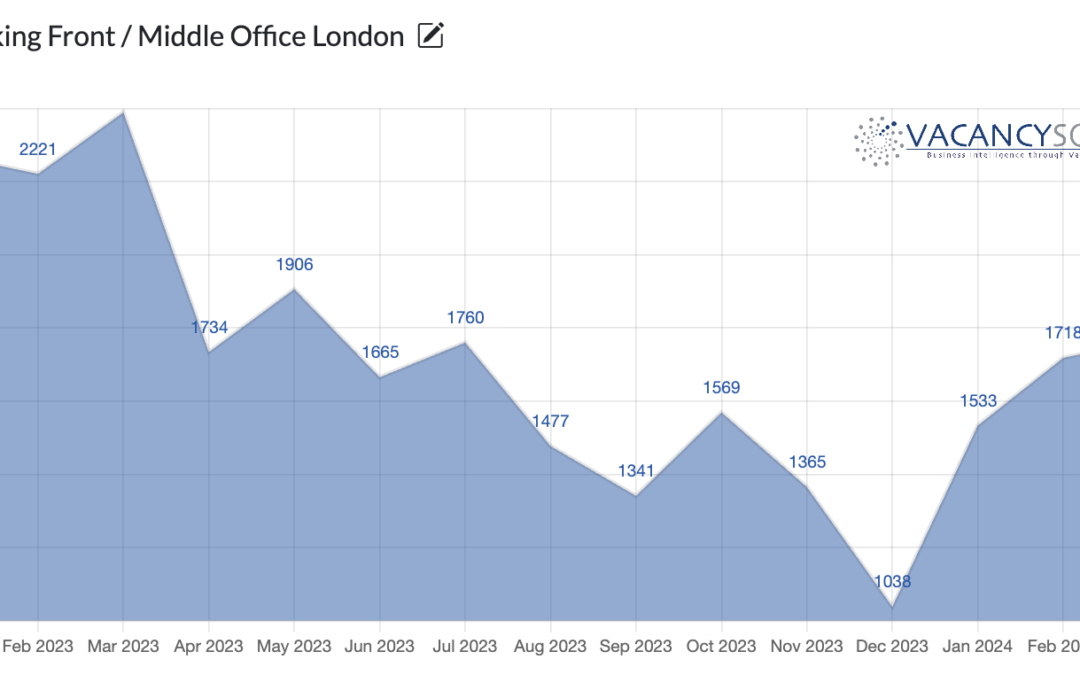

The UK stands out among G8 countries due to its political stability, with the government expected to remain in power for up to 10 years. Consequently, 2024 could mark a turning point for UK banking, thanks to recent deregulation reforms and stable interest rates.

Financial Services is one of the largest industries within the UK, and contributes 8.3% to economic output. Overall the Financial Services industry employs over 1m people in the UK, and also runs significant trade surpluses, as a result, what happens in Banking is of direct relevance to the entire economy, and London in particular is of significance.