With the impact of climate change now becoming an ever-present reality, it is now being recommended that internal auditors globally make assessing the risk part of their purview, and within the UK specifically. Nonetheless, activity has been muted so far in 2024, with vacancies slowing down by 19.7% compared to last year.

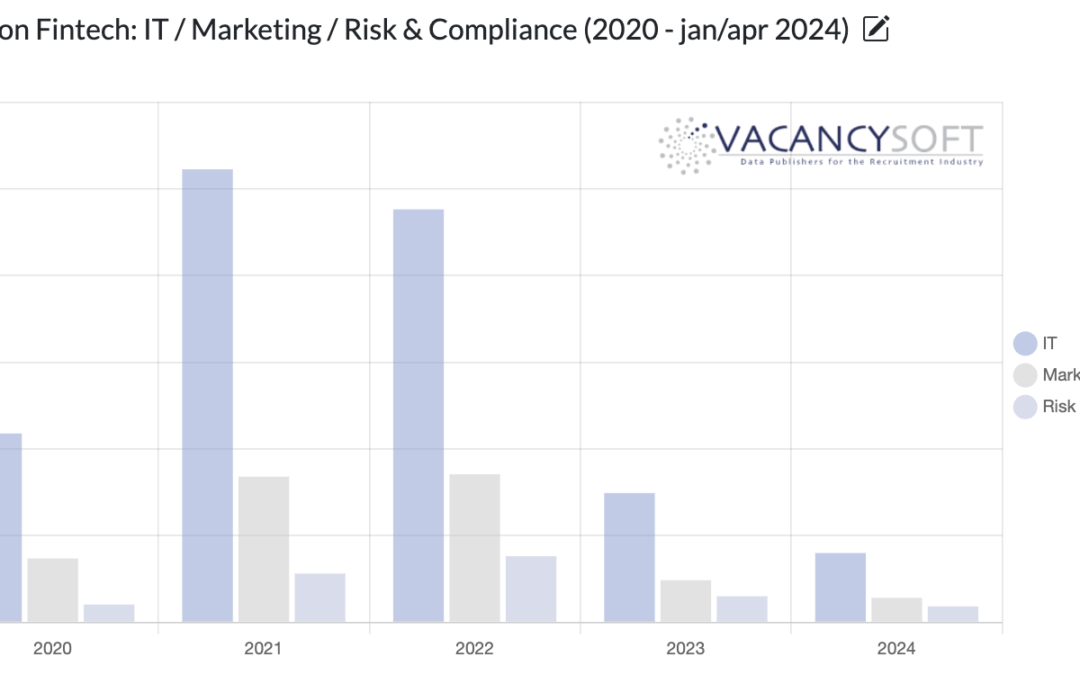

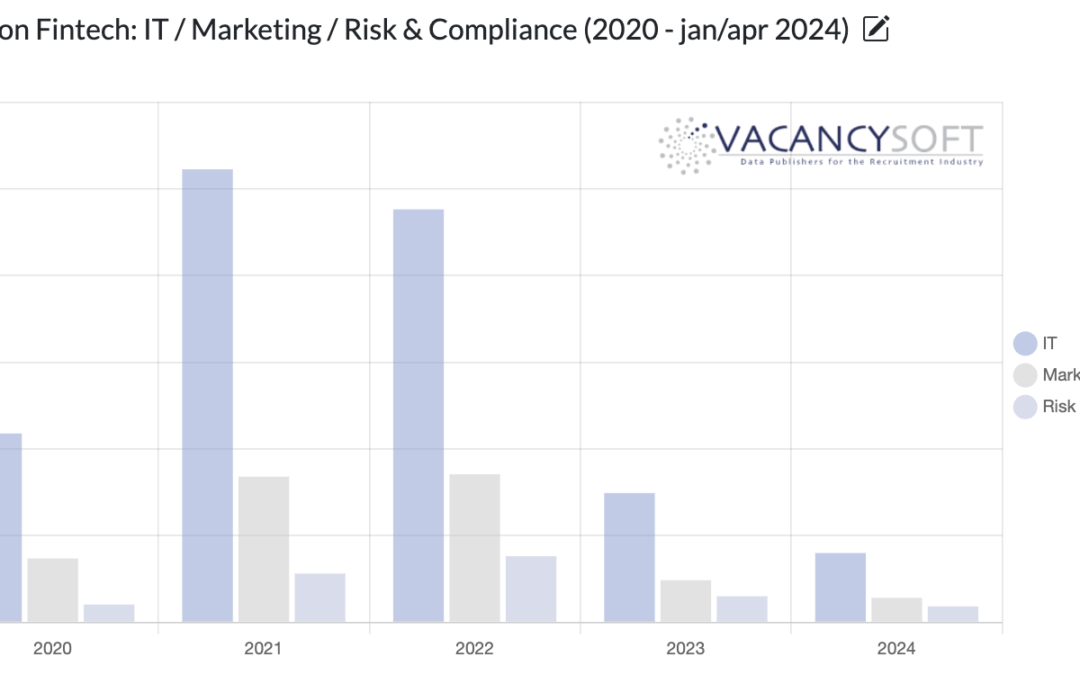

VC funding into the technology industry is on the rise again, bringing relief to policymakers. In the UK, FinTech is a major beneficiary of this increased investment, which is directly translating into heightened recruitment activity. FinTech stands out as the best-performing segment within Financial Services this year. If the current pace of recruitment continues, the number of FinTech vacancies in 2024 will be 36.7% higher nationwide compared to last year.

The Government’s Spring 2024 budget has changed the shape of taxation in the UK for high net-worth individuals who are not UK-domiciled. The implications of this change are yet to be seen properly; therefore, when looking at the recruitment patterns, we are forecasting an increase in tax vacancies this year compared to last year’s 32% in London, and 46% regionally.

After a torrid 2023, the signs are positive for Fintech as VC funding into the sector accelerates. According to a recent report by Dealroom and HSBC, in Q1 of 2024, there were 73 rounds completed in Q1 of this year, totalling $1.4BN, making it the leading sector for investment, this year so far.

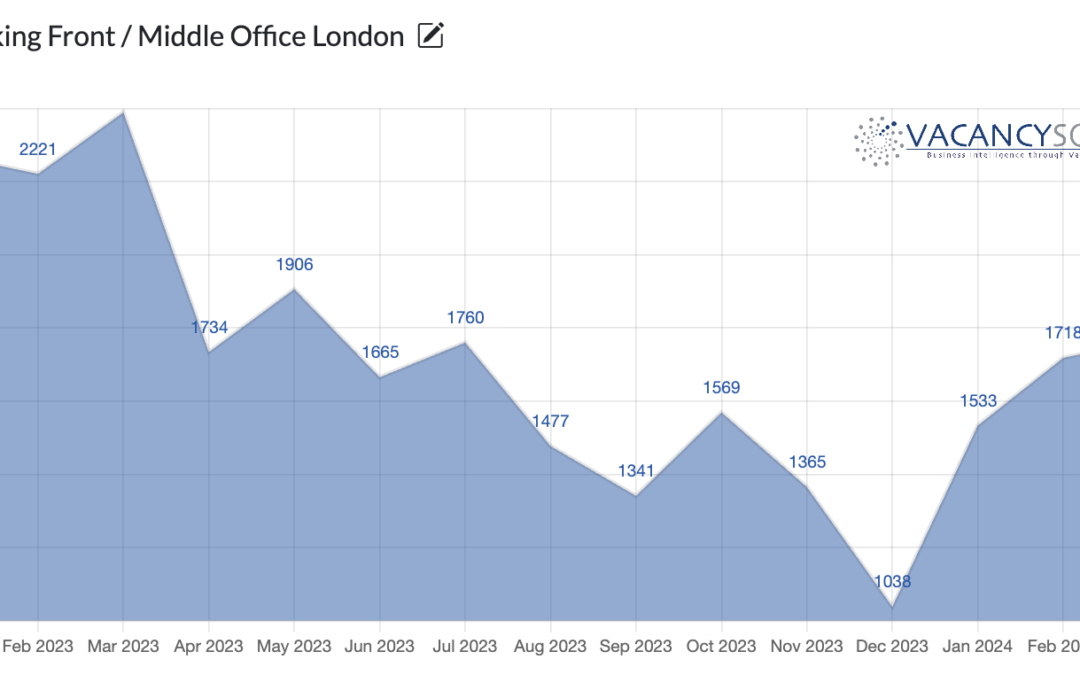

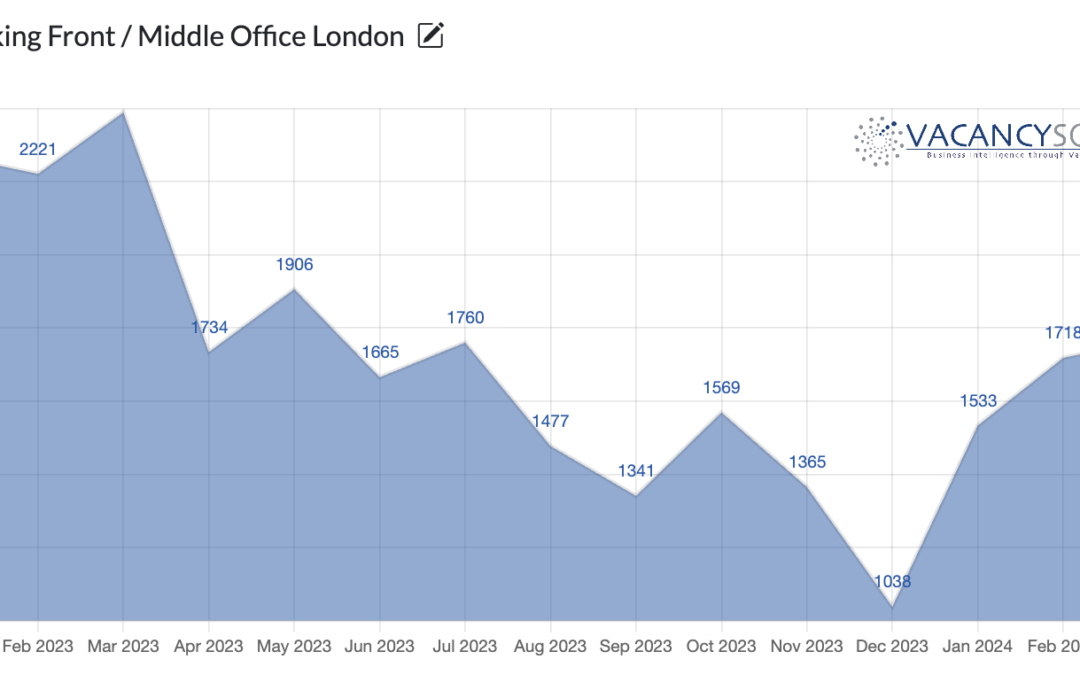

Financial Services is one of the largest industries within the UK, and contributes 8.3% to economic output. Overall the Financial Services industry employs over 1m people in the UK, and also runs significant trade surpluses, as a result, what happens in Banking is of direct relevance to the entire economy, and London in particular is of significance.